Everyone shouldn't worry about OpenAI's contract fulfillment issues with major companies anymore, because they've decided to sell adult AI content. Check out Altman's X feed for details; those who get it, get it. He really knows what makes money fast, huh?

For now, it's just conversational, not video-based. One can imagine how explosive the computing demand will be when it reaches that stage. So, thinking there's an AI bubble might be overblown.

Altman probably thought of this too. Analysts can upgrade their ratings and price targets overnight.

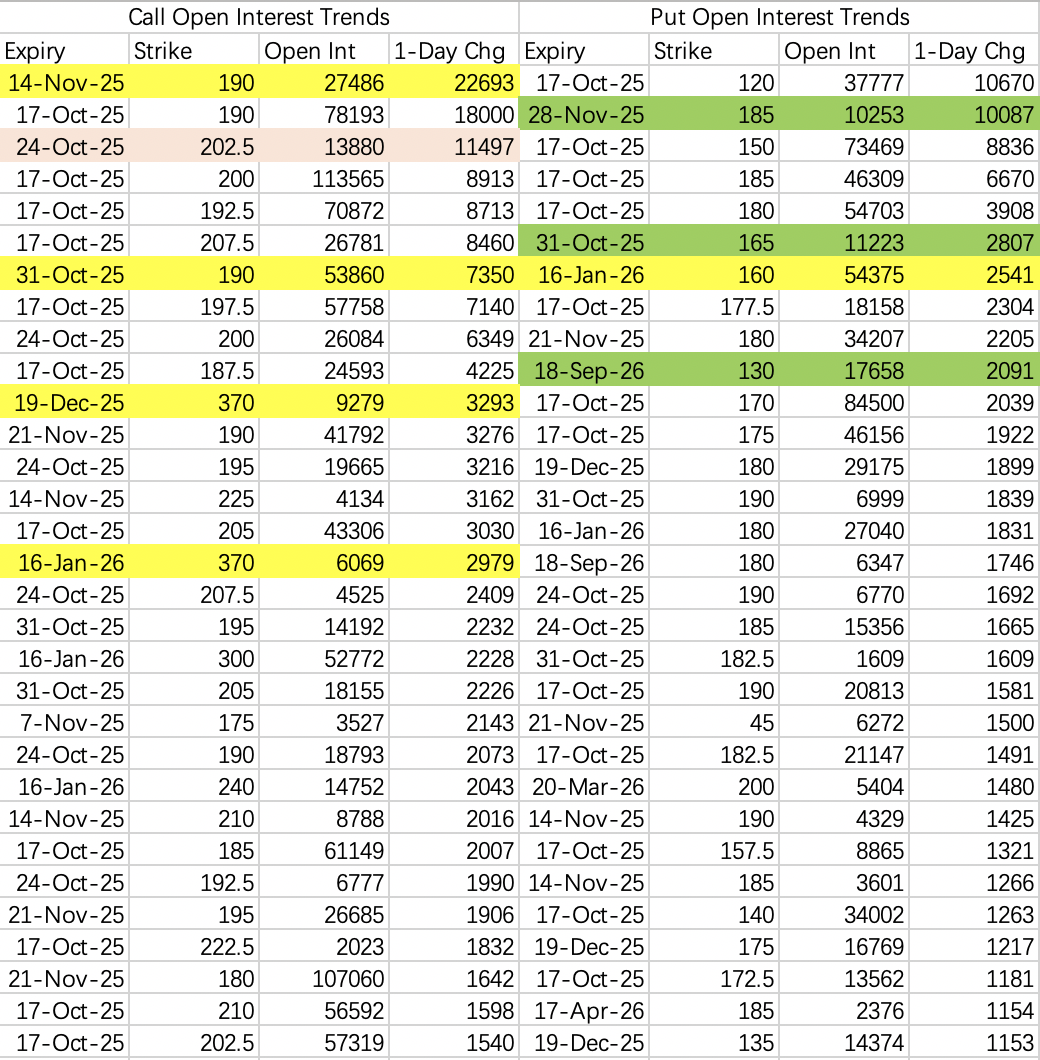

Bullish opening positions are relatively optimistic; there's a lot of long positioning in recent call options, but it's still within a normal bullish range, not to mention the price still dropped on Tuesday.

