The biggest news on Friday was the unexpected downward revision of U.S. nonfarm payroll data. The May and June figures were revised down by more than 200,000 jobs, leaving employment growth as a shadow of what was initially reported. Suddenly, it feels like the U.S. economy is on the verge of collapse, seemingly needing rate cuts to recover.

The market has been itching for a pullback, and now it has found a reason to drop.

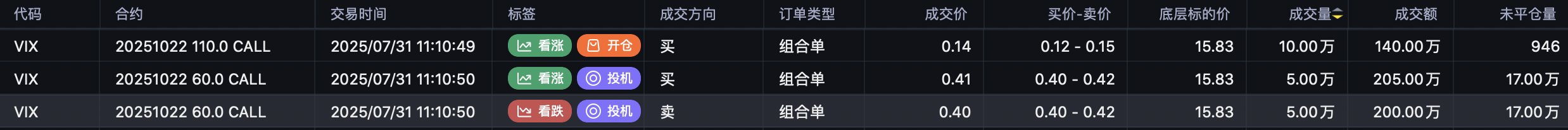

Some bearish indicators are emerging, such as VIX call spreads with strikes ranging from 60 to 100. Whether these are bullish call spreads or bearish call spreads, such strike prices are highly unusual:

$VIX 20251022 60.0 CALL

$VIX 20251022 100.0 CALL

Additionally, a massive bearish put trade was opened on TSMC with September expirations:

$TSM 20250905 240.0 PUT

$TSM 20250905 245.0 PUT

The total transaction value exceeded $20 million, signaling a conservative downside target below $230.

$NVIDIA(NVDA)$

Despite the market downturn, NVIDIA’s option activity on Thursday showed surprisingly little bearish sentiment, likely due to the exhaustion from the previous week’s short squeeze.

