After Wednesday's intraday sell-off, there are signs that short sellers are pulling back for the week. This isn't to say they've given up on shorting, but rather they are starting to shift their focus to a few weeks from now.

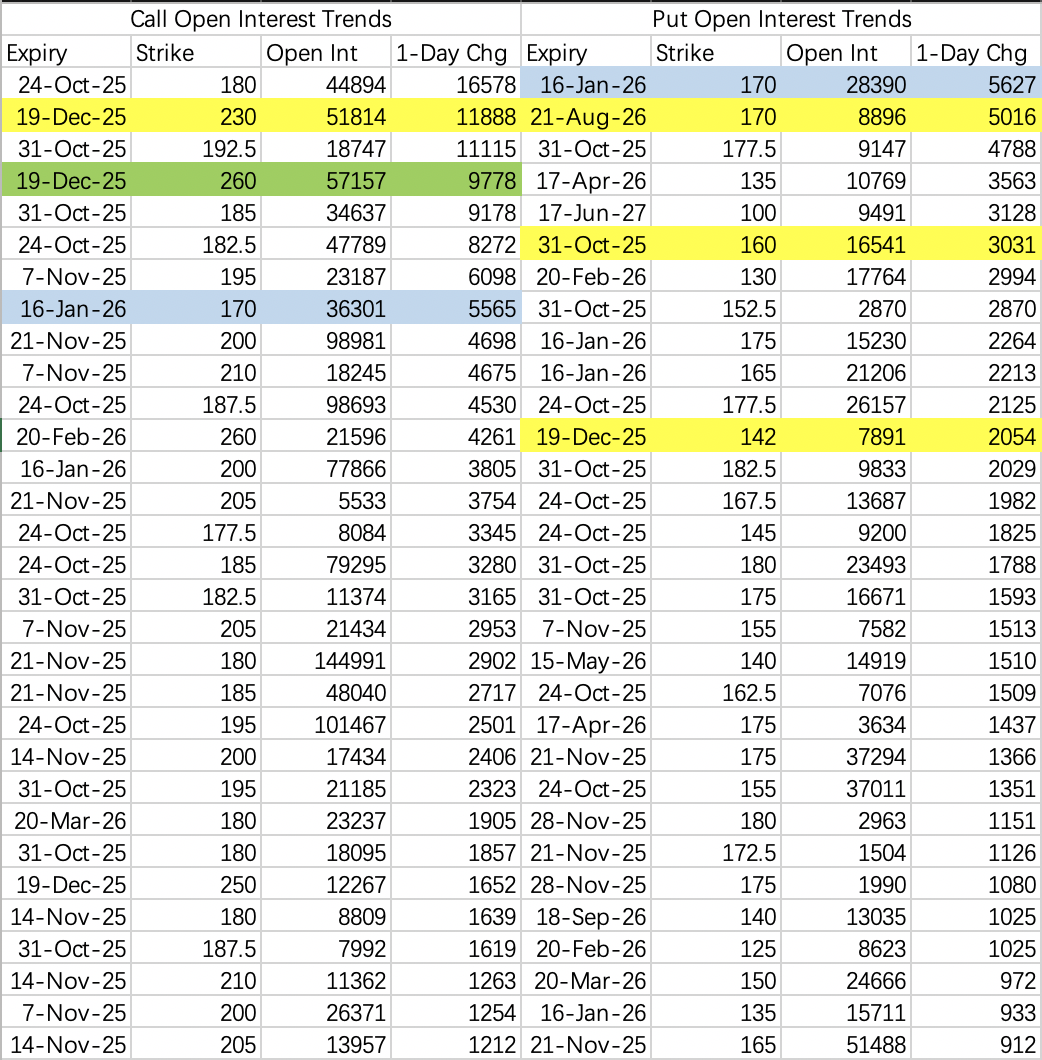

Shorts believe there's still a probability the price could fall below $170. Consequently, they are buying longer-dated put options $NVDA 20251219 142.0 PUT$ $NVDA 20260821 170.0 PUT$ , with some also positioning for next week's $160 puts $NVDA 20251031 160.0 PUT$ .

I somewhat suspect these longer-dated puts might be triggered by the $GE Vernova Inc. (GEV)$ earnings report. Management at this power equipment company stated that capital expenditure is expected to peak in 2026. This leads to the possibility that the market anticipates other equipment companies might provide similar guidance, prompting a preemptive bearish bet.

