Big-Tech’s Performance

Weekly macro storyline:

U.S. stocks risk sentiment rose sharply, the $NASDAQ(.IXIC)$ recorded the largest one-day decline since DeepSeek.

Tariffs again, USD strengthened , but the Yen began to return to the "safe-haven" property

Concerns about jobless claims data are starting to escalate, which could be a sign of economic problems or a consequence of the recent widespread layoffs in the DOGE sector, and it is suspected that the market is taking its anger out on the TSLA.

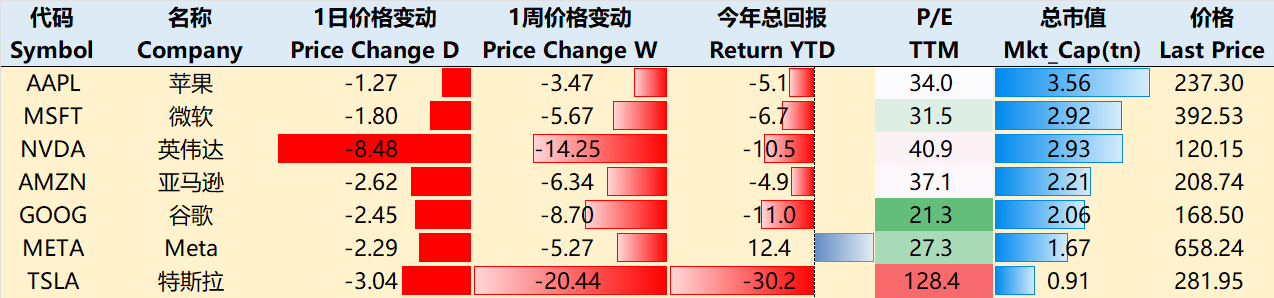

Big techs, Nvidia's earnings report is naturally the focus, but the impact has declined, even if the data is still great, but "beautiful enough" will allow investors to take profits to step on.Since the beginning of the year, only META in the big technology recorded positive returns, and META will also launch the META AI app in April, officially down to compete.

By the close of trading on February 27, Big Tech was lower across the board over the past week.Among them, $Apple(AAPL)$ -3.47%, $NVIDIA(NVDA)$ -14.25%, $Microsoft(MSFT)$ -5.67%, $Amazon.com(AMZN)$ -6.34%, $Alphabet(GOOG)$ $Alphabet(GOOGL)$ -8.7%, $Meta Platforms, Inc.(META)$ -5.27% and $Tesla Motors(TSLA)$ -20.44%.

Big-Tech’s Key Strategy

What are the key things to look for in NVIDIA's earnings report?

Sub-business segments, the game business with the improvement of chip supply is expected to realize a significant ringgit recovery, automotive electronics, although dragged down by the industry cycle, but benefited from the ADAS system penetration rate increase and a new generation of intelligent driving platform landing, still maintain structural growth.

Data center is still the core

Q4 Blackwell product line has realized $11 billion in revenue, confirming strong downstream demand, but supply chain bottlenecks may continue into the first half of 2026.Iteration of Hopper architecture products is expected to be completed in Q1 as multi-configuration solutions enter full-capacity production.

Core demand is driven by three major areas

Microsoft, Meta and other head cloud service providers continue to expand AI arithmetic clusters;

Climbing demand for model training by consumer Internet giants;

Incremental purchases from tier-2 specialized cloud service providers such as CoreWeave.

Meanwhile, the enterprise market, government organizations and vertical industry applications are expected to form the second growth curve in FY2026.

