$NVIDIA(NVDA)$

What happens when options volume for the current week suddenly surges to triple witching levels in just a few days?

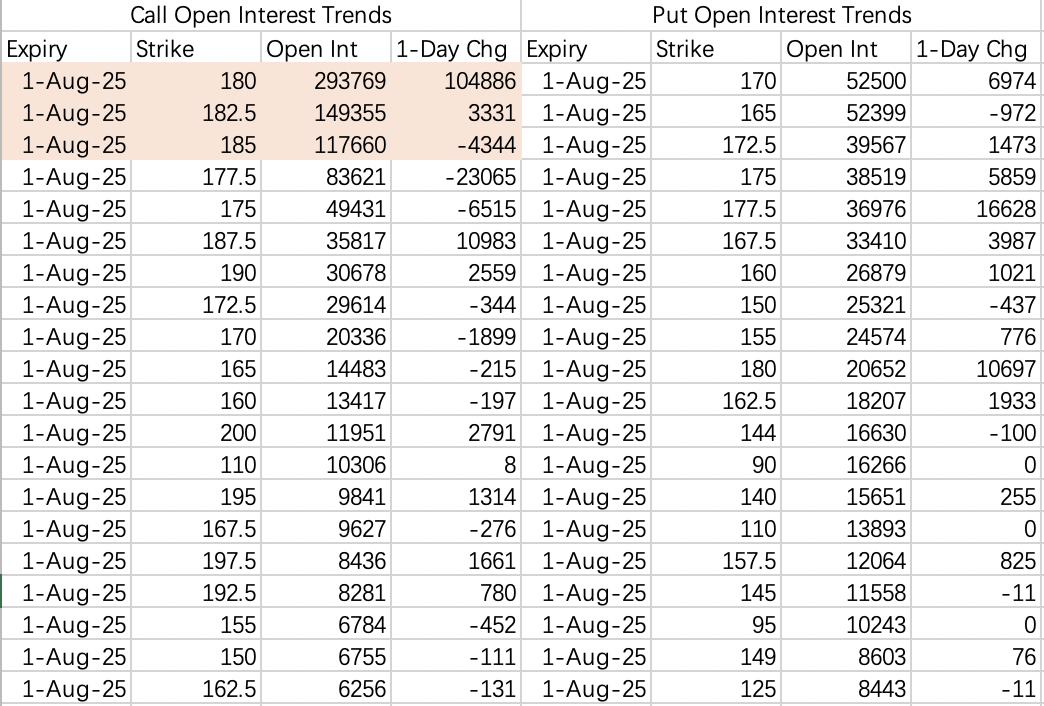

On Wednesday, NVIDIA’s stock price rose 2%, and the open interest (OI) for the $NVDA 20250801 180.0 CALL expiring this week increased by 104,800 contracts, pushing its total OI to an astonishing 293,700 contracts!

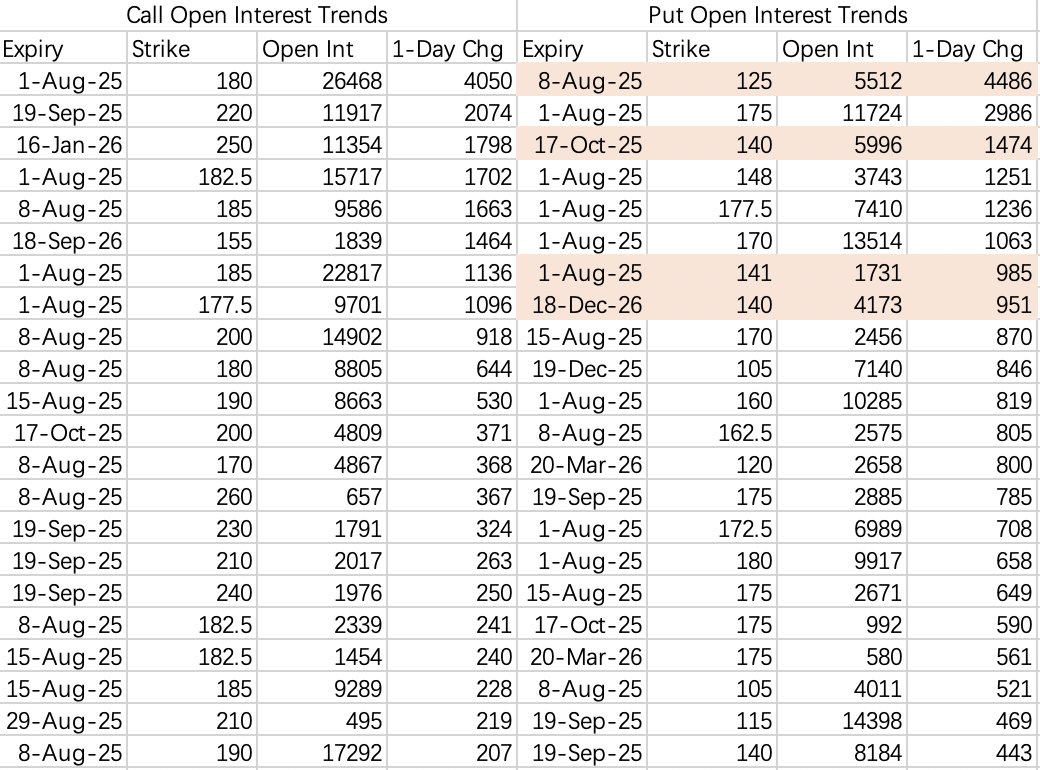

There are three call options expiring this week with OI exceeding 100,000 contracts:

