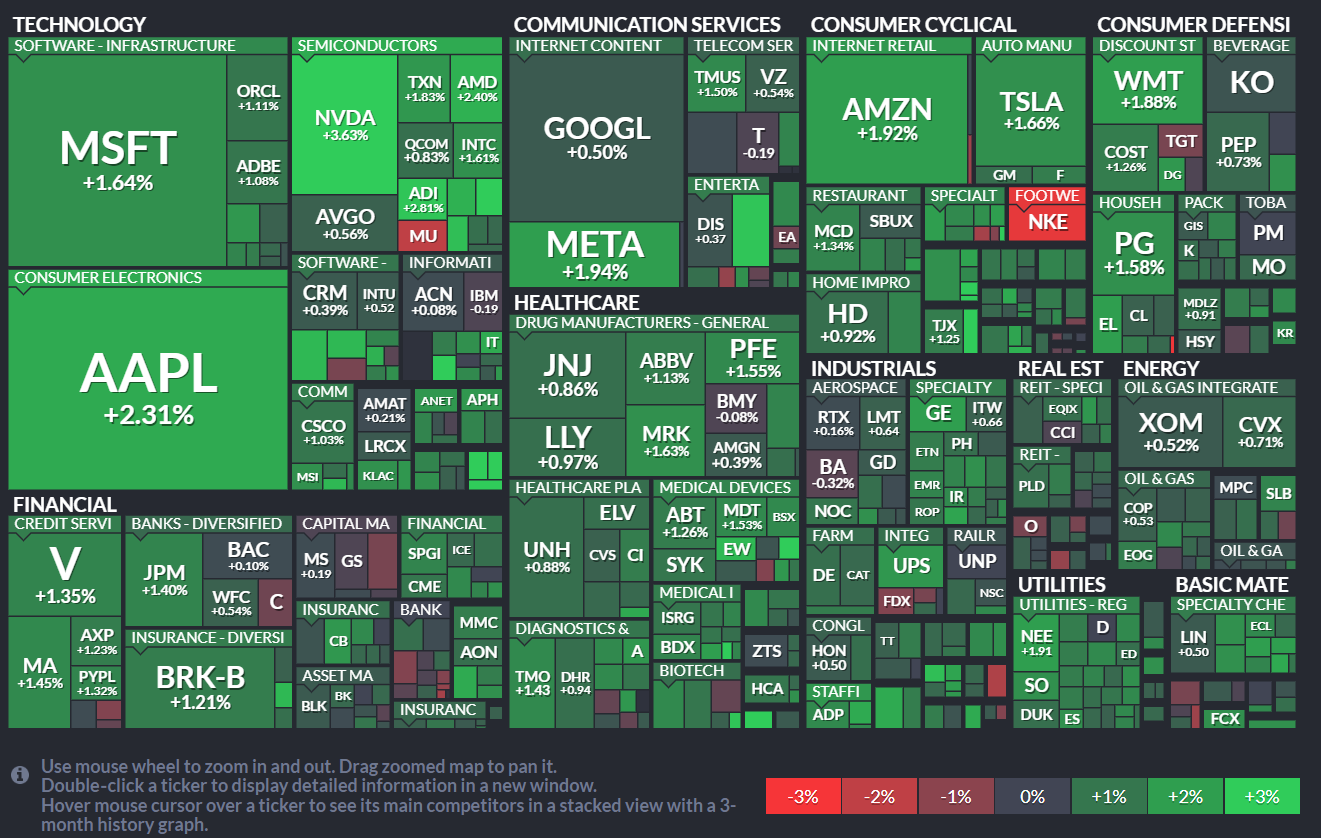

June 29th and 30th were the last two trading days of the first half of the year. Due to the bullish market sentiment, there was increased activity in trading large options orders.

Among them, for major tech companies, $Apple(AAPL)$ successfully crossing the $3 trillion market cap mark became a focus for investors and lived up to expectations by surging 2.3% on that day. Except for $Nike(NKE)$ with disappointing financial results and $Micron Technology(MU)$ affected by certain news, most stocks experienced significant gains.