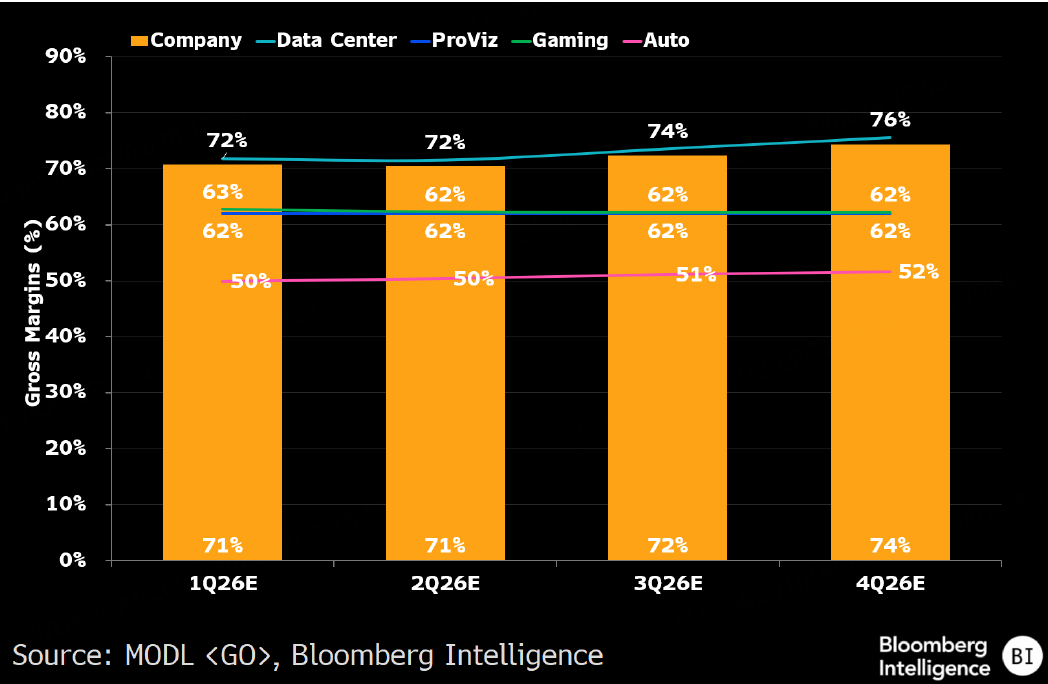

Gross Margin Phase Pressure and Structural Improvement Paths

Q4 Gross Margin fell back to 73.5% (-130bps QoQ), affected by the cost front in the initial delivery stage of Blackwell products, which is a normal phenomenon of technology platform switching, in line with the law of product iteration, and is not a structural deterioration of profitability; of course, the recovery of the growth rate of Gaming (which has a lower Gross Margin) will also affect the Gross Margin to a greater or lesser extent.

Guidelines for Q1 gross margin is about 130bps lower than market expectations, implying a positive signal of Blackwell product release speed exceeding expectations; at the same time, Jensen means that Q2 and Q1 are similar, and the end of the year will be with TSMC 3nm process yields climbing and supply chain efficiency enhancement and other restoration of Mid-70%, the core improvement in momentum from:

Unit cost decline from fab learning curve effect;

The release of economies of scale after the bottleneck of advanced packaging capacity is eased.

The company's strategic choice strengthens its competitive advantage because during the current window of explosive demand for AI computing power, NVDA adopts the strategy of "prioritizing delivery scale over short-term profitability", which helps to quickly establish Blackwell's ecological dominance in the hyperscale data center market and lays the foundation for subsequent penetration of the enterprise market.Historical data shows that similar strategies in the Hopper architecture product cycle have successfully achieved a stepwise increase in market share and profitability.

