These past few days, observing the market has felt like writing some kind of psychological thriller.

Here's the current situation: After the first round of confrontation, the US side, knowing the market should fall this round, stopped publishing the kind of foolish, escalating pressure content from April and focused instead on absolving themselves. Then, the Wall Street Journal directly published an article stating that our side wants the US stock market to crash. Our side, also aware that the US wants to pin the blame for the stock market decline on us, has been very restrained in its remarks, sticking strictly to the facts. The US isn't escalating, so we aren't either.

So, on the surface, almost everyone knows the stock market is headed for a crash—it's even been promoted in the newspapers.

Meanwhile, in the markets, because shorts had crash expectations, they built up large short positions. But unexpectedly, after the first round, both sides directly expressed restraint. Then, the AI fundamental story caught up, continuing to drive the stock market higher, directly triggering a short squeeze.

The adaptations to each move are just so fast; it feels unlikely we'll see new lows this week.

However, this peaceful situation also has a time limit because the timing of the meeting is set. So, patience is still required for now, but back-and-forth maneuvers leading to short squeezes like this will probably be frequent in the near term.

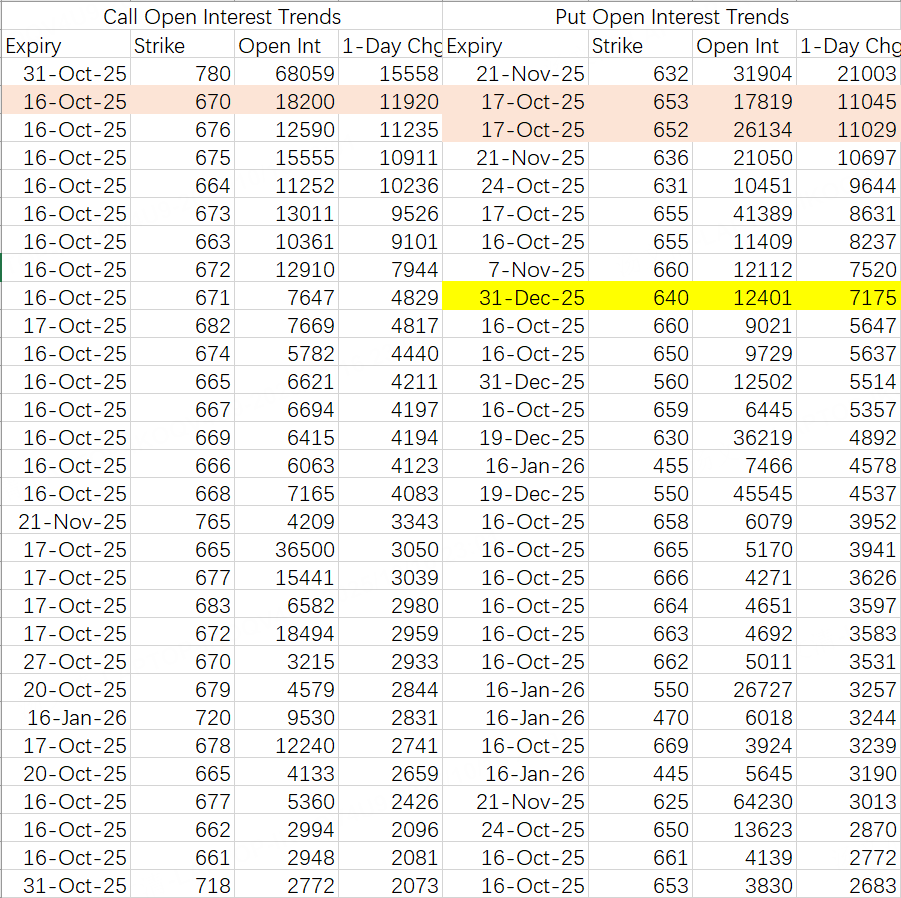

Therefore, the opening of SPY positions is in this kind of state: short-term shorts have stopped betting, and opening positions has returned to a normal oscillation pattern. The expected fluctuation range is 650-670; 640 is not within consideration for this week.

