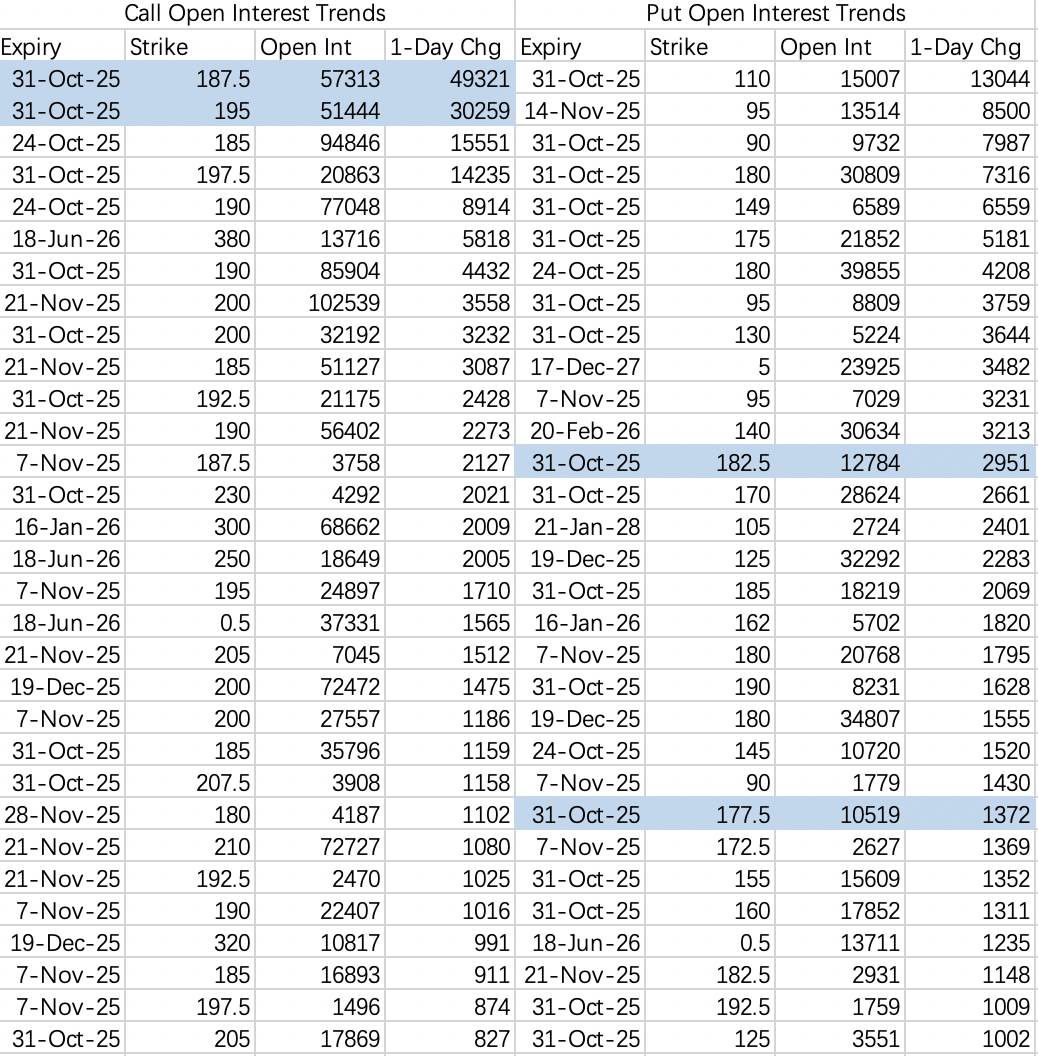

As expected, NVDA will likely continue its sideways churn next week between $175 and $187. However, the put opening volume remains somewhat puzzling. That said, with negotiation outcomes still pending, extreme hedging is understandable.