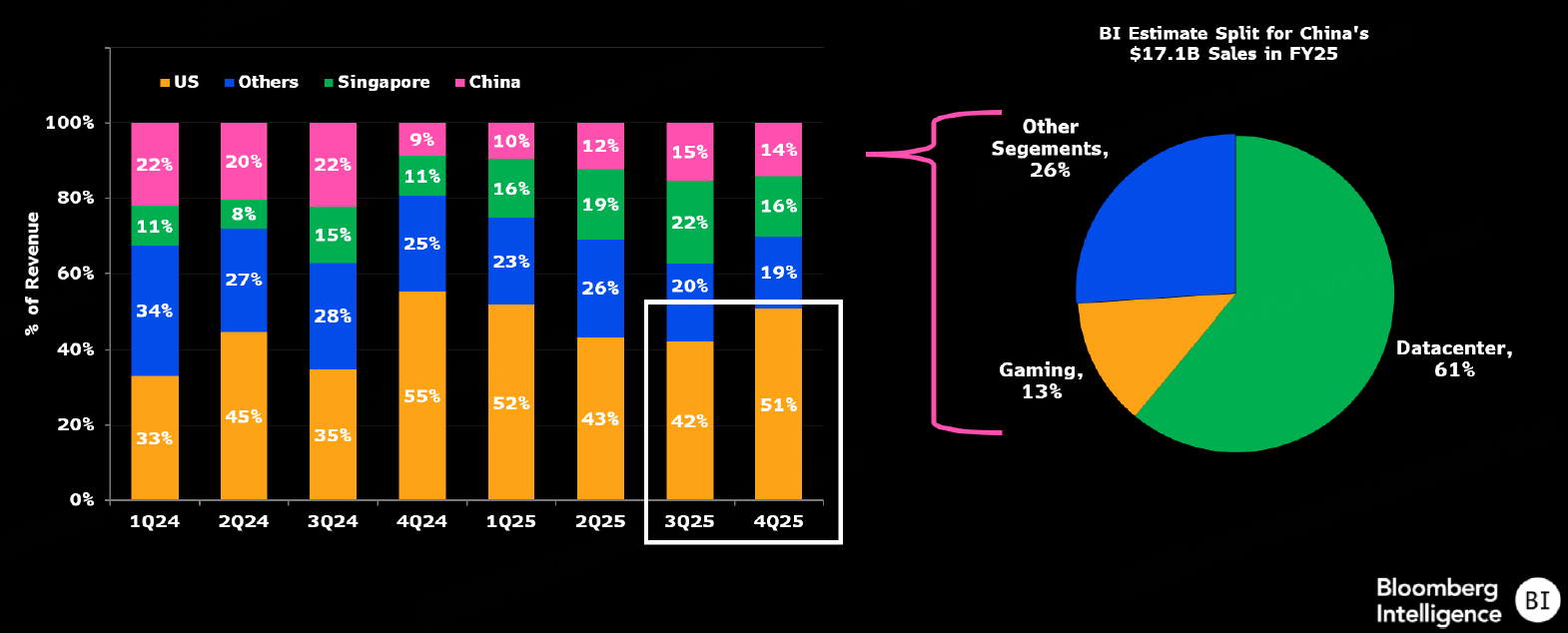

Regional Market Demand Structure Transformation

Demand in China region continues to be suppressed by export control policies, etc., which may even affect Singapore's exports;

U.S. market engine position strengthened, Blackwell accelerated delivery to drive revenue share;

The EU's €200 billion scale InvestAI program accelerates the construction of AI infrastructure in member states to provide strategic support;

The Singapore region's FY2025 revenue contribution was maintained at 2% (down sequentially), but its 18% share of billing addresses reflects changes in supply chain arrangements such as financial settlements, and the substantive business remains focused on serving the pan-Asia-Pacific non-China market;

Key Highlights

Accelerated penetration of hyperscale cloud service providers (contributing 50% of data center revenues), government AI projects and enterprise market;

Impact of 3nm process yield creep speed on the pace of gross margin repair;

Blackwell Ultra architecture route released at GTC conference

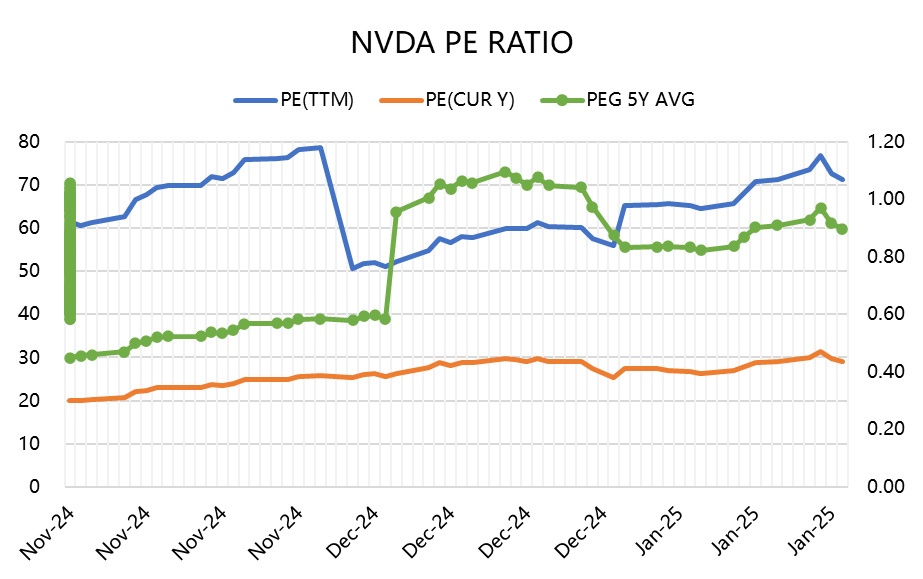

The current NVDA FY2026 Non-GAAP PE of 26x maintains a reasonable premium over the semiconductor industry average of 22x.

