Big-Tech’s Performance

Coupled with recent economic data greatly reducing the possibility of interest rate hikes, the market has once again begun to bet on the exit of the "soft landing era" of tightening.

Big tech obviously leads the way, outperforming second-tier growth this week, and having greater risk resistance in the face of macroeconomic uncertainty.

This week, the Nasdaq technology index hit a historic high.

As of the close of November 16th, the performance of big tech companies over the past five trading days has been very eye-catching, with Microsoft leading the way in setting a new all-time high.

The largest increase was $Tesla Motors(TSLA)$ +11.24%, which was the only decline last week but soared this week; followed by $NVIDIA Corp(NVDA)$ +5.39%, $Alphabet(GOOGL)$ +5.14%, $Microsoft(MSFT)$ +4.29%, $Meta Platforms, Inc.(META)$ +4.26%, $Apple(AAPL)$ +4.00%, and $Amazon.com(AMZN)$ +1.59%.

Big-Tech’s Top Newsfeed

Apple may miss its established target for launching a self-developed cellular modem by 2025 and will not release it until early 2016.

Apple will adopt RCS to improve text transmission performance with Android devices and will upgrade it after late 2024 to add RCS standards.

The Gates Foundation Q3 takes long positions on Apple, Meta Platforms, and Amazon.

Japan is considering imposing sales taxes on Apple and Google apps.

Apple lost its tax lawsuit with the European Union and may be forced to pay a $14 billion tax bill. It will challenge the Digital Markets Act in the EU court and appeal against the inclusion of app stores in EU monopoly rules.

Microsoft confirmed that Copilot will be introduced in the Win10 system, and its stock price hit a new all-time high.

Google has postponed the release of Gemini AI to Q1 2024.

Google CEO confirmed that Apple's search engine advertising revenue cut is 36%.

Nvidia launched a new AI processor H200, and its stock price has risen for 10 consecutive days and is close to a historic high.

Tesla's Cybertruck is expected to debut on November 30th, and sales contracts restrict owners from reselling within the first year of purchase.

Meta launched an AI-based video editing tool.

Big-Tech’s Key insights

Global Eyes On Nvidia

The world is focusing on Nvidia's financial report on November 21st, which is an important event leading the entire technology sector. At the S23 conference on November 14th, Nvidia suddenly announced the launch of HGX H200, which brings powerful power to the world's leading AI computing platform.

This is the first GPU to provide HBM3e, which can accelerate generative AI and large language models, and can also advance scientific computing workloads for HPC, with almost double the capacity and 2.4 times the bandwidth compared to the previous generation A100. Nvidia has already confirmed additional orders for $Taiwan Semiconductor Manufacturing(TSM)$ CoWoS advanced packaging in October, and next week's Q3 performance will be as of the end of October.

Currently, the market expects revenue to increase by 171% YoY to $16.08 billion, with data centers growing by 233% to $12.79 billion and the gaming business also growing by 71% to $2.70 billion. The gross margin is expected to rise to over 72.4%, and EBIT is projected to reach over 60%, resulting in an EPS growth of over four times to $3.36. Based on this level, the PE ratio for the fiscal year 2024 would be 45 times.

In the just-concluded Q3, hedge funds also demonstrated continued enthusiasm for NVDA in their 13F filings, with a 6% increase in weight among the top ten holdings and a 2% increase in funds holding positions.

Of course, Nvidia's financial report may also face volatility. Based on historical performance, the average expected stock price change before Nvidia's financial report is ±7.2%. The actual average change is ±7.2%. The average opening change is ±6.0%, and the intraday fluctuation is ±2.8%. Therefore, historically, shorting volatility has had a higher success rate.

Cybertruck on Cyber-Tesla!

Tesla's stock price has recently experienced significant fluctuations. Last week, investors paid little attention to Biden's support for UAW's entry. The most important thing now is the Cybertruck launch on November 30th, as the technologically advanced Cybertruck could become a key factor driving Tesla's stock price, unlike businesses like Dojo supercomputers that are difficult to generate cash flow.

The overall supply-demand relationship in the new energy vehicle industry is changing. On one hand, the supply is increasing, with traditional automakers entering the market and new forces continuing to exert their strength, putting pressure on Tesla. The diminishing effects of continuous price reductions are gradually weakening. On the other hand, demand for cars as optional consumer goods is not as strong, and declining oil prices have given conventional vehicles a chance to breathe.

The biggest issue with the Cybertruck is undoubtedly its production capacity. Musk has already warned that mass production of the Cybertruck is "very difficult" and it will take at least 18 months for it to become a "significant positive cash flow contributor." Although the target is to produce 200,000 units per year, production is much more challenging than initially designed.

In China, pickup trucks still only account for a mere 2% of the automotive market, and the penetration rate of new energy pickup trucks is even lower at around 1%, far below the 11.3% of new energy commercial vehicles. The main reason for this is the limited number of new energy pickup truck models available.

