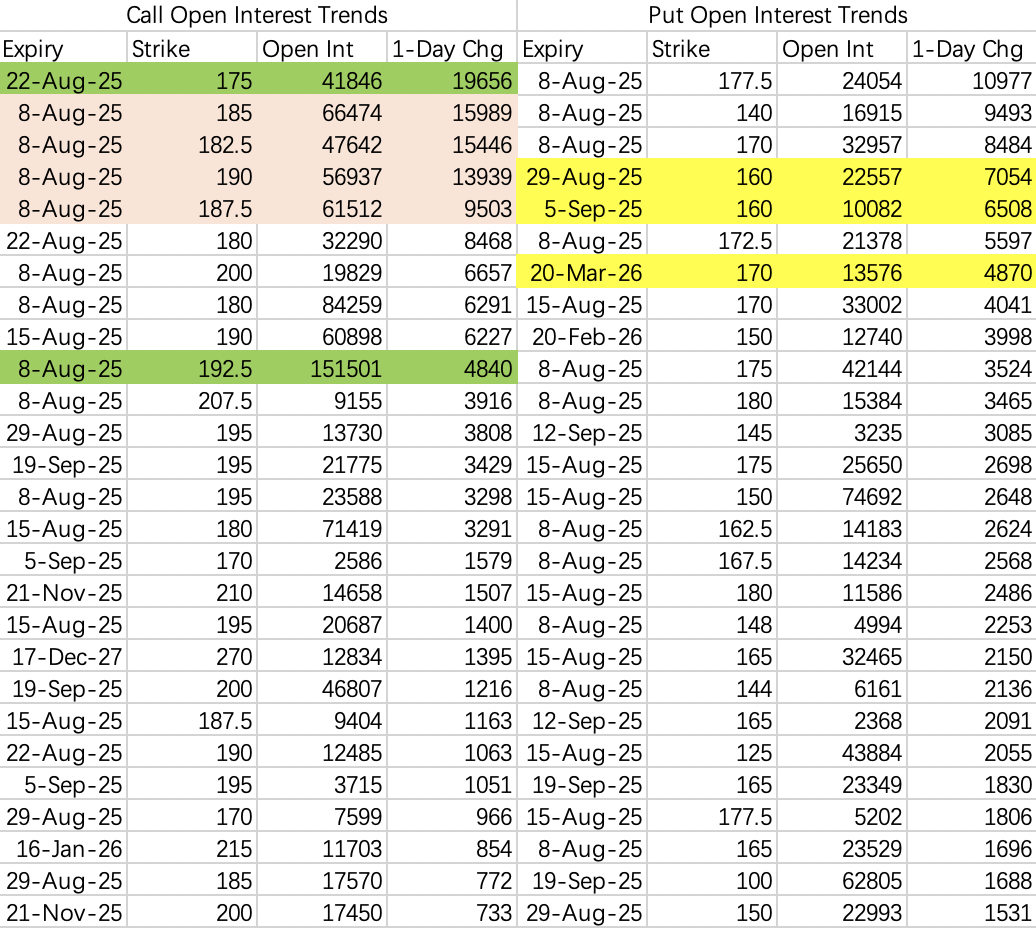

The options open interest is showing a pattern this week of preparing for an upside move in the short term but hedging for possible downside in the future.