Buy-side traders believe NVIDIA's stock price could reach the $230-$260 range by year-end $NVDA 20251219 230.0 CALL$ $NVDA 20251219 260.0 CALL$ .

The stock price is highly likely to close the week between $170 and $187.5.

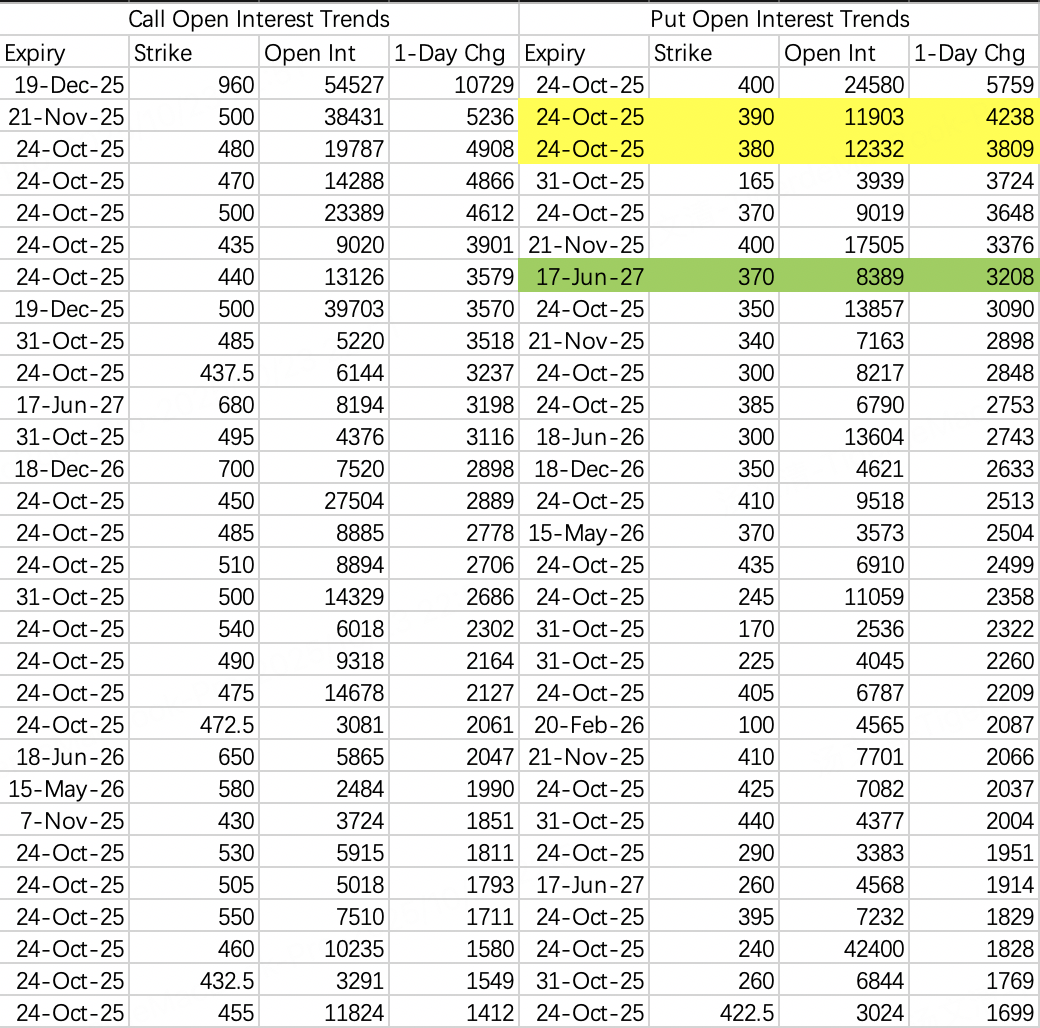

Tesla's situation is similar to before, though post-earnings sentiment is slightly more pessimistic. For instance, the support level is now seen around $370. I believe the range outside of $400-$470 is still suitable for selling options, but it could also be widened to $380-$470. $TSLA 20251031 380.0 PUT$ $TSLA 20251031 470.0 CALL$

