$Tesla (TSLA) $The third quarter 2025 results are scheduled to be released on October 22, 2025, after the stock market closes. In the current quarter, Tesla expects third-quarter revenue of $26.27 billion (according to Bloomberg estimates), up 4% from the year-ago quarter. From a profitability perspective, Wall Street expects adjusted earnings per share (EPS) of $0.53, or EBITDA of $3.78 billion.

Previously, record vehicle deliveries and energy storage deployment data released on October 2 had exceeded analysts' expectations and pushed the stock to soar 40% in the third quarter. Shares have risen more than 100% over the past six months. It closed at around $447 on October 20, primarily driven by AI optimism and strong demand. However, Wall Street remains cautious, with consensus forecasts suggesting moderate growth due to subsidy expirations and regional headwinds. Analysts expect a solid quarter without explosive growth, and the focus will shift to the evaluation of future guidance, including market demand after the tax credit ends, budget models, and the progress of artificial intelligence projects like Robotaxi and Optimus.

UBS's latest forecast is that Tesla will deliver 475,000 vehicles in the third quarter, an increase of 3% from the same period last year and an increase of 24% from the previous quarter, significantly higher than the previous estimate of 431,000 vehicles. Tesla's third-quarter delivery performance in multiple markets beat expectations.

First of all, in the U.S. market, consumers are trying to catch up with the $7,500 electric vehicle tax credit under the Inflation Reduction Act (IRA) that is about to expire at the end of September 2025, which has driven Tesla's sales to surge. UBS believes that this quarter could mark the highest quarterly deliveries in the United States since mid-2023, and possibly even the highest level ever. However, analysts also warned that the current strong demand is likely to be an "early overdraft," meaning that even if Tesla launches a "low-priced version" of the Model Y in the fourth quarter, deliveries may still decline quarter-on-quarter.

European markets are also showing signs of recovery. Data shows that in the first two months of the third quarter, Tesla's deliveries in the top eight markets in Europe increased by about 22% month-on-month. In the Chinese market, retail deliveries (i.e. wholesale minus exports) grew by about 45% month-on-month, and the performance was equally solid. In addition, UBS pointed out that delivery growth in the Turkish and Korean markets is also worthy of attention.

Looking ahead, UBS expects deliveries in the fourth quarter of 2025 to be 428,000 vehicles, down 10% sequentially and 14% year-over-year. This estimate has taken into account the launch of the Model Y L model in the Chinese market and the possible "low-priced version" of the Model Y in the US market. It is worth noting that despite the outstanding results in the third quarter, Wall Street still expects Tesla's annual sales to decline for the second consecutive year. Analysts surveyed by Bloomberg estimate that the company will deliver about 1.61 million vehicles in 2025, down from 1.79 million vehicles last year.

In addition to electric vehicle results, a major focus of the conference call is likely to be the full launch of Robotaxi in the United States in 2026 and mass production plans for Cybercabs and Optimus. Barclays analysts pointed out that Robotaxi is the most central aspect of Tesla's bullish view, while news about Robotaxi and autonomous driving progress has been quiet.

How has Tesla performed in the past few performance days?

