The "reversal" of Chinese assets has been the main trading theme of the recent past.This week's earnings reports from bit techs like $XIAOMI-W(01810)$ $TENCENT(00700)$ $PDD Holdings Inc(PDD)$ $MEITUAN-W(03690)$ Earnings reports from such giants, if they perform well, could further fuel this wave.

In a bull market, high beta (Beta >1) stocks tend to be the center of market attention due to their high volatility.The advantages are

High potential for excess returns: more sensitive to market fluctuations, and their gains are usually significantly higher than the broader market in bull markets;

Offensive tool in industry rotation: high beta industries (e.g. securities, technology) often lead the market;

Leverage effect: investors in a bull market with a clear trend can realize the "small to big" through high beta stocks;

Suitable for trend-following or momentum strategy: it can quickly capture market hotspots, especially the high beta characteristics of Chinese stocks, which are often used for short-term trading or portfolio enhancement.

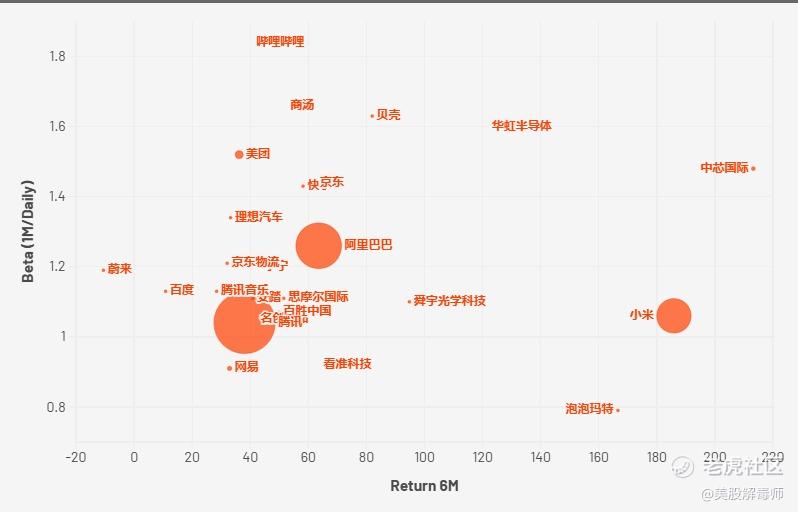

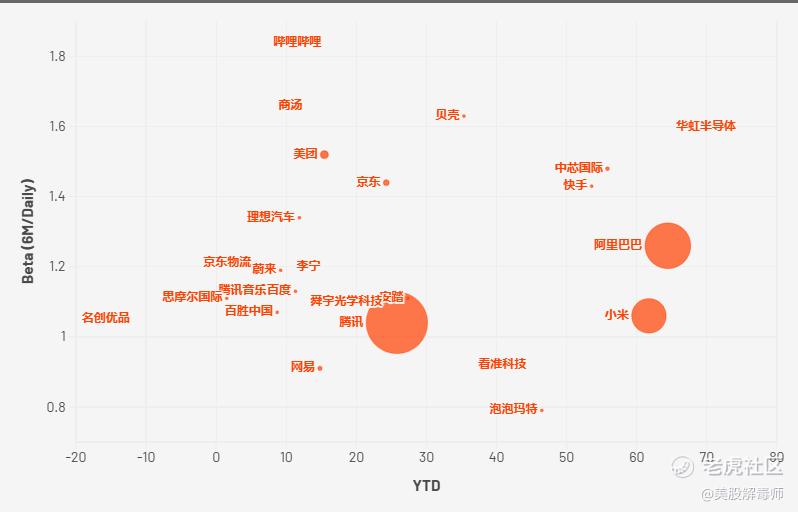

Beta in Hong Kong stocks (6 months, daily data) and returns show significant divergence characteristics, reflecting the risk-return performance of different industries and company traits in a bullish environment.

Tencent standard

Looking at the 6-month dimension, Tencent's 6-month beta is 1.04 (almost equal to the broader market), and many companies can outperform Tencent.

Companies with high Beta and high return (high resilience): $BABA-W(09988)$ $SMIC(00981)$ $KUAISHOU-W(01024)$ $BEKE-W(02423)$

Low beta high return company (stable and surprise): $XIAOMI-W(01810)$ $POP MART(09992)$

Companies with low beta and low return (stable): $BIDU-SW(09888)$ $NTES-S(09999)$

From valuation (Forward PE NTM) perspective, companies with higher gains have also overdrawn some of their future performance.

From a 1-month dimension, Tencent's beta for the past 1 month is 1.32 (outperforming the Hang Seng Index)

High Beta High Return companies (high resilience): Alibaba, Crypto, Shell, $HUA HONG SEMI(01347)$

Low beta high return companies (stable): $LI NING(02331)$ $ANTA SPORTS(02020)$ $Kanzhun Limited(BZ)$ $POP MART(09992)$

Companies with similar performance to Tencent but high beta (controversial): $BILIBILI-W(09626)$ Meituan, Jingdong;

Companies with high beta and low returns (tasteless): $SENSETIME-W(00020)$ $JD LOGISTICS(02618)$ $TME-SW(01698)$

Overall, the best holding experience is for shareholders of Xiaomi and Bubble Mart, with little volatility while enjoying high returns.

Of course, different high beta companies may also appear some differences depending on the industry, company behavior and so on.And these are historical data, the bull market in Chinese stocks is needed for different sectors to pick up the slack, and the consumer sector certainly can't be absent, so companies like Anta will see opportunities next.

In addition, and tencent return performance is similar, but beta higher companies, indicating that investors have a greater division, which performance basis of better companies may usher in the "complementary rise" opportunity.

The following are "high resilience, high return" companies in Hong Kong that have a beta greater than Tencent's over the past 6 months, and whose total returns over the past 6 months and since the beginning of the year (YTD) have exceeded Tencent's total returns:

Comments