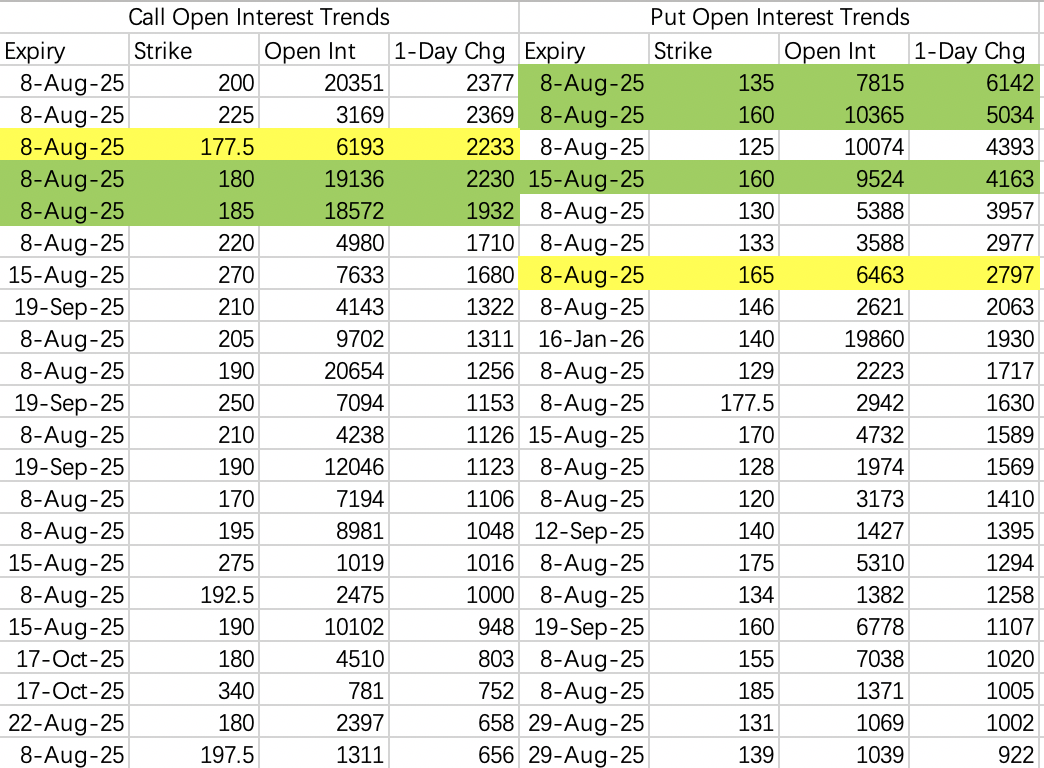

There's been very aggressive opening of 182.5–190 call positions expiring this week, which looks a bit like a short squeeze. This could be in anticipation of a surprise beat in AMD's earnings, potentially causing NVDA's stock price to soar. However, all of this is predicated on the stock price holding above 180.

From the perspective of large trades, though, the market doesn't seem to believe that NVIDIA will be able to stay above 180 in the coming weeks.

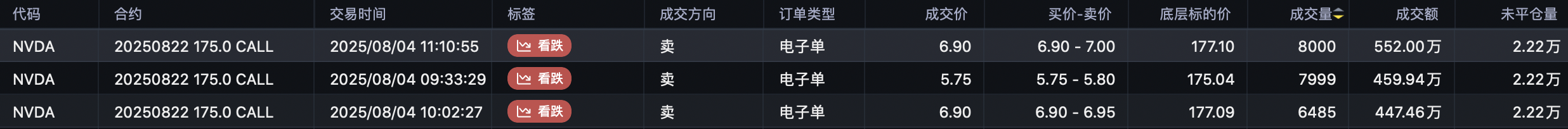

For example, there was a large sell call order for the August 22 expiry at 175 strike: $NVDA 20250822 175.0 CALL$ , with 19,000 contracts opened.

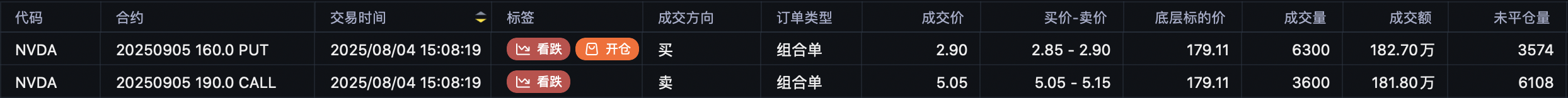

There's also a major closure of long 190 calls $NVDA 20250905 190.0 CALL$ and a switch to buying 160 puts $NVDA 20250905 160.0 PUT$ . Note that this is not a collar strategy—the call options are being closed, and put options are being opened.