Sell $NVDA 20251031 187.5 CALL$ , Buy $NVDA 20251031 195.0 CALL$

Sell $NVDA 20251031 182.5 PUT$ , Buy $NVDA 20251031 177.5 PUT$

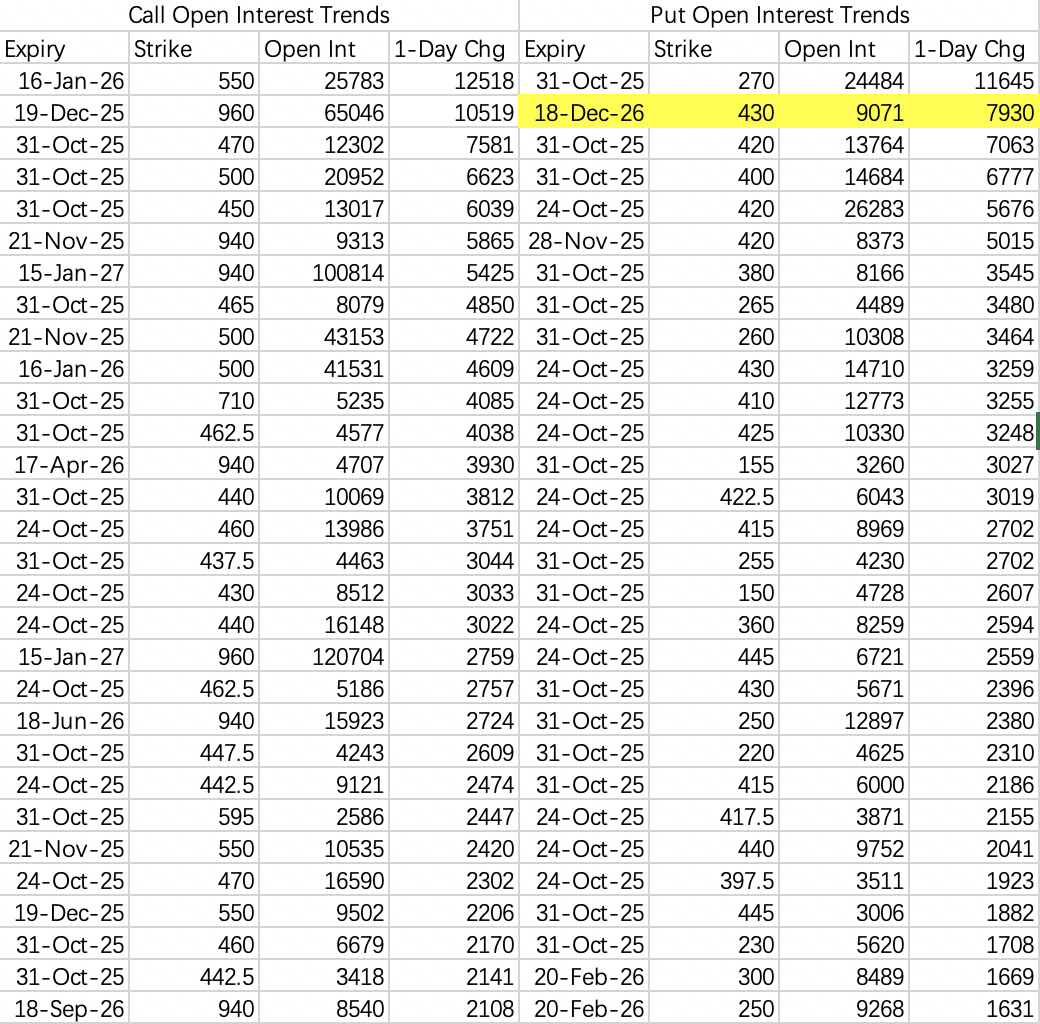

Similar to NVDA, TSLA continues trading in its old range of $400-$470.

