In the past few weeks, the U.S. stock market suffered a wave of large-scale adjustment, as if the storm hit investors' nerves.However, Bank of America is signaling that the "sell" has lifted. $NASDAQ(.IXIC)$ $NASDAQ 100(NDX)$ $S&P 500(.SPX)$ was not immune.

Nasdaq index has not been spared, fell 14%, once the scenery is infinite technology stocks "Magnificent Seven" is plunged 20%, the global stock index average decline of 5%, a bleak scene is alarming.

Bank of America chief strategist Michael Hartnett's latest point of view has been but unexpected: This round of decline is only an adjustment, not a bear market, and "sell" signal has ended, no longer recommended to continue to short U.S. stocks.

Bottom Signals Emerging

The market just experienced the largest week of global/US equity fund inflows in 2025;

U.S. bank private clients bought a large amount of equities over a two-week period;

For every $100 that has flowed into U.S. equity funds since the U.S. election, less than $1 has flowed out in recent weeks;

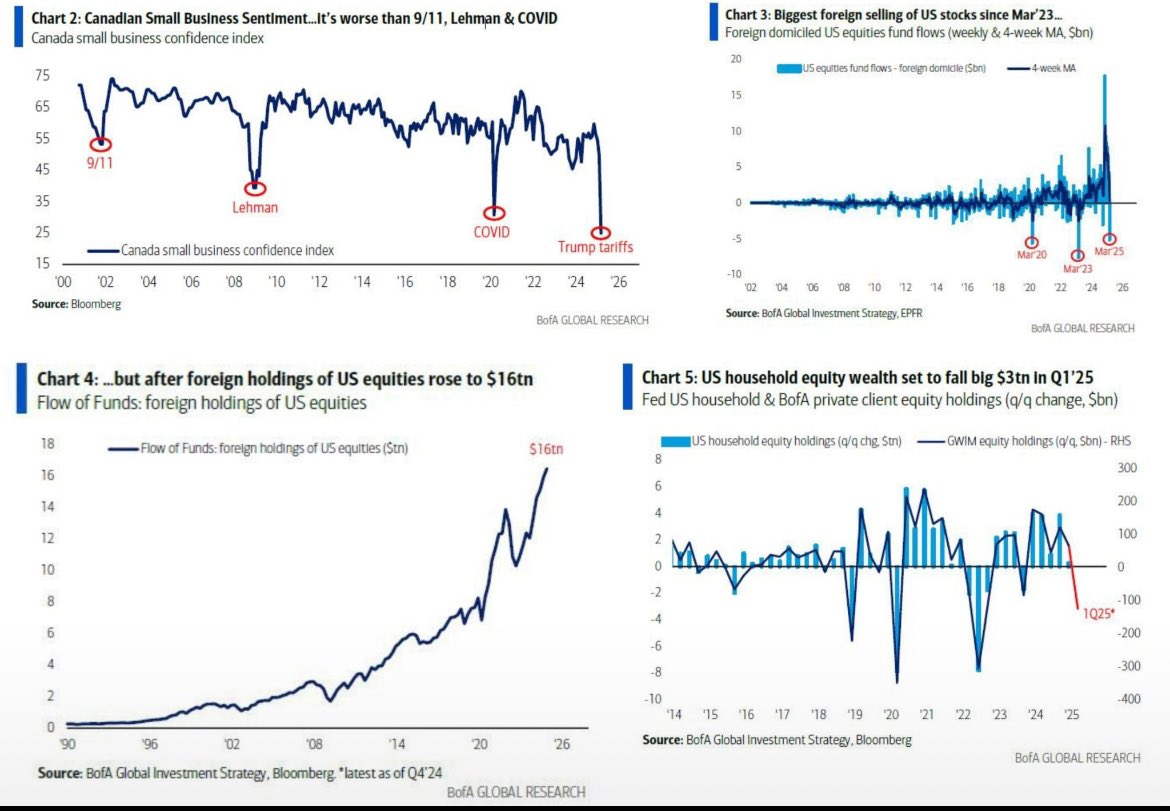

Foreign capital is flowing out, but after accumulating $16 trillion in U.S. equity positions.

