As Q2 earnings season continues with the familiar theme of stocks gapping up and selling off post-earnings, the most reliable strategy this week remains sell calls after earnings.

However, based on the current option flow, AMD, PLTR, and SMCI do not show significantly higher upside expectations compared to last week, so selling calls early may also be a viable approach.

$Figma(FIG)$ Figma’s options begin trading on its third day post-IPO, with August 15 expirations worth monitoring.

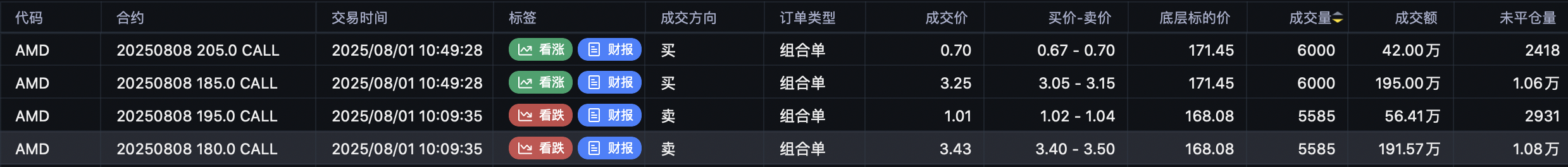

$Advanced Micro Devices(AMD)$

Last week, institutions sold calls at $182.5 and $185 while hedging with call buys at $190 and $195.

After Friday’s roll, this week’s sell call strikes remain $180 and $185:

$AMD 20250808 180.0 CALL

$AMD 20250808 185.0 CALL

However, hedged call buys increased their strikes to $195 and $205:

$AMD 20250808 195.0 CALL

$AMD 20250808 205.0 CALL

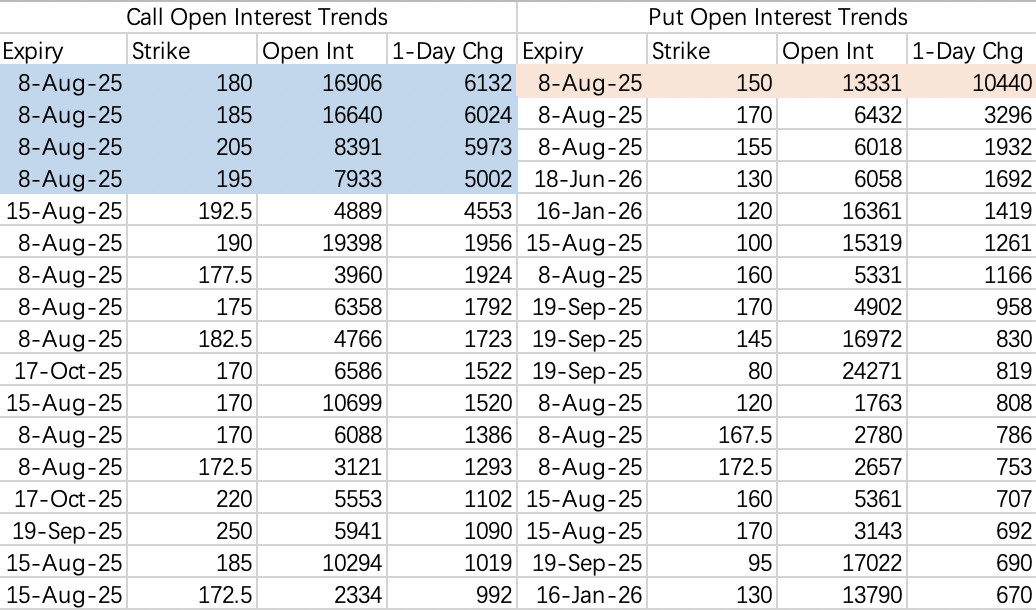

Outlook:

Bearish expectations are not as unified as bullish expectations, but new put positions at $150 saw the highest volume.

Selling calls before earnings is a reasonable strategy, as the stock could gap down and rally intraday on good earnings.

