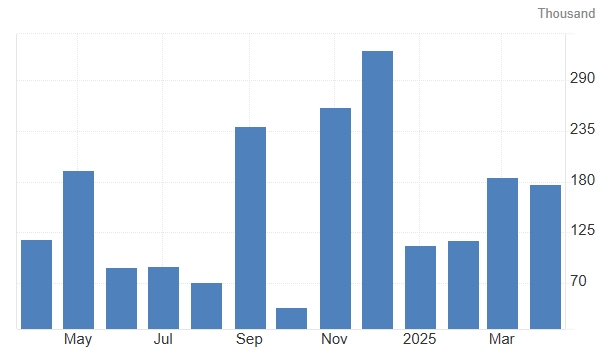

TradingKey - The U.S. Bureau of Labor Statistics (BLS) will release the May nonfarm payrolls report on Friday, June 6, with investors closely scrutinizing the data for signs of labor market resilience or weakness. This comes after mixed signals earlier this week — JOLTS job openings unexpectedly rose, while ADP employment growth plunged by half, deepening uncertainty.

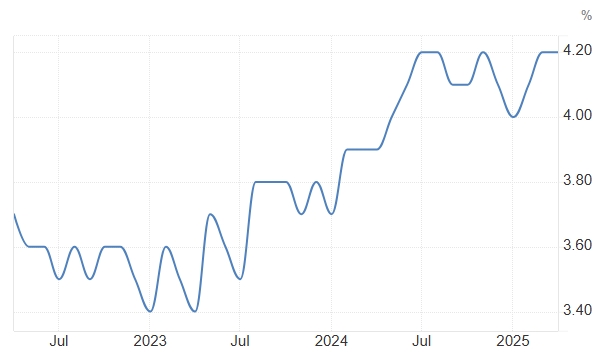

Economists forecast 125K new jobs in May, down from April’s 177K, with the unemployment rate expected to hold steady at 4.2%, while risks tilt toward an uptick to 4.3%.

U.S. Nonfarm Payrolls, Source: Trading Economics

U.S. Unemployment Rate, Source: Trading Economics

U.S. Unemployment Rate, Source: Trading Economics

This year, the market’s biggest debate has centered on how Trump’s tariffs will impact inflation, employment, and economic growth. Most economists argue that tariffs fail to revive U.S. manufacturing while driving up prices and joblessness — despite Trump’s claim that this is merely a "transition period."

Conflicting Signals from Recent Data

- Tuesday (June 2): JOLTS job openings climbed to 7.391M (vs. 7.1M expected), suggesting lingering labor demand.

- Wednesday (June 3): ADP employment cratered to +37K (vs. 114K forecast), the weakest in two years.

- Fed Beige Book: Economic activity cooled in recent weeks due to tariff and policy uncertainty, with businesses delaying hiring plans.

Market Implications

Bloomberg analysts now project payrolls could dip to 90K, well below consensus (130K), with leisure/hospitality a key drag.

S&P 500 options imply a ±0.9% swing post-NFP — the smallest implied volatility since February — though ADP’s shock may render this outdated.

Despite lingering trade war noise, the S&P 500 has rallied over 7% since May on easing tensions. But with soft ADP data, Friday’s jobs report could reignite volatility — especially if the labor market cracks further.

Citi warns the real risk is an unexpected unemployment spike (e.g., to 4.3%, the highest since Nov. 2021), which could trigger a growth-scare repricing in equities.

Find out more

Comments