$NVIDIA(NVDA)$

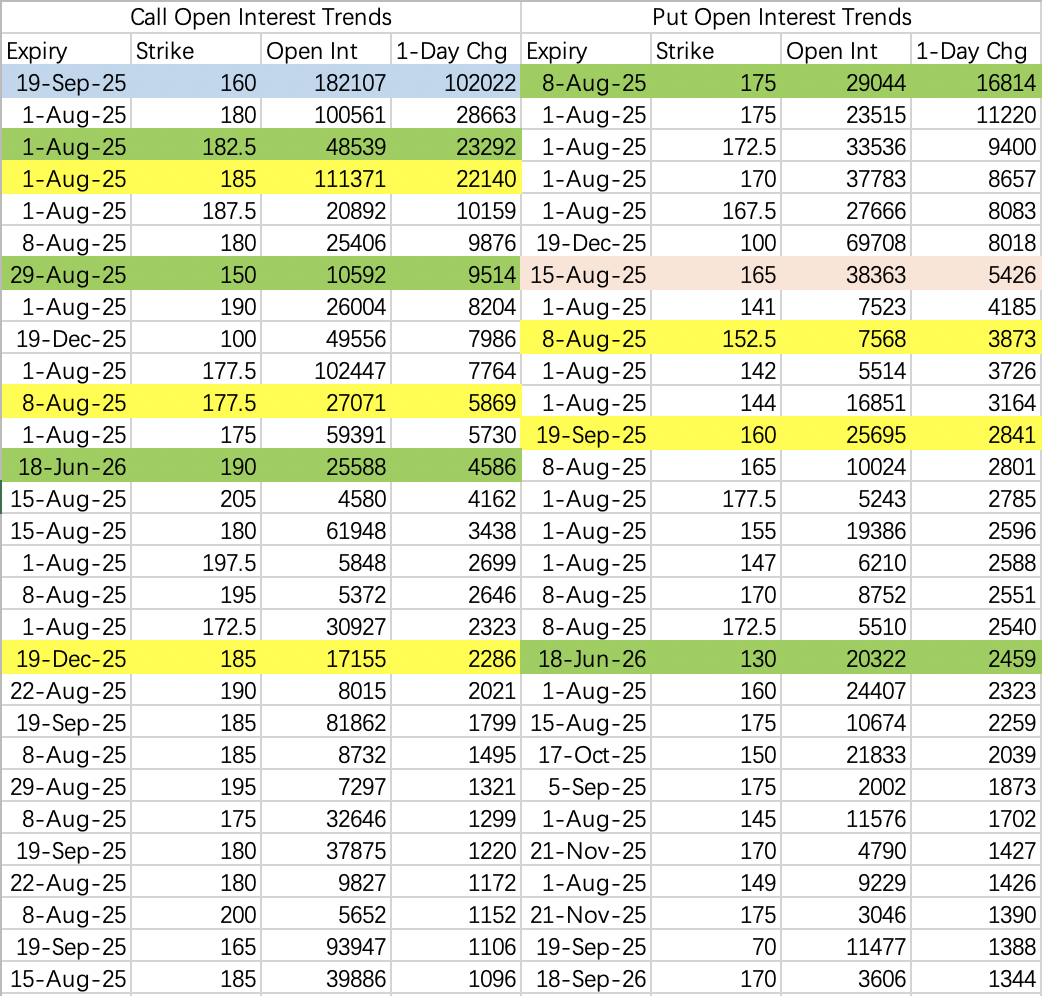

It’s only Monday, and the open interest (OI) for this week’s expiring options has already reached astonishing levels.

There are three call options with OI exceeding 100,000 contracts:

$NVDA 20250801 177.5 CALL

$NVDA 20250801 180.0 CALL

$NVDA 20250801 185.0 CALL

For context, even during the June triple witching day, only four call options had OI exceeding 100,000 contracts.

High OI can have different impacts depending on the timing:

Early in the week (Monday–Wednesday): High OI creates a squeeze effect, pushing the stock price higher as it gravitates toward the higher strike prices. That’s why I believe NVIDIA has a chance to hit $185 this week.

Later in the week (Thursday–Friday): The stock price tends to stabilize in the range with the largest OI. At this point, short-term sell put and sell call strategies become more attractive.

Expected closing range for this week: $175–$185, with a possible close near $182.5.

Interesting Monday Trades

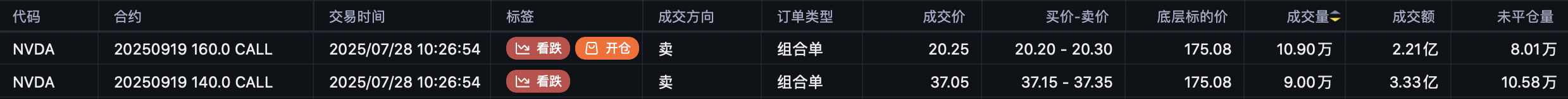

$200 Million Roll: A large player rolled their position from $NVDA 20250919 140.0 CALL to $NVDA 20250919 160.0 CALL.

