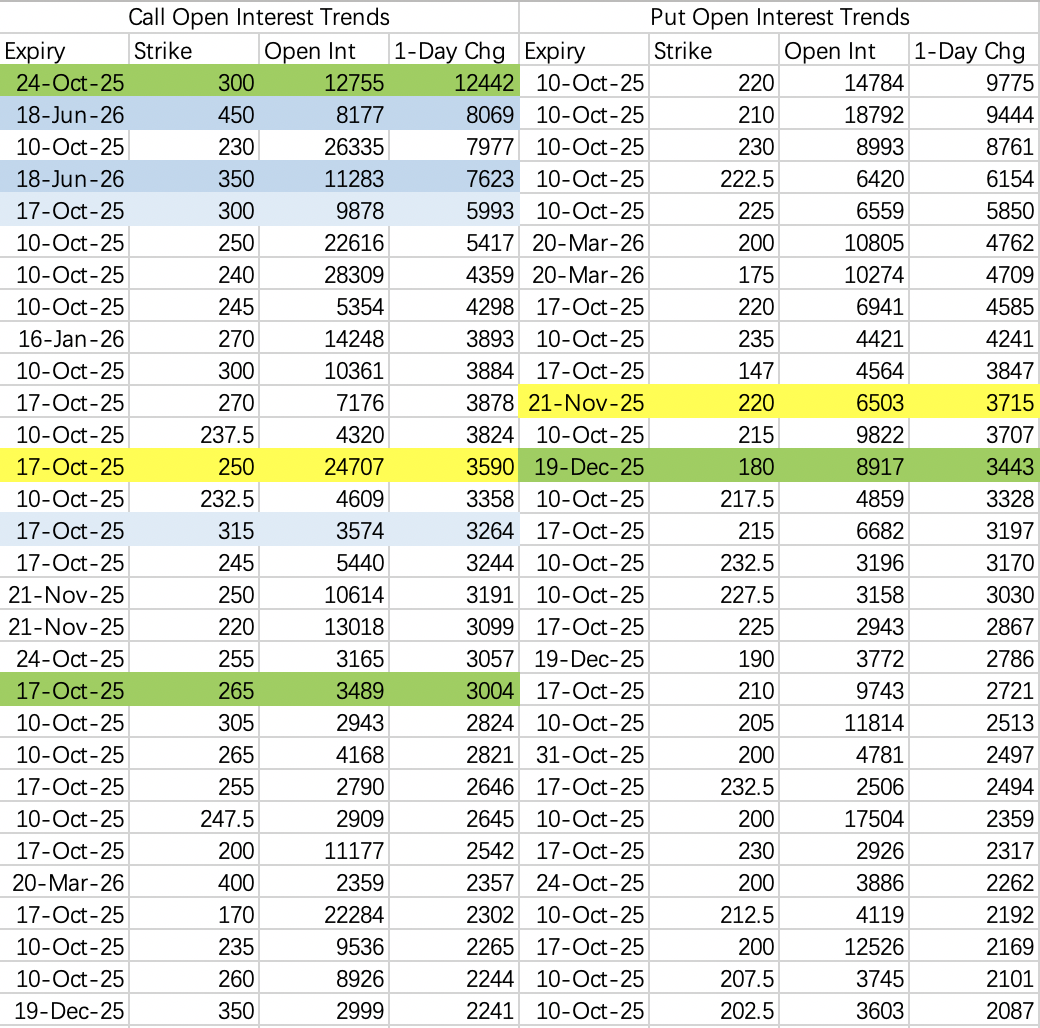

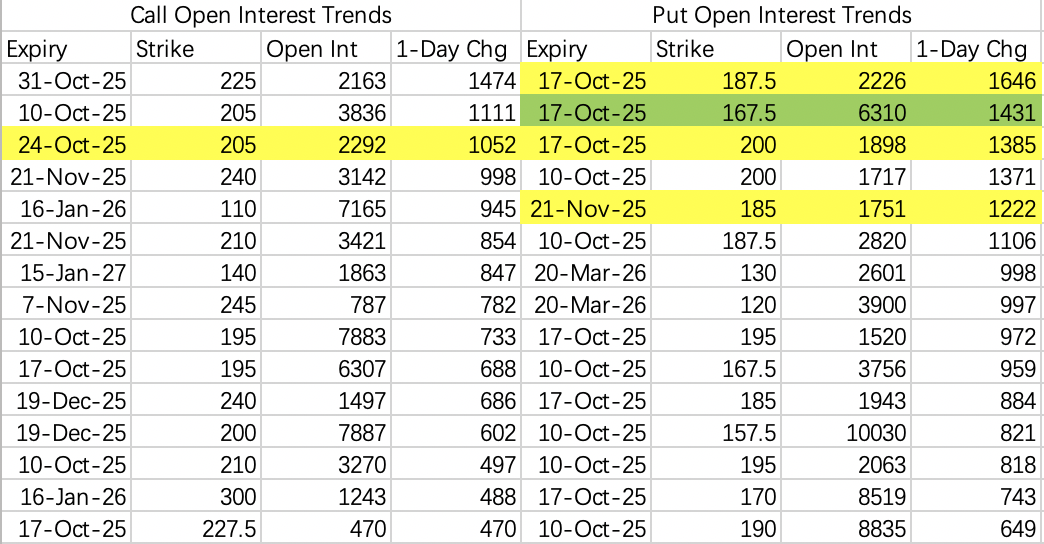

Options flow suggests the market expects this rally to pause around the 250 level.

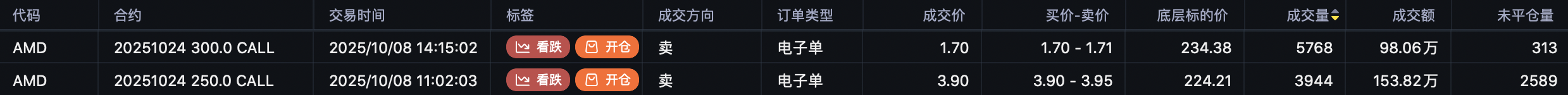

However, expectations are one thing, reality is another. Large sell call orders are targeting prices significantly above the main open interest zone:

Sell call: 12.4k lots of the $AMD 20251024 300.0 CALL$ opened.

There are also large sell call orders at lower strikes, like the 250 $AMD 20251024 250.0 CALL$ , which feels prone to a short squeeze.

Put open interest is concentrated between 210 and 220. Selling puts could be considered below this range, e.g., the $AMD 20251017 210.0 PUT$ .

This week will likely close below 250 but above 210.

If AMD seems too expensive, consider the 2x leveraged ETF $GRANITESHARES 2X LONG AMD DAILY ETF(AMDL)$ . Note that ETFs differ from stocks, especially regarding investor protections – it's like going bare. Also, be mindful of leverage decay; the drag and returns resemble holding long-dated ATM calls for over a year. Suitable for small positions; larger capital is better allocated to AMD shares.

