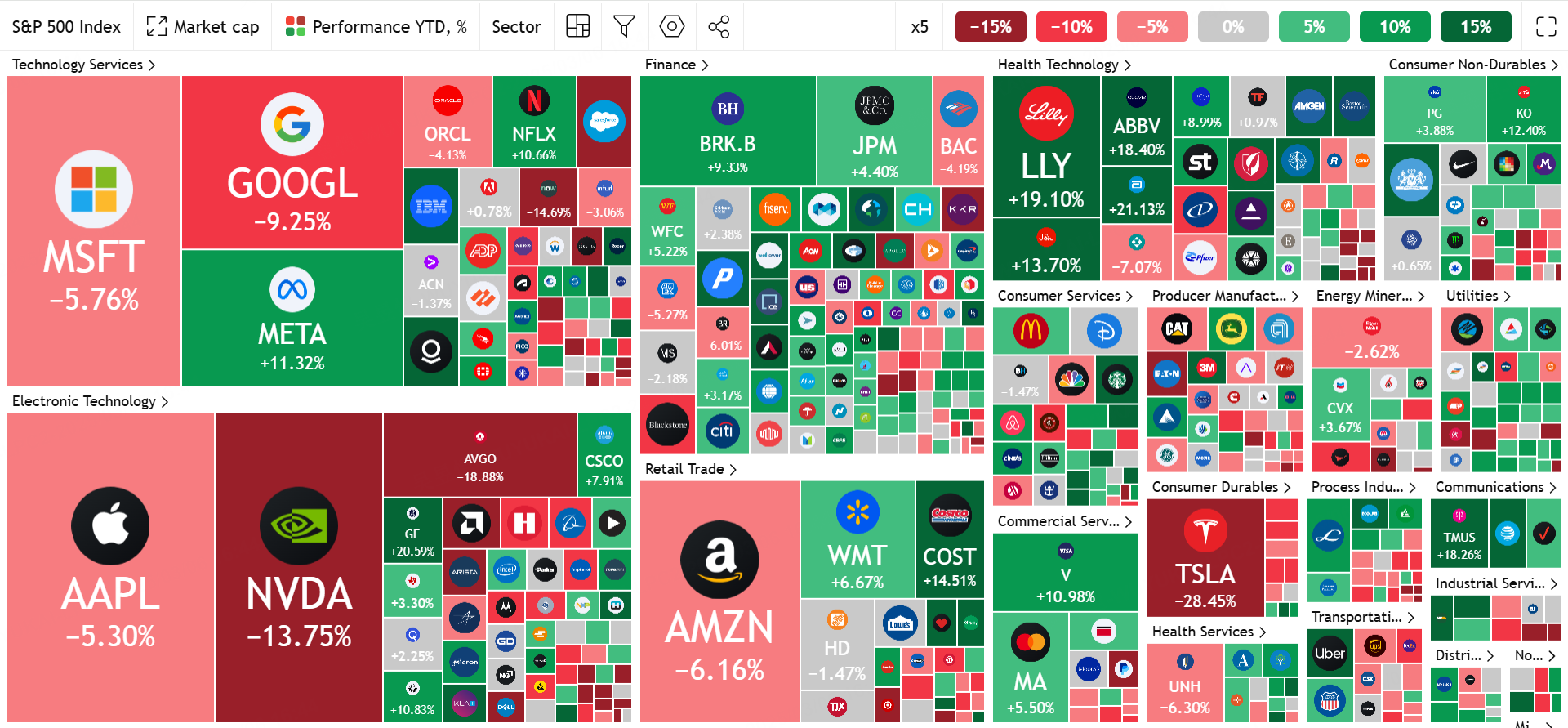

Previously, when the big banks predicted the U.S. stock market in 2025, they used the words "shock" and "volatility".From the performance since the beginning of the year, the "defense" posture is a very obvious feature, for example: from the sector point of view, $S&P 500(.SPX)$ index of the sector dynamics of the change, it is notable from the previous dominant technology stocks to the shift of financials, health care and materials sectors.Materials sectors.

Policy dividend-driven financial sector, earnings repair healthcare and materials sectors have become the new focus in 2025, while technology stocks are temporarily weak due to valuation pressure.