Massive Put Selling: An unknown trader sold 16,800 contracts of $NVDA 20250808 175.0 PUT, signaling confidence that NVIDIA’s price will stay above $175 over the next two weeks.

Bearish Call Spread: Another trader executed a bearish call spread by selling $NVDA 20250801 182.5 CALL and buying $NVDA 20250801 185.0 CALL, further contributing to this week’s record-breaking OI.

Deep ITM Call Selling: A trader sold $NVDA 20250829 150.0 CALL, a strategy equivalent to shorting the stock. This suggests they’re betting on a pullback after earnings.

My Stance on NVIDIA: I’m neither bullish nor bearish on NVIDIA this week. Its price movements will be heavily influenced by the OI dynamics. For now, I’ll follow the market’s lead and trade accordingly.

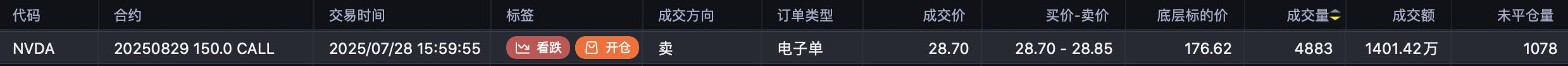

$Advanced Micro Devices(AMD)$

AMD’s price is unlikely to exceed $180 this week.

Last week, institutions sold $AMD 20250801 170.0 CALL and $AMD 20250801 172.5 CALL, while hedging with $AMD 20250801 177.5 CALL and $AMD 20250801 180.0 CALL.

This week may resemble the week of July 18, where AMD stabilized after institutional positions were squeezed.

Earnings Next Week (August 5):

Call options are extremely bullish, with 13,000 contracts opened for $AMD 20250808 190.0 CALL.

There’s also a bullish call spread for mid-August: buying $AMD 20250815 200.0 CALL and selling $AMD 20250815 230.0 CALL.

Unlike NVIDIA, AMD’s OI isn’t significant enough to dictate price movements, so AMD’s stock might outperform NVIDIA before earnings due to its lower market cap advantage.

$Tesla Motors(TSLA)$

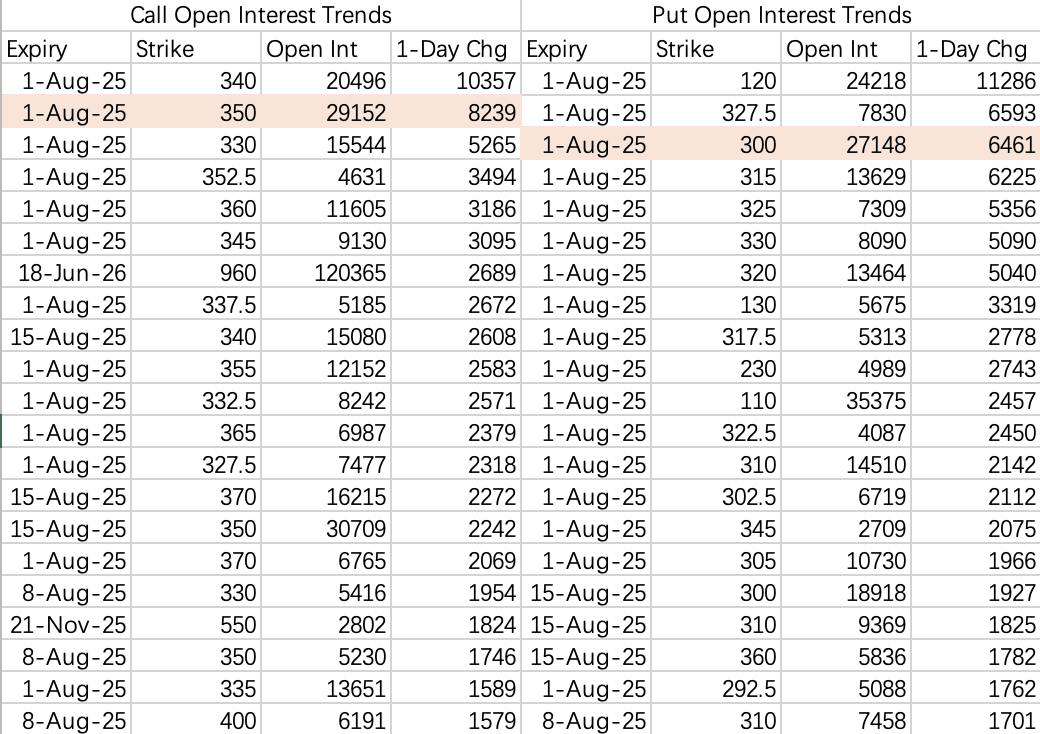

Expected range for this week: $300–$340.

Both sell put and sell call strategies are viable.

Trading Notes

I didn’t roll my sell call positions on Monday because the bullish call options seemed suspiciously aggressive. It’s important to stay patient. While stop-losses for sell calls are normal and manageable, rushing to roll without understanding the trend often leads to repeated losses and major drawdowns. The same principle applies to sell puts.

Today’s Trade

Selling puts on Microsoft ahead of its earnings:

$MSFT 20250801 500.0 PUT

Comments