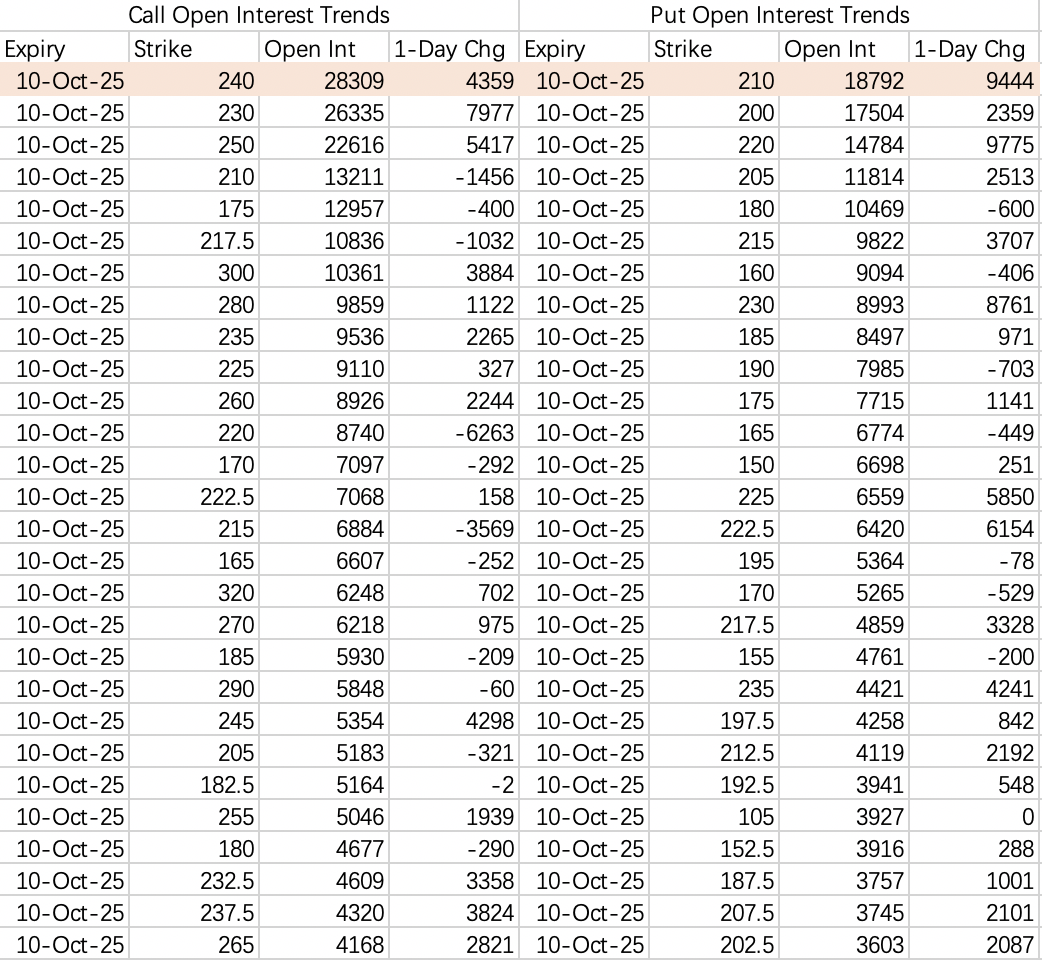

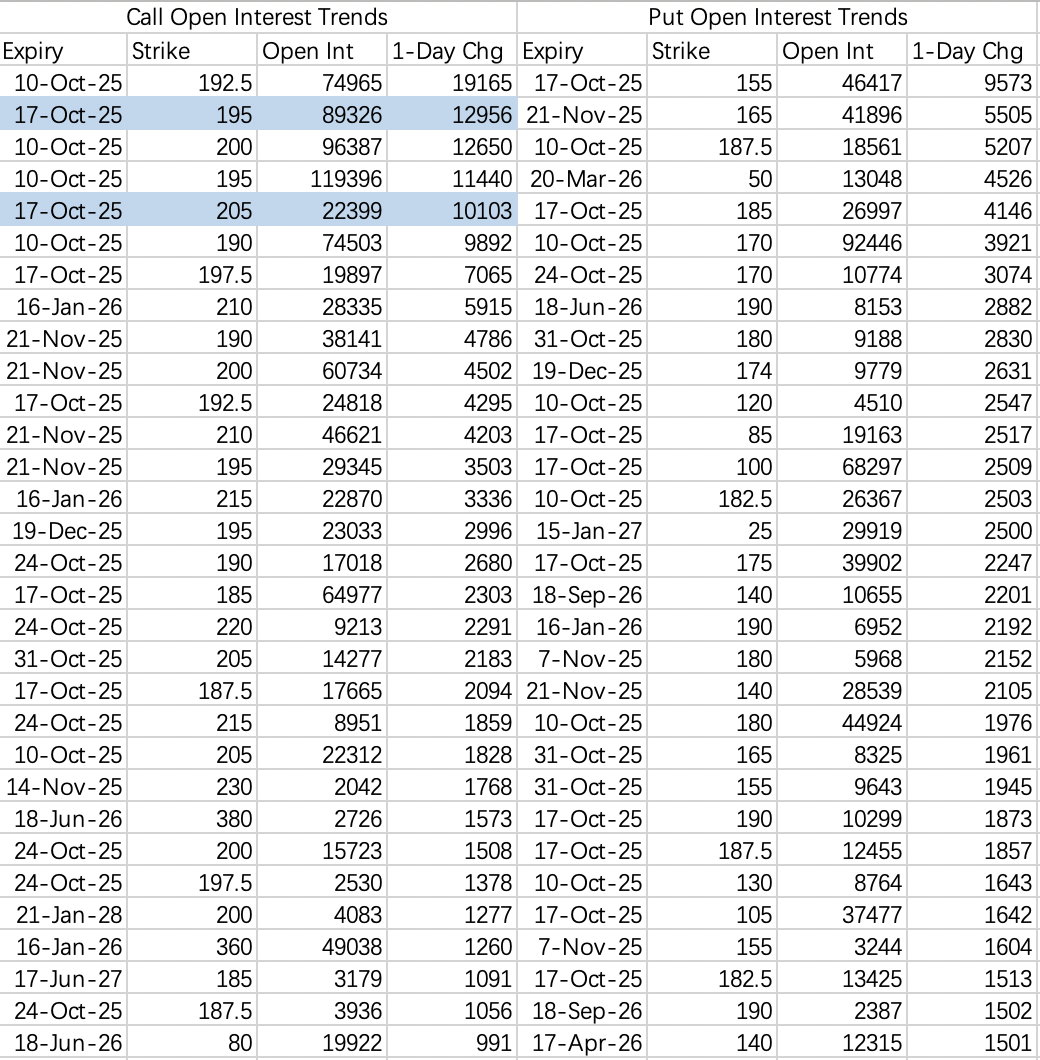

Lacking momentum this week; unlikely to break 200. Key level 197.5 saw many positions closed. Expect a close around 195 this Friday, with a break above 200 likely next week.