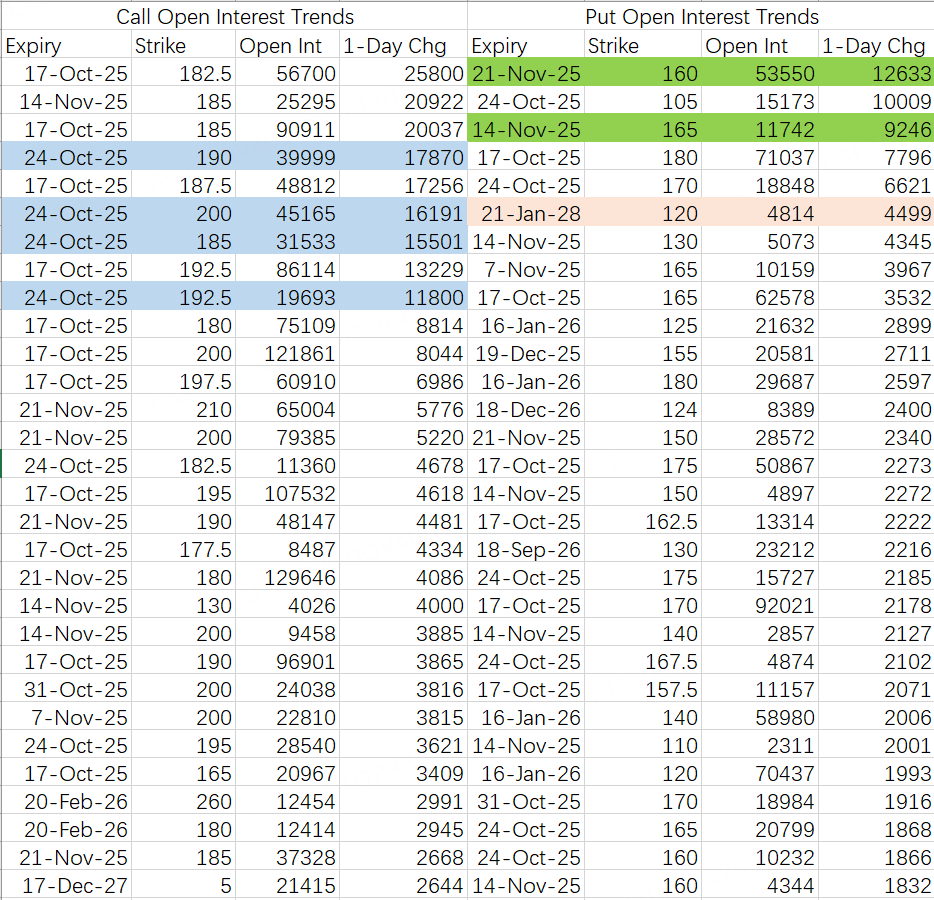

There's high risk aversion regarding NVIDIA. Institutions are rolling positions early into next week's bullish spreads, similar to this week, still below 185, hedging 192.5. $NVDA 20251024 185.0 CALL$ $NVDA 20251024 192.5 CALL$

Put opening provides a floor at 165, expecting a pullback to previous lows. $NVDA 20251114 165.0 PUT$ $NVDA 20251121 160.0 PUT$