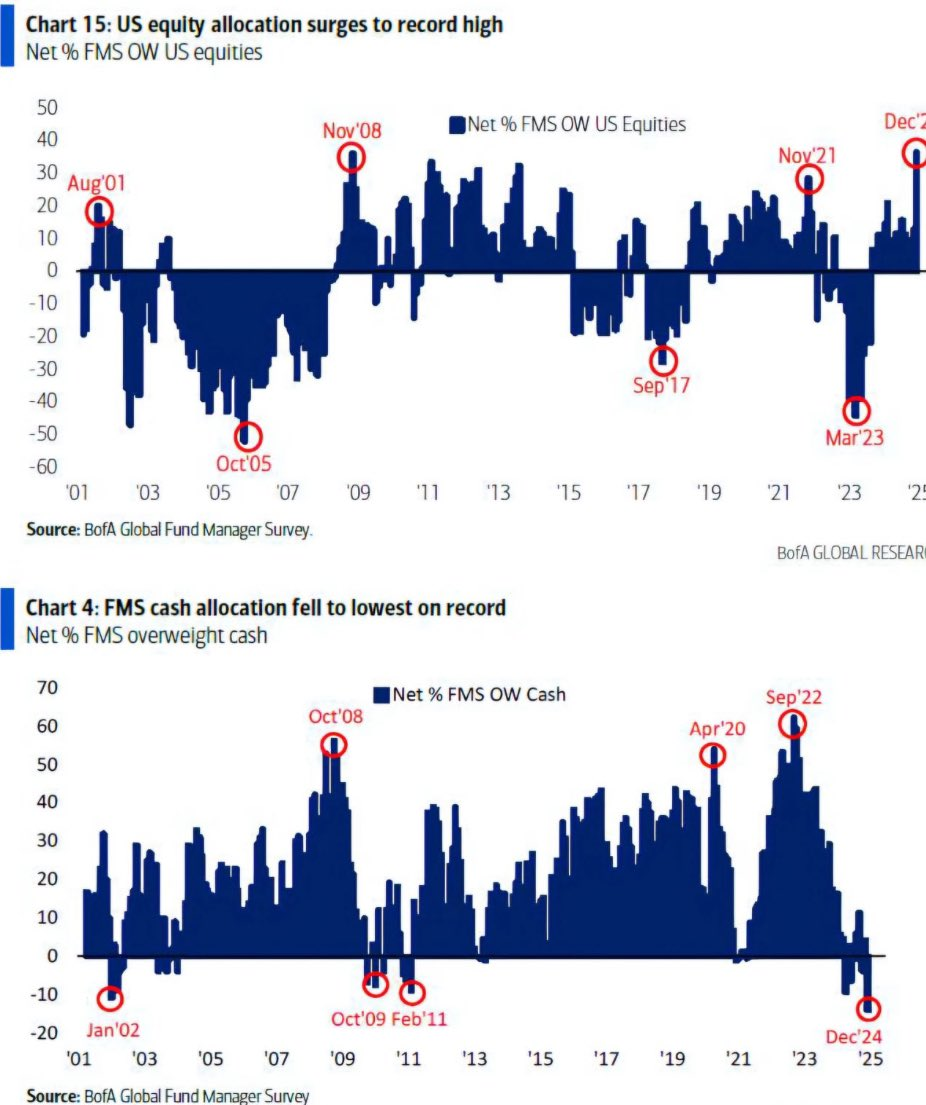

Cash levels jumped from 3.5% to 4.1%, the biggest one-month increase since March 2020, according to the latest fund manager survey.This change means that the "sell" signal triggered on December 17th last year has ended.

However, it should be noted that his sell signal from December 17th, was also delayed until at least the DeepSeek crisis in January of this year, when the market actually released the risk.

But the bottom signal is not yet fully in place

It is worth noting that the Fed announced the latest interest rate resolution after the market reaction was clearly divided:

2-year U.S. bond yields behaved like the Fed's stance is "dovish", the

The dollar index is like the Fed stance "hawkish".

This asset price divergence puts risky investors on the sidelines.When cash levels are above 4%, high-yield bond spreads are near 400 basis points, and equity outflows are accelerating, enter the bottom at 5300 on the S&P 500.