Bearish opening positions are either for a sharp drop or nothing happening. Compared to opening positions for this week, the market prefers longer-dated ones, probably because the uncertainty this week is just too high. Also, there are quite a few sell puts, like $NVDA 20251128 185.0 PUT$ and $NVDA 20251031 165.0 PUT$ .

$SPDR S&P 500 ETF Trust (SPY)$

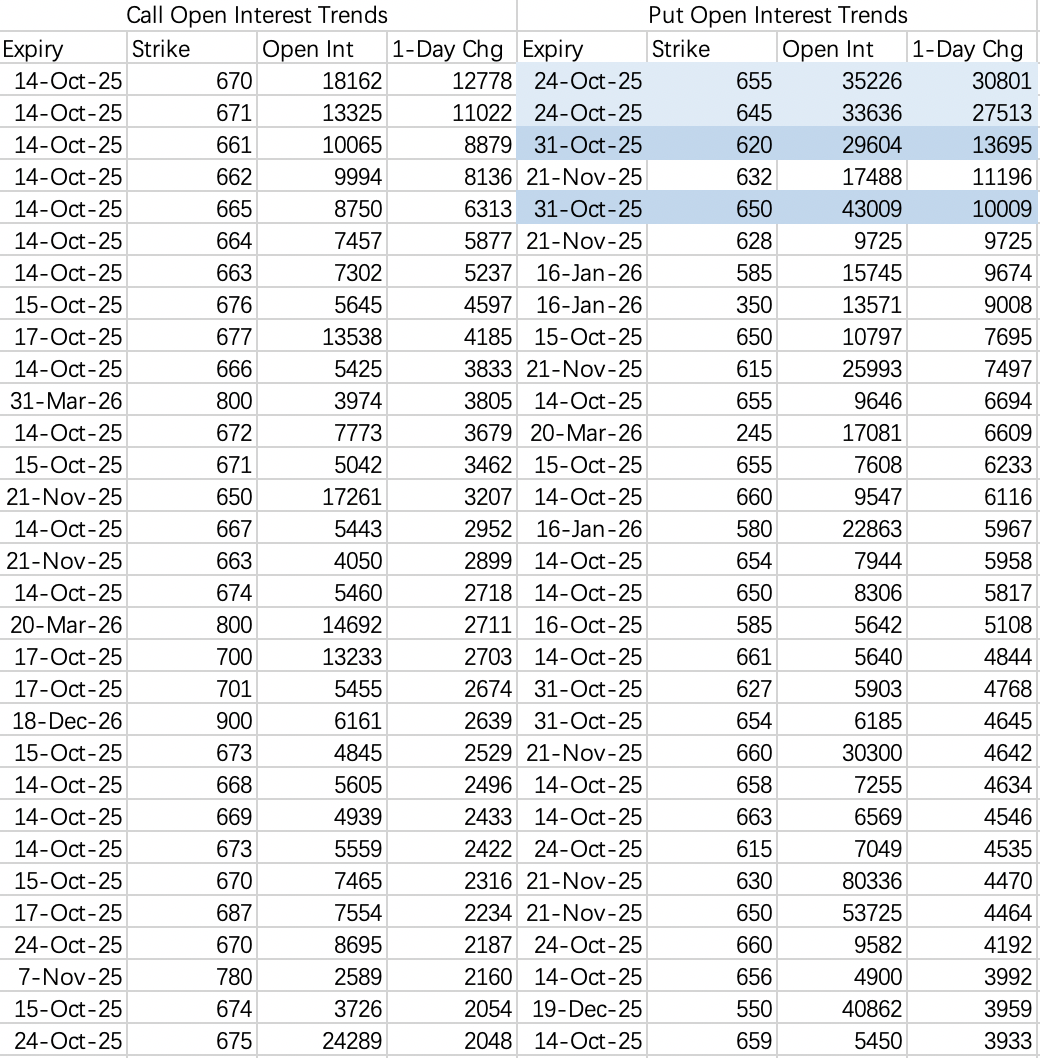

The Tuesday opening habit remains: the US side shows willingness to negotiate, the market rallies, still leaning towards the US narrative. I think we need to wait and see a bit more.