$TSLA 20251031 470.0 CALL$ $TSLA 20251031 400.0 PUT$

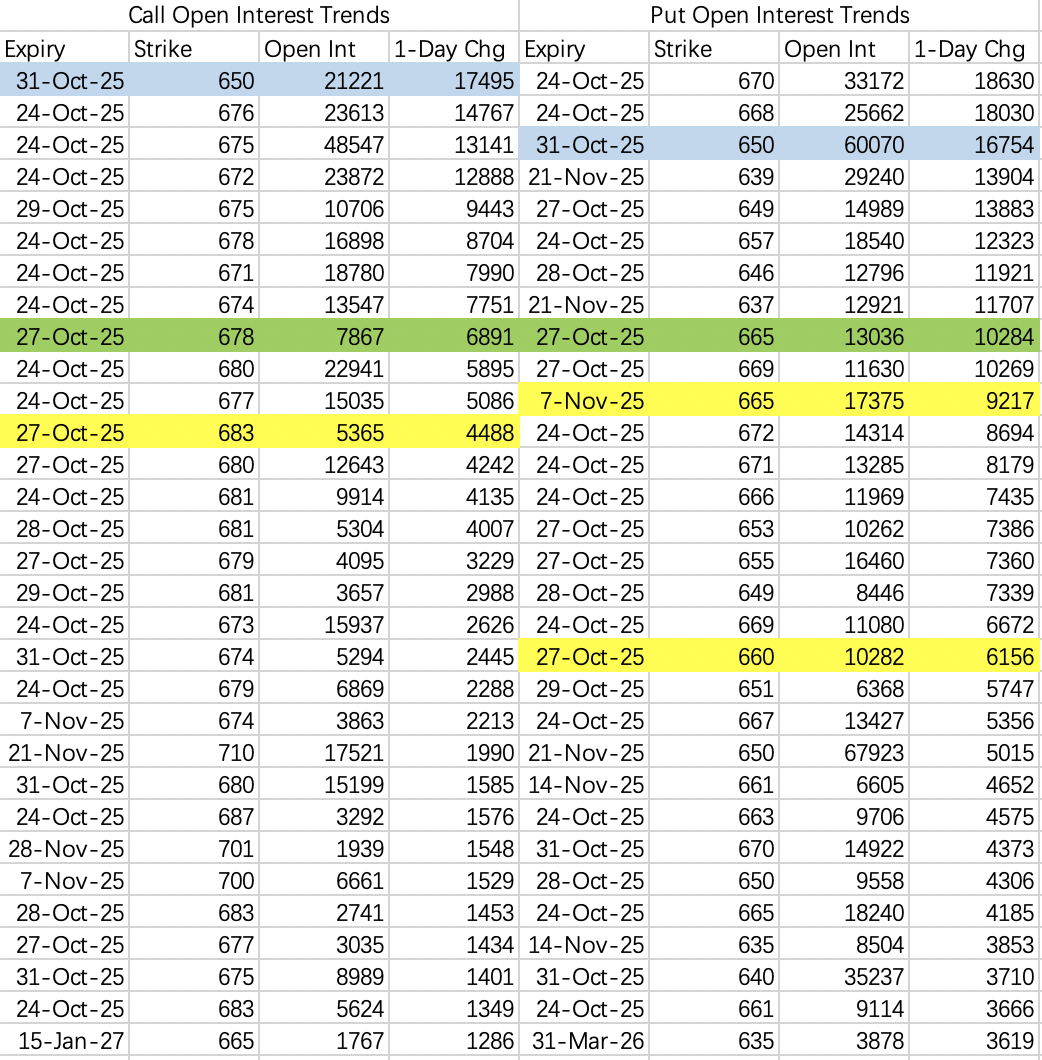

Expect more sideways action next week, oscillating between $650 and $675.

