$NVIDIA(NVDA)$

This week, Meta, Microsoft, Apple, and Amazon are all reporting earnings. Their expected results and price patterns may mirror Google’s: price increases but gap up followed by a sell-off. These companies are also likely to expand their investments in AI, similar to Google.

With AI demand continuing to grow, NVIDIA has strong support underneath, making sell puts a relatively safe strategy. The same applies to AMD.

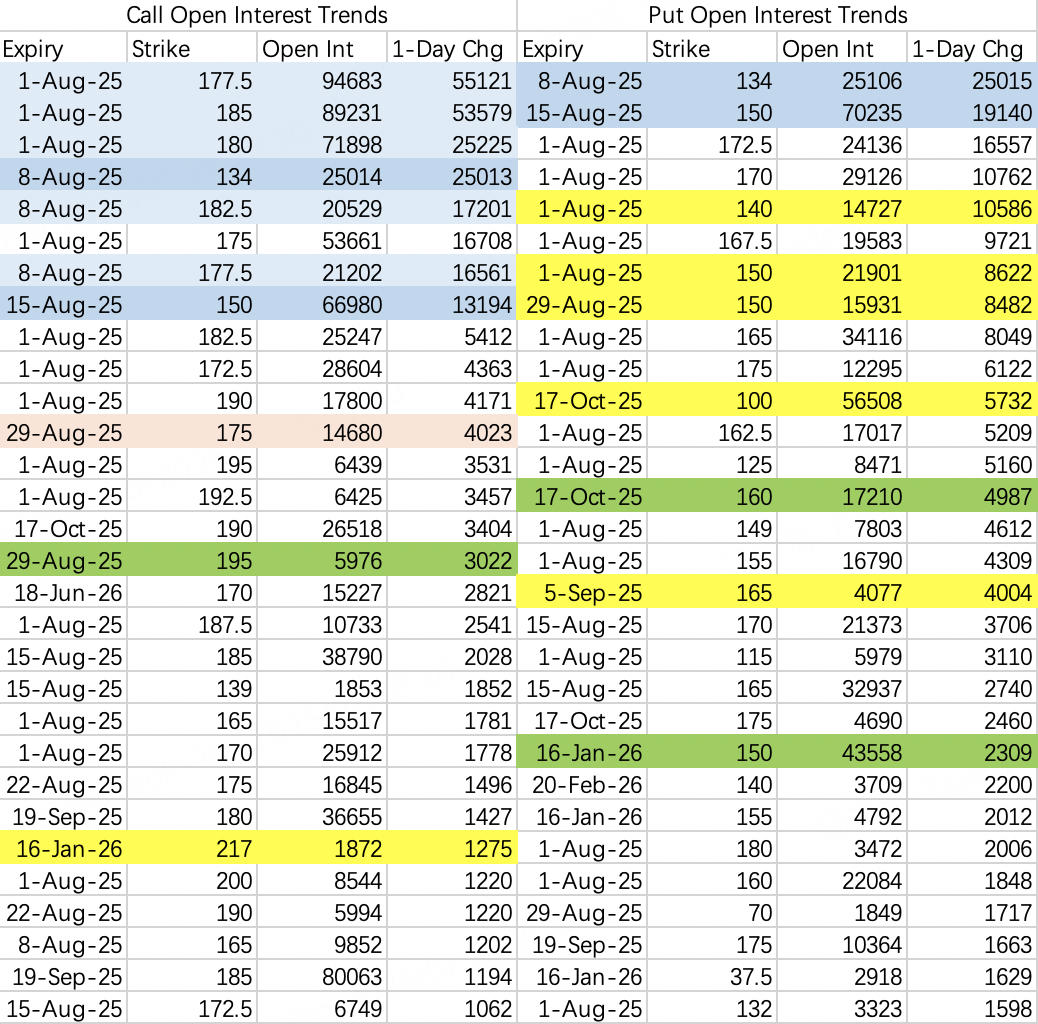

For call options, institutions are selling $NVDA 20250801 177.5 CALL and $NVDA 20250801 180.0 CALL, while hedging with $NVDA 20250801 182.5 CALL and $NVDA 20250801 185.0 CALL. It’s worth noting that the open interest at $177.5 is close to 100,000 contracts, suggesting there’s a good chance NVIDIA’s price will close near $177.5 this week.

