Nvidia, the leader in AI chips, will release its financial report after the market closes on August 27, Eastern Time (after 4 a.m. on August 28, Beijing time). It is expected to achieve revenue of US $45.97 billion in 2026Q2, a year-on-year increase of 53.03%; Earnings per share are expected to be $0.935, a year-on-year increase of 39.51%.

From the Nvidia supply chain: the performance of TSMC, KYE Electronics, Foxconn and other companies, and the situation of Nvidia in the second quarter of fiscal year 2026, the revenue, production capacity and other data of the three all show that Nvidia's demand is strong.

The market expects the company's revenue in the second quarter of this year to be approximately US $46 billion, a year-on-year increase of approximately 53%; Earnings per share were approximately US $0.935, an increase of approximately 40% year-on-year. The above revenue and profit expectations should include the H20 ban known to the market. After all, since the ban was implemented in April, about 2.5 billion US dollars of products cannot be shipped normally, and will even face the pressure of impairment losses.

In addition, BLACKWELL's current shipments and market demand are huge, which guarantees revenue and profitability. The key factor is only in terms of gross profit margin. The company's guidance last quarter was non-GAAP gross profit margin guidance of 72.0% ± 0.5% (i.e. 71.5% to 72.5%). Meanwhile, GAAP gross margin guidance is 71.8% ± 0.5%. The performance of gross profit margin will be the key factor after judging the performance.

Morgan Stanley's research report in mid-August has clearly pointed out that under the same conditions, data centers using Nvidia GB200 NVL72 are the most efficient, which has led to stronger acceptance of BLACKWELL in the market. Most importantly, it will have a more positive effect on the upgraded version of Blackwell Ultra (delivered in the second half of 2025) that has entered mass production. Current partners include AWS, Google Cloud, Supermicro, etc. reflect strong market demand (orders are rumored to be sold out in 2025), which guarantees revenue. As long as there is no negative news from the production line, it will be beneficial to the company's earnings and revenue guidance performance.

In addition to the performance of last quarter, the performance guidance and outlook given by the company are also important. After the official announcement of Blackwell Ultra at the GTC conference on March 18, this performance is believed to focus on this upgraded version, positioned as a key computing platform in the era of AI Factories, focusing on AI reasoning, agent AI and physical AI and other high-performance applications.