Big Tech Options Strategy

Is Tesla testing Election Day?

Big Tech, which has benefited the most from the Trump concept, nearly doubled its high from Election Day, only to be followed by a pullback.It's safe to say that TSLA is the least fundamentally related of Big Tech's stock prices.

This is despite the fact that we have further emphasized the prospects of businesses like energy storage, AI, and robotics when discussing the fundamentals.

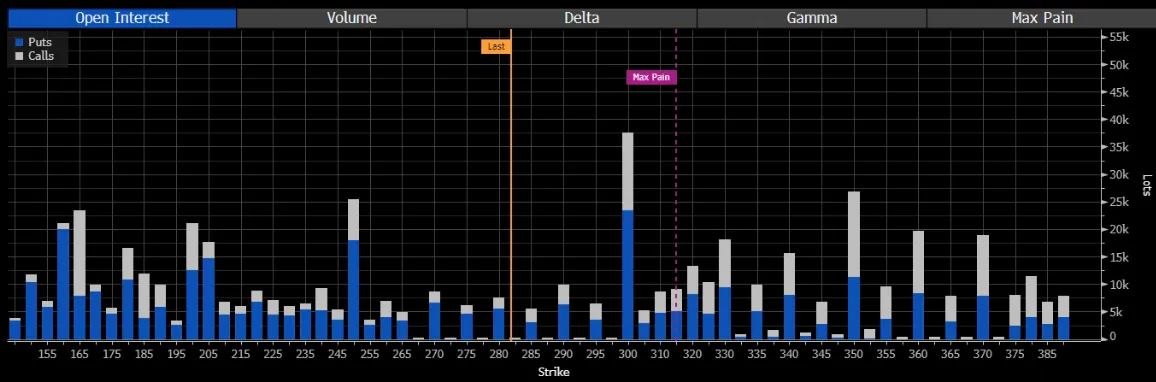

And with the 20+ point pullback this week, TSLA sentiment has retreated further. the risk posed by Elon Musk himself has also been Price-in and hence the current price deviation has been relatively added to.Options are still basically above 310 at Max Pain, while the stock is already at 280 Annex, and further 260 is Election Day support.

With a large PUT order betting on 235 yesterday, implying a significant drop still to come, and with overall PUT profits starting to zoom in recently, when shorts consider closing out their positions could be the focus of whether or not they stabilize next.

