The minutes of the Fed's January 28-29 meeting, released on Wednesday, were actually pretty much what the market communicated.The short answer is:

Little willingness to cut rates, need to see more inflation data.

Slow down QT, or even pause it.Reduce the pace of balance sheet reduction.

Will adjust with fiscal policy.

Possible impact of Trump's tariff policy;

Reforms undertaken by Musk's DOGE department altering the US government's cash reserves (while the Treasury re-accumulates cash reserves, bank reserves could fall rapidly)

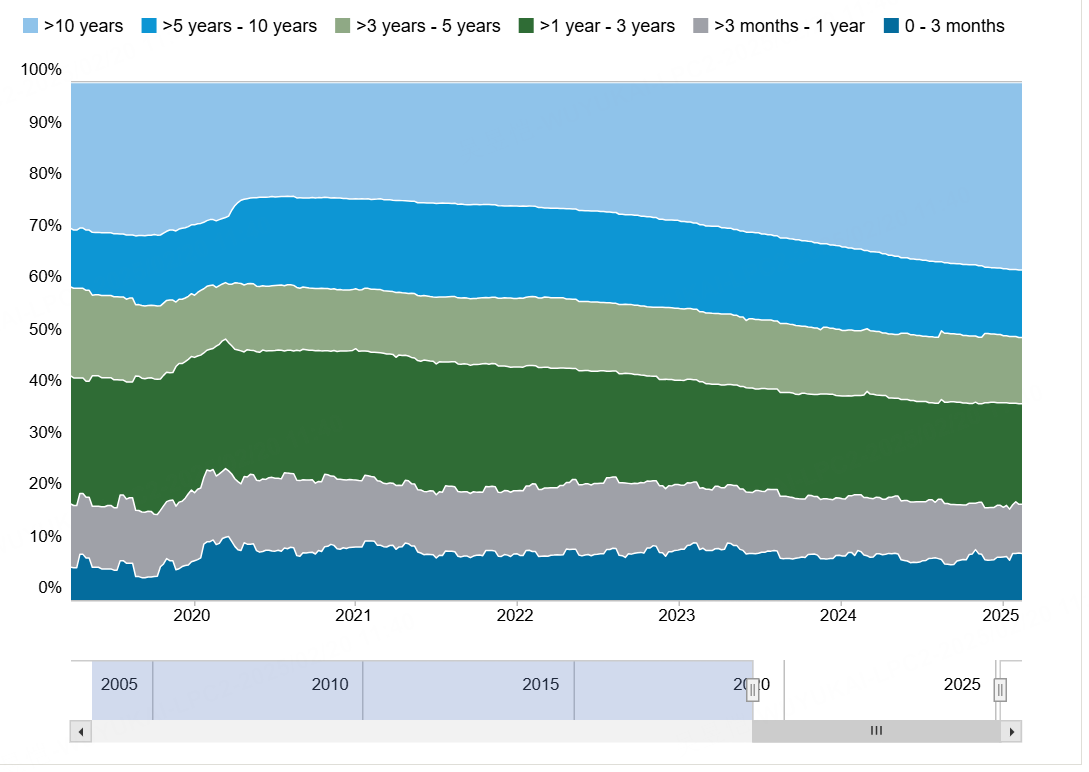

But there is one piece of information that could affect future US bond trends: The Fed may adjust the bond composition ratio of SOMA after suspending tapering, implying possible purchases of US Treasuries in the secondary market.

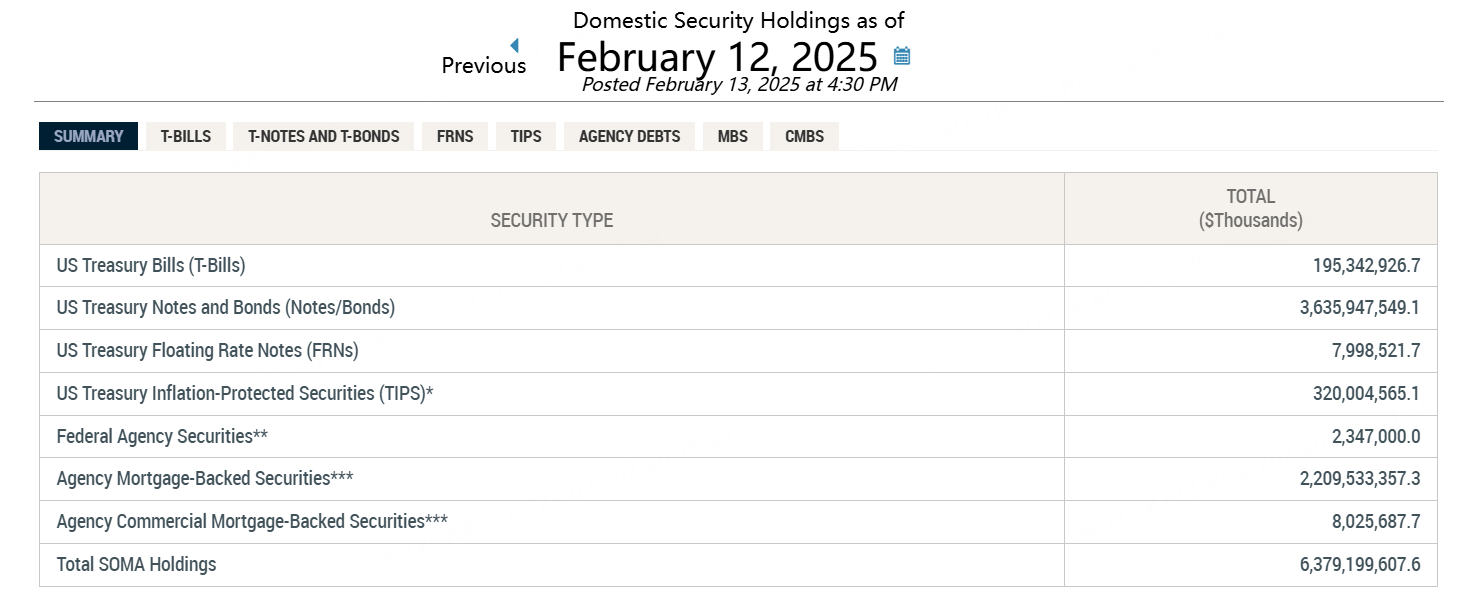

The System Open Market Account (SOMA) is a key component of the Federal Reserve's monetary policy framework.Managed by the Federal Reserve Bank of New York, the SOMA holds assets acquired through open market operations (OMOs), which are used to influence interest rates and manage liquidity in the banking system to achieve its monetary policy objectives.

SOMA consists primarily of U.S. Treasuries and agency mortgage-backed securities (MBS).As of February 2025, the total value of the SOMA portfolio is approximately $6.5 trillion.

As a result, the assumed growth in the share of Treasury bills in the SOMA portfolio over the next few years varies.

Comments