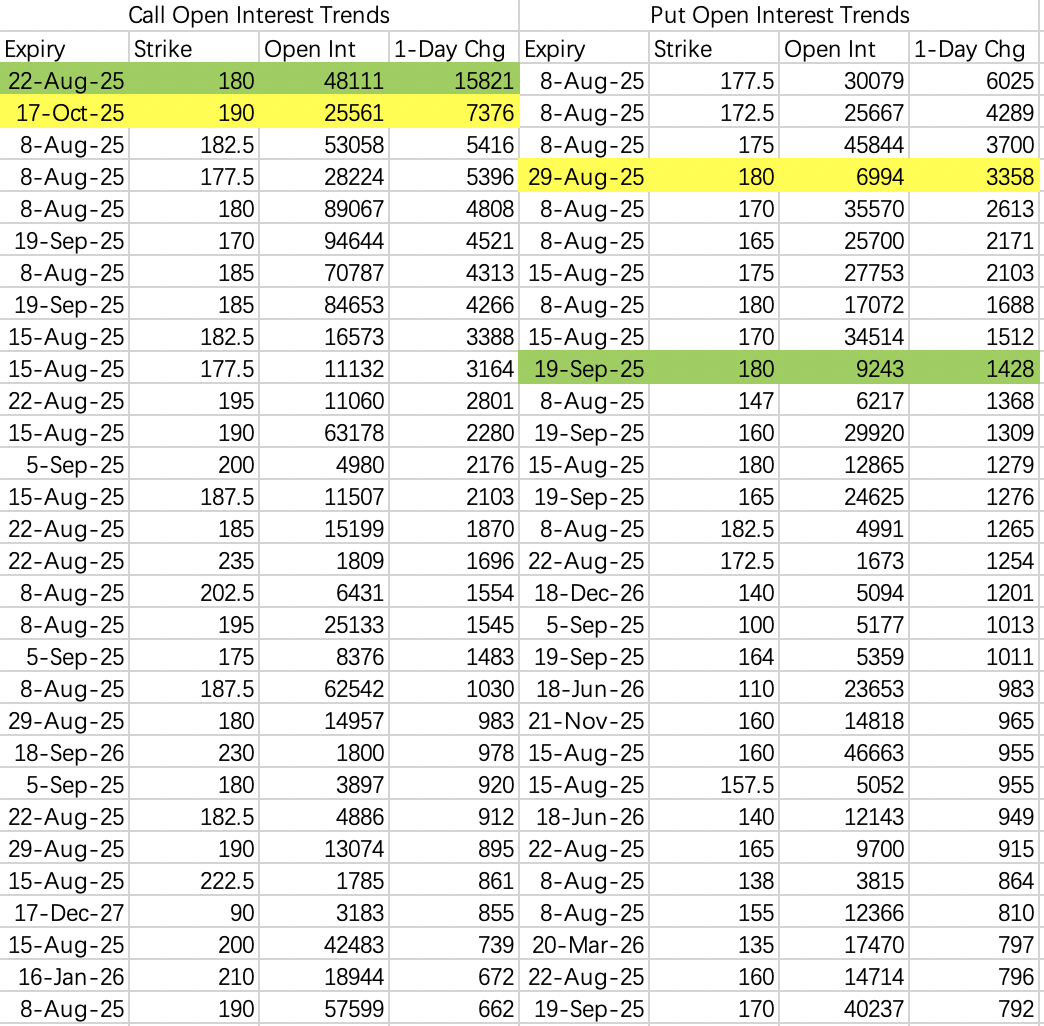

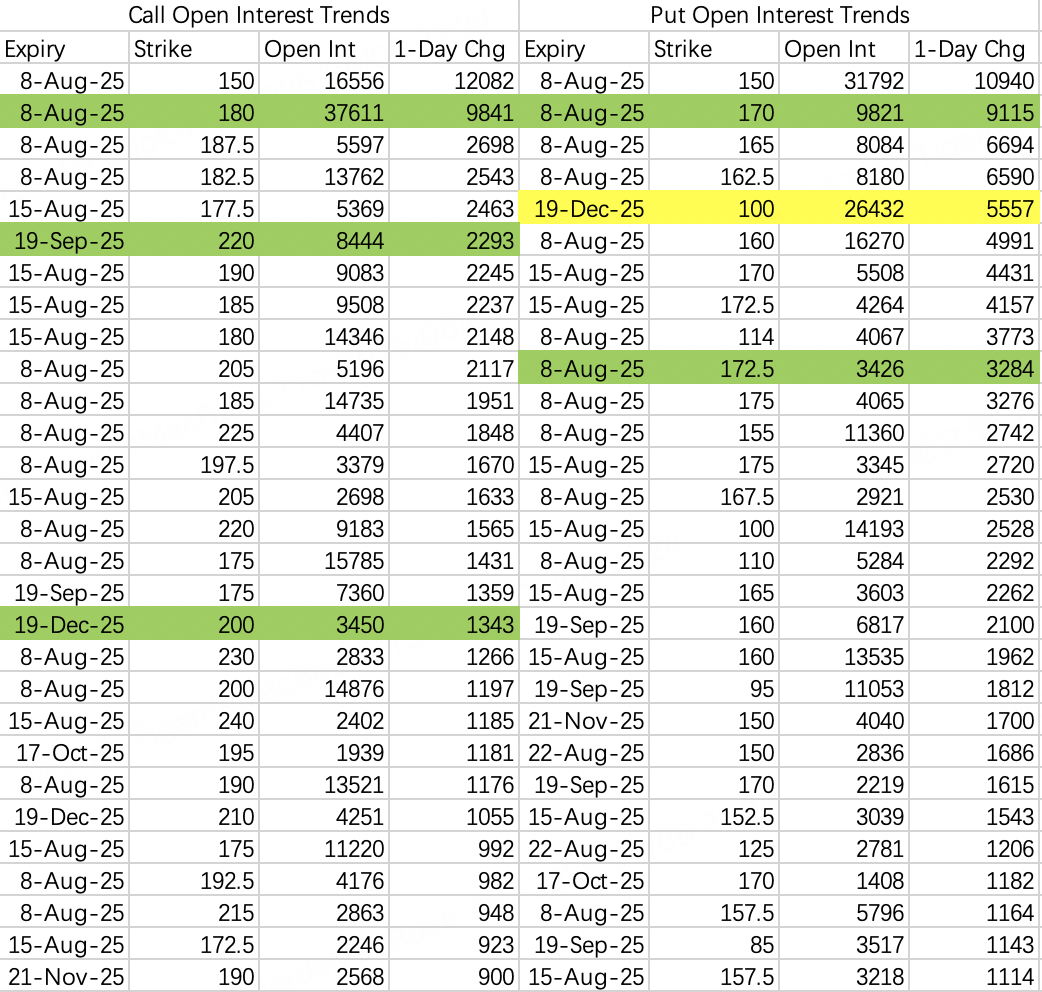

The first downside target after the pullback is 155.

Earnings were decent, but didn’t live up to the squeeze expectations set before the report, which is why the stock dropped.

