$NVIDIA(NVDA)$

This week, it’s either the short squeeze of the century or nothing happens.

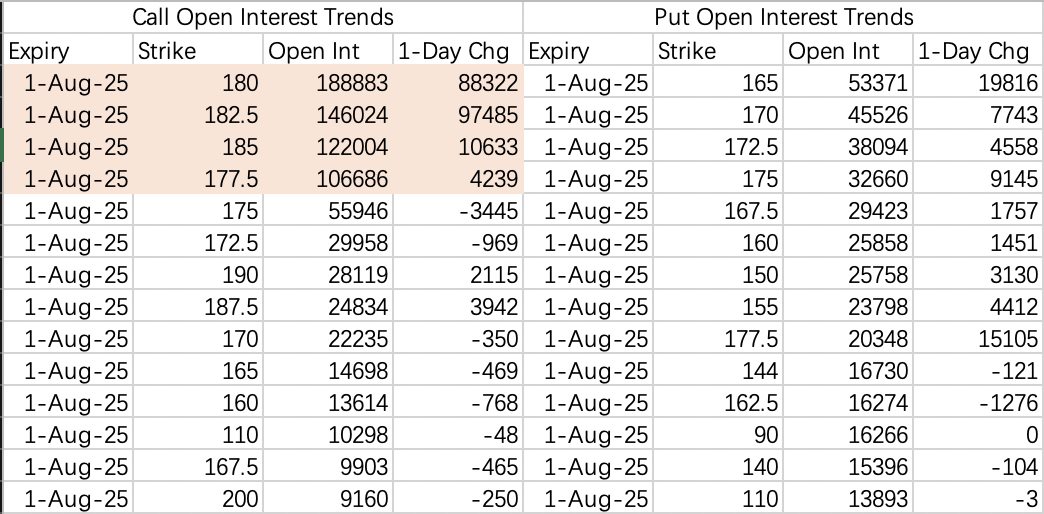

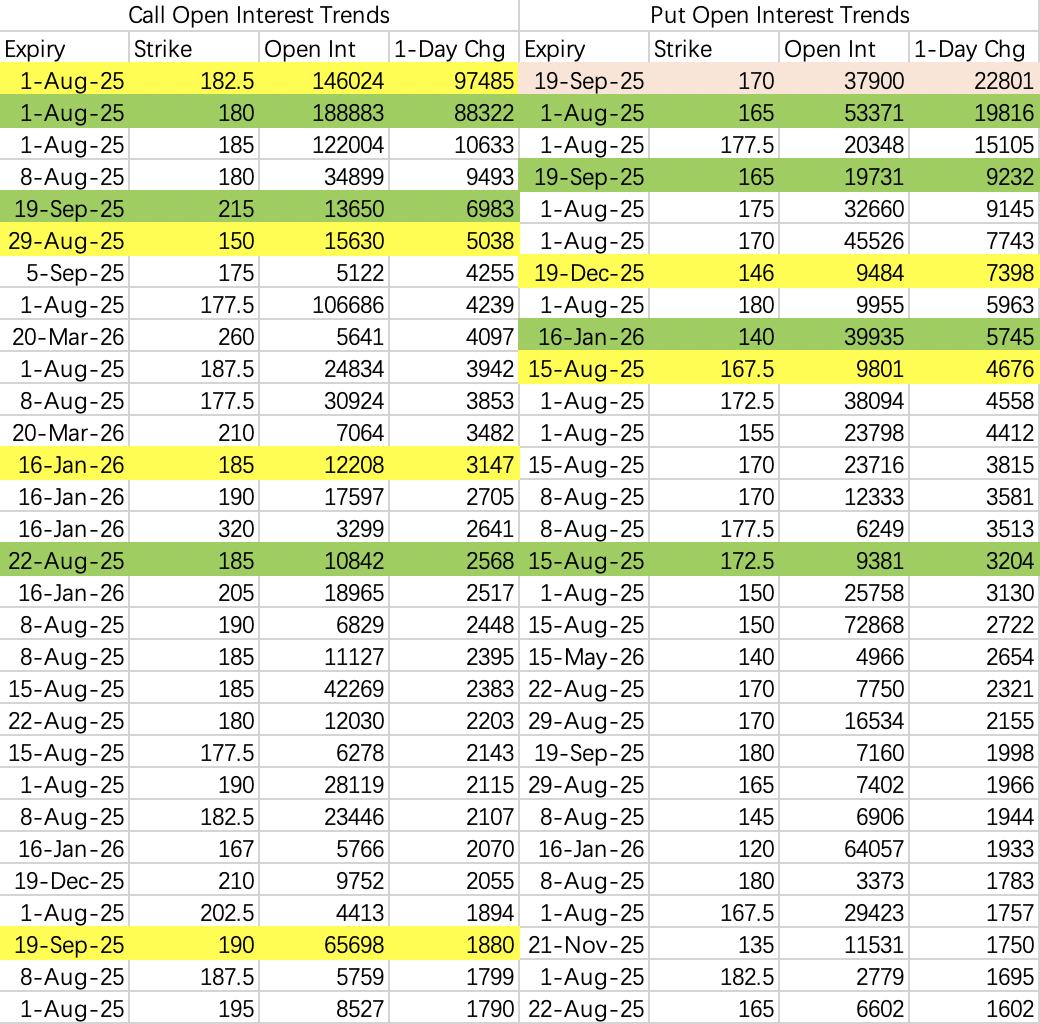

On Tuesday, a massive 200,000-lot bullish call spread was opened:

