$POP MART(09992)$ announced its full-year results for FY24 at noon on March 26, demonstrating "both internal and external cultivation" to be the best among Chinese companies. 2024 has verified the triple logic of "globalization expansion + IP iteration + operational leverage".Overall, 2024 verified the triple logic of "globalization expansion + IP iteration + operation leverage", and the performance exceeded expectations:

Overseas outbreak: localized operation ability breaks through the regional ceiling, overseas cultural output opens the second growth curve, and domestic refined operation is a hedge against weak consumption.

IP vitality: new and old IP synergize, product structure upgrades to high gross profit, scale effect releases profit elasticity.

Next point of concern:

Can overseas growth sustain 50%+ in 2025

Slope of MEGA/plush share improvement

Paradise Earnings Model Validation.

Current Valuation

PE (Forward) 2024 is 51.34x, down from 89x, still reflecting high growth expectations.

The PE (Forward) for 2025 is 37.9x.

The current valuation reflects the market's recognition of its long-term growth, but we need to pay attention to the pace of overseas expansion and the progress of cultivating new categories.

Performance and Market Feedback

Core Data

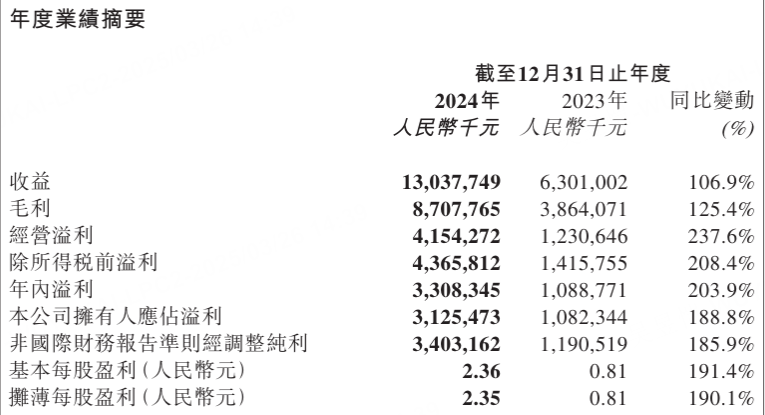

Revenue: CNY13.04bn (+107% yoy), ahead of market expectations (ref. market expectation of ~+80%), Q4 single-quarter revenue growth expected to be over 120% yoy.

Profit:

Gross profit of 8.68bn (+125% yoy), record gross margin of 66.8% (vs 61.3% in 2023);

Operating profit of 4.15bn (+238% yoy), operating margin of 31.9% (+13.4pct yoy);

Net profit of 3.31bn (+204% yoy), net margin of 25.4% (+8.9pct yoy).

Sub-region:

Overseas revenue of 5.07bn (+375% yoy), 39% share (17% in 2023);

Mainland China revenue of $7.97bn (+52% yoy), of which $4.53bn (+41% yoy) was generated from offline stores and $0.60bn (+112% yoy) from the Shake Shack platform.

IP & Category:

THE MONSTERS revenue of $3.04bn (+727% yoy), surpassing MOLLY to become the No. 1 IP;

Plush toys revenue of 2.83bn (21.7% yoy), MEGA series revenue of 1.68bn (12.9% yoy);

Membership of 46.08 million (+34% year-on-year), repurchase rate of 49.4%.

Investment Highlights

Overseas surge: volume and price, localization strategy is effective

Data validation: Overseas revenue accounted for nearly 40% (17% in 2023), with Southeast Asia (revenue of 2.40 billion, +619%) and North America (720 million, +557%) as the core incremental growth, and the first European store in the Louvre in Paris.

Core logic:

Channel expansion: 130 overseas stores (+50 yoy), 192 robot stores (+73 yoy);

Localized operation: scenario-based marketing such as Labubu theme store in Thailand and Gulabu store in Vietnam pulled single-store efficiency;

Online explosion: TikTok platform revenue of 260 million (+5779%), Shopee 320 million (+656%).

Risk tips: geopolitics, exchange rate fluctuation, overseas supply chain management.

IP structure optimization: THE MONSTERS takes over, plush + MEGA opens the second curve

IP iteration: new IPs such as THE MONSTERS (3.04bn) and CRYBABY (1.16bn, +1537%) explode, MOLLY (2.09bn, +105%) stays resilient, and IP concentration decreases (49% of revenue share of TOP3 IPs vs. 53% in 2023).

Category upgrade:

Gross margin of plush toys exceeds 70% (speculative), replacing blind boxes as profit engine;

High-end MEGA series (unit price of 1,000-4,000 RMB) contributes to high premium, GRAND series incorporates traditional cultural craftsmanship.

Sustainability: PDC original studio incubates new IPs such as HIRONO ($730m, +107%) and Nyota, with sufficient reserves.

Release of operating leverage: new high gross margins, declining expense ratios

Gross margin improvement: 66.8% (+5.5 pct yoy), mainly due to the increase in the proportion of overseas high-margin business (71.3% gross margin) and product mix optimization.

Expense control:

Selling expense ratio 28.0% (-3.7 pct yoy), administrative expense ratio 7.3% (-2.1 pct yoy);

People efficiency improvement: revenue generation per capita of 1.94m (1.43m in 2023), employee headcount increased to 6,702 (+34% yoy).

Cash flow: net operating cash flow undisclosed, but cash and equivalents of 6.11bn (+194% yoy), supporting expansion.

Future guidance: globalization + IP derivation, parks and blocks become new attractions

Strategic direction:

Overseas: plan to add 50+ stores in 2025, focusing on Europe and America;

Category: Block products will be launched in the first year, aiming to become the third largest category;

Experience economy: optimized operation of Bubble Mart City Park (Halloween/winter event traffic +30% YoY in 2024), globalization of PTS Tide Show (Singapore stop attracted 30,000 visitors).

Risk points: losses during park climb, fierce competition in block category.

Comments