Bearish option positions seem to be more for hedging against extreme market drops, so they have limited significance.

$Tesla Motors(TSLA)$

Last Friday, Tesla sharply squeezed short sellers, but institutional $TSLA 20250801 317.5 CALL sell positions remain open.

Option data for Tesla is surprisingly bullish this week:

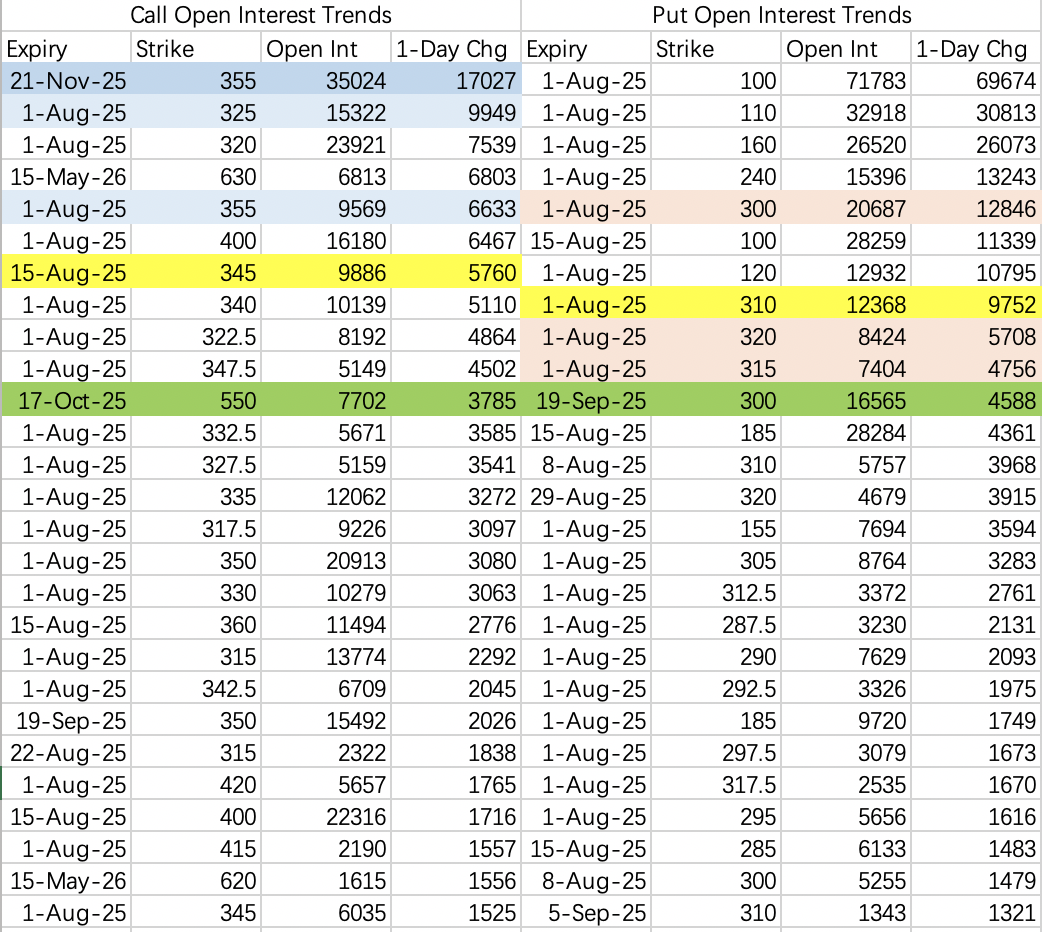

For call options, there’s a notable bullish call spread on strikes $325–$355 expiring this week.

For August 15 expiry, large positions were opened on $TSLA 20250815 345.0 CALL, primarily through significant buy orders.

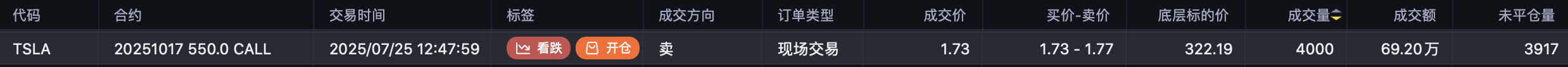

At Tesla’s recent highs, some traders sold $TSLA 20251017 550.0 CALL, likely to short volatility.

