$Dell Technologies Inc.(DELL)$ this quarter showed a "fire and ice" pattern: AI server demand explosion and traditional business decline coexist, PC market dawn but the consumer side is still mired in the quagmire.

Short-term catalysts: AI server deliveries driven by improved GPU supply; long-term risks: storage business shrinking faster than expected, APEX transformation not as good as peers (e.g., $Hewlett Packard Enterprise(HPE)$ 's GreenLake).

Key indicators to watch: AI server deliveries, commercial PC order growth, APEX subscription revenue share.

Performance and market feedback

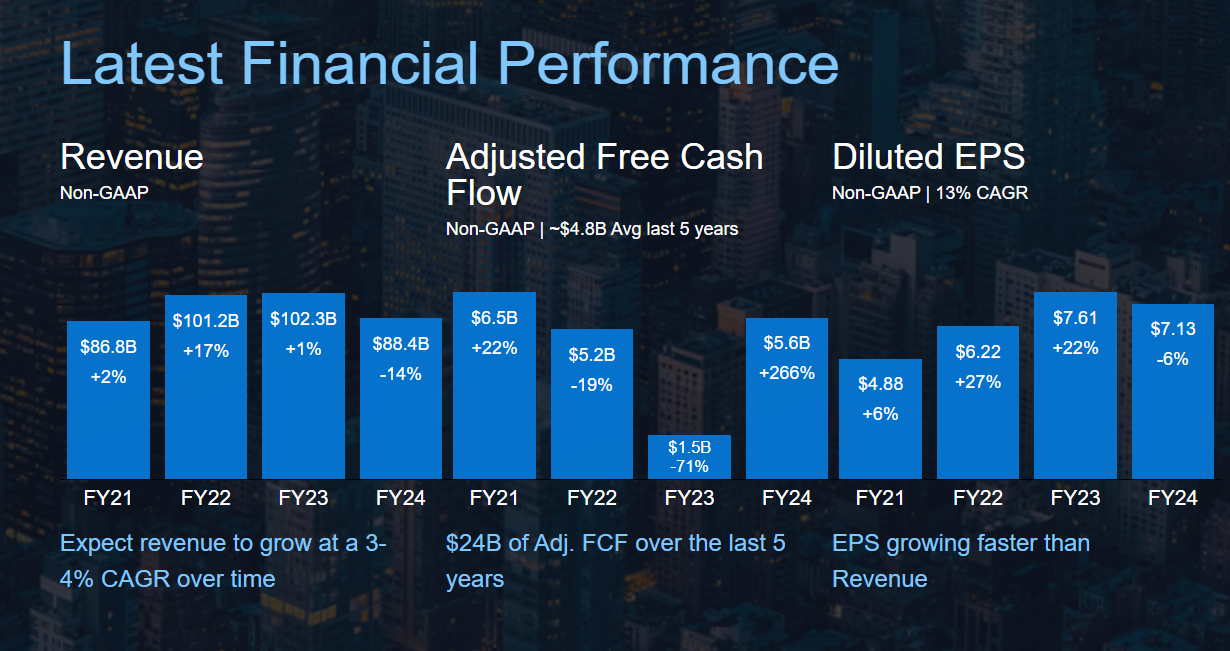

Core Financials

Revenue: $22.3B (11% yoy, slightly beat estimates of $22.1B, +0.6%)

Adjusted EPS: $1.74 (beat estimate of $1.72, +1.2%)

Gross Profit Margin: 24.5% (+1.8pp y-o-y, benefited from cost control and higher proportion of high margin business)

Operating cash flow: $1.45B (full year cumulative $8.7B, +15% YoY)

Segment Performance

Infrastructure Solutions Group (ISG): revenues of $9.3B (5% yoy), including $4.8B in server revenues (+8% yoy, driven by AI servers) and $4.5B in storage revenues (15% yoy)

Client Solutions Group (CSG): $11.7B in revenue (12% yoy), with $9.2B in revenue from commercial PCs (-7% yoy) and $2.5B in revenue from consumer PCs (25% yoy)

Market Feedback

After-hours stock volatility: down 5% (mainly due to 5th consecutive quarterly revenue decline and weakness in the consumer side of the business)

Market divergence: JPMorgan raised target price to $130 (bullish on AI servers), Citi maintained neutral rating (worried about weaker-than-expected PC recovery)

Investment highlights

1. AI server demand explodes, but supply constraints drag down short-term revenue

Order growth: AI-optimized server orders reached $2.9B (+40% YoY), with backlog accounting for over 30%.