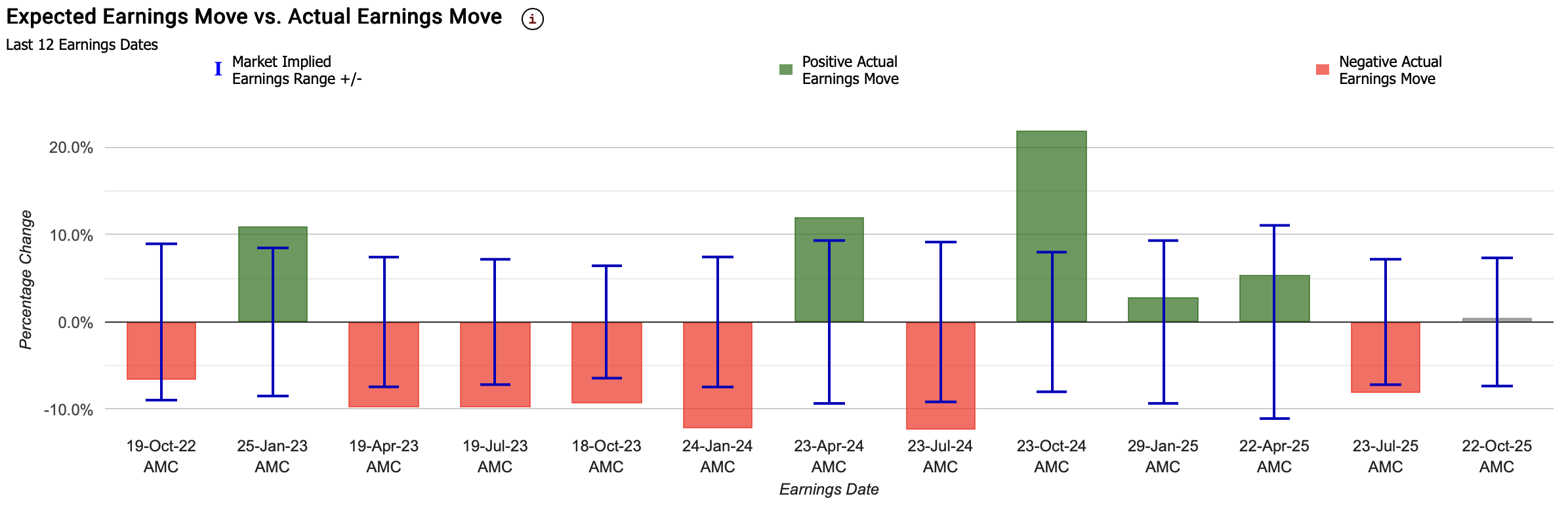

Tesla's current implied change is ± 7. 3%, indicating that the options market bets on its single-day rise and fall of 7.3% after its performance; In comparison, its post-performance stock price change in the first three quarters was about 5.5%.

In the last 12 earnings quarters, the options market overestimated Tesla's post-earnings stock price volatility 25% of the time. The options market forecasts an average post-earnings stock price volatility of ± 8.3%, while the actual average volatility (in absolute terms) is 10.1%. This suggests that Tesla's stock price tends to be more volatile after earnings than the options market expects. However, there are also cases where the stock price changed by as much as 21.9% after the results in the third quarter of last year, mainly due to the financial report data exceeding expectations and the high growth expectations of FSD and other businesses.

The post-earnings performance of Tesla in the past six times is +12.1%,-12.3%, +21.9%, +2.9%, +5.4%,-8.2%.

Considering that Tesla's third-quarter performance data has been reflected in the stock price, and the fourth-quarter performance growth may decline and the slow progress of the AI and autonomous driving business, we do not expect Tesla's stock price to rise significantly, so we recommend adopting a bear market bullish spread strategy.

Bear Market Call Spread Strategy

Bear market bullish spread strategy refers to investorsSell lower strike priceCall options, andBuying higher strike priceCall options. This combination producesNet income, the income comes from the decay of time value. Bid priceFalling or not risingWhen the sold option expires, the investor retains the premium rights; If the priceA sharp rise, the loss is limited by the difference between the two exercise prices minus premium income.

1. Profit and loss analysis

InvestorSellThe exercise price of one$487.5Call option (Call), obtain premium$3.10;

meanwhileBUYThe exercise price of one$495.00Call, paying premium$2.22。

After the legs are combined, the investor's net income (initial premium income) is: $3.10 − $2.22 =$0.88/Share。 Calculated based on 100 shares corresponding to each contract, investors initially receive$88Net income of.

At the expiration of the option:

If Tesla stock priceUnder $487.5, both options are worthless, and the investor retains all premium income of $88;

If the stock priceBetween $487.5 and $495.0, the sold options gradually incur losses, but the purchased options have not been fully hedged, and the investor's net income decreases as the stock price rises;

If the stock priceAbove $495.0, the profits and losses of the two options are offset, and the investor reaches the maximum loss level.

Hence:

Maximum benefit= Initial Net premium Income =$0.88/Share(that is, $88);

Maximum loss= ($495 − $487.5) − $0.88 =$6.62/Share(that is, $662);

Range of yield: This structure belongs toModest Bearish to Neutral Strategy, the gain is realized when the stock price remains below $487.5, and the stock price rises and faces losses.

2. Risk analysis

Limited return risk structure: The maximum income for investors has been fixed at premium's net income of $0.88/share. If the stock price remains at or below $487.5, the income will be locked after maturity.

Limited Loss Risk: If the stock price rises by more than $495, the loss of the low exercise option sold is partially hedged by the bought high exercise option, and the maximum loss is limited to $6.62 per share, and there will be no unlimited loss.

Directional risk: The policy isBearish to NeutralStructure. If Tesla's stock price rises significantly, investors will face losses; If the stock price is stable or falls slightly, stable returns can be achieved.

Time value and volatility impact: With the passage of time, if the underlying price does not rise significantly, the decay of the time value of the sold option will benefit investors; If the implied volatility decreases, the overall value of the portfolio also tends to increase (due to the net seller position).

Risk/benefit ratio: Investors take up a loss of up to $662 in order to obtain a potential gain of $88, with a risk-reward ratio of about1: 7.5。 This structure is only suitable for investors to clearly judge the short termTesla's stock price won't be used when it rises sharply.

3. Balance point analysis

Break-even point= lower strike price + (net premium income) but as it is a combination of net income premium, the break-even point is calculated as:$487.5 + $0.88 = $488.38。

Tesla Stock Price When ExpiresUnder $488.38, investors achieve profitability; When the stock priceOver $488.38When investors began to lose money.

Taking the current stock price of $442 as a reference, Tesla needs to rise by about10.5%It will hit the break-even point. Therefore, the strategy will remain profitable as long as the stock price does not significantly break through this level.

sum up

Investors construct this Bear Call Spread strategy to gain premium income with limited risk.

Investors are expected to obtain stable returns when Tesla's stock price remains stable or falls slightly;

If the market rises strongly, the loss will be limited to a controllable range by the high exercise price Call bought.

This strategy is suitable for market environments where investors judge the short-term trend of the underlying as "sideways or moderately downward".

At the same time, we hope to obtain a certain option time value return on the premise of controlling risks.

Comments