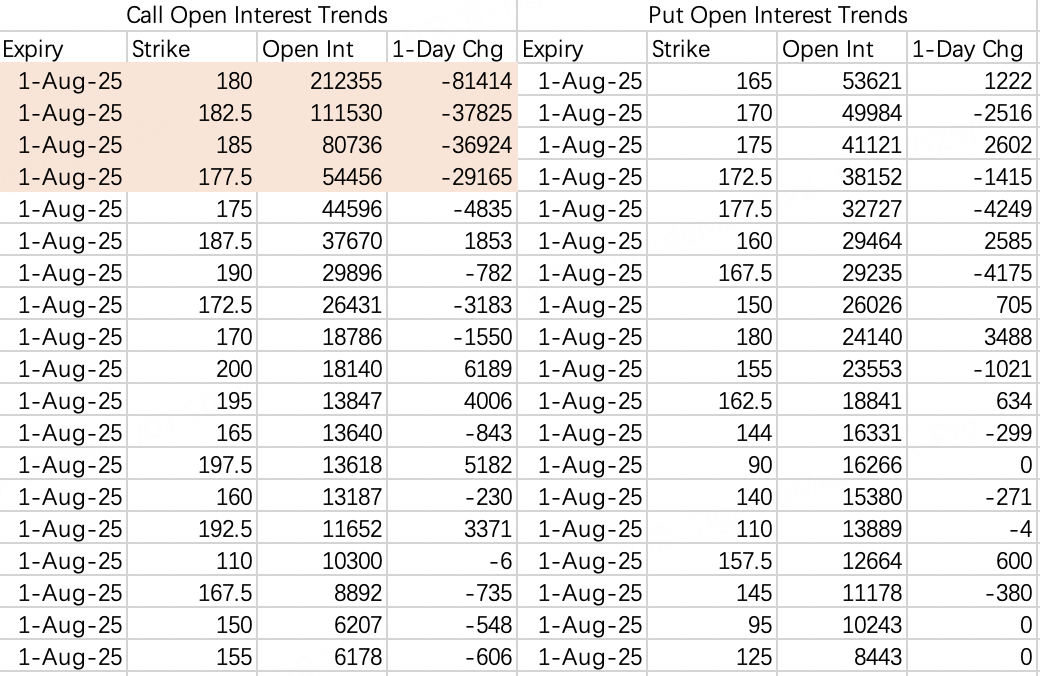

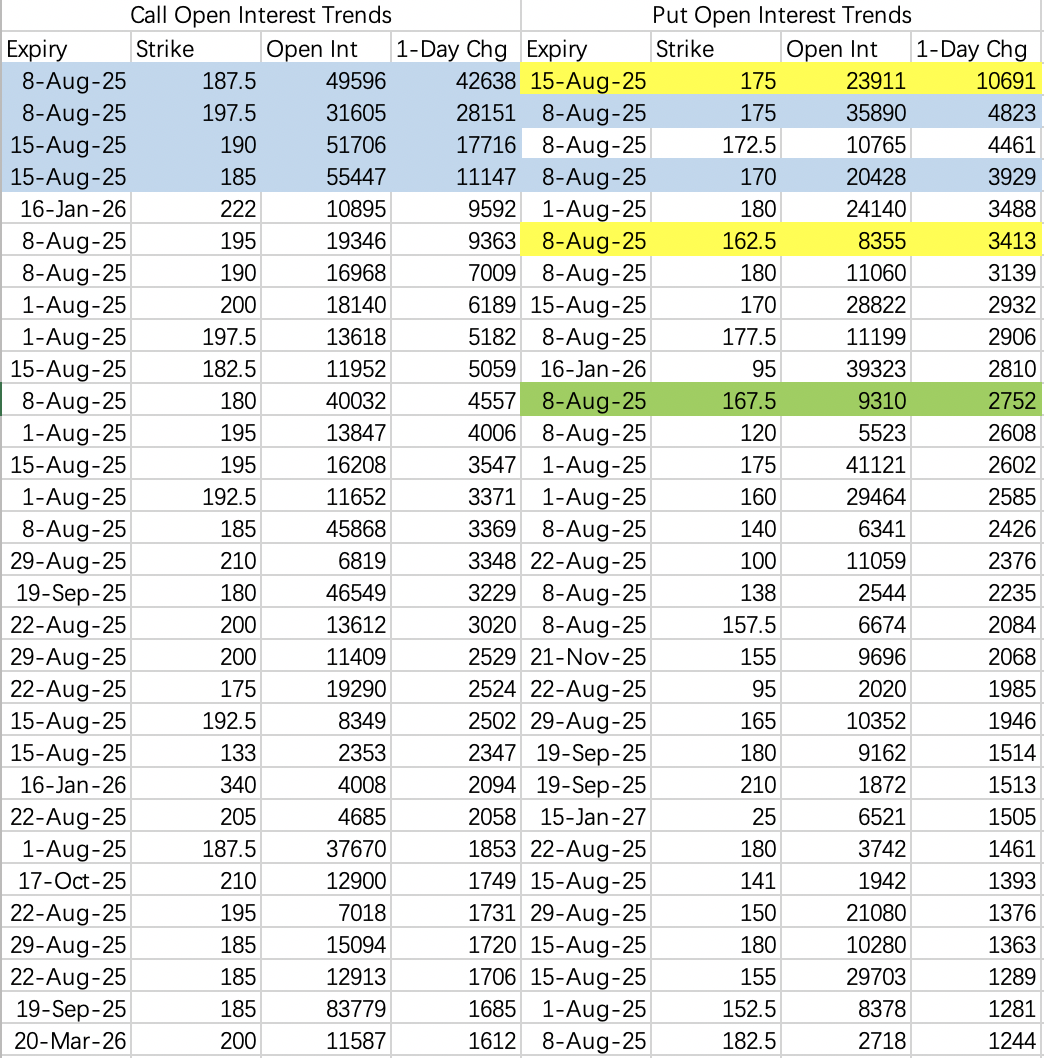

Key observations:

Call Option Activity:

A large number of weekly call options rolled into next week’s contracts.

Bearish call spreads for next week include:

$NVDA 20250808 187.5 CALL – 197.5 CALL spread

$NVDA 20250815 185.0 CALL – 190.0 CALL spread

The higher strike prices for these spreads do not suggest bullish sentiment for next week but are instead a reflection of the severe squeeze from this week.

Put Option Activity:

Surprisingly low put option volume, especially for $NVDA 20250808 175.0 PUT.

However, there were significant single-leg purchases of $NVDA 20250815 175.0 PUT for mid-August.

Outlook:

Thursday’s option activity suggests an expectation that NVIDIA will stay above $170 next week.

Friday’s data might adjust this outlook, depending on updated bearish positioning.

Recent Trades and Comments

Amazon Earnings:

Closed Amazon positions at a loss.

While the earnings numbers were decent, the management’s poor communication during the earnings call, especially their lack of AI strategy, created unnecessary uncertainty.

Amazon is now on my “cautious trading blacklist” for future earnings seasons.

AMD:

Stopped out of sell put positions but kept sell call positions.

TSMC:

Opened a sell call position:

$TSM 20250808 240.0 CALL.

Comments