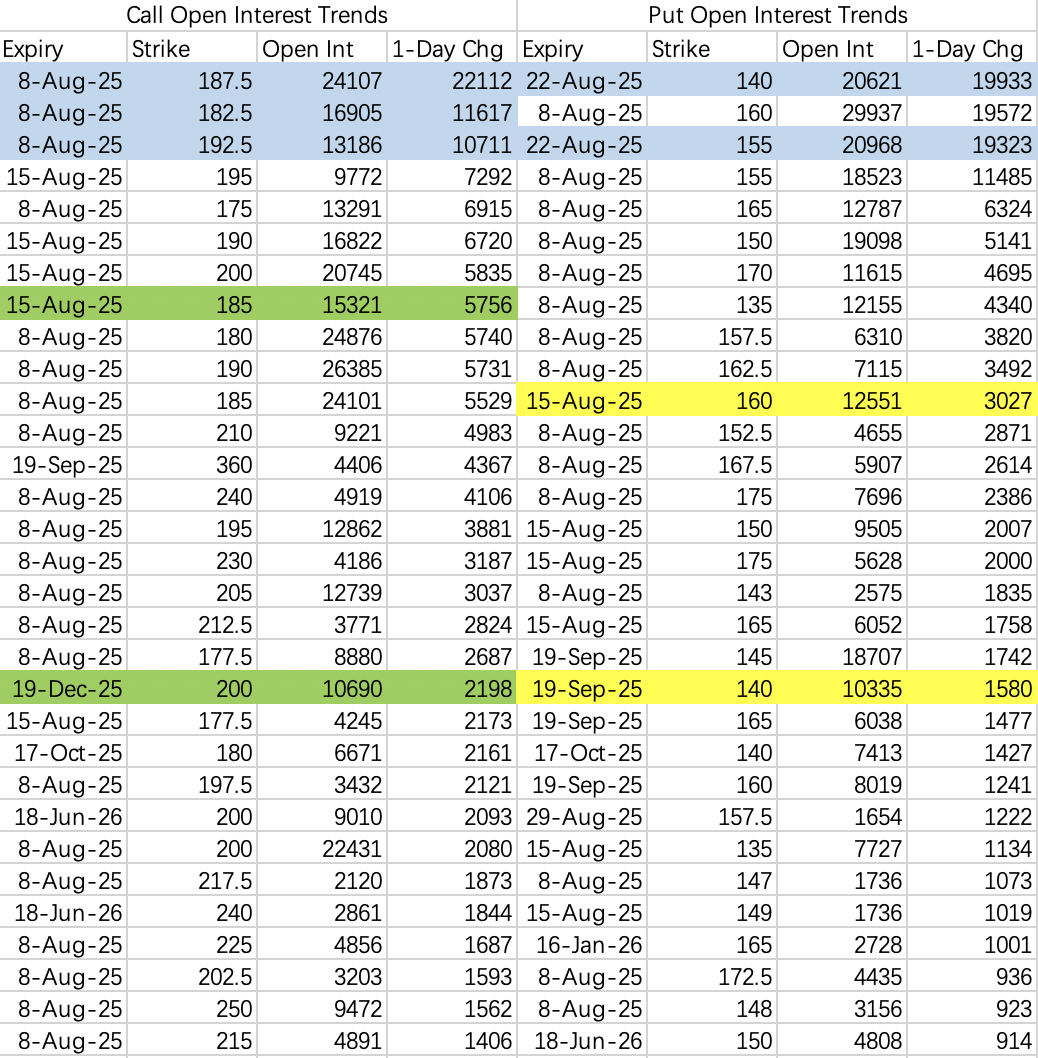

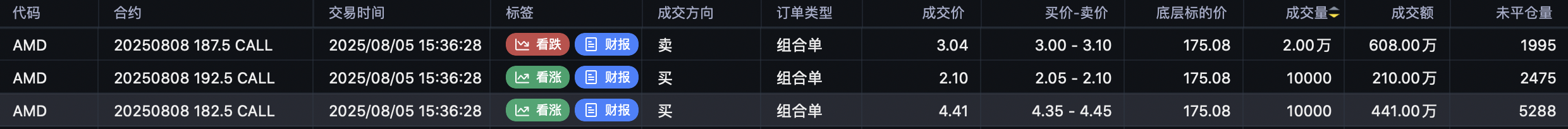

Before earnings, there were two large but opposing trades. One was bullish, targeting 182.5, set up as a butterfly spread with a very low cost—only about $400k.

The other was bearish, targeting below 155, by buying the 155 put $AMD 20250822 155.0 PUT$ and selling the 140 put $AMD 20250822 140.0 PUT$ , which is still open.