Selling $NVDA 20250801 180.0 CALL

Buying $NVDA 20250801 182.5 CALL

As a result, the open interest for $NVDA 20250801 182.5 CALL surged from 48,000 contracts on Monday to 146,000 contracts.

Potential Outcome: If NVIDIA’s stock price breaks $177.5, there’s a high probability of a squeeze, potentially pushing the price directly to $185.

Bearish Positions:

No excessive bearish sentiment. Most put options are opened at the $170 strike.

A notable longer-term bearish position is the $NVDA 20251219 146.0 PUT, with 7,398 contracts opened.

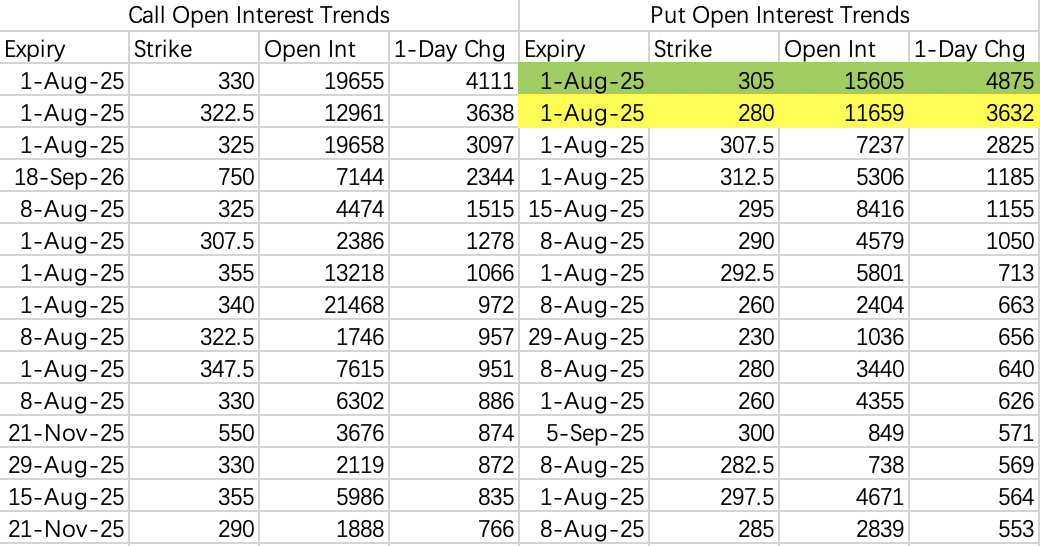

$Tesla Motors(TSLA)$

For this week’s $305 puts, the majority of trades are sell-side transactions, indicating bullish sentiment.

July delivery data is unlikely to disappoint, as Tesla is likely trying to meet end-of-September policy deadlines.

Bullish call positions are normal, but the stock is unlikely to exceed $330 this week.