$NVDA 20250801 180.0 CALL: 293,700 contracts

$NVDA 20250801 182.5 CALL: 149,000 contracts

$NVDA 20250801 185.0 CALL: 117,000 contracts

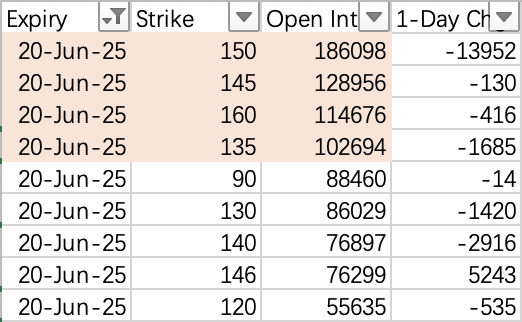

To put this into perspective, let’s compare it to the June 20 triple witching day:

On June 20, there were four call strikes with OI exceeding 100,000 contracts: $NVDA 20250620 150.0 CALL, 145.0 CALL, 160.0 CALL, and 135.0 CALL.

The $NVDA 20250620 150.0 CALL had the highest OI, with 186,000 contracts.

This week’s OI levels for NVIDIA’s call options are far beyond typical weekly expirations, rivaling major triple witching days.

Observations and Institutional Activity

While most of the high OI for this week’s calls comes from bullish call spreads created by institutions, some retail investors are also jumping in, buying last-minute call options in hopes of a short squeeze.

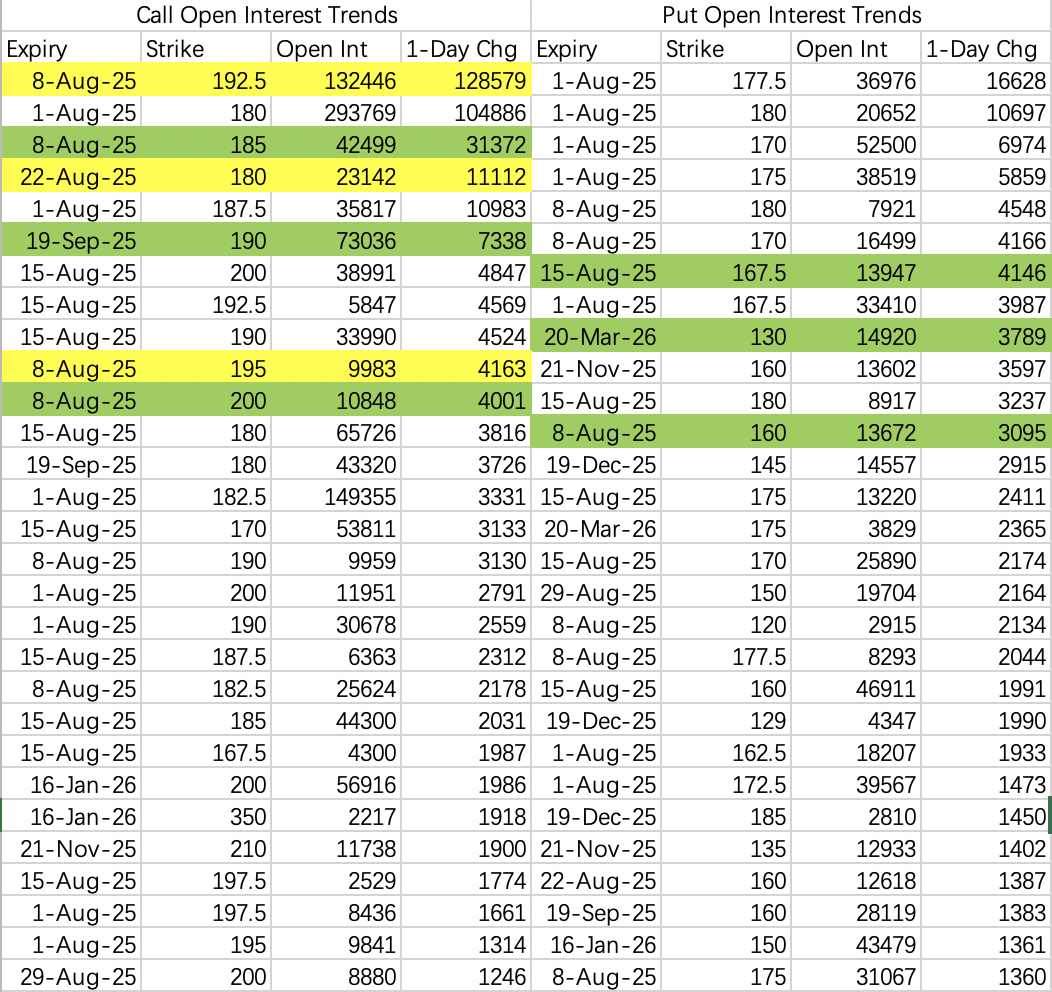

On Wednesday, institutions closed their $177.5–$185 call spreads expiring this week and rolled them into:

$NVDA 20250808 185.0 CALL (sell)

$NVDA 20250808 192.5 CALL (buy)

However, the OI for the $NVDA 20250808 192.5 CALL surged to 128,000 contracts, far exceeding the 31,000 contracts for the $NVDA 20250808 185.0 CALL. This indicates a significant number of single-leg call buys on the $192.5 strike.

Given the order flow, these large trades appear to be institutional activity, likely positioning for a post-earnings rally in NVIDIA, with AMD’s earnings next week acting as a catalyst.

Outlook

This Week: NVIDIA is unlikely to break $185, with an expected closing range of $175–$185.

Next Week: A potential short squeeze cannot be ruled out as institutions continue to build bullish positions.

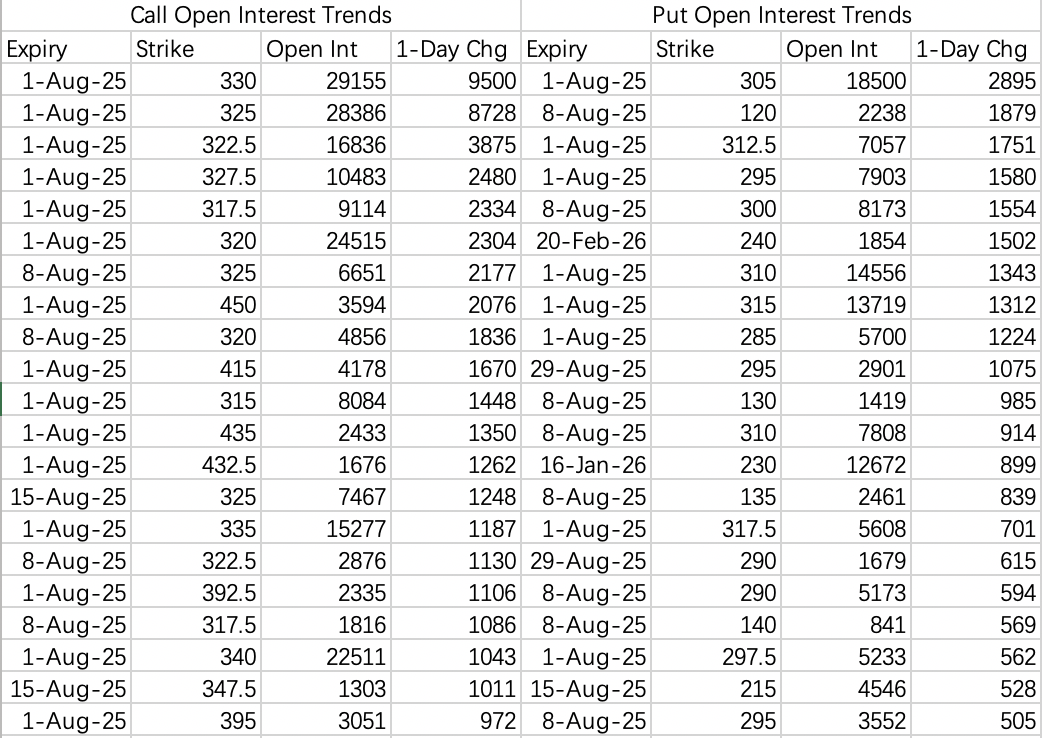

$Tesla Motors(TSLA)$

Tesla remains in the $300–$330 range this week.

$Advanced Micro Devices(AMD)$

Institutions have not rolled their call spreads for next week yet, but there’s a chance they could face margin pressure again.

Pre-Earnings Outlook: AMD is unlikely to drop before earnings, making sell put strategies favorable.

Bearish Positions: Surprisingly weak. Some traders have opened puts targeting $140, but this reflects low conviction.

AMD’s earnings are notoriously unpredictable, often resulting in gap-ups followed by sell-offs or gap-downs followed by recoveries. This is typical of AMD, so it’s best to trade cautiously around its earnings date.

Today’s Trades

Amazon:

Considering the strong post-earnings performance of Meta and Microsoft, I’ve closed my Amazon sell call position but retained my sell put.AMD Straddle:

Opened a short straddle:Sold $AMD 20250808 170.0 PUT

Sold $AMD 20250808 190.0 CALL

Plan to close both positions on Monday.

Comments