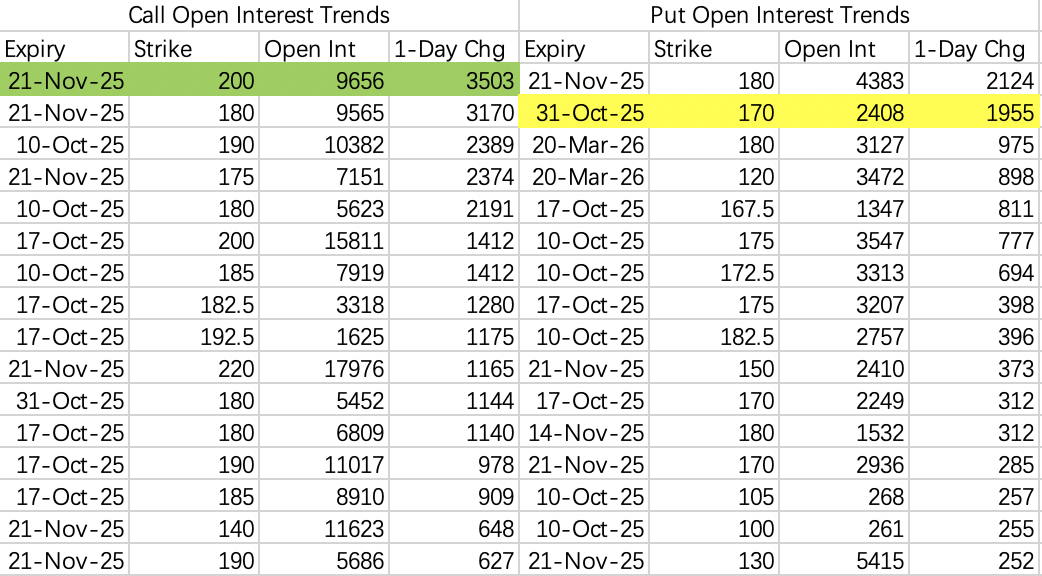

Considering the 200 breakout, low-strike put open interest seems less relevant now. Are we seeing ambiguous hedging, suggesting a sharp pullback after breaking 200?