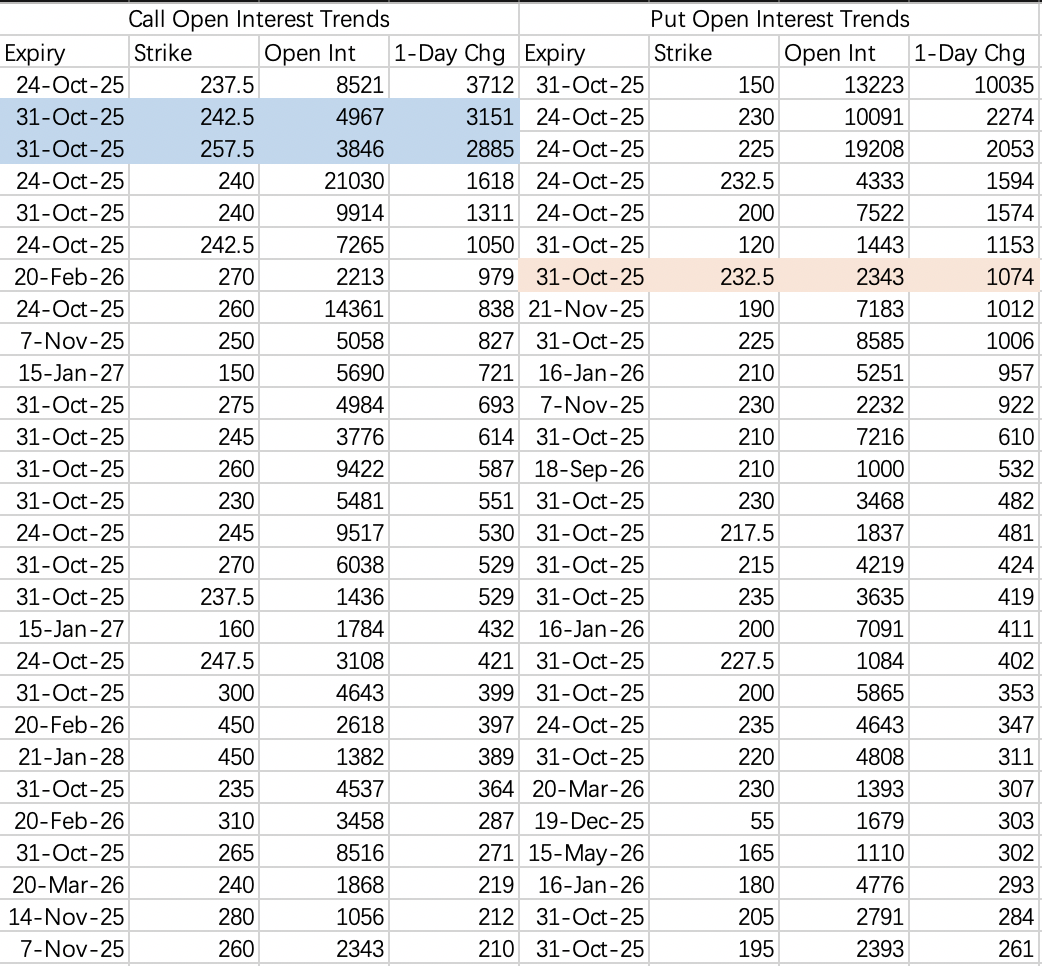

Last week's AMD trade was: Sell Call $245, Buy Call $260.

For the week of the 31st: Sell Call $AMD 20251031 242.5 CALL$ , Buy Call $AMD 20251031 257.5 CALL$

However, at the open, a new large order appeared: Sell Call $AMD 20251031 260.0 CALL$ , Buy Call $AMD 20251031 270.0 CALL$