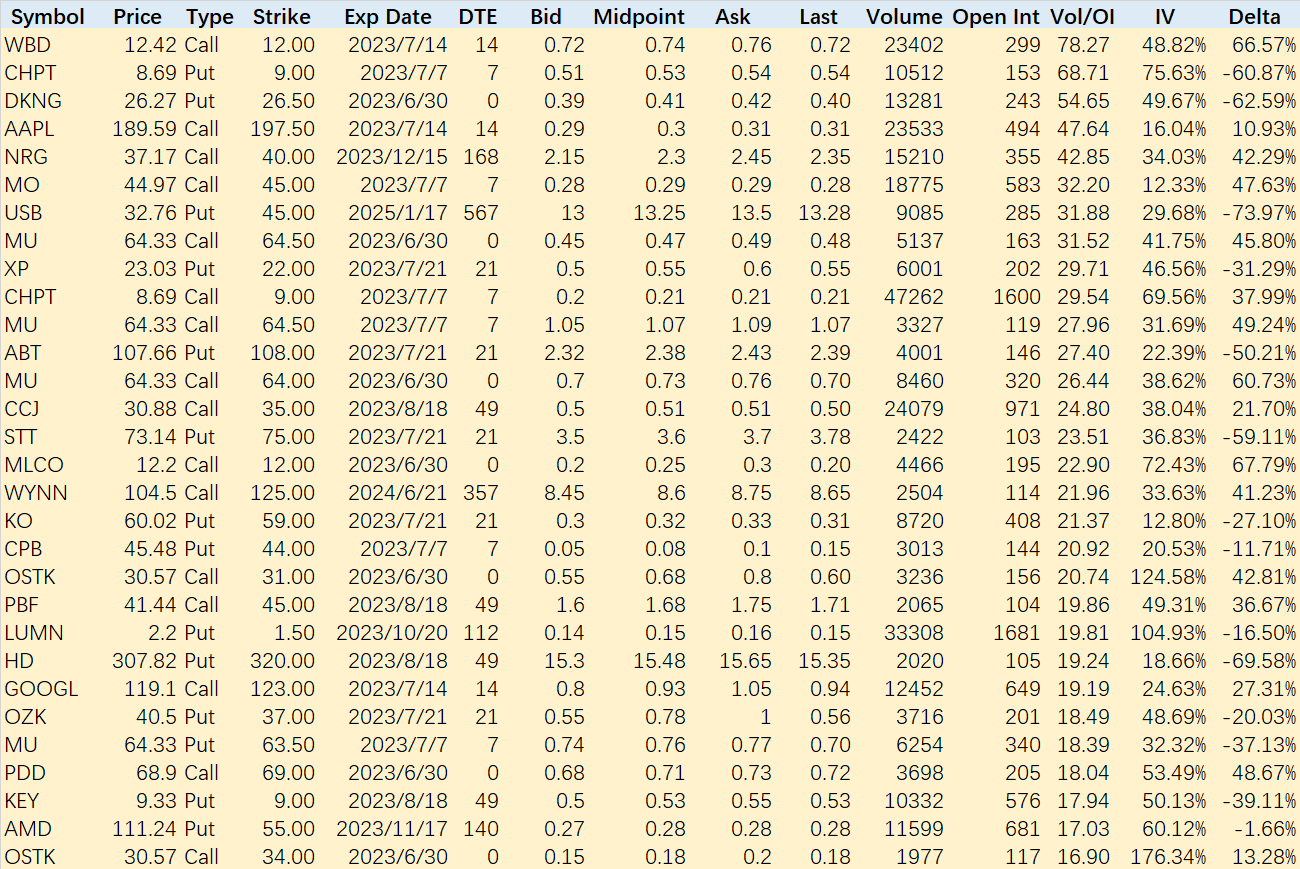

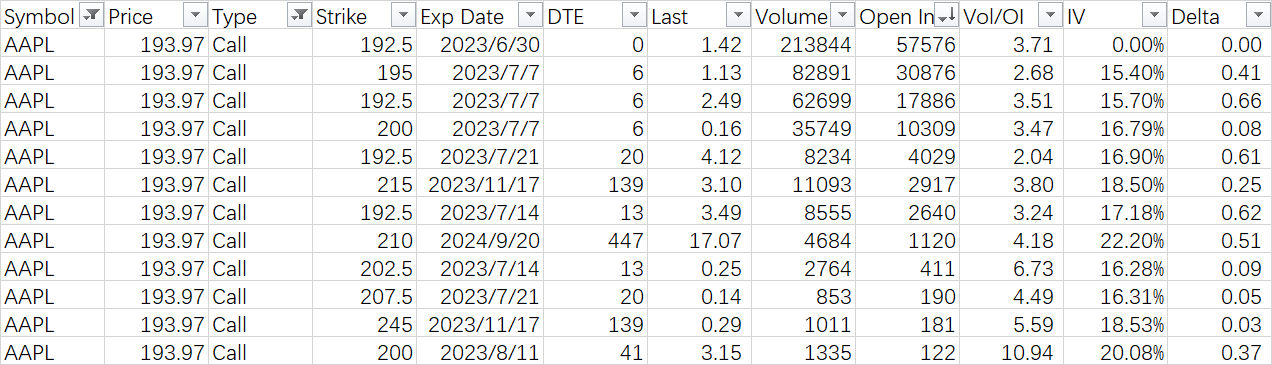

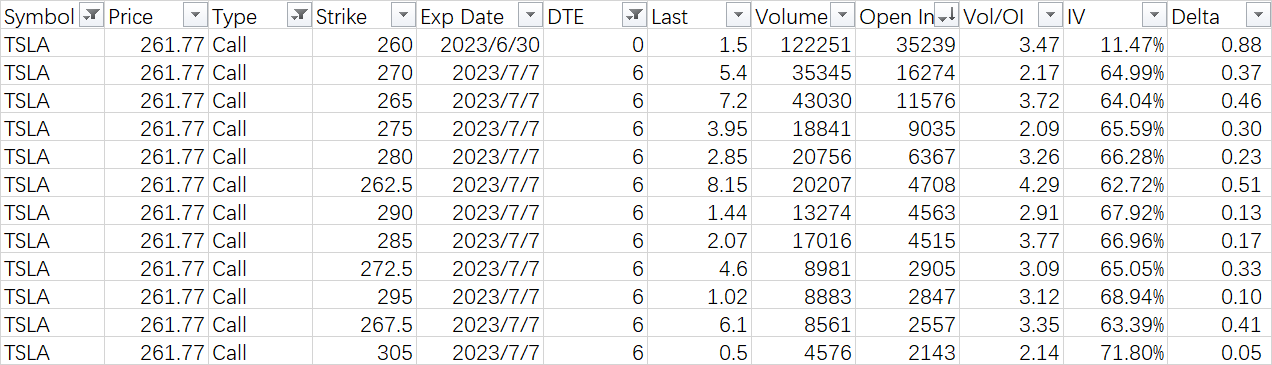

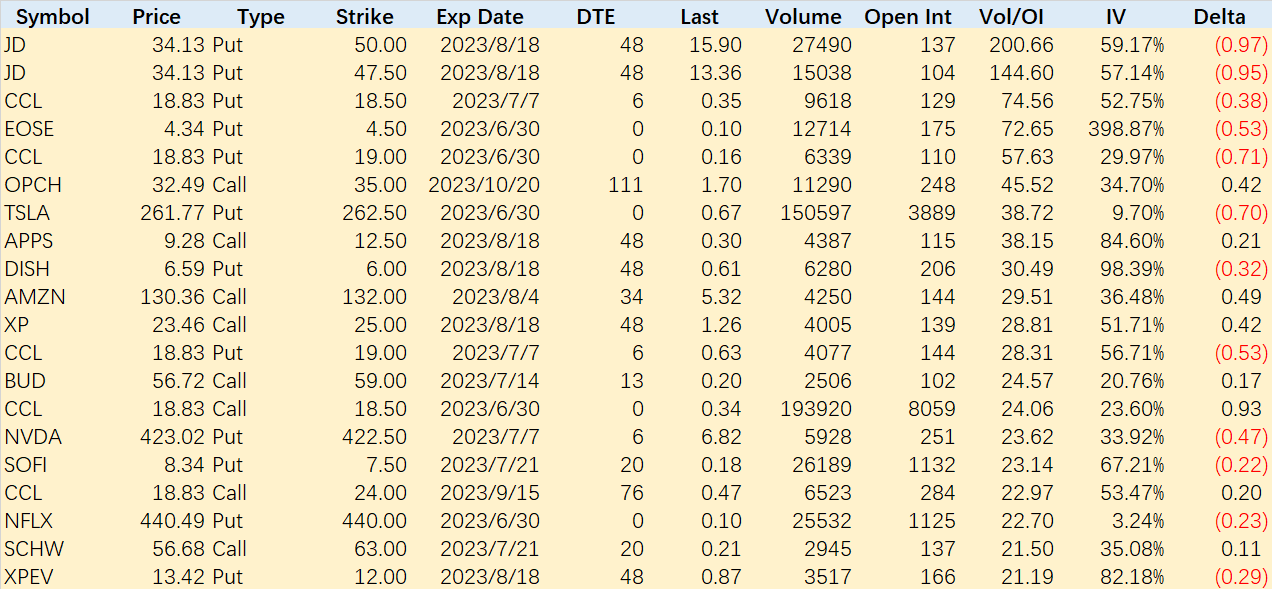

Regarding unusual options activity, we can still observe many investors seeking covered protection.

Specifically $Apple(AAPL)$ has a large number of orders were placed between $190 and $200, indicating the presence of resistance at these levels for further upside movement.

$Tesla Motors(TSLA)$ had a wider distribution of strike prices. However, overall, the volume of unusual end-of-day large options orders was significantly lower compared to before, especially the volume of put sell orders was notably reduced.

Noteworthy unusual options activity $JD.com(JD)$ had a deep in-the-money put option with a strike price around $50 expiring in approximately one and a half months.

Comments

"Wow, AAPL hitting $3 trillion market cap? I can't even comprehend that much money!

Looks like the tech stocks were playing a game of 'who can make the most gains' today

AAPL, you magnificent beast! Keep making those gains and making us all proud

"The stock market was a rollercoaster today! Hold on tight, investors!

"I guess NKE and MU didn't get the memo Better luck next time, guys!