U.S. consumer pain is just beginning

Despite the lifting of the "sell" signal, the outlook for the US consumer is pessimistic.The main reason for this is the end of the COVID-19 period and the depletion of excess savings, which is starting to put pressure on households.

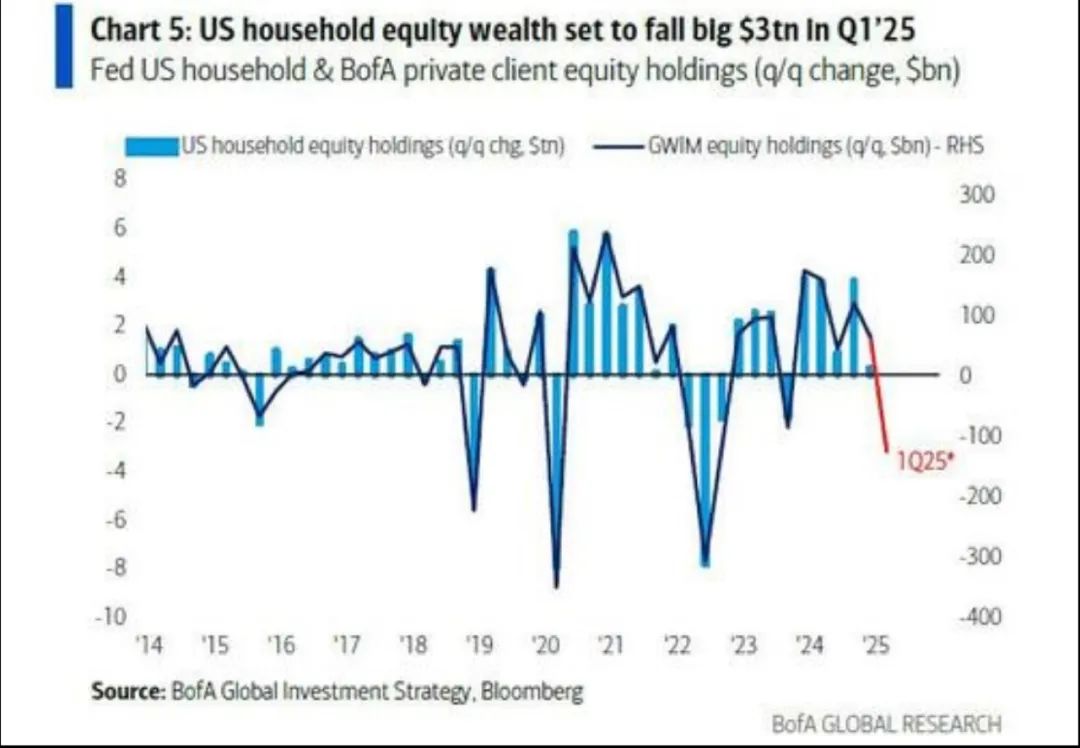

U.S. households' equity wealth, which had soared to $56 trillion, will likely decline by $3 trillion by Q1 2025.

And with no clear dovishness in fiscal, monetary and trade policies, the US Treasury yield curve could invert again, further exacerbating pressure on consumers.

April 2 tariff deadline, or "panic day"?

In addition to the pressure on consumers, the April 2 "tariff deadline" will begin to have an impact on global data.Once the U.S. formally implements higher tariffs, global supply chains and trade patterns will face significant uncertainty.

Over the past five years, U.S. nominal GDP has soared 50% thanks to a 65% increase in U.S. government spending, which has triggered much Main Street/Wall Street inflation and led to a collapse in U.S. Treasuries.

Over the next five years, China, Japan and Europe will experience fiscal inflationary excesses, but this will be offset by fiscal deflation in the U.S. That's why it's important to go long the BIG: Bonds (U.S. Treasuries), International Stocks, and Gold (U.S. Dollar Bear Market). $iShares 20+ Year Treasury Bond ETF(TLT)$ $SPDR Gold Shares(GLD)$ $Global X Dax Germany ETF(DAX)$ $KraneShares CSI China Internet ETF(KWEB)$

Optimism among Canadian small businesses has fallen to an all-time low as U.S. tariffs are expected to jump from 2-3% to over 10%.

Bonds and gold are more defensive than U.S. and international equities in the face of impending tariff risk and are relatively less vulnerable to tariff policy.

Comments