The Big-Tech Portfolio

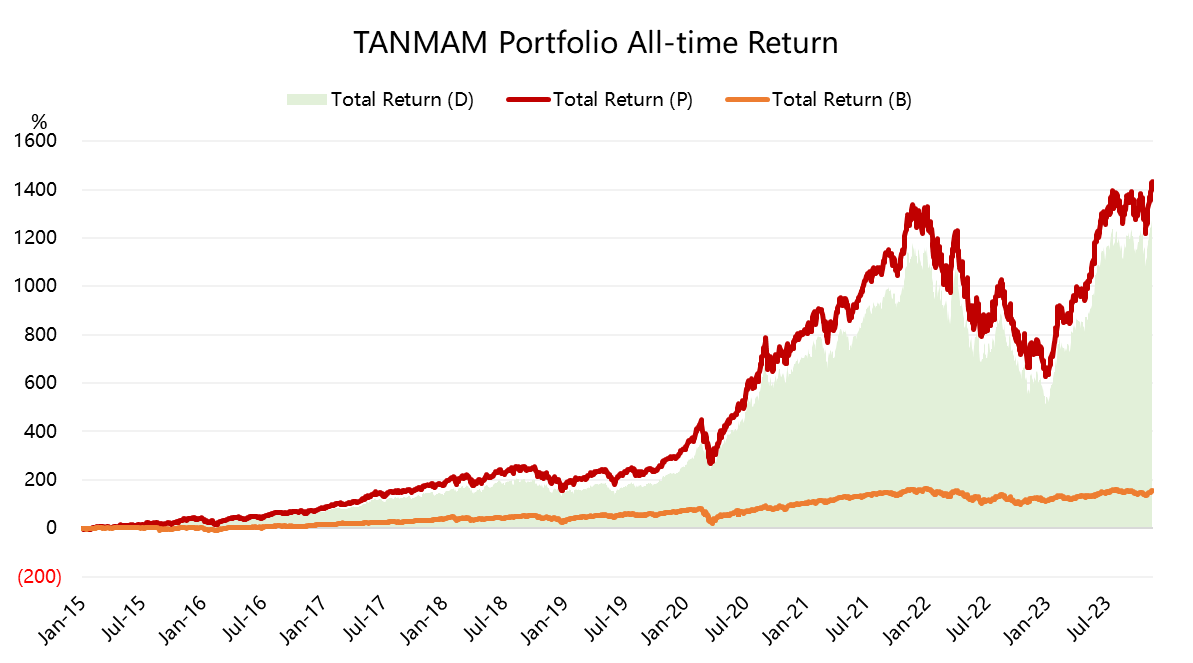

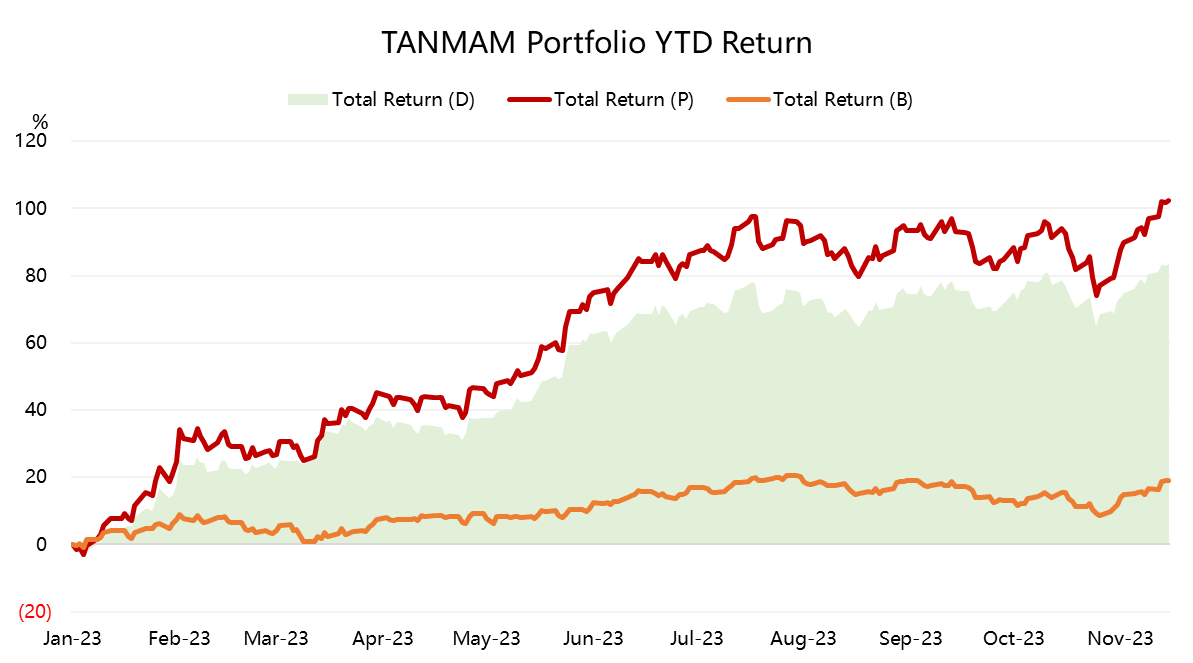

"We will combine the seven companies with the highest weights into an investment portfolio called the 'TANMAM' portfolio.

By equally weighting and readjusting the weights quarterly, the performance of this portfolio since 2015 has far exceeded the S&P 500, with a total return of 1432%, setting a historic high. In the same period, the $SPDR S&P 500 ETF Trust(SPY)$ had a return of 156.61%, but still hasn't reached a new high.

The annualized return is 37.33%, higher than SPY's 11.47%. The Sharpe ratio is 4.6, higher than SPY's 1.3%.

Additionally, the return over the past five working days is 5.2%, surpassing SPY's 3.8%, with a Sharpe ratio as high as 68.3, compared to SPY's 39.5.

Comments