The parent companies of both McDonald's and KFC have been quietly hitting record highs, and recent Q4 results from both companies have caught investors' attention.

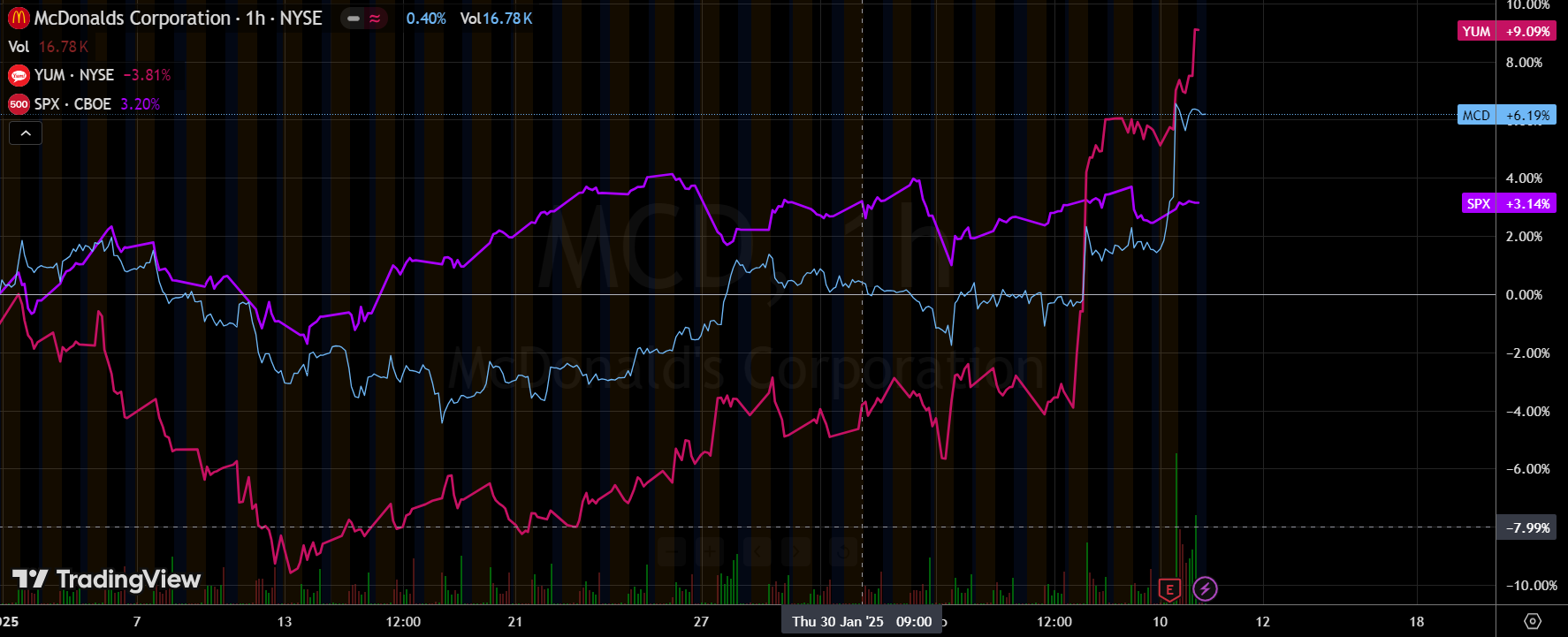

Interestingly, $McDonald's(MCD)$ and $Yum(YUM)$ shares have diverged from $S&P 500(.SPX)$ to varying degrees this year, with negative correlation coefficients.SPX)$ have diverged from the $S&P 500 (.SPX)$ to varying degrees so far this year, with negative correlation coefficients, and have become somewhat of a portfolio hedge against inflation and macroeconomic uncertainty.MCD has become a hedge against inflation and macroeconomic uncertainty in its investment portfolio to a certain extent.