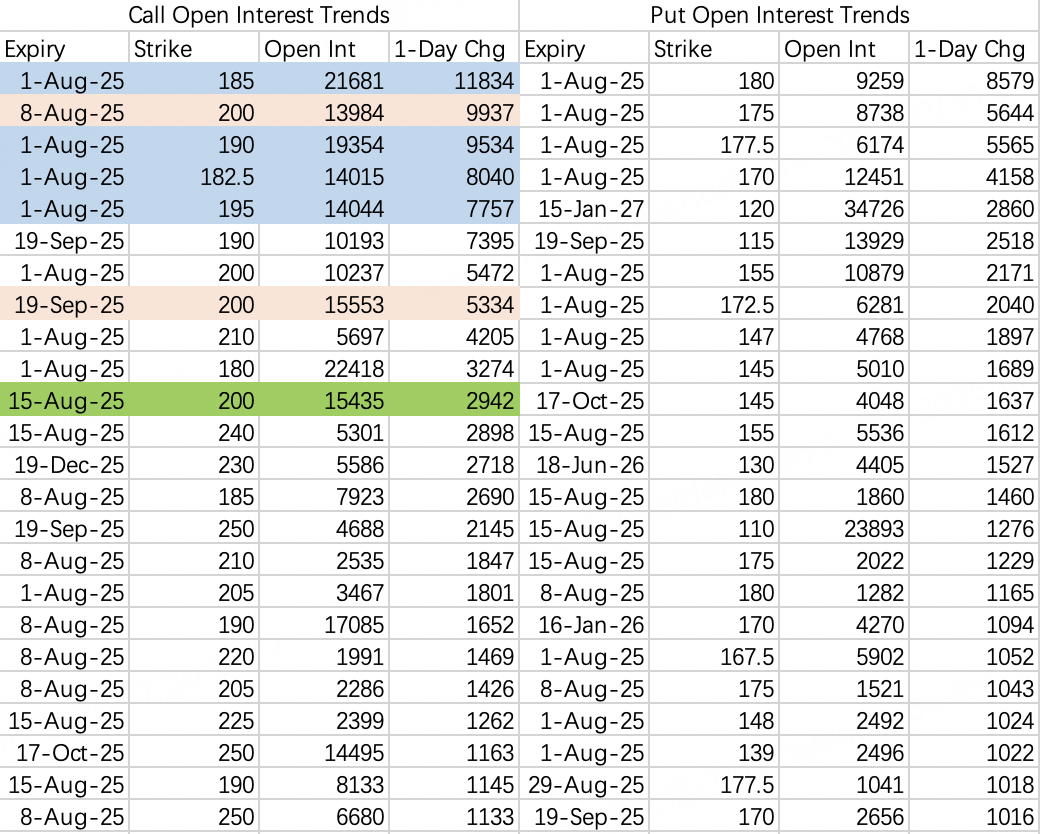

$Advanced Micro Devices(AMD)$

Institutional sell call strategies have shifted:

Selling $AMD 20250801 182.5 CALL and 185.0 CALL

Hedging by buying $AMD 20250801 190.0 CALL and 195.0 CALL

Institutions are not rushing to roll their call positions into next week, likely waiting to observe Friday’s movement.

Next Week: With earnings coming up, sell call strategies will likely dominate, and even after earnings, sell call remains a strong strategy.

$UnitedHealth(UNH)$

Option positioning is very clear, with several large trades setting the tone:

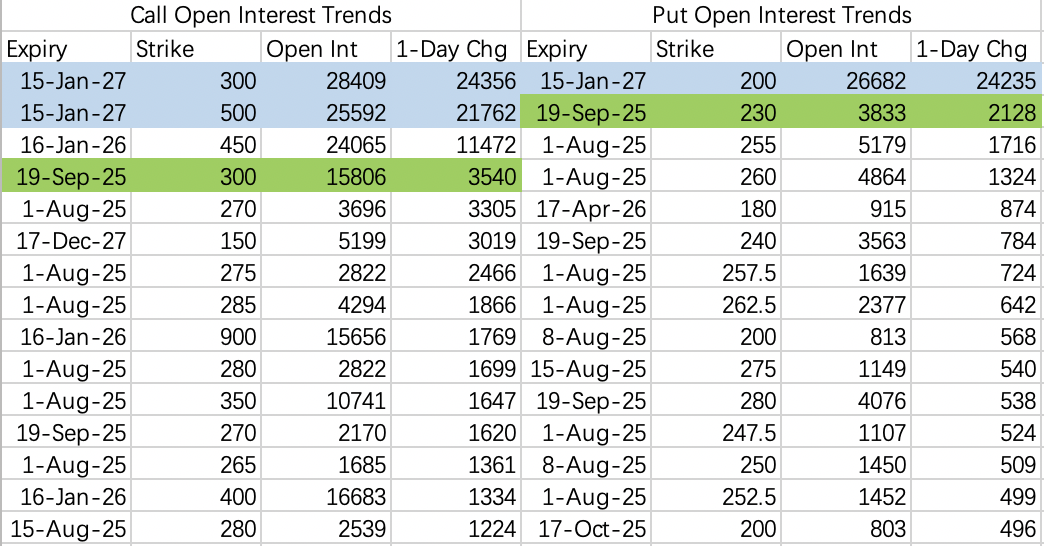

Long-Term Bullish Spread: Targeting the $300–$500 range while selling downside protection:

Buying $UNH 20270115 300.0 CALL

Selling $UNH 20270115 500.0 CALL

Selling $UNH 20270115 200.0 PUT

Each leg has an open interest exceeding 20,000 contracts.

Shorter-Term Single-Leg Positions:

Selling $UNH 20250919 300.0 CALL

Selling $UNH 20250919 230.0 PUT

Today’s Trades

Unfortunately, I couldn’t sell AMD calls expiring this week due to margin limitations—a missed opportunity.

Instead, I executed trades on three earnings plays:

Microsoft:

Sold $MSFT 20250801 500.0 PUT

Amazon:

Sold a straddle:

$AMZN 20250801 245.0 CALL

$AMZN 20250801 225.0 PUT

Apple:

Sold a straddle:

$AAPL 20250801 222.5 CALL

$AAPL 20250801 200.0 PUT

Comments