$Adobe(ADBE)$ outperformed in Q1 of FY2025, but guidance was weaker and AI product monetization capabilities will have a validation window after Summit.

Performance and Market Feedback

Key financial indicators exceeded expectations across the board

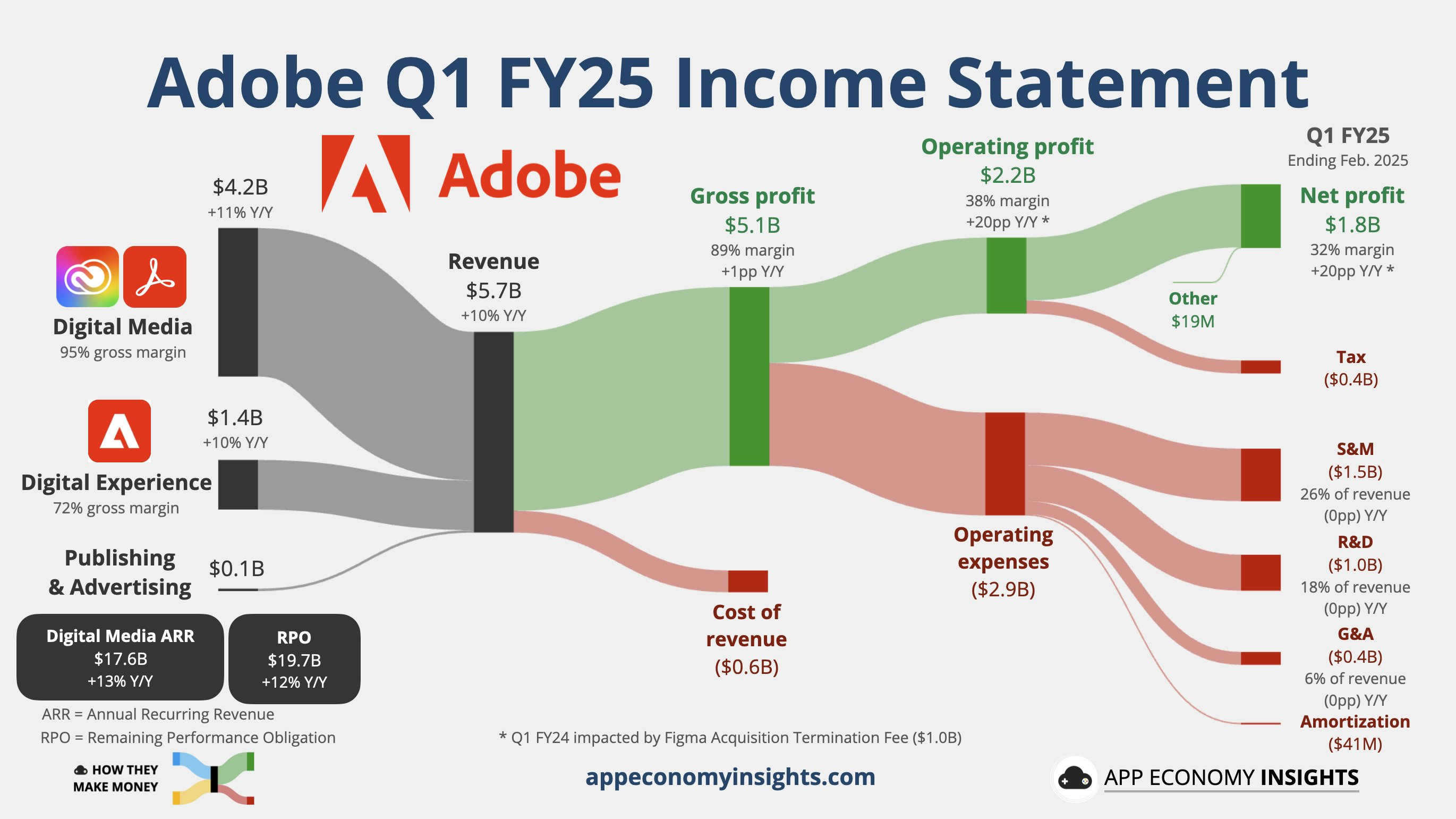

Operating Income: $5.71B (+11%YoY), beating market expectation of $5.66B; Adjusted EPS: $5.08 (+13%YoY), higher than expectation of $4.97

Operating cash flow: $2.48B (+18%YoY), supporting 7M share repurchase

Remaining Performance Obligations (RPO): $19.69B

Solid growth in core businesses

Digital Media Revenue: +11% YoY, with Creative Cloud subscription growth accelerating

Digital Experience Revenue: +10% YoY, with increased penetration of enterprise-side AI solutions

Market reaction and valuation game

Shares fell 4% after hours following the earnings release and are still down 14% year-to-date.Current PE 35.5x vs. 5-year average of 42x, reflecting the market's concern about the pace of AI commercialization.The current valuation has partially reflected the short-term pressure, but the ability to monetize AI products will usher in the validation window after Summit.

Weaker-than-expected earnings guidance

Reiterated FY2025 revenue of $23.3B-$23.55B (median +9.6% yoy), implied H2 growth rate needs to reach 10.2%, but still lower than market expectations of $23.5B

Q2 guidance for revenue $5.77B-$5.82B (+9.8% yoy), below market expectation of $5.8B

Full year adjusted EPS guidance of $20.20-$20.50, above industry average forecast of $20.40.

Investment Highlights

AI product matrix enters the value release period

Creative Cloud's integration of Firefly AI tools resulted in more than 300 million daily user-generated content; Experience Cloud launched real-time customer profiling, increasing customer retention by 5 percentage points.

Management emphasized that the Firefly series of products are still in the user acquisition stage, and the credit depletion mechanism has not been fully launched yet. david Wadhwani pointed out that "at present, we are still focusing on expanding the user base as the core objective, and will gradually roll out the tiered subscription model in the future"

AI assistant in Acrobat has reached over 50% of enterprise customers, but consumer penetration is still below expectations

Management clarifies GenAI commercialization roadmap to be disclosed at March 18 investor conference

Creative Cloud Growth Sustainability (Kash Rangan, Goldman Sachs)

Creative Cloud ARR reached $15.76B (+14% yoy), with single-app subscription share improving to 35%.Enterprise contributed over 20% ARR growth, with 25% growth in emerging markets.

Newly launched Firefly web subscription ($4.99/month) garnered 500K subscribers in Q1 and management expects ARR contribution to top $250M by end of 2025

Pricing power dynamically balanced with subscriber growth

ARPU increased by $4.5/month after 8% price increase for flagship product suite, but new subscriber growth slowed to 6

SMB segment share rose to 32%, partially offsetting the impact of budget contraction in large enterprises

Cash flow strategy supports shareholder returns

Full year share repurchase increased to $6B, corresponding to a 3.2% dividend yield

Balance Sheet Optimization: Net Cash Position of $4.2B, Sufficient M&A Ammunition

Risk Concerns

⚠️ Lagging AI realization: average daily credit consumption by Firefly users was only 0.8 times, significantly lower than the expected 1.5 times

⚠️ Competitive pricing pressure: Adobe Express price-sensitive user churn up 2% YoY after Canva launches AI design tool

⚠️ REGULATORY UN CERTAINTY: EU AI Bill Could Lead to 15-20% Increase in Firefly Training Data Costs

Comments