If AMD’s stock gaps down on Wednesday, consider selling puts as well.

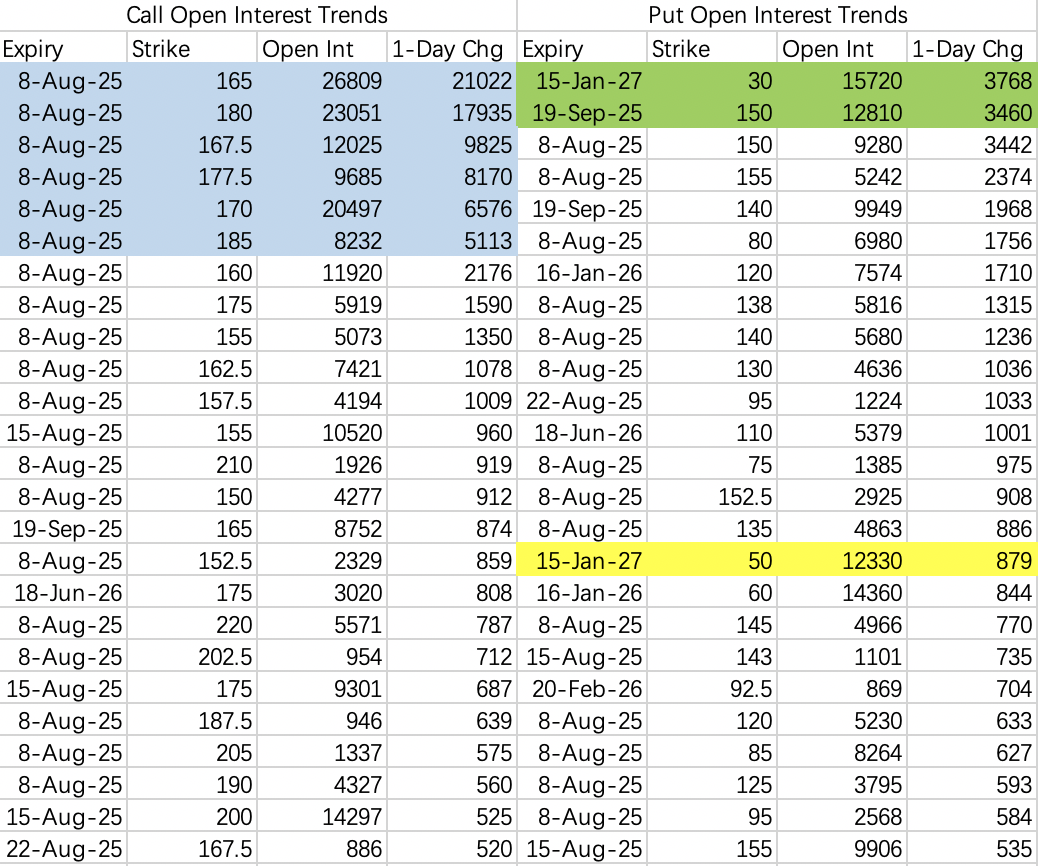

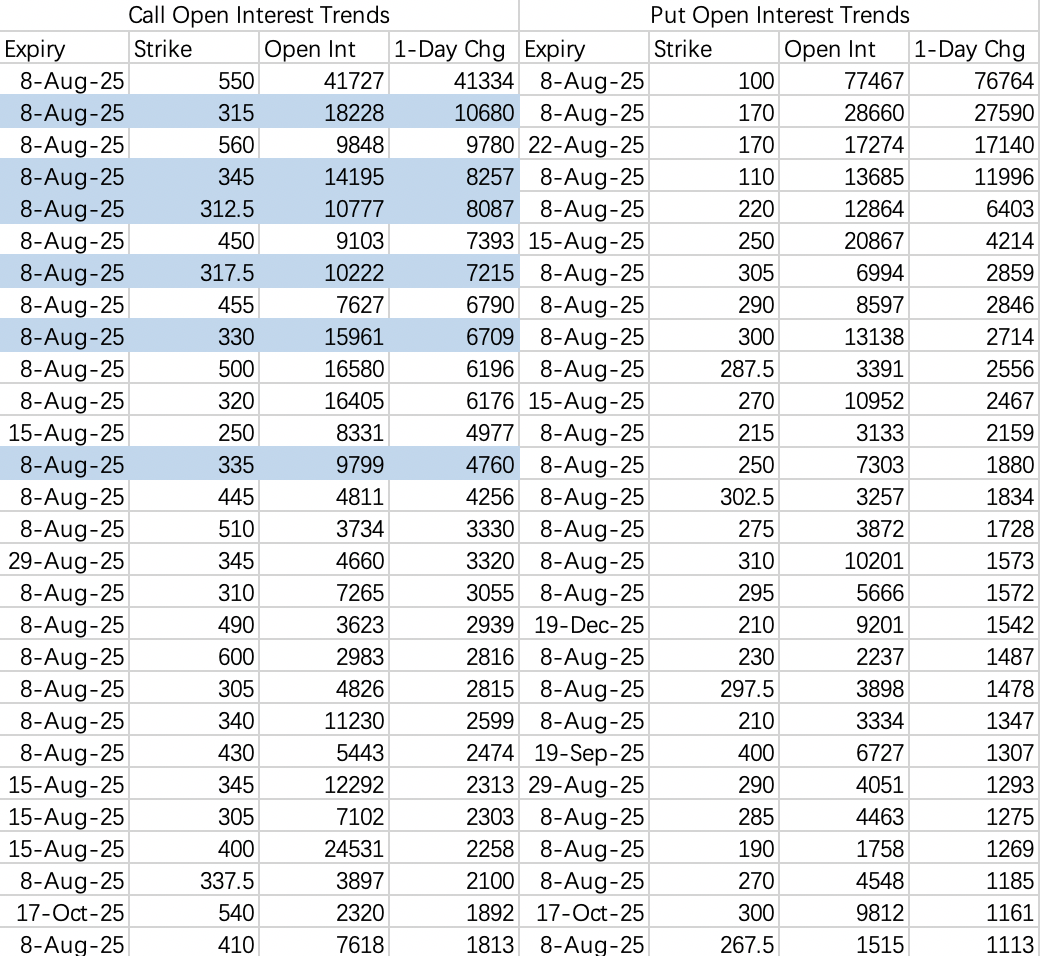

$Palantir Technologies Inc.(PLTR)$

PLTR’s earnings are more complex than AMD’s, with institutions preparing multiple hedging strategies:

Last week’s bearish call spread:

$PLTR 20250808 162.5 CALL – $PLTR 20250808 170.0 CALL

Friday’s roll included four spreads:

$PLTR 20250808 167.5 CALL – $PLTR 20250808 180.0 CALL

$PLTR 20250808 165.0 CALL – $PLTR 20250808 180.0 CALL

$PLTR 20250808 165.0 CALL – $PLTR 20250808 177.5 CALL

$PLTR 20250808 170.0 CALL – $PLTR 20250808 185.0 CALL

Outlook:

With upside already priced in, cloud service providers like PLTR are expected to outperform chipmakers.

PLTR’s upside is capped at 6%, making it more likely to remain below $170.

Bearish put activity targets a pullback to $150, with September $PLTR 20250919 150.0 PUT showing primarily sell-side interest.

$SUPER MICRO COMPUTER INC(SMCI)$

Last week, institutions sold calls at $61 and hedged with calls at $65.

Friday’s roll maintained the same strikes:

$SMCI 20250808 61.0 CALL (sell)

$SMCI 20250808 66.0 CALL (buy)

Outlook:

This week’s earnings are unlikely to break previous highs.

