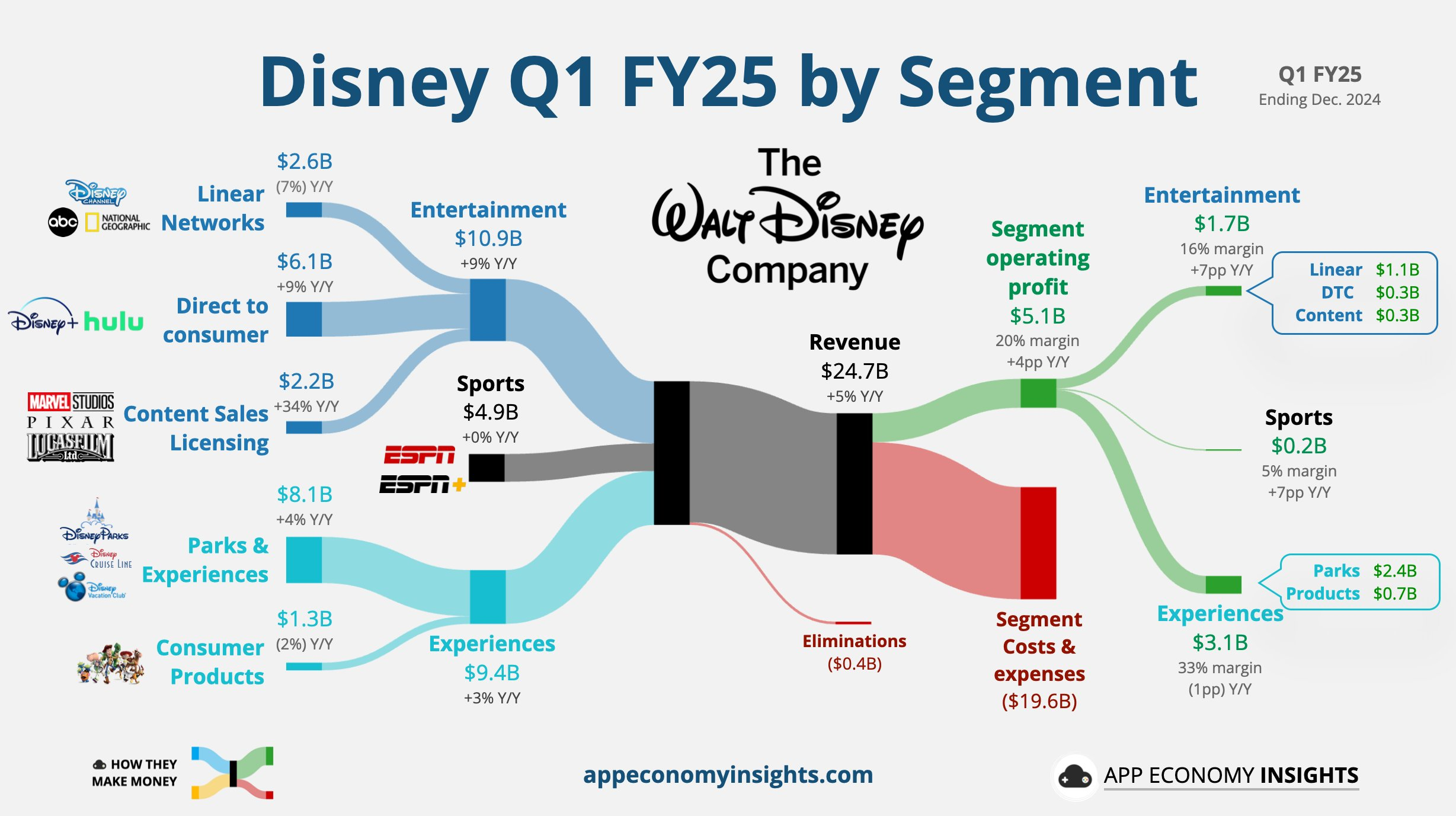

$Walt Disney(DIS)$ earnings after the "high open low", the overall results exceeded expectations, guidance is also relatively optimistic, but the market this performance is clearly a large divergence.

Investment highlights

Streaming business performance is stable, the earnings effect satisfied investors, but there are still doubts, the effect of crackdown on shared accounts is different from $Netflix(NFLX)$ too many streaming channels also reduce synergy;

The same crackdown on shared accounts, Disney + local and international markets, instead, a net decrease of 700,000 YoY, the opposite of Netflix at the time, competition is one aspect, but users of Disney streaming in the consumer positioning may be different;

Netflix's content coverage is more comprehensive, while Disney+ is more of a business supported by IP fans;

The upside is that the price hike has boosted ARPU and increased revenue by nearly 10%, while tight expense control has maintained a 5% operating margin, a key goal of Iger's rise to power;

While bundling Disney+ expands ESPN+'s subscriber category and improves profitability, it also hits subscribers, and internal competition in the long run will require further expansion of Synergy; in addition, Netflix is also strengthening its sports channel support.

ESPN streaming all-platform (expected to be launched at the end of 2025) and the application of AI technology into key areas of investment;

The movie cycle is picking up, and IP is tough enough to support its streaming business at the same time

The top three box office in 2024 are all under Disney's banner, with Ocean's 2 performing well at the box office and breaking $1 billion at the global box office; there are also important IPs such as Frozen 3 in 2025;

The content cycle is also an important factor in determining subscriber support for its streaming business, with spinoffs such as the Marvel series and Star Wars in 2025 also important channels;

A steady rebound in the parks business, sacrificing free cash flow and kicking off a capital investment cycle in anticipation of future growth

Relative rebound in demand, with modest growth in both foot traffic and per capita spend, and flat profits despite hurricane impacts that shut down Disney Florida for a day and suspended one route;

Theme park expansion projects in Paris and Hong Kong continue to move forward, and capital expenditures in 2025 may be skewed toward international markets;

After the inaugural voyage of Disney Treasure, plans to add two new cruise ships, the next three years related investment or more than 2 billion

Valuation

Because of Disney's many businesses, an overall valuation on a profit multiple would be a good test of the level of profit growth over the next few years, but streaming and movies have just begun to be profitable not long ago, and the way that the different business segments have been valued previously is more applicable to DIS.

The targets established by management are also relatively clear when viewed over the long term (FY2026).

Traditional media to streaming media;

Increase streaming breadth to fuel growth and wait for opportunities to raise prices to boost margins;

Defining the content supply cycle to maintain freshness;

Offline theme parks are also gradually returning to growth

The current valuation is not too expensive and investors may be willing to give a higher valuation in the long run if the resumption of growth is confirmed.

Comments

sen