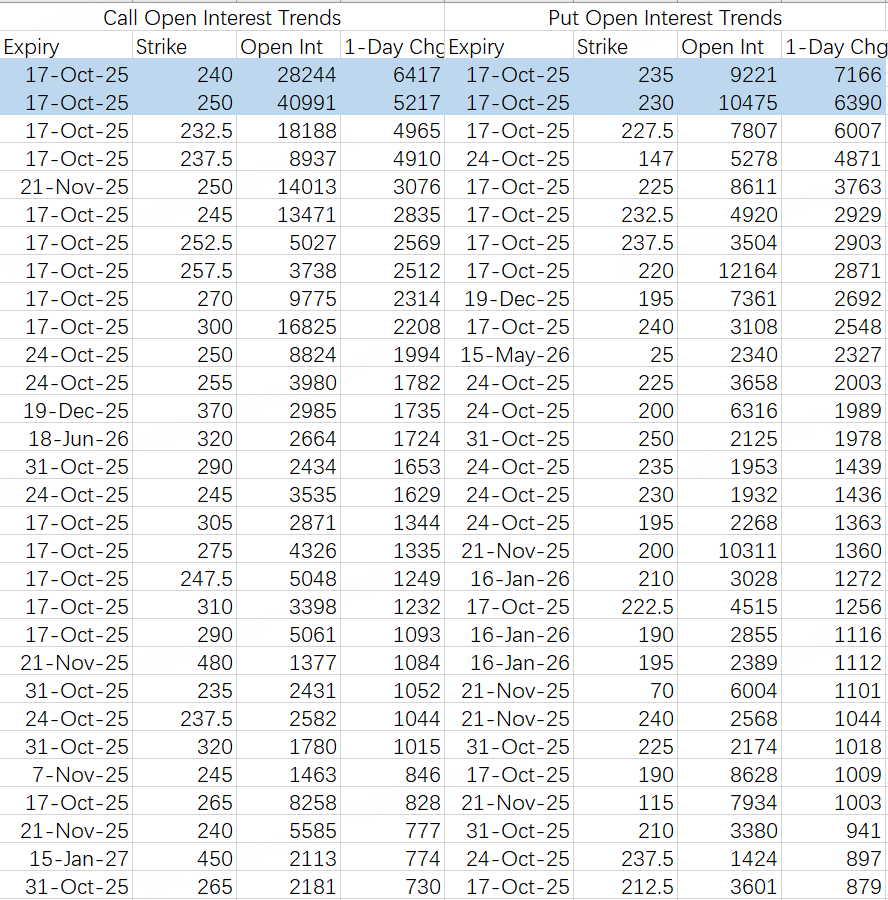

Expected to finish this week with high volatility within the 230 $AMD 20251017 230.0 PUT$ ~ 250 $AMD 20251017 250.0 CALL$ range. Considering being a seller on both ends might be an option.

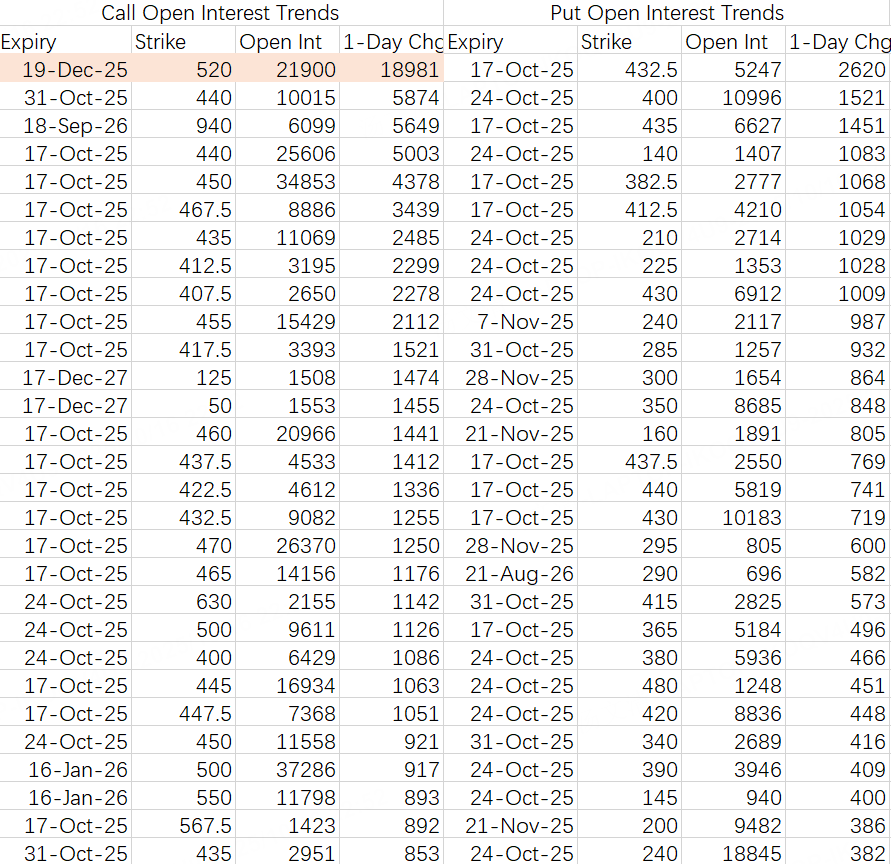

The fluctuation range remains the same as before, 400~470. Consider being a seller outside this range.

