$VanEck Semiconductor ETF(SMH)$

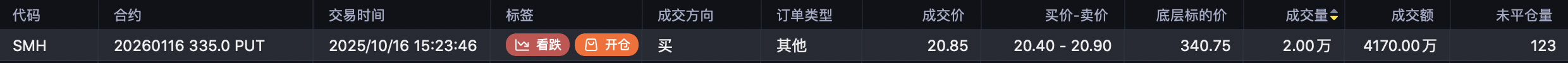

A significant bearish block trade was executed in the Semiconductor ETF on Thursday. The trade involved buying 20,000 contracts of the January 16, 2026, 335 put $SMH 20260116 335.0 PUT$ , totaling $41.7 million.

It's difficult to pinpoint the exact shorting level for this at-the-money put expiring in over three months, but the substantial premium paid indicates strong conviction from the seller regarding an upcoming pullback in semiconductors.

The current bearish activity is intense. If you are uncertain about the market outlook but tempted by the recent gains, consider maintaining a position below 50% with cash reserves, and implementing option protection strategies like covered calls or collars to maintain a balanced mindset.

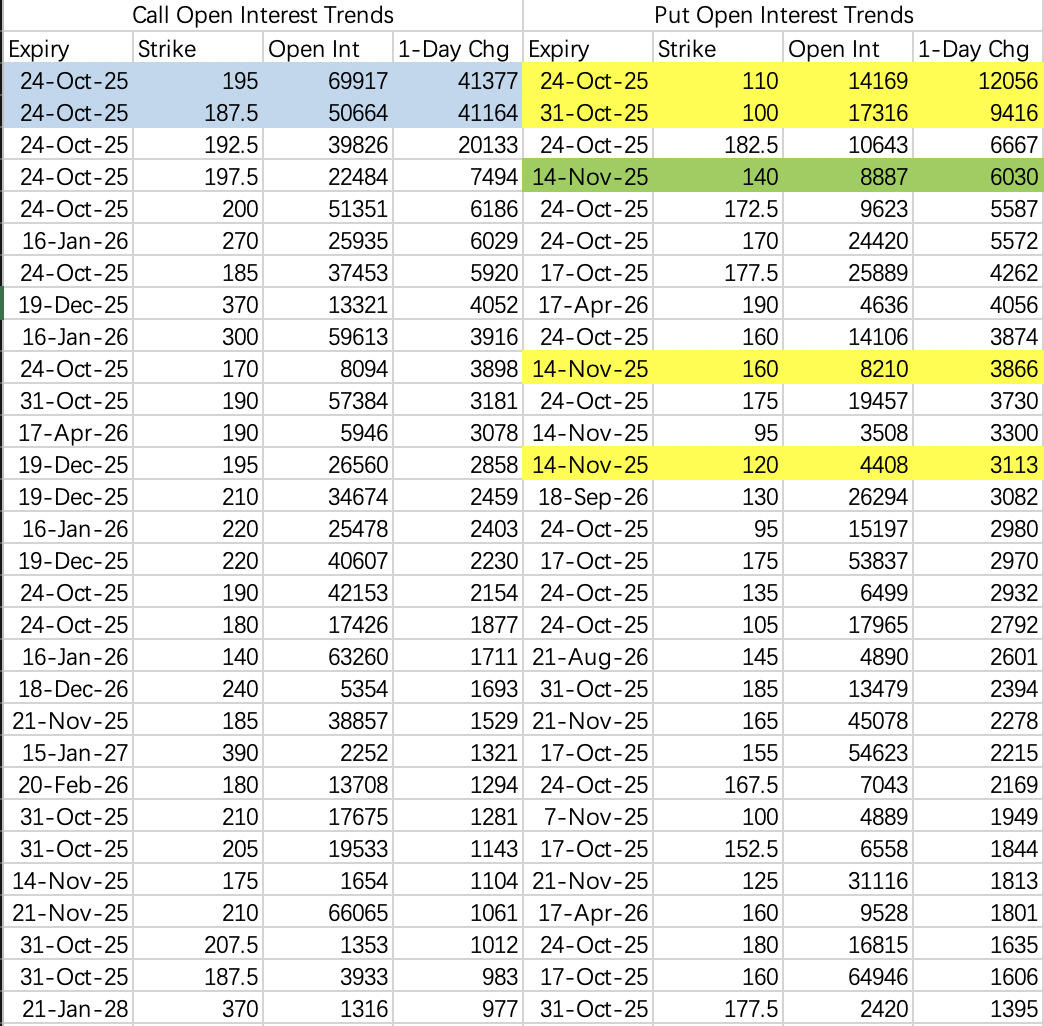

Institutional traders opened a bullish call spread between 187.5 and 195 $NVDA 20251024 187.5 CALL$ $NVDA 20251024 195.0 CALL$ , anticipating the stock price to stay below 187.5 next week.

