$名创优品(MNSO)$ $名创优品(09896)$

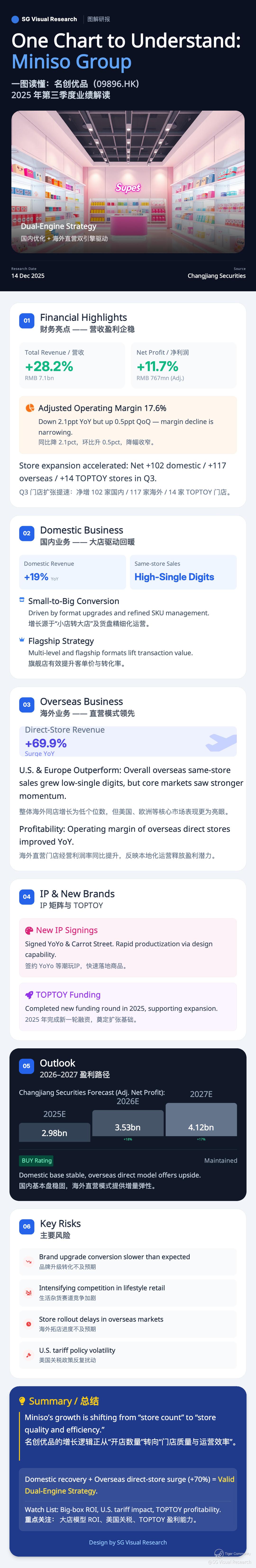

Miniso’s overseas direct-store revenue jumped +70% YoY in Q3—while domestic same-store sales accelerated to high-single digits.

This isn’t just about opening more stores. It’s about big-box upgrades, IP monetization, and owned retail economics in the U.S. and Europe.

Yet margins are stabilizing, not collapsing. Is the market still pricing Miniso as a discount retailer… while it’s becoming a global brand platform?

(One Chart to Understand below 👇)

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Comments