TRADE WITH UNUSUAL OPTIONS

June 9th, the market was not particularly intense as usual Fridays, but some big-tech companies still maintained significant momentum. Apart from AI-related hardware, companies such as $Advanced Micro Devices(AMD)$ and $Qualcomm(QCOM)$ experienced a rebound, along with potential opportunities for AI-related software companies like $Adobe(ADBE)$ $Oracle(ORCL)$ $Salesforce.com(CRM)$ $Intuit(INTU)$ .

However, the main highlight was still $Tesla Motors(TSLA)$ which has been rising for 11 consecutive days. As the most active stock in the US stock options market, Tesla often experiences epic volatilities.

In 2020, it had a "Gamma Squeeze," where long positions rushed in and pushed the stock price to an extremely absurd level. After experiencing an 11-day rally, Tesla's stock price has reached a new high for the year, displaying a similar pattern.

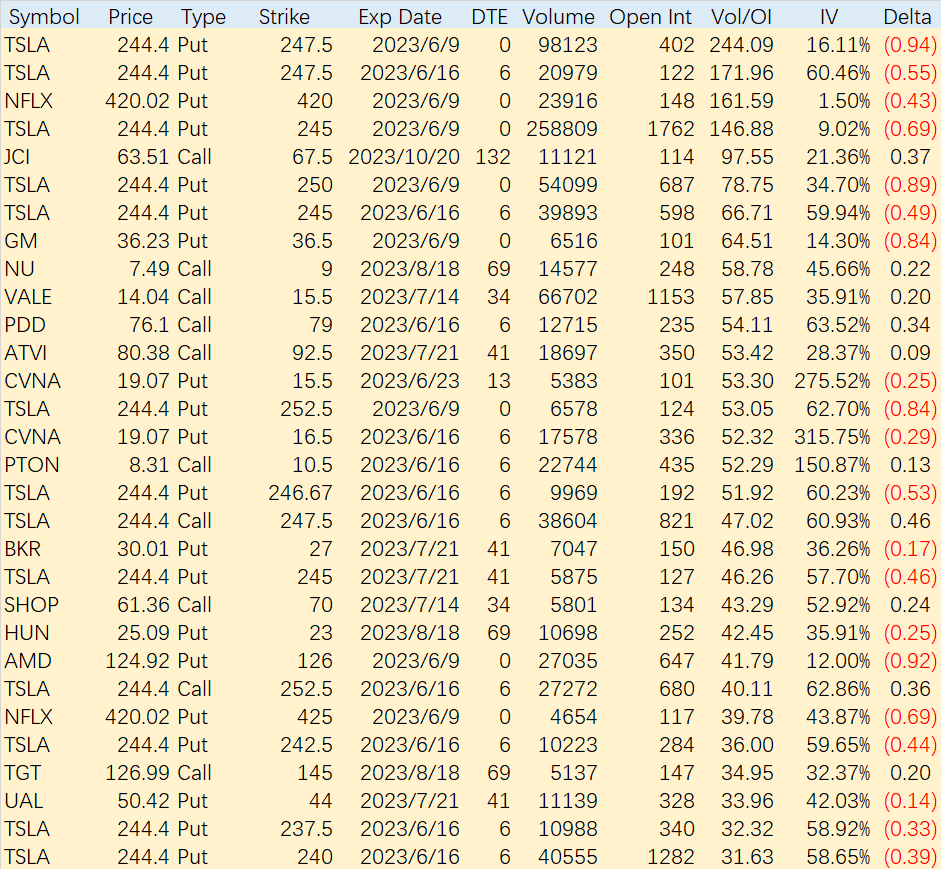

On the options leaderboard for June 9th, TSLA still had multiple options listed, most of which were either expiring soon or expiring within a week.

$Netflix(NFLX)$ followed a similar trend, but its focus was more on performance expectations. However, the seller of the large put option at $420 for Netflix managed to escape narrowly as the closing price ended at $420.02.

Regarding Tesla's future direction, it might be easier to understand from a bearish perspective. In the short term, bearish positions will be more cautious, with shorter holding periods and a preference to avoid overnight positions (gap openings). Hedge funds, if caught in a Gamma Squeeze, will need to passively add more long positions, resulting in very limited downward momentum. However, this does not indicate a change in the supply and demand situation in the new energy industry, so even in the case of a Gamma Squeeze, it is unlikely to reach the heights of 2020.

In addition, this week's CPI data (automotive subcategory) and the results and rhetoric of the FOMC could also impact the flow of market funds. Here are a few notable options:

$Johnson Controls(JCI)$ : It is rare to see large call options for longer terms, so if they appear, the buyers must have sufficient reasons. Considering this company's position in refrigeration equipment and hardware such as air conditioners, one can speculate that the buyers may be optimistic about a high probability of experiencing extreme heat in the northern hemisphere this year.

For companies like Nu Holdings Ltd. (NU), Vale, and Peloton Interactive, Inc. (PTON), which experienced significant declines but have a certain rebound potential, the large call options that appear are mostly Covered Calls, as investors often lack confidence in these companies. Much more like short squeeze.

Additionally, an interesting option is the 92.5 call option for Activision Blizzard (ATVI) with a July expiration. Whether it's a Covered Call or a naked call, choosing this strike price is quite good. Even if it gets approved by the UK and the FTC, there may still be a slight discount from the ultimate target price, making this strike price relatively safe.

Comments

That was a close call for the seller of the Netflix put option at $420! Did they have a lucky escape?

Tesla seems to always have ups and downs in the market. Do you think it's a good time to invest in them?

Wow, Tesla's stock is really on a roll! How long do you think this rally will last?