A tactical trade could be selling this week's 190 strike put, with a low probability of assignment: $NVDA 20251010 190.0 PUT$ .

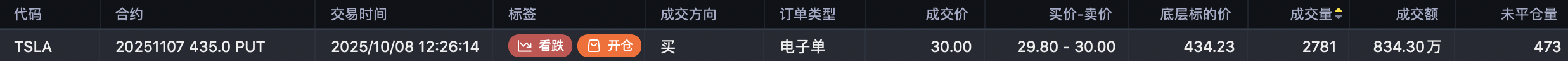

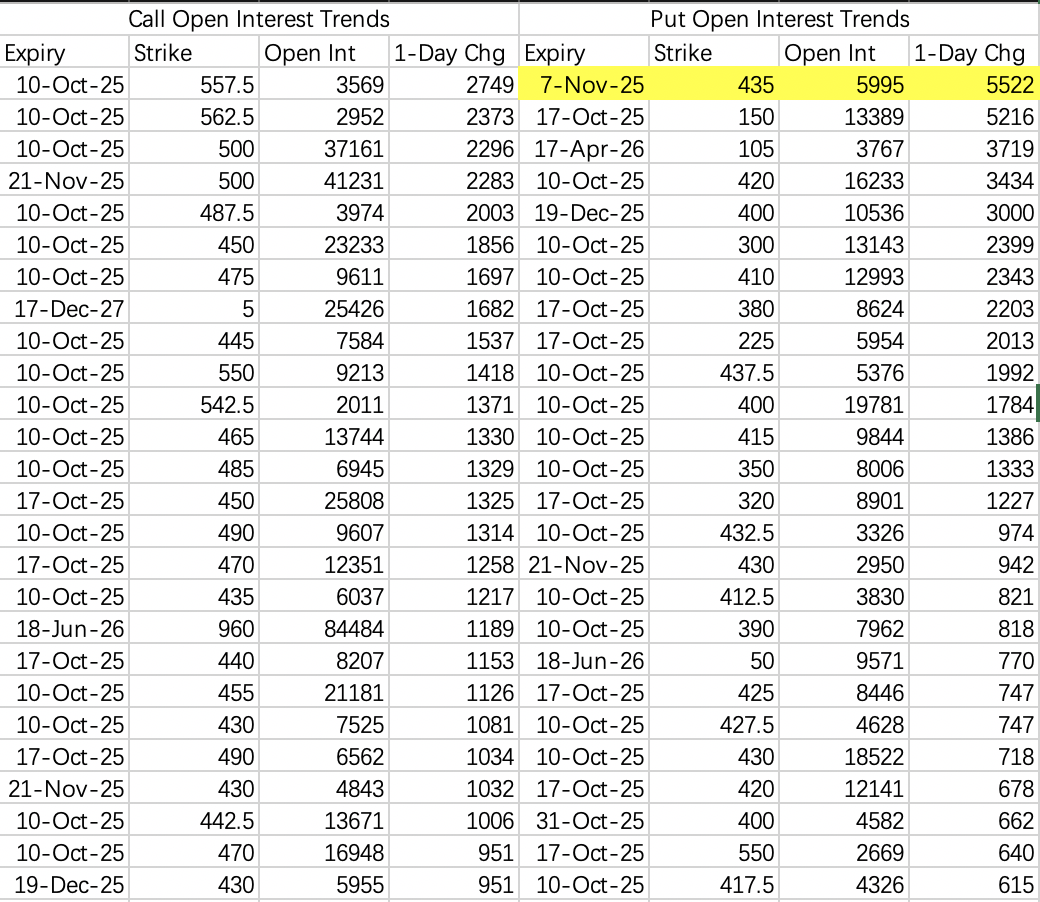

With TSLA pulling back below 435, someone opened 5.5k lots of the Nov 7th 435 put $TSLA 20251107 435.0 PUT$ , estimated value ~$15M.