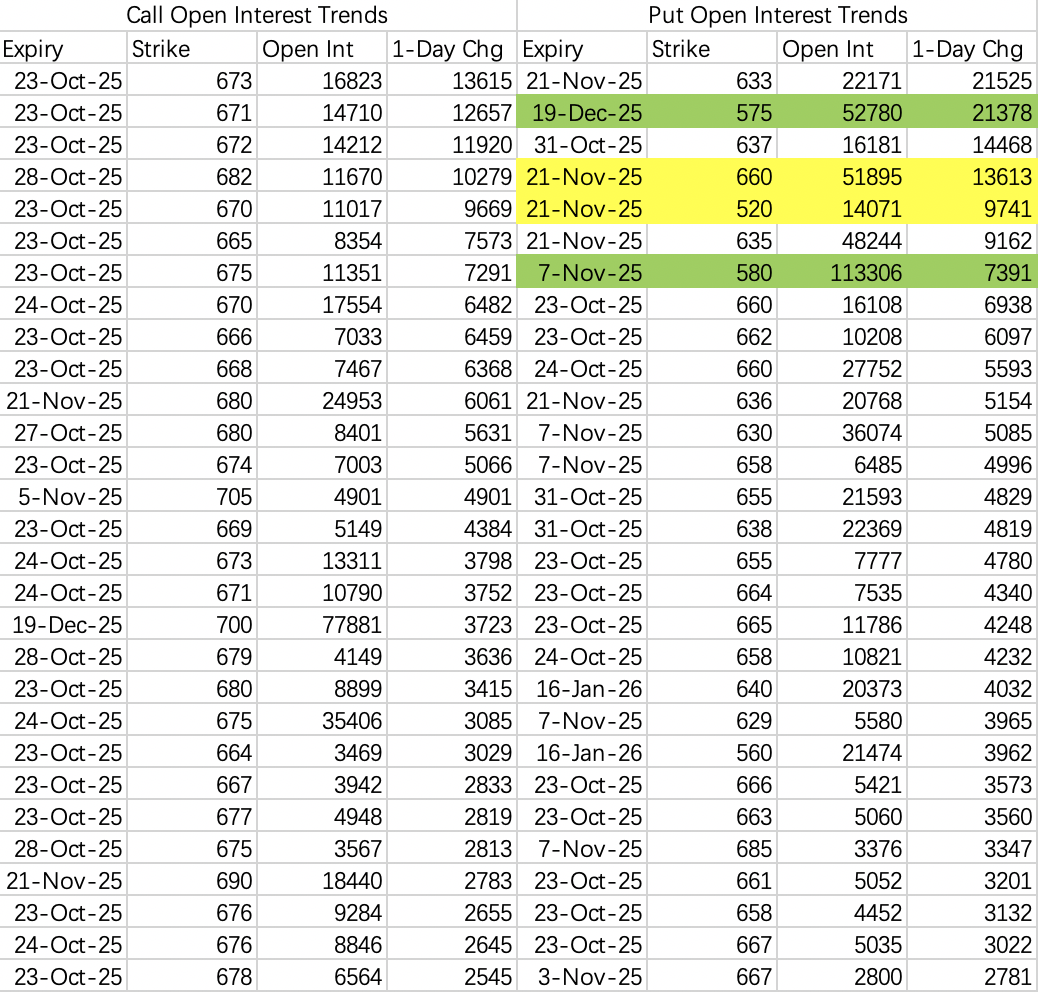

Similar to NVIDIA, short sellers have not continued opening put positions expiring this week. It's estimated Friday's close will be between $660 and $673.

Oil prices surged sharply. The US Energy Secretary suggested it's okay to buy oil now, which is rather astounding.

Subsequently, I noticed XOM seems quite suitable for selling options, and indeed, institutions are doing just that.

Last week, institutions were quoting a bull call spread range of $113-$116 and a bear put spread range of $108-$113.

After the price increase, the institutional spread for next week is sell $117 / buy $119 calls. The put spread is sell $112 / buy $107 puts.

Sell $XOM 20251031 117.0 CALL$ , Buy $XOM 20251031 119.0 CALL$

Sell $XOM 20251031 112.0 PUT$ , Buy $XOM 20251031 107.0 PUT$

The stock plummeted during Wednesday's session. In the last half hour before the close, a large block order came in, opening 21,000 contracts of $CRWV 20251219 140.0 CALL$ . Rough estimates put the trade value at over $20 million.

Typically, this is a signal of bottom-fishing. However, given the high macro risks currently, it's advisable to be cautious about adding leverage.

Comments