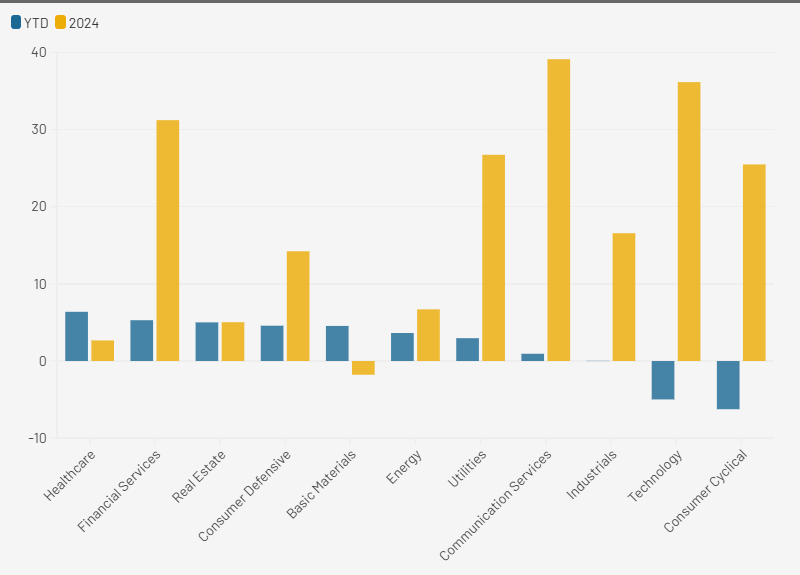

Sector Rotation Status

The Information Technology (+36%) and Communication Services (+39%) sectors, which led the way in 2024 , weakened in early 2025, becoming the main drag on returns in the U.S. market indexes.

"Sentiment and price divergence" correlates with waning investor confidence in highly valued technology stocks.

The Information Technology sector's Forward PE of 26.7x is significantly higher than its historical average, and it will need to rely on future earnings growth to absorb valuations.

The financials sector continues to "outperform", benefiting from the interest rate and policy tailwinds under the new administration, in addition to the expected rate cuts that will create a looser monetary environment.

The Healthcare sector is essentially flat in 2024 (+1%), but has topped 2025 year-to-date performance (+8.8%), driven by investor expectations to the upside on the back of policy shifts, technology adoption (AI), and evolving consumer demand.

The Materials sector, unlike Healthcare, underperformed in 2024 and returned 4.55% in 2025, a "turnaround".

The Consumer Goods sector is beginning to diverge:

Non-essential consumer goods, despite their stellar returns in 2024 (+29%), have waned over 25 years (-5.8%) due to valuation concerns and weaker future earnings

Essential consumer goods, on the other hand, have acted as a hedge to some extent, with a year-to-date performance of +4.8%, but inflationary pickup concerns, rising unemployment, and recessionary expectations may to some extent also put pressure on companies to consumers

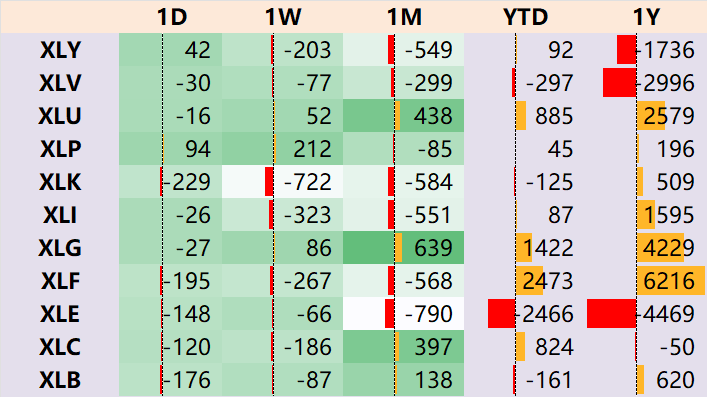

Capital Flow Characteristics

1. Rotation towards value and cyclical stocks

Funds are shifting from highly valued technology stocks to lower valued sectors such as financials, materials and healthcare.Goldman Sachs expects the market to spread "beyond the Big Seven tech giants" to broader sectors.

For example, the EPS beat ratio for the information technology sector fell from 89% in the third quarter of 2023 to 87% in the fourth quarter of 2024, signaling a weakening of earnings surprises.

2. Policy-driven capital flows

Tax cuts and fiscal stimulus have attracted flows into the financial and industrial sectors, while potential tariff policies could further favor domestic manufacturing.

The S&P 500 Industrials are expected to grow earnings by 15.28% in 2025, which is higher than the long-term average.