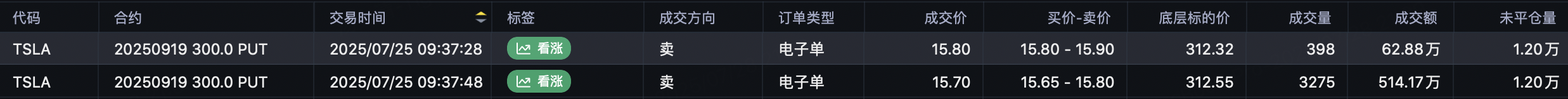

On the put side, one noteworthy trade occurred shortly after the market opened on July 25, where someone sold $TSLA 20250919 300.0 PUT, with a transaction value exceeding $5 million.

For now, I’ll close my current sell call positions and won’t roll them over.

$Coinbase Global, Inc.(COIN)$

Coinbase reports earnings this week. While there’s been positive progress in industry regulations, Q2 results are expected to miss expectations, making it suitable to sell calls.

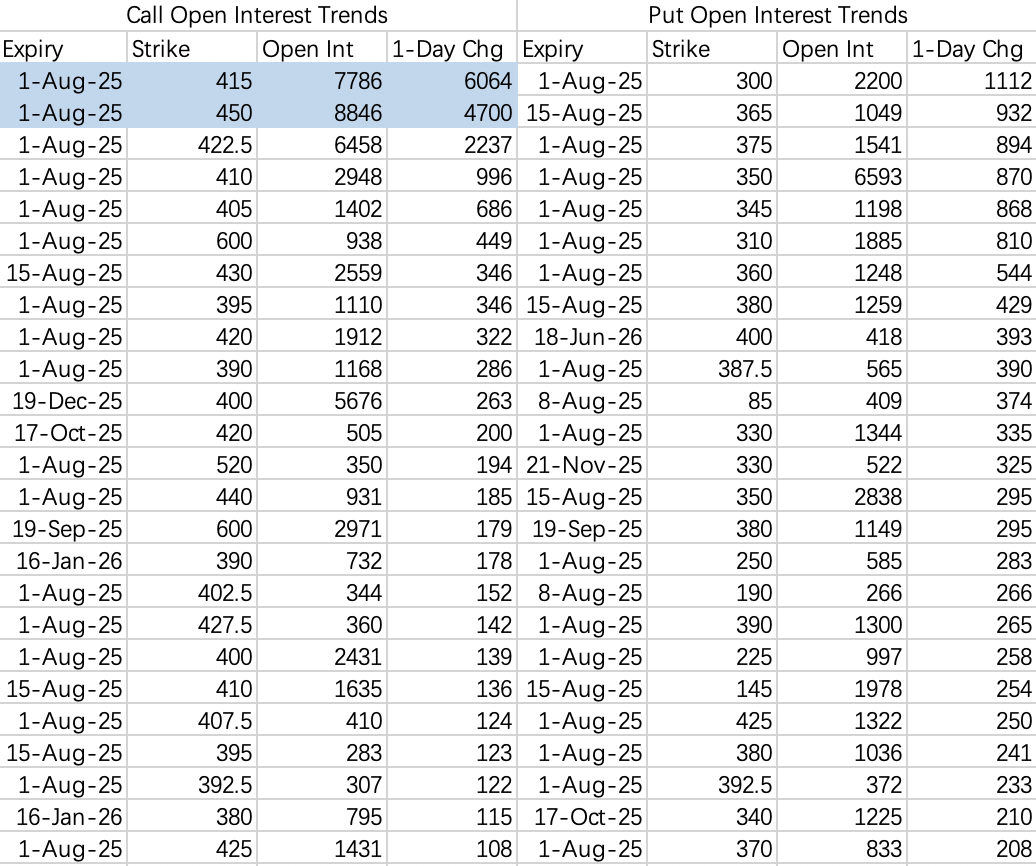

Institutions are selling $COIN 20250801 415.0 CALL while hedging with $COIN 20250801 450.0 CALL. Last week, they sold $440 calls and hedged with $475 calls, indicating a weaker trend this week.

Today’s Trades

Close sell call positions on Tesla and NVIDIA.

Open a sell call position: $COIN 20250801 430.0 CALL.

Comments