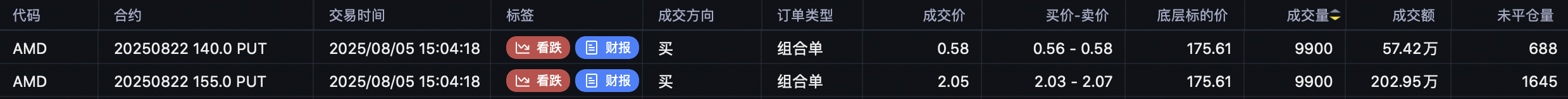

It’ll be difficult for NVIDIA to break above 180 this week, and also hard to fall below 170. The level of faith in NVIDIA is still much higher than in AMD.

$Palantir Technologies Inc.(PLTR)$

Earnings were very strong. There’s been heavy selling of 180 calls expiring this week—not sure if this will trigger a short squeeze.

On the bearish side, open interest in 170 puts and 172.5 puts is mostly on the sell side. Overall, the stock remains quite strong.

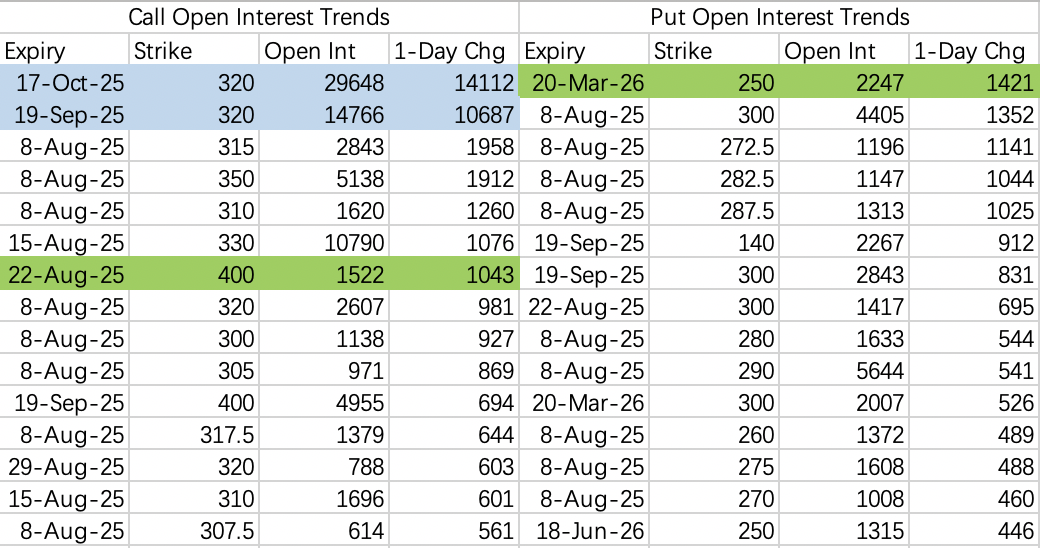

There was a large far-dated sell put order: $COIN 20260320 250.0 PUT$ . There’s still a possibility of further downside in the near term, so any new sell puts should consider strike prices below 270.

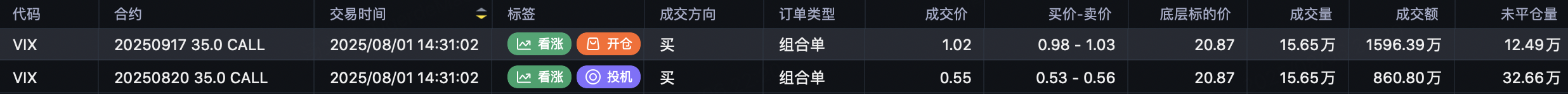

Despite the recent sharp declines in semiconductors, there doesn’t seem to be a black swan event on the horizon. VIX options rollovers show the strike unchanged; August positions are being rolled to September, still at 35 $VIX 20250917 35.0 CALL$ .

Today, I sold AMD calls $AMD 20250815 175.0 CALL$ and sold puts on PLTR $PLTR 20250815 165.0 PUT$ . As for AMD puts, I’ll continue to monitor for another couple of days.

Comments