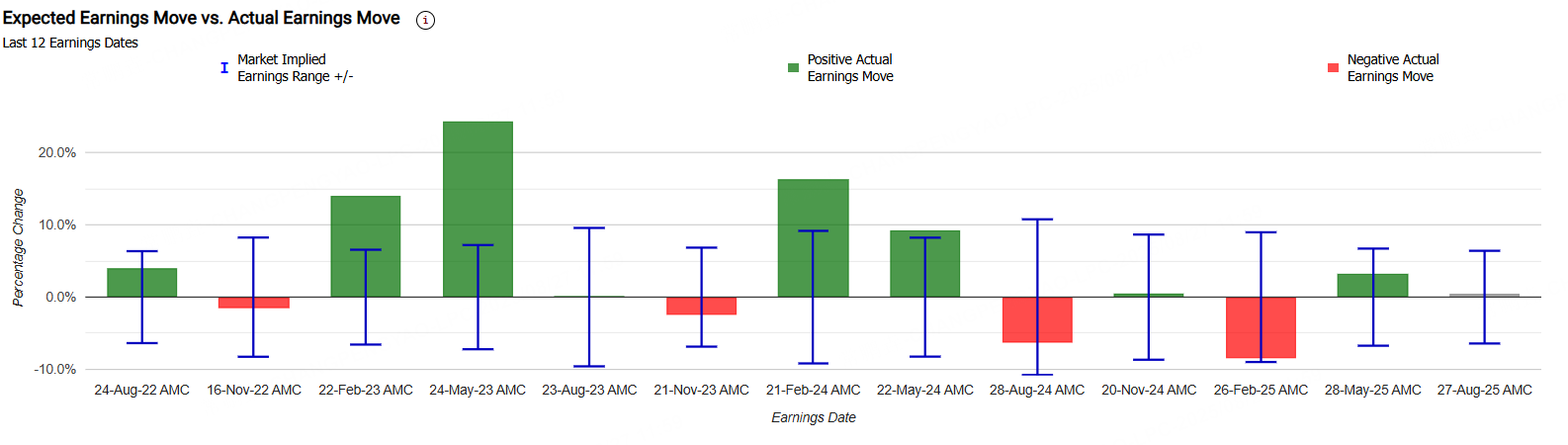

Nvidia's post-earnings volatility

Nvidia's current implied move is±6.07%, indicating that the options market is betting on its single-day rise and fall after its performance6.07%。

According to Marketchameleon data, Nvidia's pre-performance option volatility is usually overvalued: Nvidia's market expectations in the first four quarters of its post-performance volatility range averaged±8.8%, and the final actual change range reaches±4.7%;

In the past 12 performance days, Nvidia's probability of rising is67%, the maximum increase is+24.37%, the largest drop is-8.48%;The market expects that the average post-performance fluctuation range of the previous 12 results is±8.1%, and the final actual change range reaches±7.6%, the options market has67%Time ofOverestimateThe fluctuation range after Nvidia's financial report was announced.

Judging from the current implied volatility IV,Current IV is 48.10%, in the 38% percentile, which is higher than historical volatility (HV = 24.89%),Shows that the option premium is high, but relatively historically low, meaning that there is no obvious directional preference in the current market.

In view of the current Nvidia financial report market, investors who have different expectations for Nvidia's stock price trend can adopt different strategies. Investors who are cautious and bullish in holding shares can adopt the collar strategy, investors who want to go long or short can use the spread strategy, and investors who want to short volatility can use the short-selling wide straddle strategy.

For investors who don't want to predict the rise and fall of Nvidia, investors can make profits by going long conservatively, and the strategy here can consider the bull market bearish spread strategy.