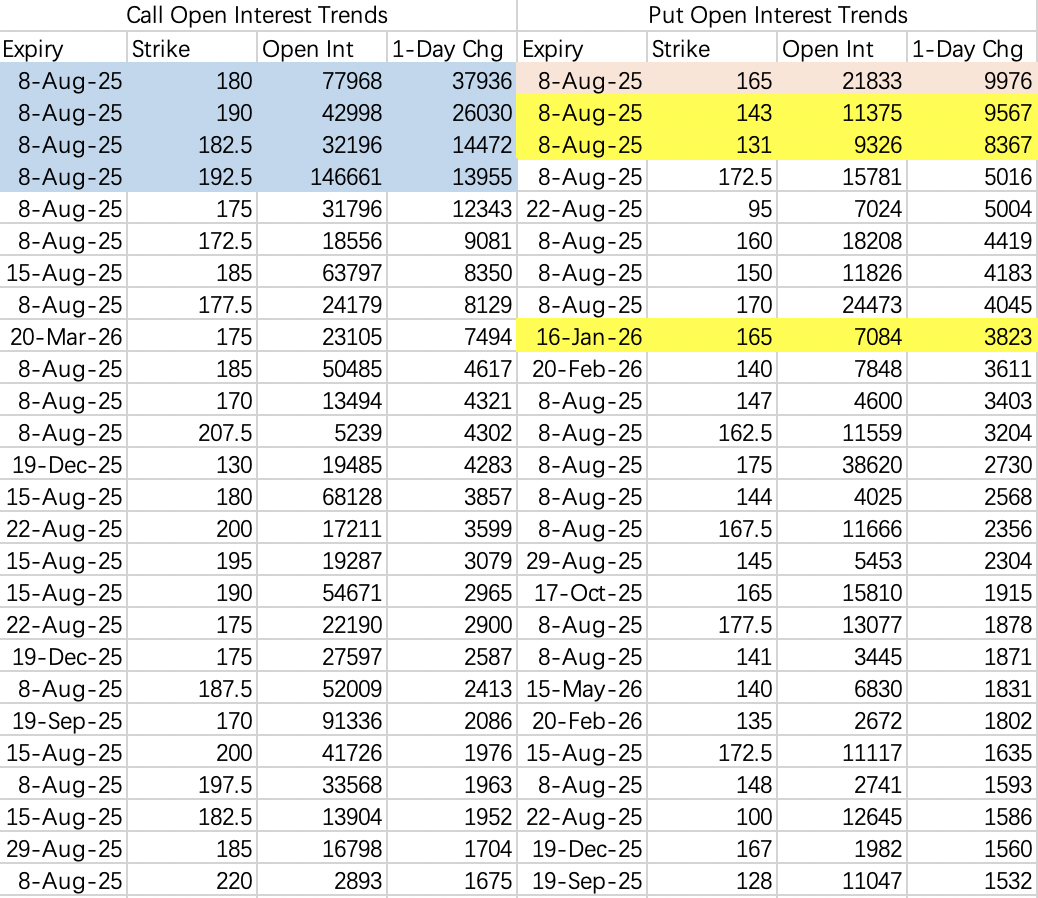

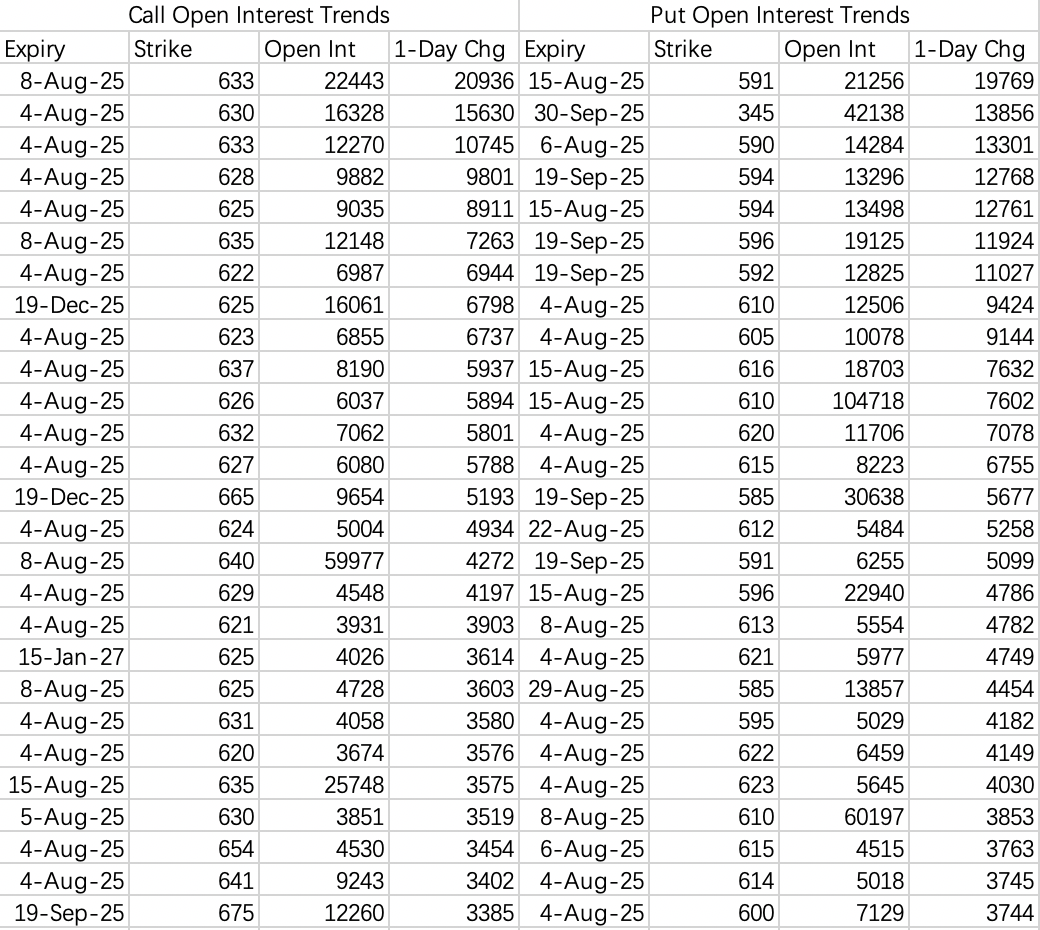

$NVIDIA(NVDA)$

Institutions sold calls at $180 and $182.5, hedging with buys at $190 and $192.5.

Bearish Put Flow:

Institutions target two levels for a potential pullback: $165 and $140, with $165 being the more likely retracement level.

$SPDR S&P 500 ETF Trust(SPY)$

Bearish positioning on SPY contrasts with NVIDIA, with upside targets at $590 and $610.

Most hedging is focused on worst-case scenarios.

$Tesla Motors(TSLA)$

Institutions sold calls at $312.5, $315, and $317.5, which could trigger a short squeeze.

The best sell call strike remains $335.

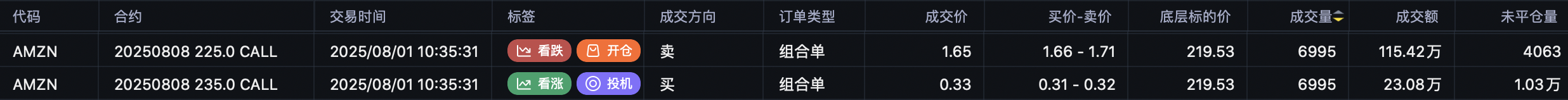

$Amazon.com(AMZN)$

This week is an excellent setup for sell calls. Follow institutional flow:

Sell $AMZN 20250808 225.0 CALL

Buy $AMZN 20250808 235.0 CALL

Current Positions

$TSMC (TSM)$: Continue with sell call:

$TSM 20250808 240.0 CALL

$AMD: Maintain sell call at $190 strike.

Comments