Bearish options activity continues with extreme strategies; shorts are betting on a sharp drop within the next two weeks $NVDA 20251024 110.0 PUT$ $NVDA 20251031 100.0 PUT$ .

Additionally, a large butterfly spread was placed betting on a decline to 140, structured with: $NVDA 20251114 120.0 PUT$ , $NVDA 20251114 140.0 PUT$ x2, $NVDA 20251114 160.0 PUT$ .

Barring extreme moves, the trend is expected to remain similar to this week, oscillating between 170 and 185.

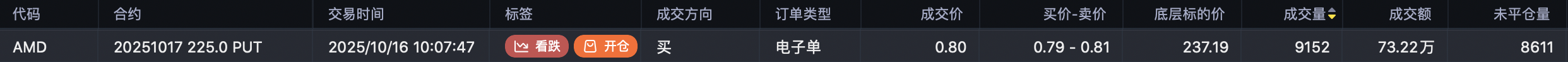

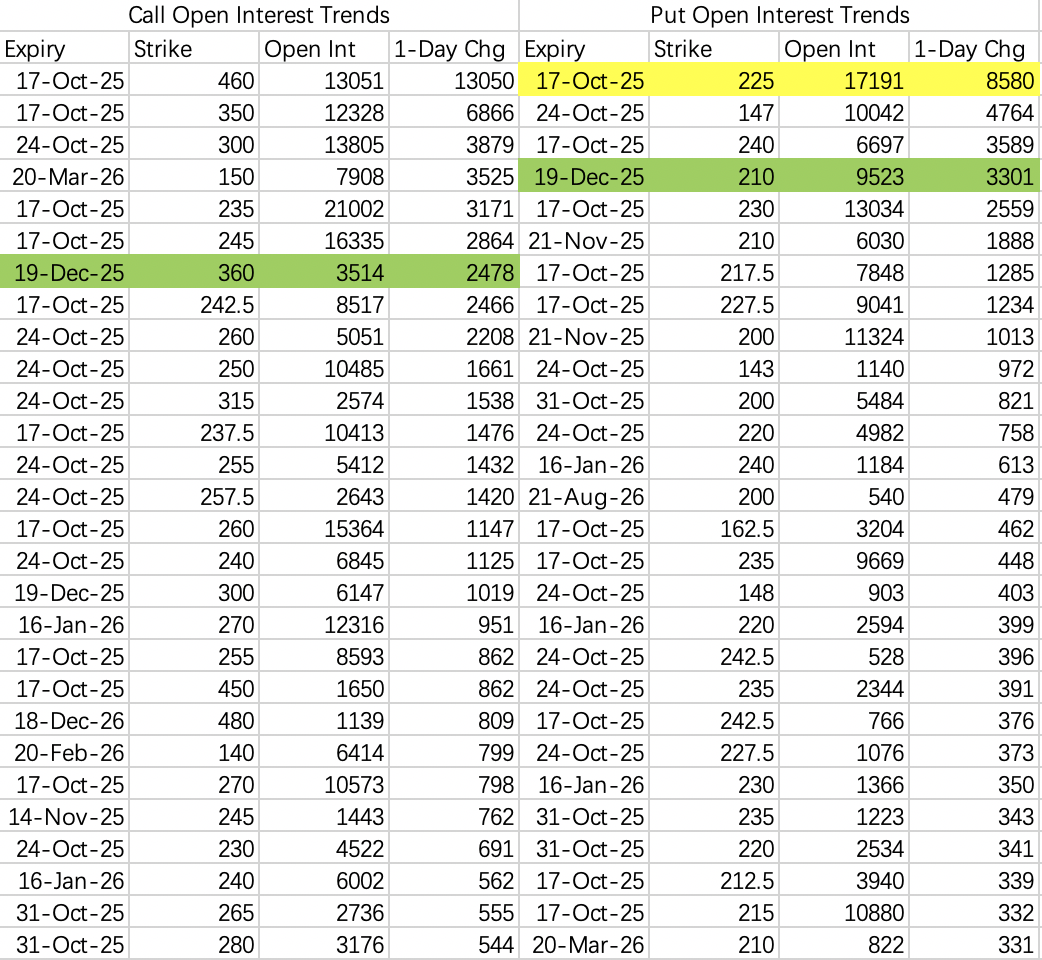

AMD's options activity appears normal, but there was a notable $730,000 trade on a weekly put expiring soon $AMD 20251017 225.0 PUT$ .