Bull Put Spread Strategy

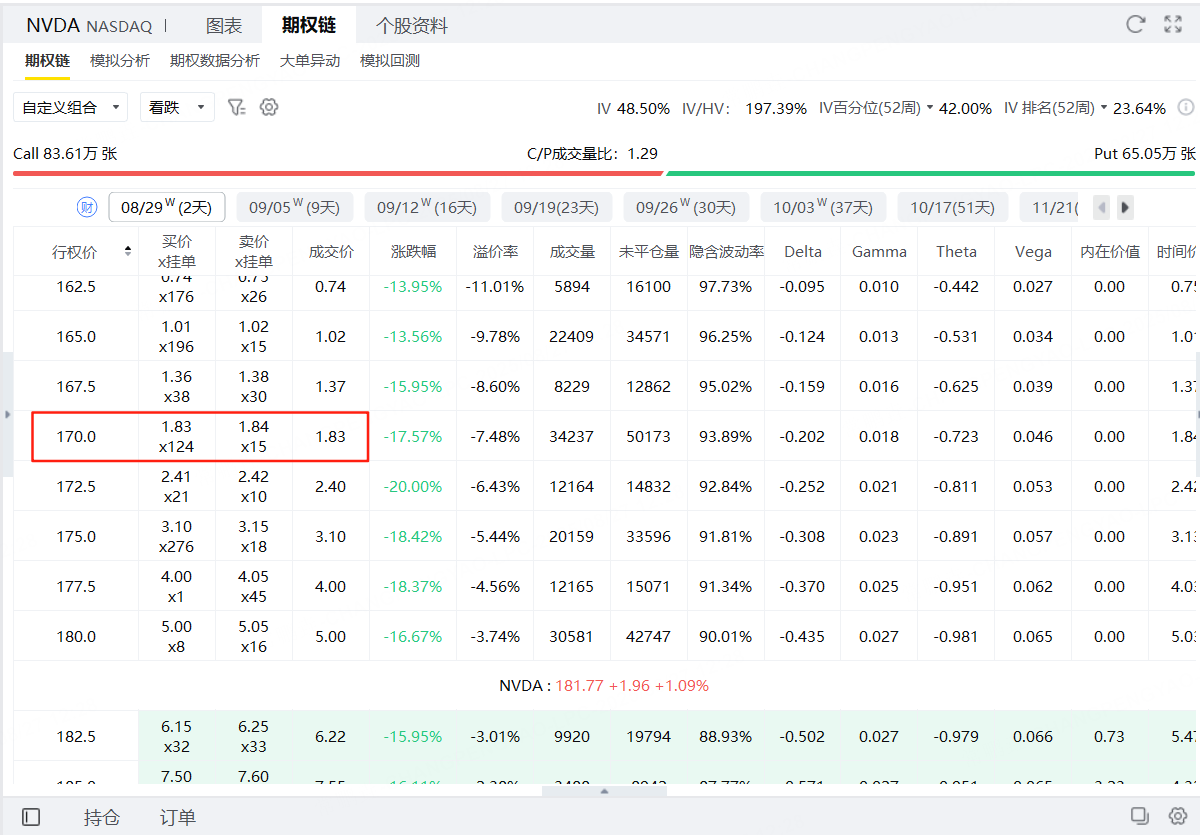

Investors can use the bull put spread, Nvidia's current price is 182.64. Investors can bet that after the earnings report, the stock price will rise slightly. Investors can sell Put with an exercise price of 180 and receive a $500 premium.

In the second step, investors can buy a put option of 170, which costs $183 premium.

By selling 180 strike puts and buying 170 strike puts, investors are betting that Nvidia stock will rise slightly or stay around $180 after the earnings release.

Strategy Building

Investors can complete the strategy construction through the following two steps:

Sell a Put option (Put) with an exercise price of US $180 and receive a premium of US $5.00 per share, corresponding to a revenue of US $500 per contract;

Buying a Put option (Put) with an exercise price of $170 pays a premium of $1.83 per share, corresponding to a cost of $183 per contract.

The portfolio's net premium revenue was:

$500-$183 = $317 (per contract)

This net income represents the maximum profit an investor can make when the stock price is above $180.

PROFIT AND LOSSThis strategy is an option strategy with limited risk, and the maximum gain and maximum loss are determined when the position is opened.

Maximum Profit: $317

Conditions: If Nvidia's stock price is higher than $180 when the option expires

Neither option will be exercised at that time, and premium's net income will be the profit

Maximum loss: $683

Conditions: If Nvidia's stock price is below $170 at expiration

Short Put executed, need to buy stock at $180

Long Put was also executed, sold at $170

The loss between the legs is $1,000 (strike spread × 100), minus $317 premium income, and the final net loss is $683

Break-even: $176.83

Calculated as: Strike price of $180 selling Put minus net premium income of $3.17 (per share)

Investment Logic and Risk Control

The core idea of the strategy is to bet that Nvidia will not fall significantly after the earnings report. As long as the stock price stays above $180, investors can reap the full premium gains. Even if the stock price retreats slightly, it can still be profitable as long as it doesn't fall below the breakeven point of $176.83. From a money management perspective, the maximum risk of this strategy is $683 and the maximum profit is $317. This is a structure that takes into account risk control and income efficiency during the high volatility financial report window period.

The bull market put spread is a rational choice when faced with high uncertainty events such as financial reports. Compared with directly betting on a sharp rise in stock prices, it is more suitable for the market expectation of "moderately optimistic and maintaining a high level". By reasonably choosing the exercise price and term, investors can obtain steady returns while controlling the pullback/retracement.

Comments

Thanks for the information 👍🏻💵💪🏻😁$NVIDIA(NVDA)$ [Allin][USD]