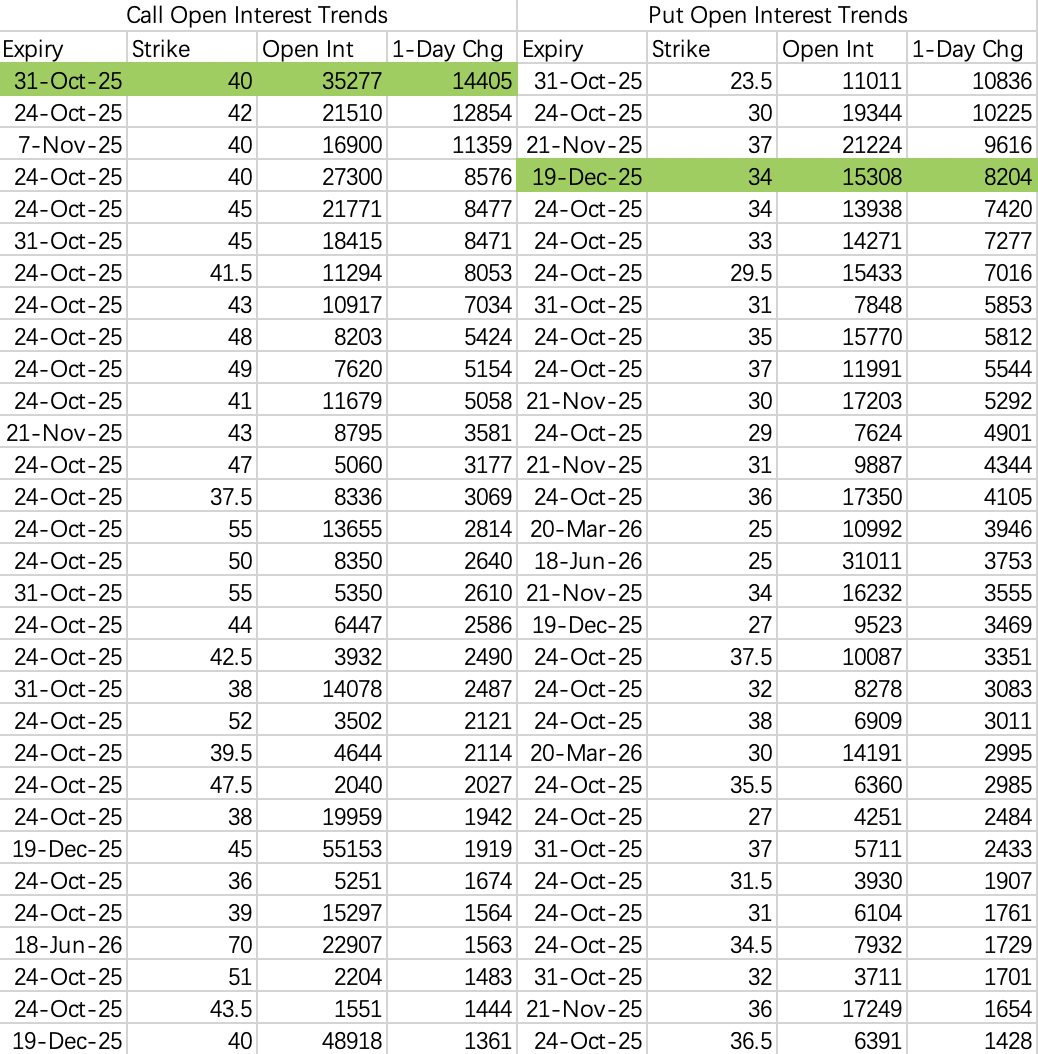

Two main large blocks: Long-term, getting assigned at $34 seems acceptable, but breaking $40 near-term looks difficult.

Close $INTC 20251121 33.0 PUT$ , Roll to $INTC 20251219 34.0 PUT$

Spread Strategy: Sell $INTC 20251031 40.0 CALL$ , Buy $INTC 20251031 45.0 CALL$

Institutions are rolling positions. This week's opened strikes were the 132 call, 121 put, and 110 put. Next week's roll strategy is split into two groups as follows:

$CRWV 20251031 130.0 CALL$ , Sell $CRWV 20251031 110.0 PUT$ , Buy $CRWV 20251031 100.0 PUT$

$CRWV 20251031 129.0 CALL$ , Sell $CRWV 20251031 112.0 PUT$

The general expectation is for CRWV to trade between $110 and $131 during the week of Oct 31st, with a potential probe down to $100 not ruled out. Essentially, it's continuing to test around the 60-day moving average.

Don't exclude the possibility of calls being rolled again if there's a gap up at today's open.

There are acquisition rumors surrounding this offshore oil and gas driller. A massive block of call options $RIG 20260116 5.0 CALL$ saw an astonishing 92,000 contracts opened.

Comments