Both companies had the following things in common in Q4:

International performed better than North America, although of course there are variations between regions (preference for product categories, geo-events impact)

Consumption of lower priced packages is up, interestingly enough in North America, and reliance on lower and mid-consumption groups has increased, also highlighting some conflicting economic data in North America;

Both are diversifying out of packages to further improve margins;

Digital integration and membership systems are growing at an optimistic rate and bringing a larger customer base to the company

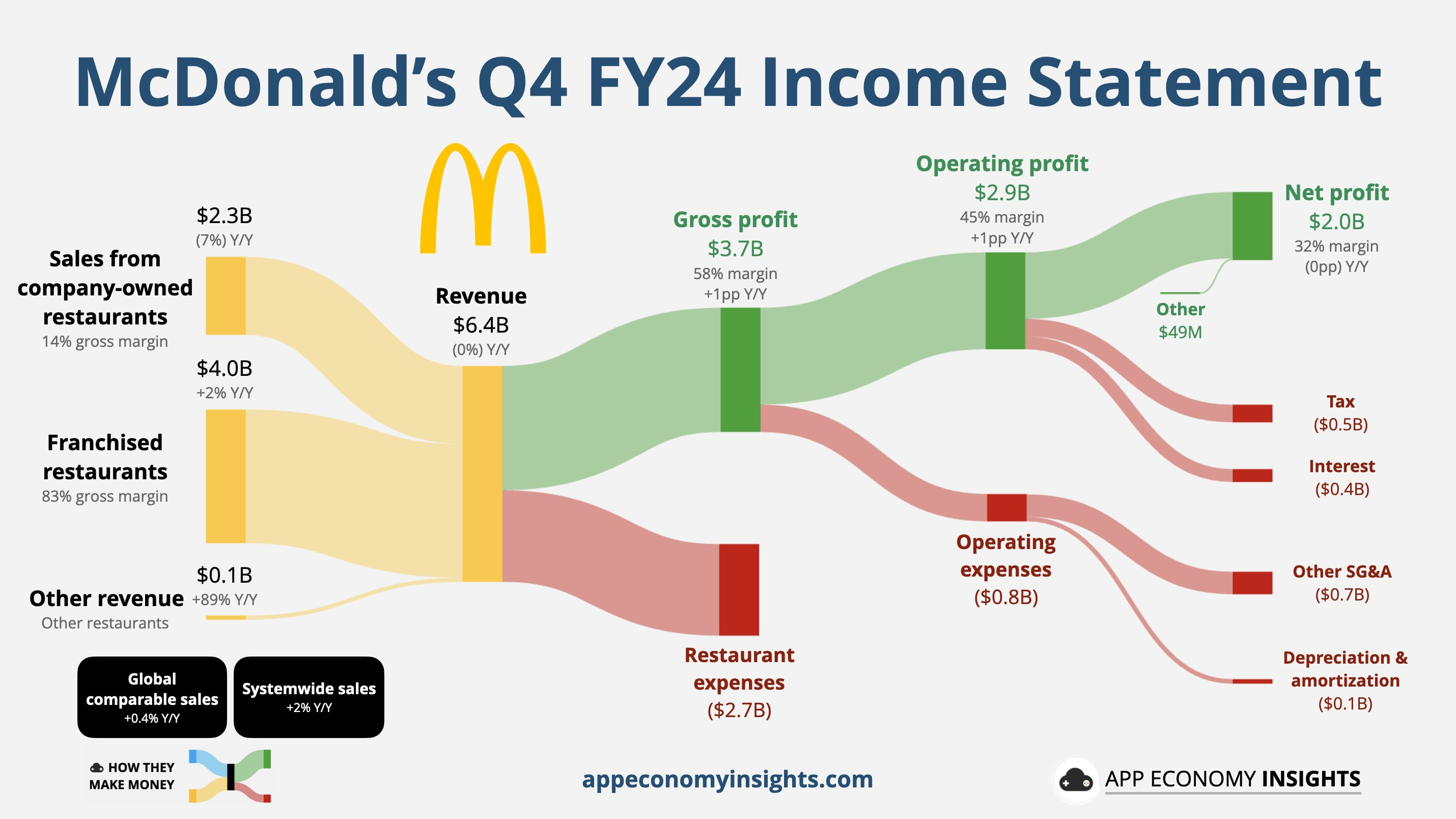

MCD 24Q4 Takeaways.