Monday's opening positions were also optimistic due to the positive market sentiment, but some still opened puts at strikes 655 and 645: $SPY 20251024 655.0 PUT$ $SPY 20251024 645.0 PUT$

$Taiwan Semiconductor Manufacturing Company (TSM)$

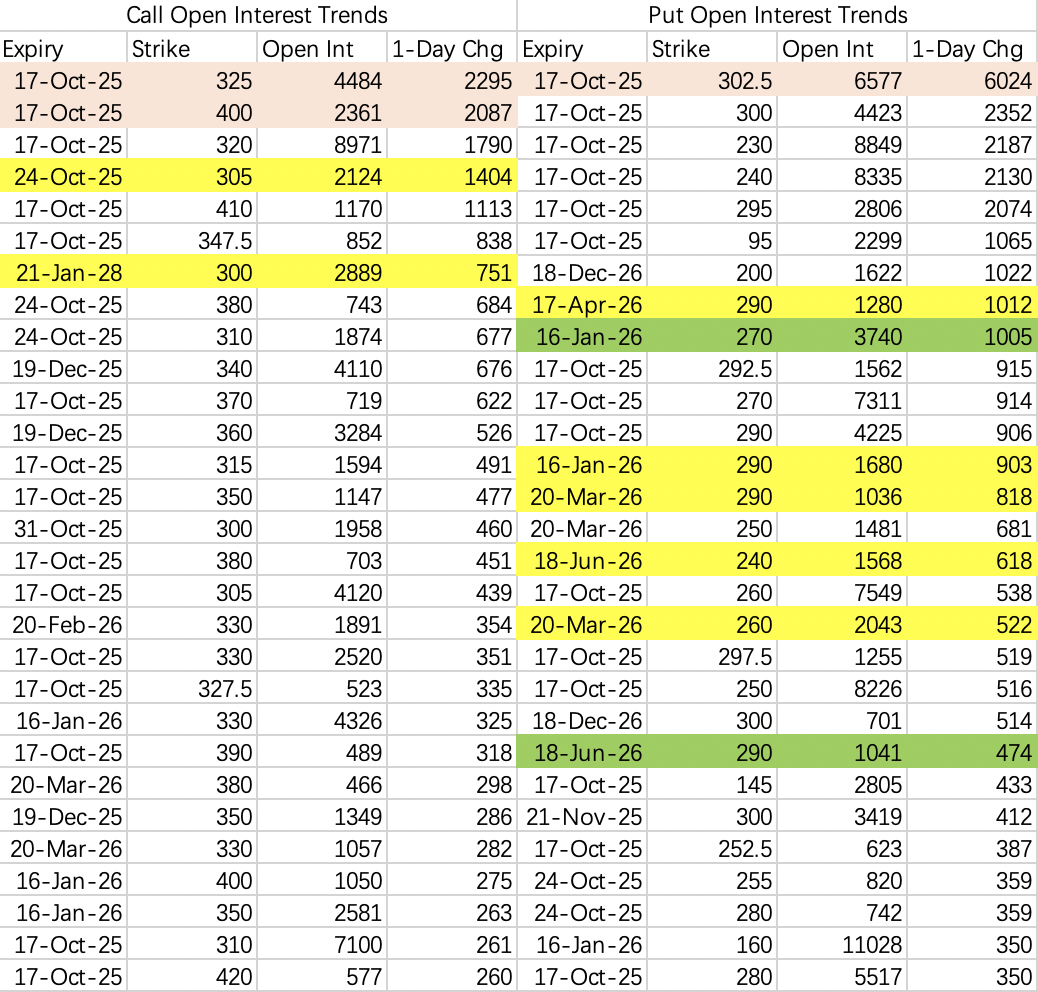

The earnings report was undeniably great; the key question is how the stock price will move.

Judging from Samsung's earnings report on Tuesday, there's a high probability of a gap up open followed by a sell-off.

Option opening positions also show this polarization: Bullish openings include $TSM 20251024 305.0 CALL$ and $TSM 20281021 300.0 CALL$ .

Longer-dated bearish put openings are mainly concentrated at the 290 strike: $TSM 20260417 290.0 PUT$ , $TSM 20260116 290.0 PUT$ , $TSM 20260320 290.0 PUT$ .

Although the positive catalyst can persist, the negotiations aren't finished yet, so volatility is expected to continue.

Comments