$NVDA$

New bearish narratives are gradually gaining traction.

Narrative A: An analyst claims that the circular financing within the AI supply chain resembles a Ponzi scheme and constitutes fraudulent activity.

Narrative B: Another analyst refutes the "Ponzi scheme" claim as nonsense, arguing that stock volatility and financial data reflect normal valuation adjustments and standard industry practices. However, this narrative introduces a new bearish element: the $500 billion in orders through 2026 – does this represent genuine computing demand or overbuilding of infrastructure?

Frankly, Narrative B might be more damaging. Orders from overbuilding can "evaporate," potentially triggering a bubble burst. Cisco faced a similar situation back in 2000 – the stock chart tells the story.

For now, maintaining the view for a pullback toward $170. Will reassess if/when it reaches that level.

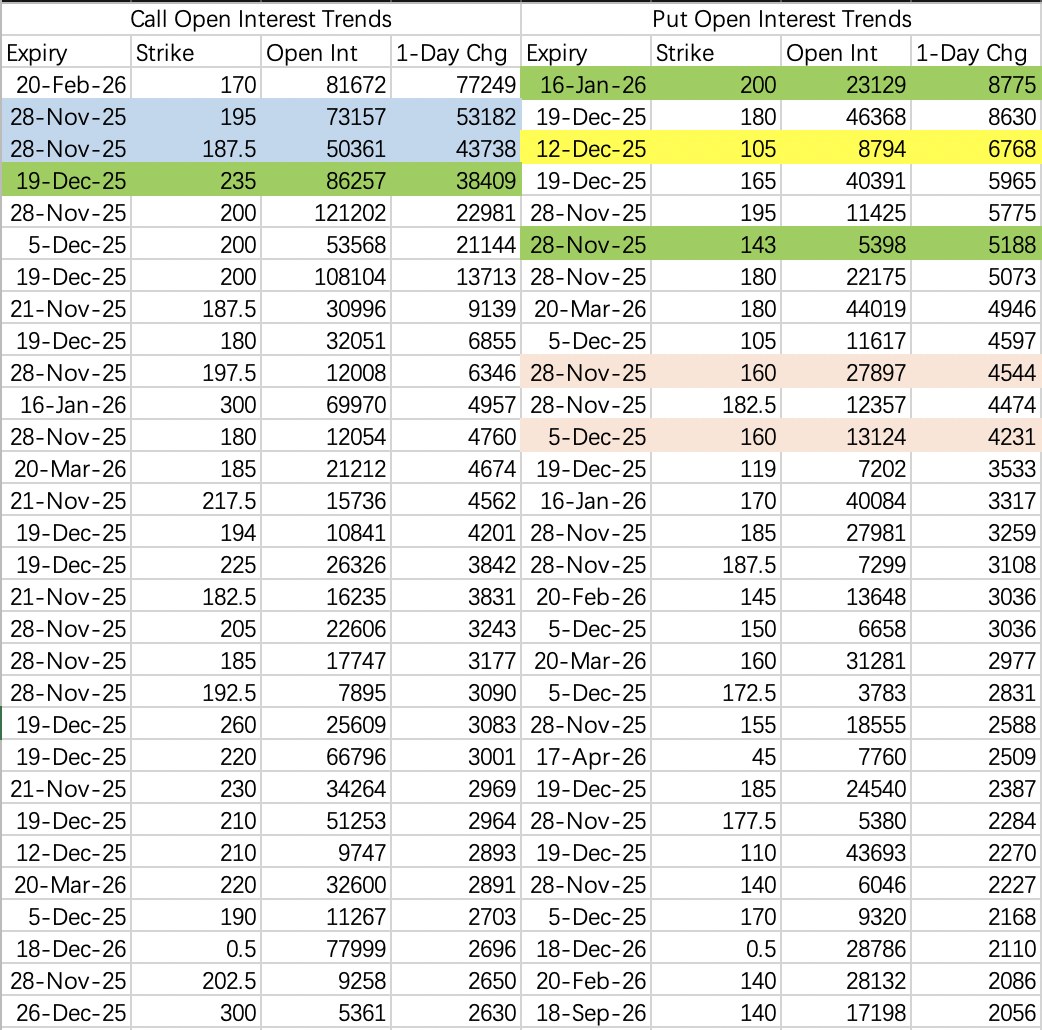

Post-earnings, large November positions are being rolled, with more cautious strike selection. The 180 call $NVDA 20251121 180.0 CALL$ was closed and rolled to the Feb 170 call $NVDA 20260220 170.0 CALL$ .

Institutions are positioning for next week with a call spread between 187.5 and 195 $NVDA 20251128 187.5 CALL$ $NVDA 20251128 195.0 CALL$ .