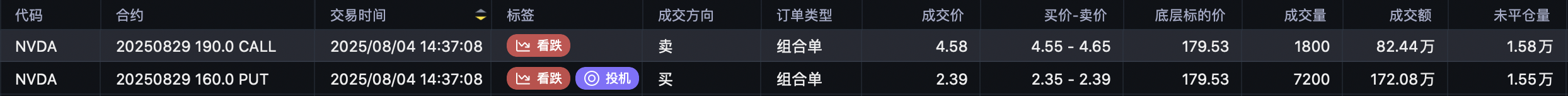

Similarly, we've seen closures of the August 29 expiry 190 calls $NVDA 20250829 190.0 CALL$ with a switch to buying 160 puts $NVDA 20250829 160.0 PUT$ .

Wednesday's earnings will likely see AMD's stock price fluctuate between 160 and 185. The stock is already trading at a high level, and the market feels it's hard for Dr. Su to paint an even bigger growth story.

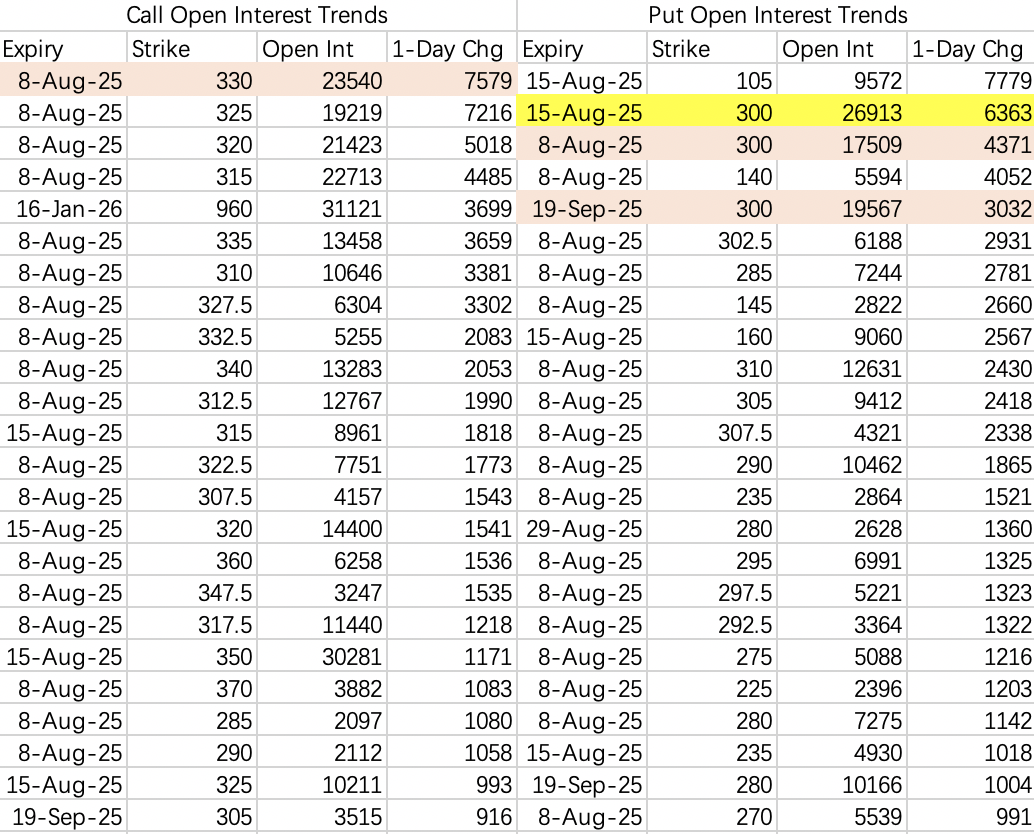

Tesla continues to hold steady in the 300–330 range.

PLTR: Initiated a sell call position $PLTR 20250808 185.0 CALL$ .

Comments