$Sea Ltd(SE)$ reported a 7% overall headwind collection after reporting Q4 earnings, and the market is optimistic about e-commerce performance in the quarter, with SE stock nearly tripling from its lows at the beginning of last year.

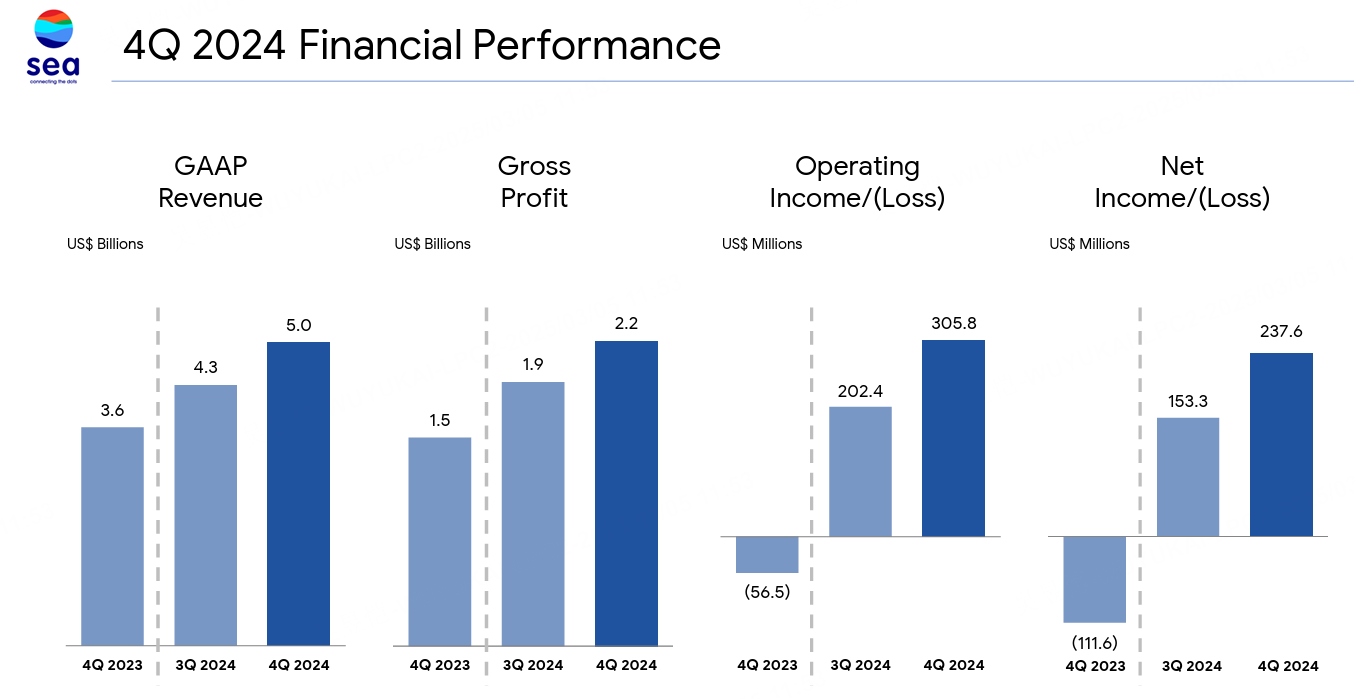

Sea Limited (SE) Q4 2024 revenue reached $5.0B (+36.9% yoy), significantly exceeding market expectations of $4.65B. GAAP net profit was $237.6M vs. a loss of $111.6M a year ago, and for the first time ever a full-year profit of $447.8M was realized (vs. $162.7M in 2023).Segmented business look:

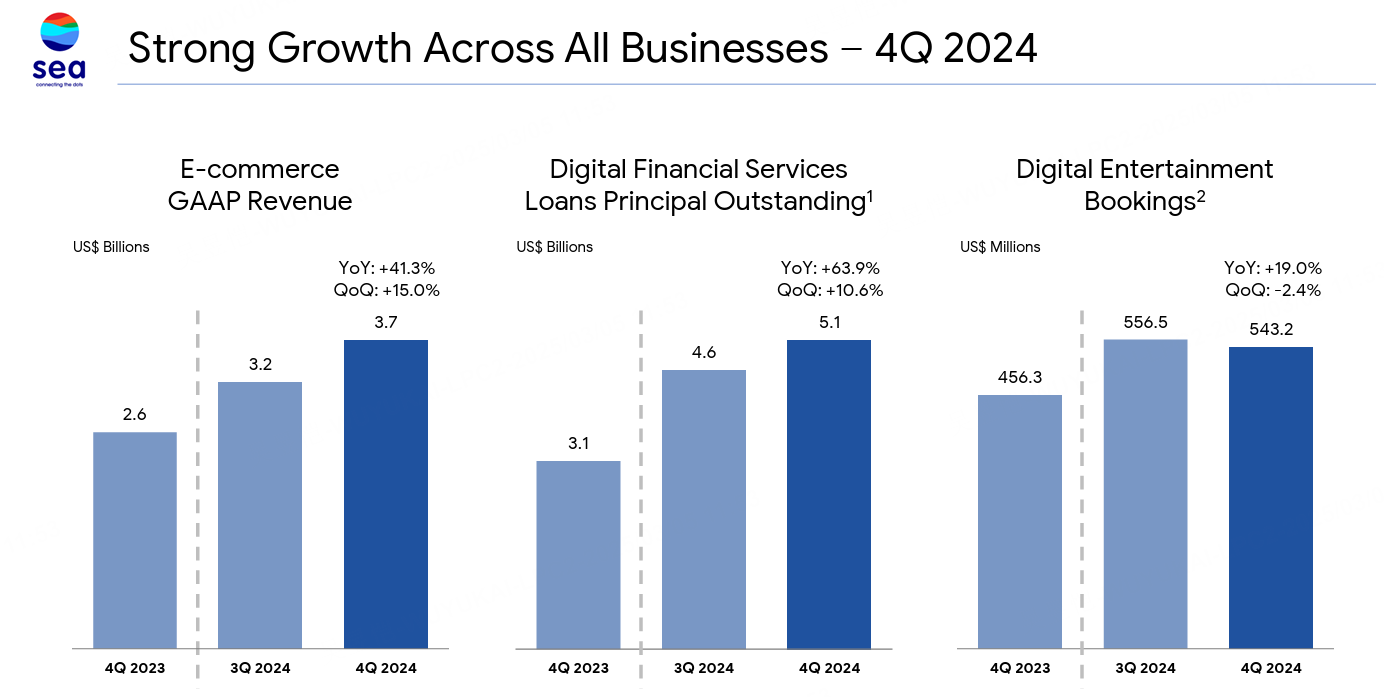

E-commerce (Shopee): GMV exceeded $100B (+28% yoy), focusing on Asia and Brazil markets Adj EBITDA turned positive;

Digital Finance: loan size grew 60% yoy to $50B, but underlying loan growth was slightly lower than expected and expense overruns dragged down profit growth;

Digital Entertainment (Garena): bookings up 34% y/y, but subscriber numbers and per capita payments both declined, weakening eco-activity.

Market reaction: shares surged in pre-market after earnings release, but narrowed to 6.35% after hours due to gaming and financial business concerns. 2024 full-year cumulative share price gained 135.57%, reflecting the market's long-term optimism for e-commerce-led earnings improvement.

Investment highlights

E-commerce: Growth engine continues to gain momentum, but competitive pressures emerge

Shopee's GMV exceeded the $100 billion milestone for the first time. Revenue growth was driven by increased penetration in core markets (Southeast Asia, Brazil), but the room for monetization rate improvement was limited by the regional low-price strategy;

Adjusted EBITDA turned positive mainly due to optimization of fulfillment cost under scale effect, but user acquisition cost (CAC) rose year-on-year, and attention should be paid to the sustained input-output ratio in emerging markets (e.g. Latin America);

Gaming and finance: structural conflicts highlighted

Game business: booking volume growth mainly relies on the realization ability of head IP (e.g. Free Fire), but MAU year-on-year decline reflects the decline in user stickiness, and we need to be vigilant about the risk of new games not being able to catch up;

Financial business: although the expansion of loan scale is fast, the rising cost of funds has led to the narrowing of net interest margin (the financial report did not disclose the specific data), coupled with the over-expectation of wind control costs, short-term profit pressure.

Earnings guidance and analysts' concerns

Management emphasized in the call that it will prioritize securing e-commerce market share, and capex in 2025 is expected to be tilted toward logistics and AI technology, which may lead to short-term margin volatility.

Analysts questioned the long-term growth momentum of the game business, and the company responded that it will increase cross-platform intermodal transportation and IP derivative development, but did not give specific user growth targets.

Risks: Inflation in emerging markets may depress consumer demand; accelerated loss of game users may lead to slower growth in bookings in 2025.

Comments