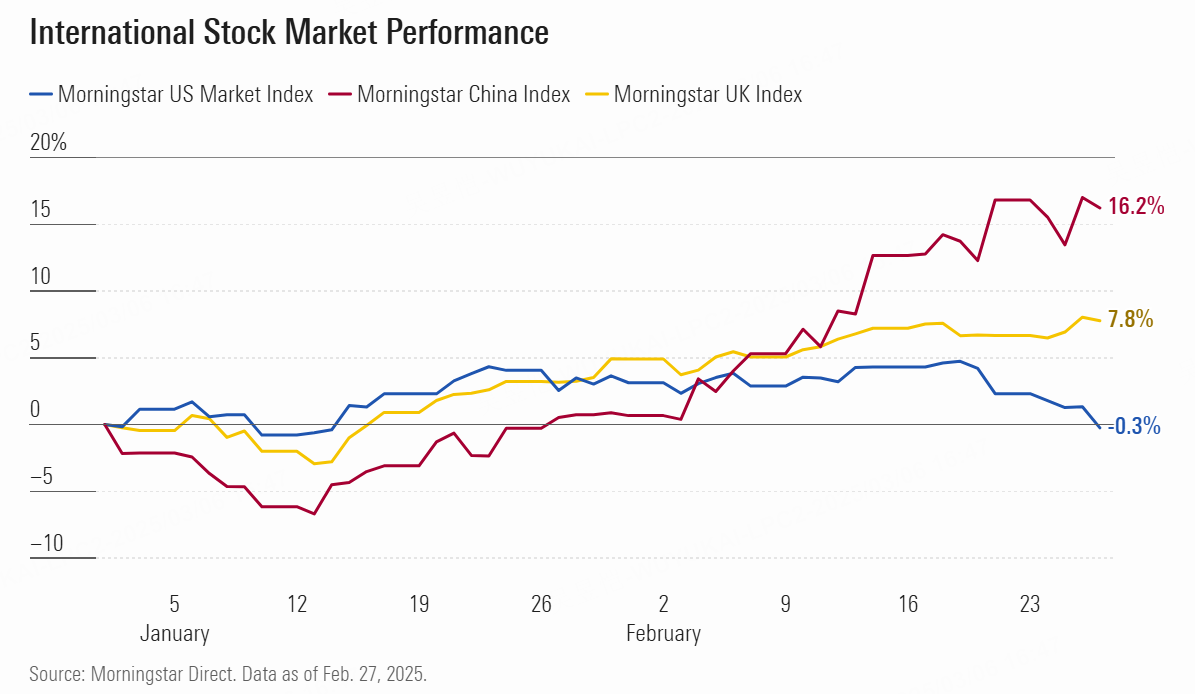

3. Internationally Diversified Allocation

Regional performance has also varied, and while there may have been a delay in the tracking of funds, it is clear that there has been a significant difference compared to the "congestion" of tech stocks and US dollar trading at the end of last year.

Investors have shifted to lower valued non-US markets (e.g. UK, Germany) to avoid the risk of high valuations in US stocks.This is consistent with warnings that the S&P 500 Shiller P/E ratio (inflation-adjusted) is at historically high levels (behind 2001 and 2021).

Rotation Strategy and Allocation Recommendations

The market is currently split on the sustainability of rotation:

Those who think there is no continuity

Only 18% of S&P 500 components are at record highs

Historically, market rotation after Covid-19 has been very fast-paced, with August 2023 rotation lasting only 4-6 weeks

AI investment boom has not subsided and will continue to return to tech stocks

Think there is continuity

Mag7 "concentration risk" already exists, while the earnings gap between S&P ex-Mag7 companies and Mag7 will narrow;

Tightening premium on defenses: Consumer Staples sector PE down to 21x from 24x.

Current areas of opportunity:

Overseas layouts, including China equities (P/E 10.2x vs. 20.3x for US equities), FTSE 100 (dividend yield 3.8%), European defense stocks (order backlog +17% y/y), and others

Sector cyclical layouts: financials (net interest margin widened to 3.05%), industrials (PMI >50 for 5th consecutive month)

Defensive sectors: healthcare/utilities and other defensive sectors

Risks and Outlook

High Valuation Sensitivity

- The S&P 500's current forward P/E of 21.7x is in the 93rd percentile historically and is highly sensitive to rising interest rates or weaker earnings expectations.

- A sustained weakness in market sentiment indicators (e.g., declining market breadth or momentum) could trigger a sharper correction.

Earnings Growth Dependence

- Analysts expect S&P 500 earnings to grow 11% in 2025, with financials and industrials needing to deliver on high expectations to support shares.

- The risk point is that tech earnings could be falsified if AI technology fails to drive productivity jumps as expected.

Policy and economic resilience

The Fed rate-cutting cycle and a "soft landing" for the economy remain key assumptions, and market optimism could be reversed if inflation rebounds or geopolitical conflicts escalate.

Comments