Supply chain bottlenecks: Lack of supply of GPUs (especially H100) has lengthened lead time to 6-9 months, management expects relief in 2H2024

Competitive position: 17.5% market share in x86 servers (IDC data, ranked 3rd), but AI server market share increased to 12% (8% in 2023)

2. Marginal improvement in PC business, but consumer side still a drag

Commercial PC recovery signal: enterprise replacement cycle kicked in, Q4 commercial PC revenue +10% YoY (still -7% YoY)

Consumer side weak: revenue -25% YoY, significantly weaker than Lenovo (-15%) and HP (-18%)

Market share: global PC market share 17.1% (maintained 3rd), high-end workstation market share 32% (+2pt YoY)

3. Storage business continues to be under pressure, slow progress in multi-cloud strategy

Traditional storage declined: $4.5B in revenue (-15% yoy), mainly due to enterprises cutting back on local data center investments.

Progress in multi-cloud services: APEX (as-a-service offerings) revenue of $1.1B (5% of total revenue), growth slowed to +20% yoy (+35% prior)

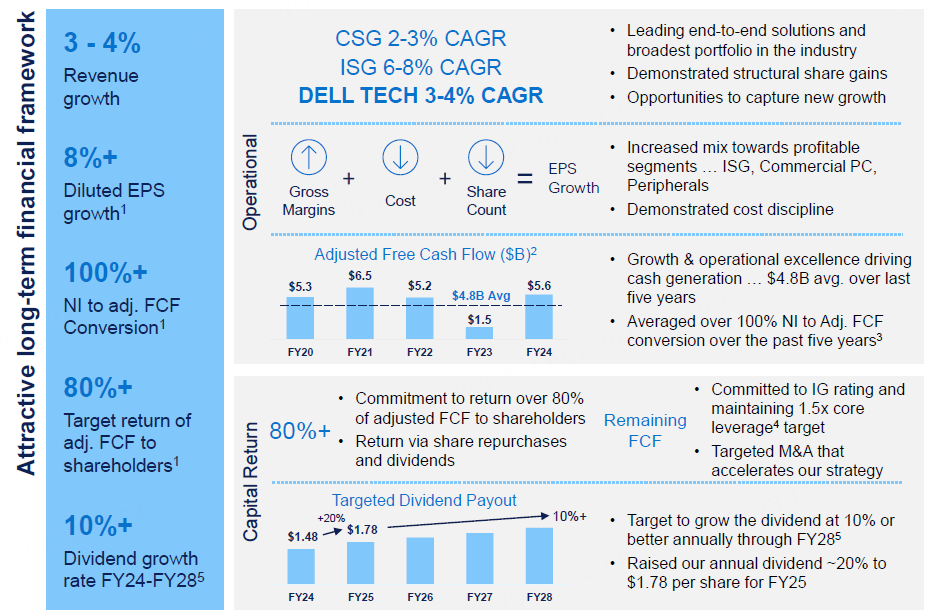

4. Strong cash flow to support capital returns

Stock repurchase: Q4 repurchased $1B of stock, totaling $5B for the year (4% of market capitalization)

Dividend policy: Quarterly dividend increased by 5% to $0.37/share, annualized dividend yield of 1.8%

5. Earnings guidance and analysts' concerns

FY2025 guidance: revenue -3% to +1% YoY (below market expectations of +2%), AI server revenue guidance of $10B+ (30% of ISG revenue)

Focus Question:

Q: Are AI server gross margins sustainable? Currently, AI server gross margin is over 30% (traditional server is about 20%), but we need to continue to invest in R&D to maintain our technological advantage.

Q: When will the PC business return to growth? Management forecast: commercial PC revenue to turn positive year-on-year in the second half of 2024, with the consumer side still waiting for 2025.

Comments