Performance and Market Feedback

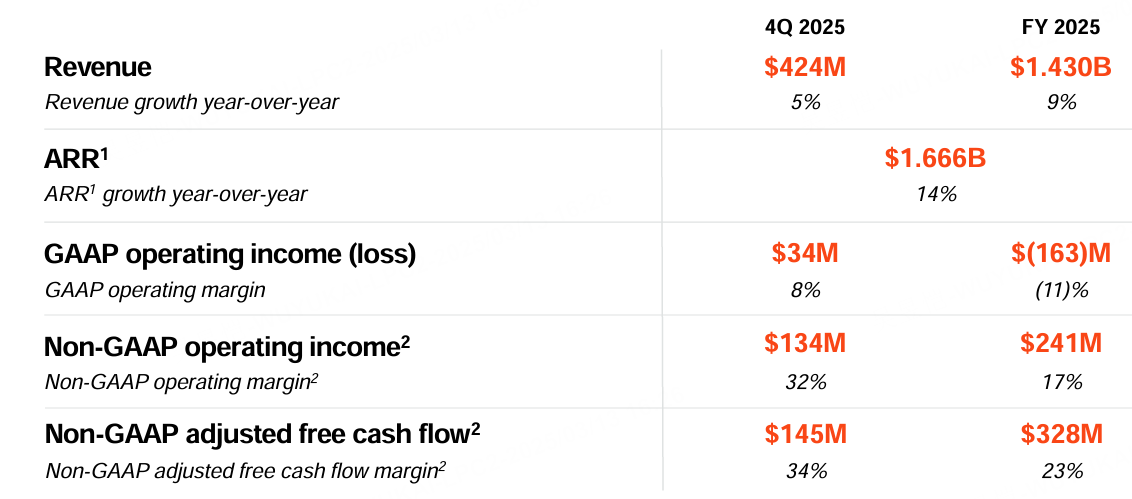

$UiPath(PATH)$ financial performance for the fourth quarter of FY2025 is as follows:

Revenue: Revenue for the fourth quarter was $424M, up 5% year-over-year.Adjusting for the impact of foreign exchange, revenue was $426M

ARR: Annual Recurring Revenue (ARR) of $166.6B for the year ending January 31, 2025, up 14% year-over-year

Net New ARR: Q4 Net New ARR of $60M

Net Retention Rate: 110 percent

GAAP Gross Profit Margin: 85%; Non-GAAP Gross Profit Margin: 87

GAAP operating income: $34 million; non-GAAP operating income: $134 million

Earnings per share (EPS): $0.26, beating expectations of $0.20

Despite the EPS beat, UiPath's shares plunged 15.89% in after-hours trading, likely due to broader market uncertainty as well as specific issues mentioned during the earnings call

Investment highlights

Revenue growth: UiPath's revenue growth was relatively stable but slightly below expectations.The company's cloud services ARR grew by more than 50%, demonstrating the effectiveness of its strategy in cloud and AI solutions

ARR Growth: 14% YoY growth in ARR shows the company's progress in customer retention and new customer acquisition.

Product Innovation: UiPath launched several new products such as Agent Builder and Agentic Orchestration, underscoring the importance of agent automation in business process optimization

Strategic acquisitions: The acquisition of Peak AI has helped strengthen the company's specialization in verticals, particularly in pricing and inventory management

Market Outlook: While the company beat EPS estimates, the decline in the stock price reflects concerns about its future growth, especially in the context of macroeconomic uncertainty.

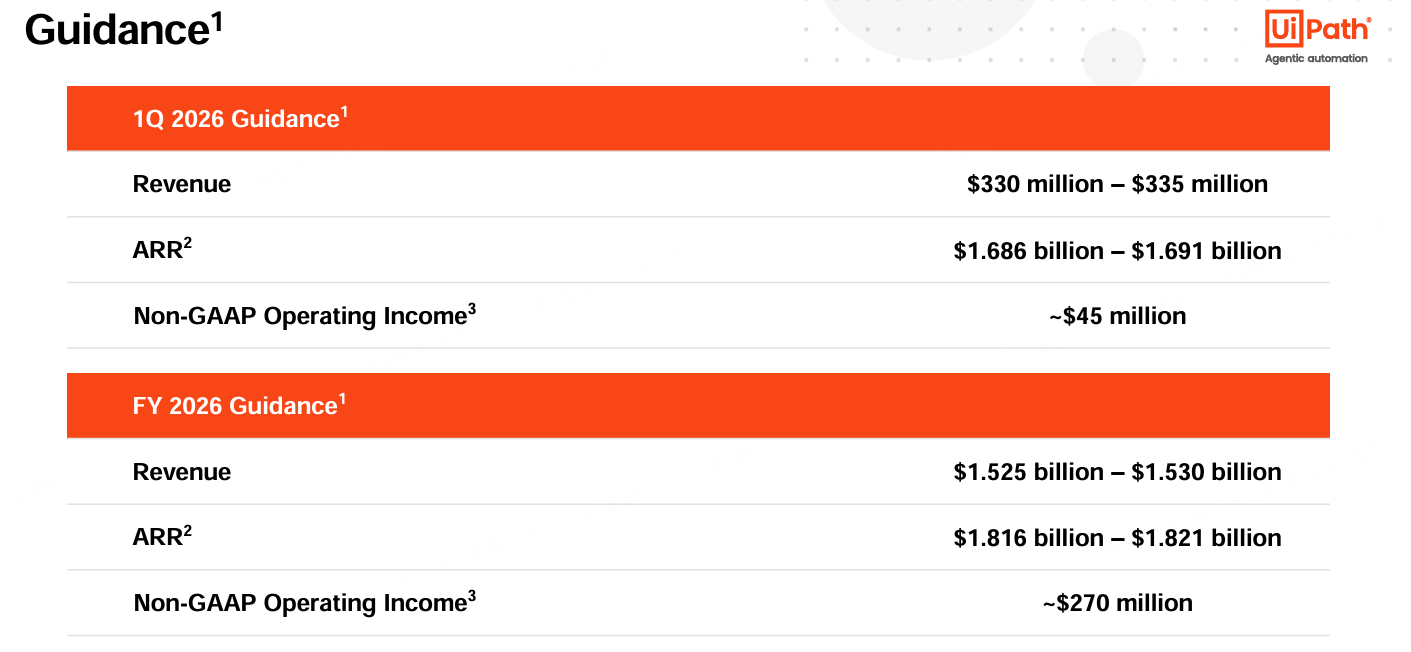

Financial Guidance: UiPath expects Q1 2026 revenues to be in the range of $330 million to $335 million, with ARR in the range of $168.6 billion to $169.1 billion.4 Non-GAAP operating income is expected to be approximately $45 million.

Comments

now it is trading under $10 after this earing report, but the balance sheet is much improved.