Q4 earnings did not exceed expectations, with EPS $2.83 < Consensus $2.86 and revenue $6.39B < consensus $6.45B.

North America miss, of which North America Same-store sales -1.4%YoY , due to: consumer spending pressure, E. coli food safety incident and other external challenges impact;

International overall beat, although the performance of the regional Same-store sales varied, the overall slightly positive growth +0.1%YoY, of which the chain stores +4.1%, mainly due to targeted marketing in November and December to bring the improvement of customer traffic in the ring;

Low-priced set menus were hot, with $5 set menus remaining popular and the newly launched McValue menu, coming to attract customers by offering more choices and flexibility; however, pricing flexibility is limited in the current environment amidst continued inflationary pressures on food and labor costs.

Membership programs were further enhanced with Q4 Loyalty sales of approximately $30 billion, with the goal of achieving $45 billion in system-wide sales and 250 million 90-day active users by 2027.

In terms of guidance, global restaurant development remains a priority, with approximately 2,200 restaurants planned to open in 2025, delivering over 4% unit growth, of which 1,600 will be opened by international development franchises, with 1,000 in China alone, and demonstrating confidence in the company's Accelerated Arch strategy and optimism for a 2025 recovery.It also shows confidence in the company's "Accelerated Arch" strategy and optimism for a recovery in 2025, with a target of slightly more than 2% system-wide sales growth through restaurant expansion in 2025.

It is worth noting that over the past month, MCD's beta is -0.06, much lower than the average of 0.42 over the past 2 years; the correlation coefficient, r, is -0.034 (using the SPX as a benchmark), which means that to some extent at this stage, MCD's correlation with the broader stock market is very low, and can be interpreted as part of the hedge

YUM 24Q4 Takeaways.

Q4 results all exceeded expectations with adjusted EPS of $1.61 on revenue of $2.36 billion; digital sales growth of ~15%, digital penetration of over 50%, net new store growth of 5% and same-store sales growth of 1%

Taco Bell outperformed the industry, realizing 24.3% restaurant-level margin for the year, +7% YoY at the global level and +5% at the U.S. Same-store;

KFC's international store additions were strong, driven in part by geo-factors, with a strong recovery in the Middle East and significant growth in Africa, Latin America and Canada, with Q4 international Same-store +1%YoY;

Launched the "Byte by Yum!" SaaS platform to streamline operations and enhance the customer experience, which has been adopted by over 25,000 restaurants globally.

YUM's beta of -0.04 over the past month is well below the average of 0.61 over the past 2 years; the correlation coefficient r is -0.015 (using SPX as a benchmark).

The fast food industry may perform better under different economic scenarios

Downturn: When the economy is in a downturn, consumers may spend less at upscale restaurants and opt for more affordable fast food.Fast food restaurants offer "good value" food that is more appealing in tough economic times.

Inflation: Although food costs may rise, fast food restaurants can often maintain profitability by controlling costs and optimizing operations.In addition, fast food restaurants can attract price-sensitive customers by offering promotions and discounts.

Changes in the pace of life (which may be brought about by changes in technology): In a fast-paced lifestyle, consumers are increasingly focused on convenience.Fast food restaurants often offer quick and convenient dining options that fulfill consumers' need for time efficiency.

Demographic Changes: Younger generations often prefer fast food because it is affordable and easily accessible.As the young population grows, the fast food industry is likely to benefit.

Comments