Big-Tech Portfolio

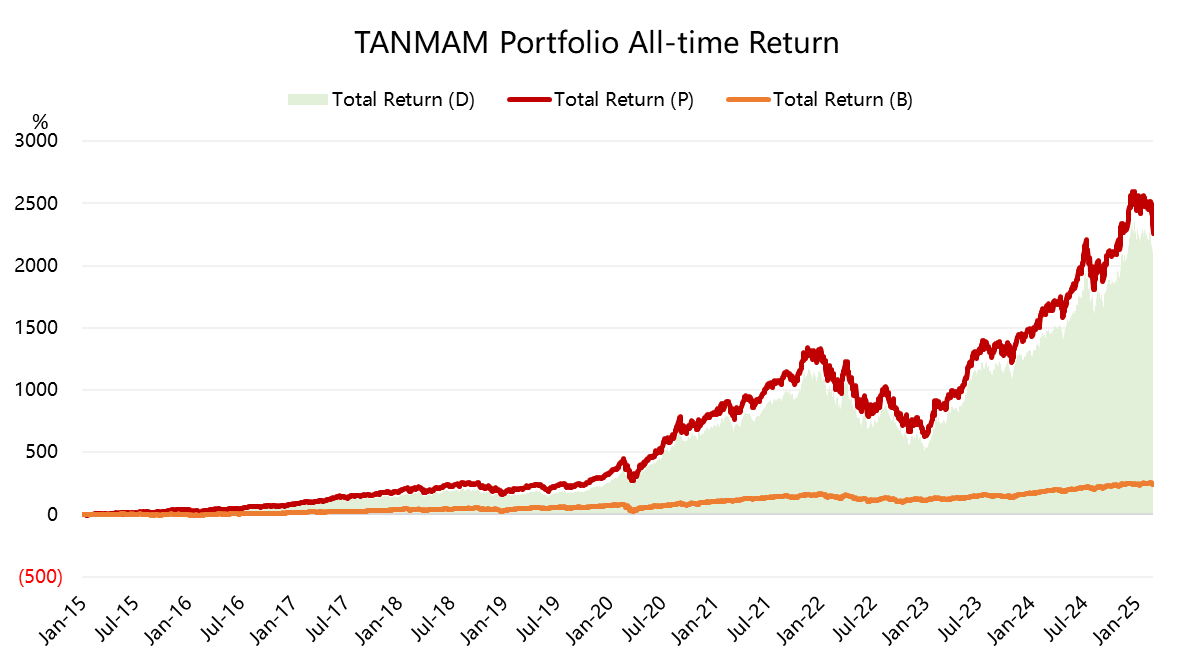

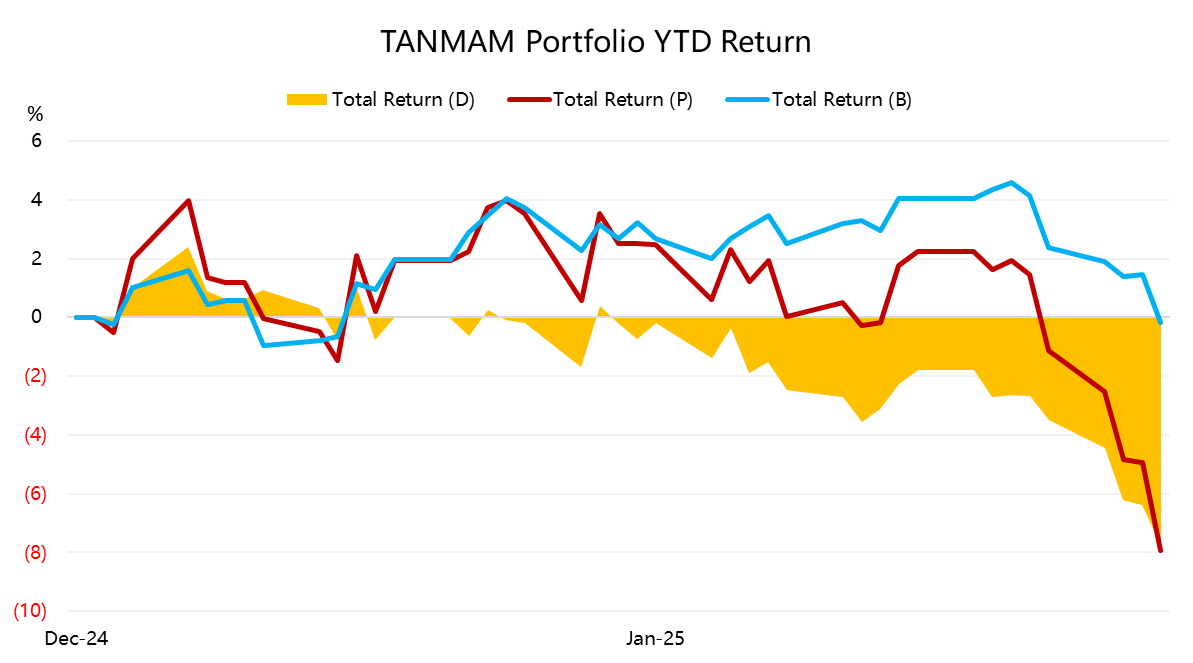

The Magnificent Seven form a portfolio (the "TANMAMG" portfolio) that is equally weighted and reweighted quarterly.The backtest results are far outperforming $S&P 500(.SPX)$ since 2015, with a total return of 2,252%, while $SPDR S&P 500 ETF Trust(SPY)$ has returned 239% over the same time period, for an excess return of 2017%.

Comments