$SPDR S&P 500 ETF Trust(SPY)$

Institutions rolled a massive call spread worth over $20 million on SPY, indicating an expectation that SPY will reach $640–$650 by August 8.

Opened long: $SPY 20250808 640.0 CALL

Opened short: $SPY 20250808 650.0 CALL

While it’s hard to predict August 8, the broader market is unlikely to pull back significantly before next week’s tech earnings reports on Thursday and Friday (August 1).

After earnings, performance might mirror similar patterns seen in TSMC and Amazon—a gap-up at the open followed by a sell-off.

$NVIDIA(NVDA)$

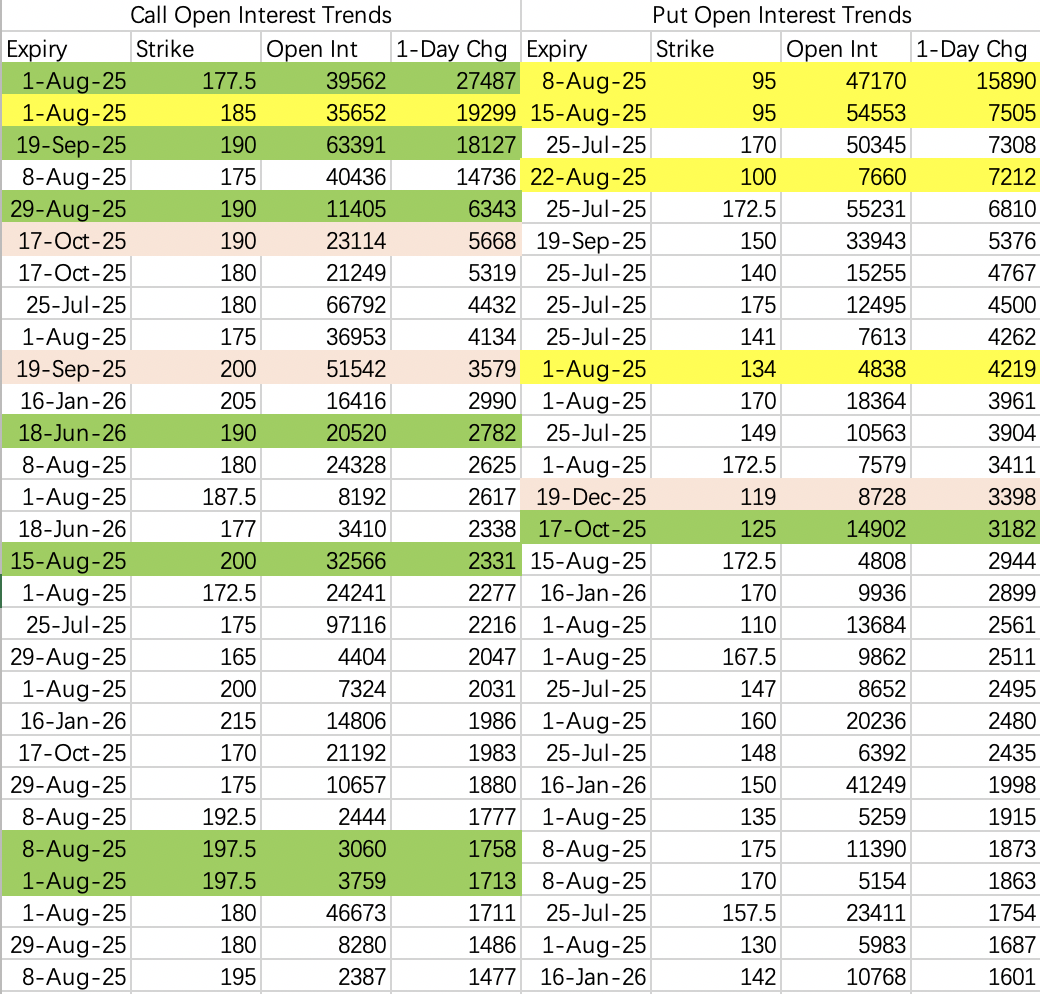

Friday’s closing range is $165–$175, with a more detailed expectation of $172.5–$175.