The pullback target is still around 400.

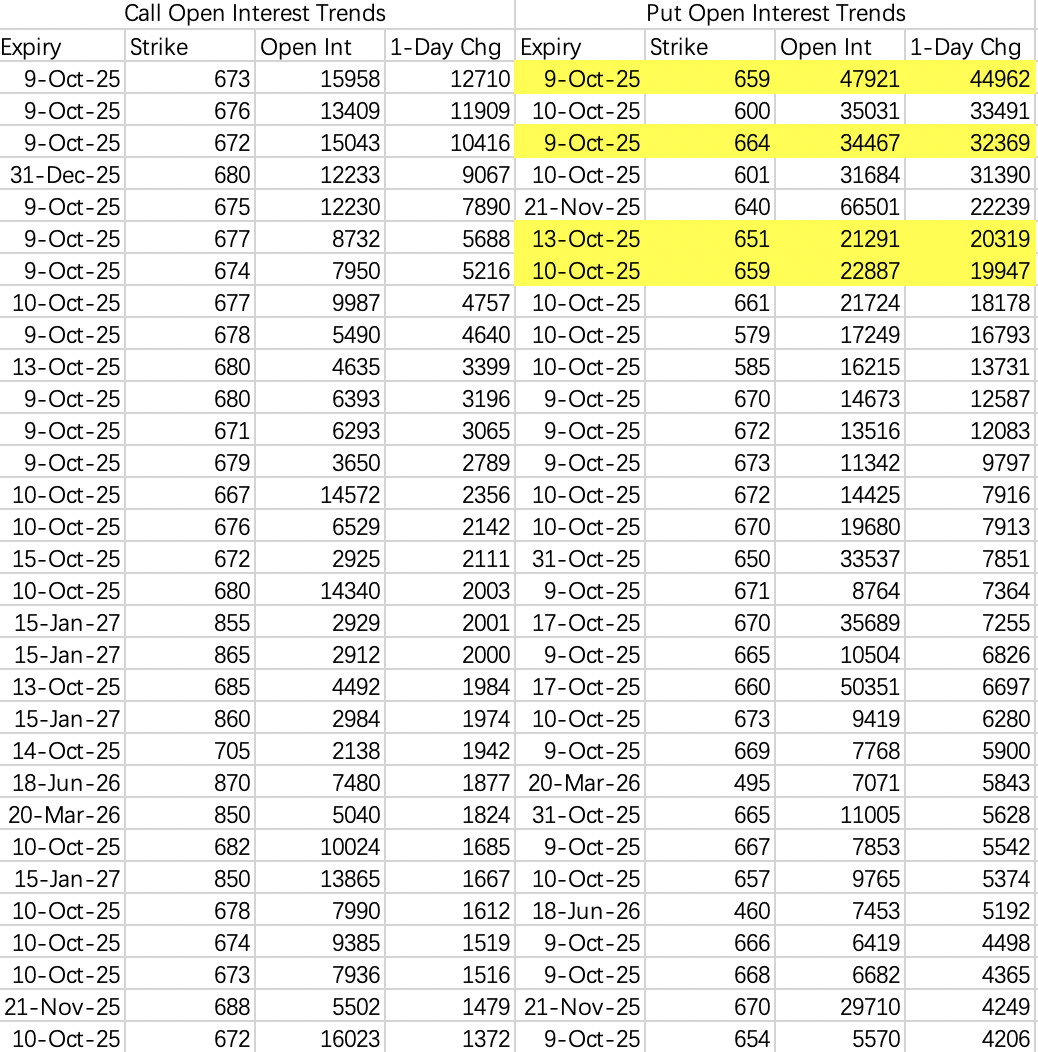

Despite recent AI sector positives, strong pullback sentiment emerged Thursday/Friday, betting on a <3% dip into next week, aligning with the NVDA put open interest.