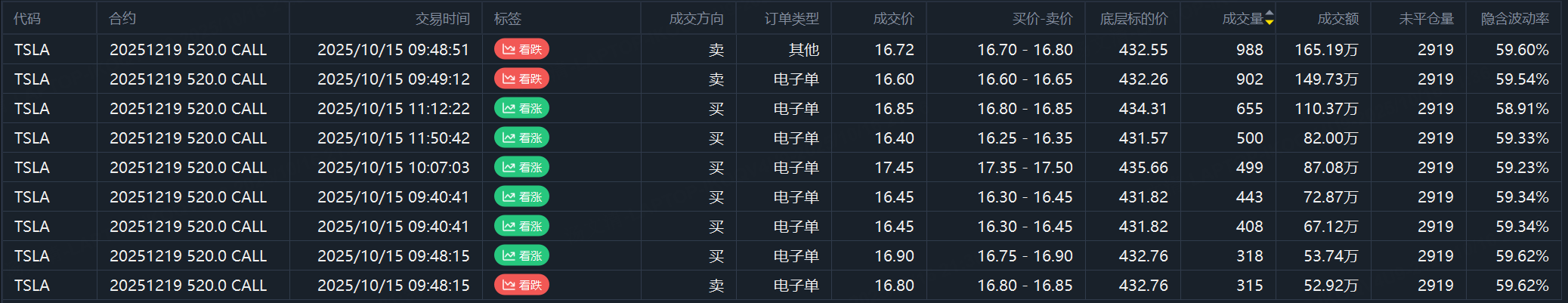

The highlight is a large position opened for the end of December 520 call $TSLA 20251219 520.0 CALL$ . The direction is unclear. I think it might be bullish.

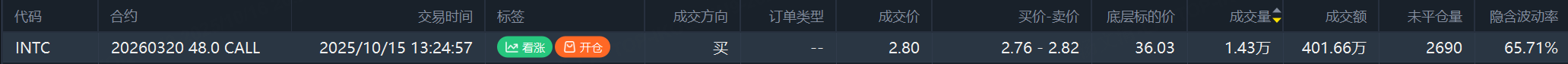

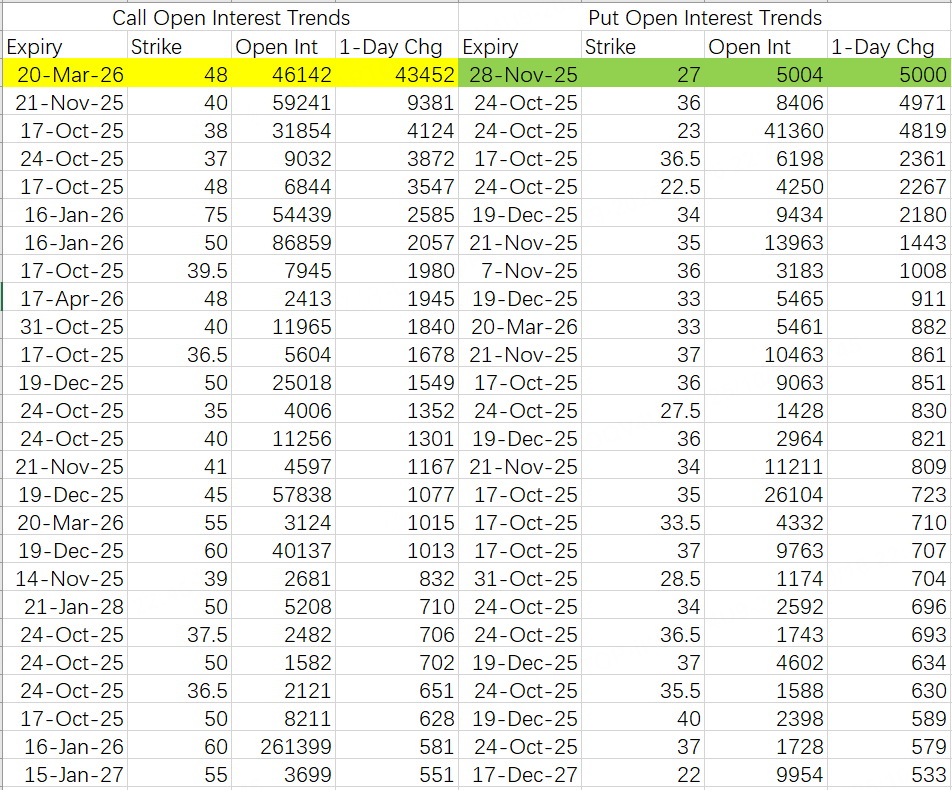

Large lot call buying is back. The March 2026 expiry 48 call $INTC 20260320 48.0 CALL$ saw 43,000 contracts opened, with a transaction value of roughly over 12 million.

A large sell put position was opened for the end of November 27 put $INTC 20251128 27.0 PUT$ , with 5,000 contracts opened. This is considered an extremely safe price level.

Comments