For the week of August 1, volatility is expected to be similar to this week. Selling calls at $177.5 should be relatively safe:

$NVDA 20250801 177.5 CALL

On the downside, bearish positions opened for the week indicate that bears are becoming impatient for a pullback.

$Tesla Motors(TSLA)$

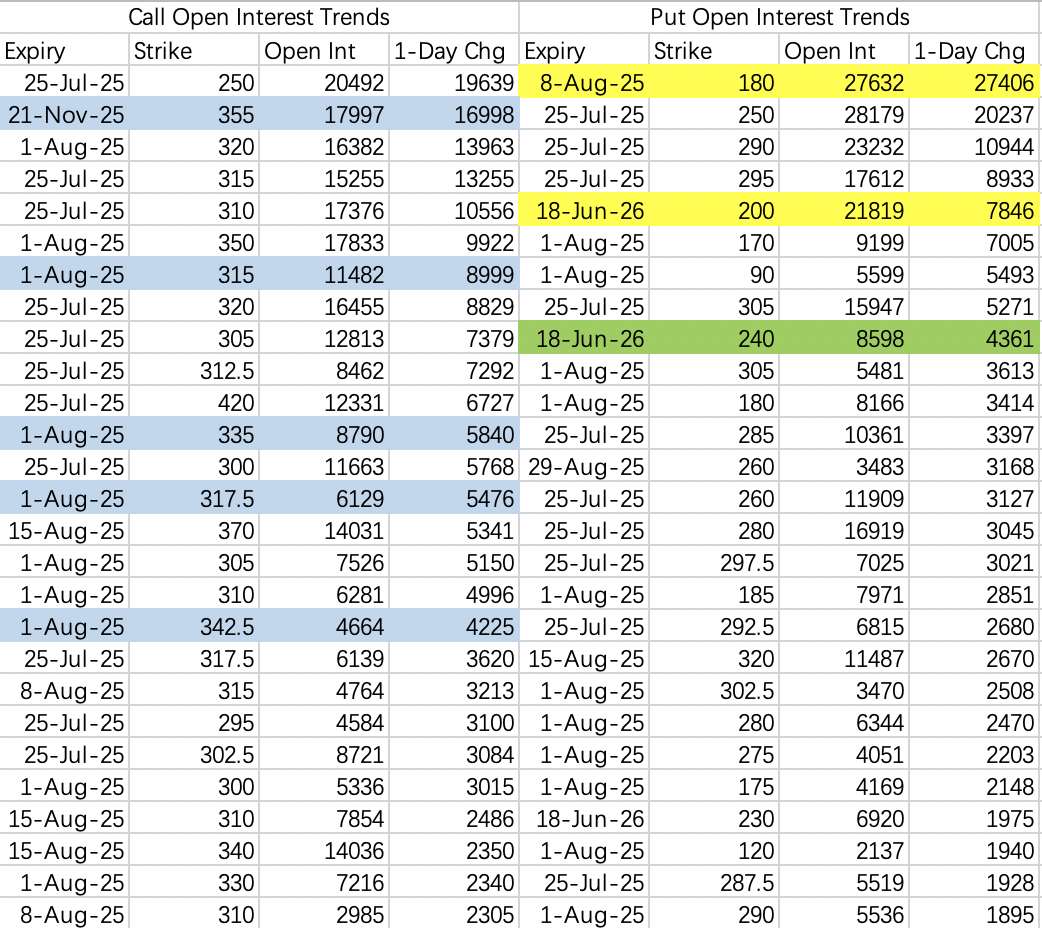

Institutions sold calls expiring next week at strikes $315 and $317.5:

$TSLA 20250801 315.0 CALL

$TSLA 20250801 317.5 CALL

To hedge, they purchased $335.0 CALL and $342.5 CALL.

There’s little guidance from put options, but sell puts can be closed on rebounds.

Today’s Trades

I’m executing the following sell call positions:

$TSLA 20250801 325.0 CALL

$NVDA 20250801 177.5 CALL

Comments