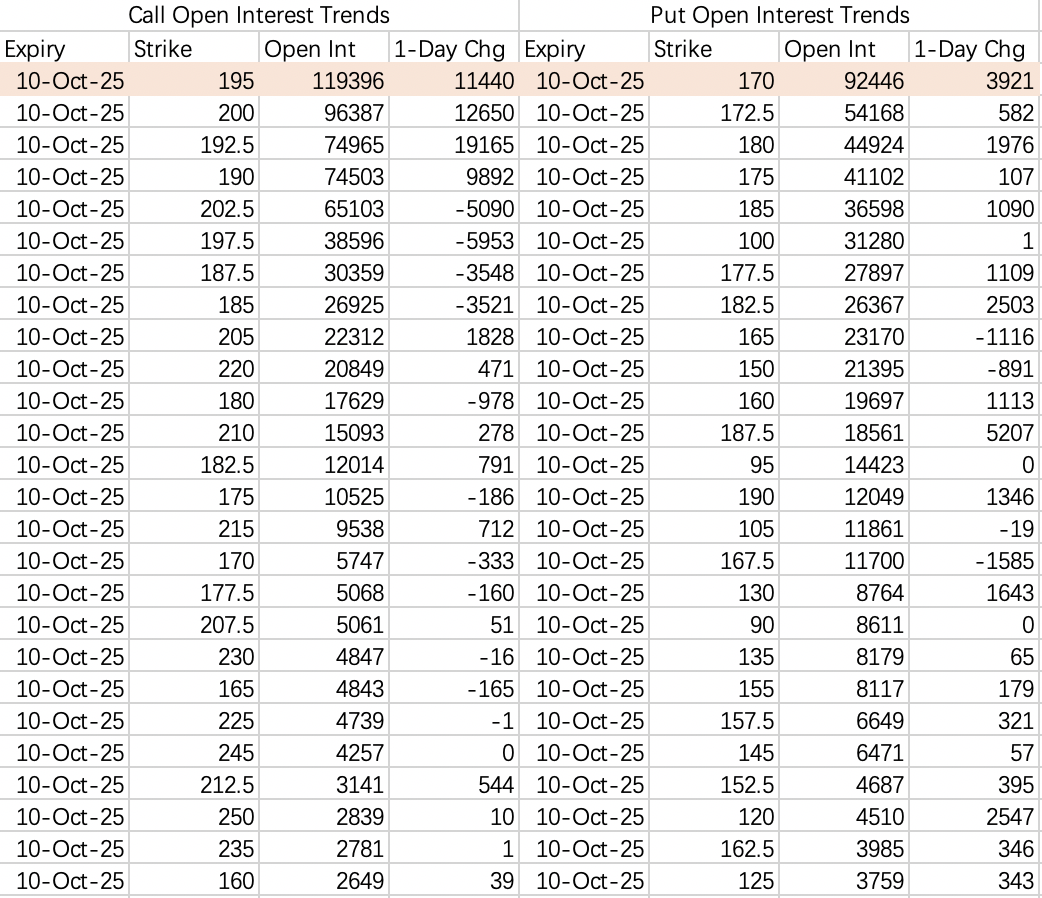

Expect BABA to trade between 170-200 until November. Selling puts near 170 on dips is viable.

Large sell order in the Nov 200 calls: $BABA 20251121 200.0 CALL$ , with recent price action staying below 200.

Large buy order in the Oct 31st 170 puts $BABA 20251031 170.0 PUT$ , indicating an expected pullback towards 170. Overall put open interest suggests support at 170, making it a suitable level for selling puts on a dip.

Aggressive put selling is evident, but the expected pullback magnitude is small. Consider selling the 180 put for near-term range-bound action: $MU 20251017 180.0 PUT$ .

Comments