A trading range of $160-$190 seems reasonable for next week.

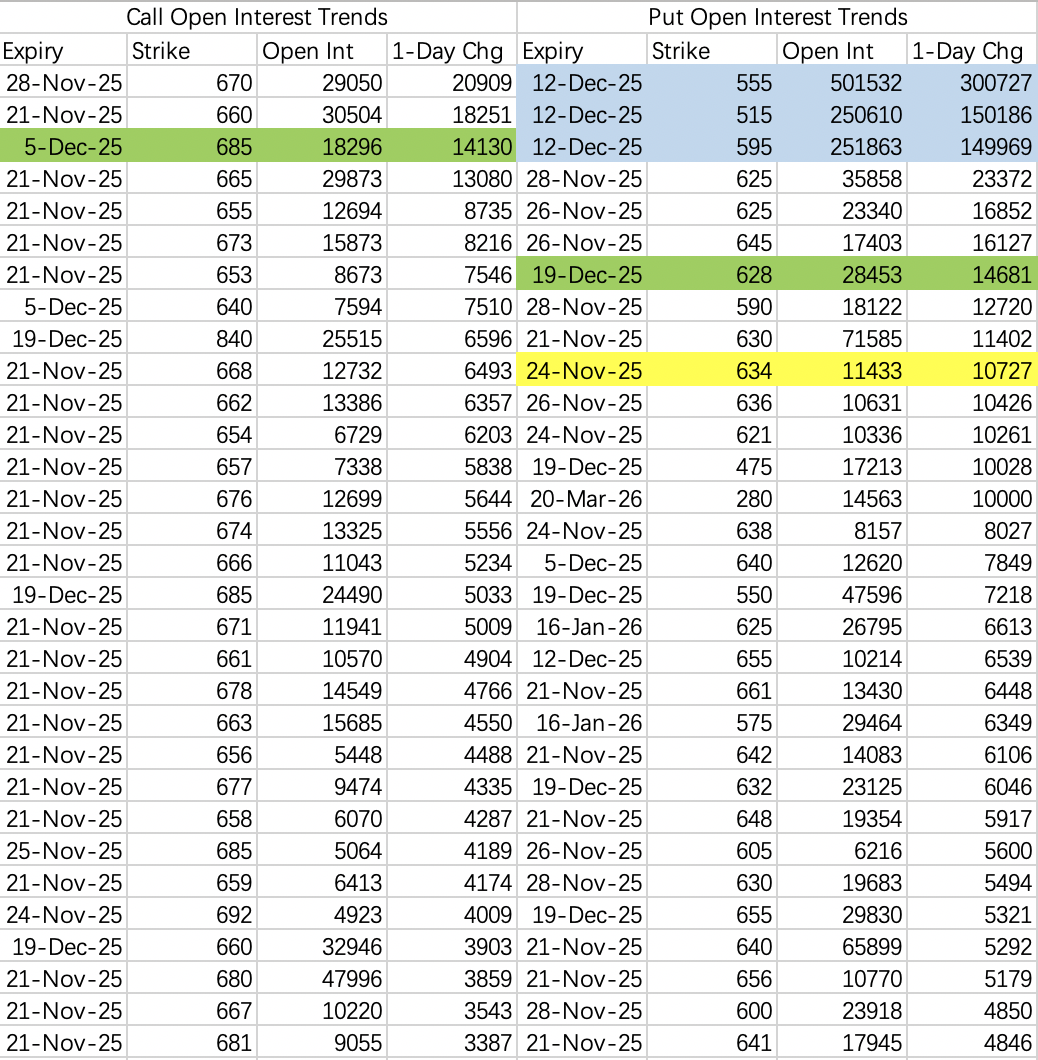

$SPY$

The potential for a sharp drop below 640 remains for next week. Notably, someone opened a 600k-contract put butterfly, betting on an unexpected plunge below 595 before the FOMC meeting.

$TSLA$

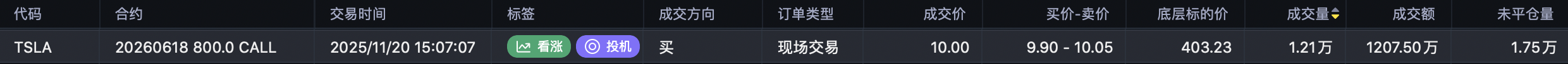

Amidst the broad market pullback, Tesla saw a sizable opening of 30k contracts in the June 18th 800 call $TSLA 20260618 800.0 CALL$ , with a total premium of approximately $300 million.

With investor Duan Yongping also recently mentioning a position in Tesla, it raises questions about what potentially significant catalysts might be anticipated for next year, prompting such aggressive long-dated call buying at this risky juncture.

Comments