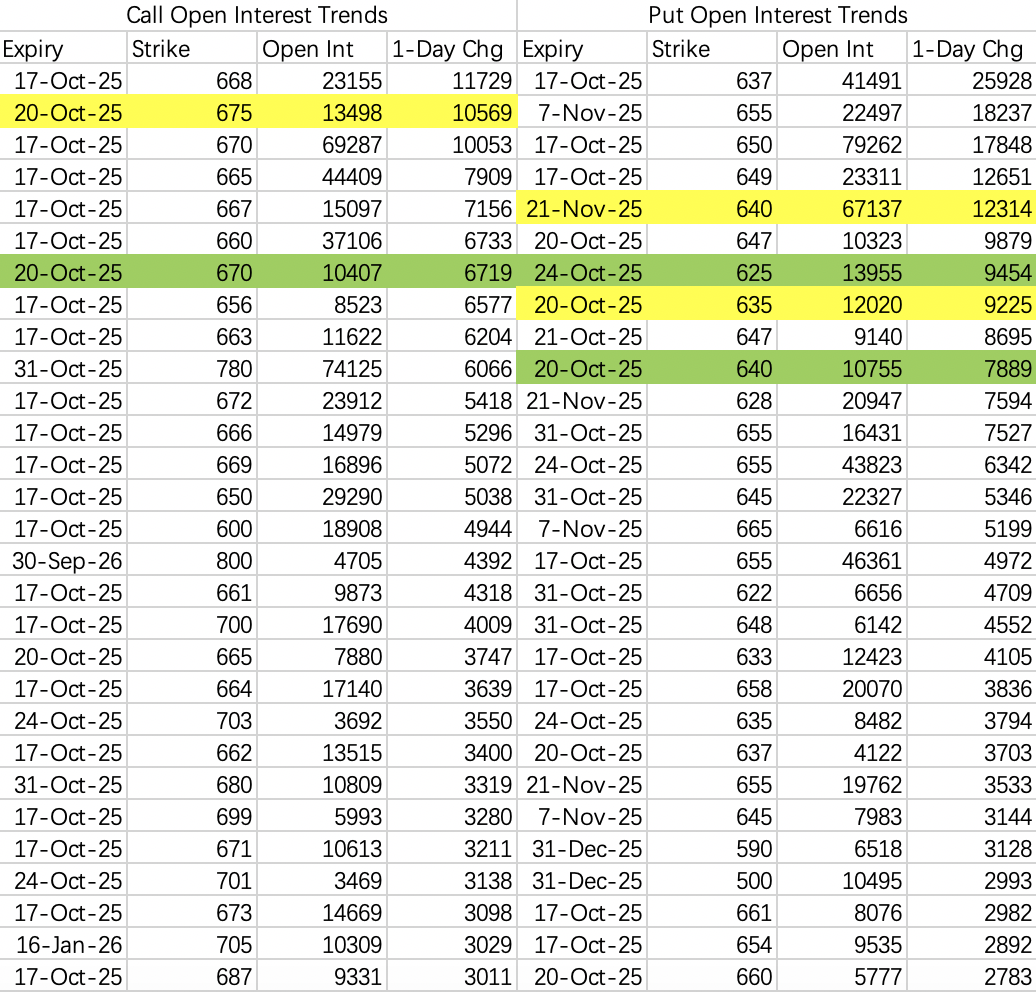

Hedging for a potential drop next week is gaining traction. Notable large trades include an Iron Condor:

Sell $SPY 20251020 670.0 CALL$ , Buy $SPY 20251020 675.0 CALL$

Sell $SPY 20251020 640.0 PUT$ , Buy $SPY 20251020 635.0 PUT$

And a Collar:

Sell $SPY 20251020 675.0 CALL$

Buy $SPY 20251020 625.0 PUT$

There was also a single leg opening: $SPY 20251121 640.0 PUT$

Overall, there's a probability SPY could test the 640 level next week.

Comments

Great article, would you like to share it?