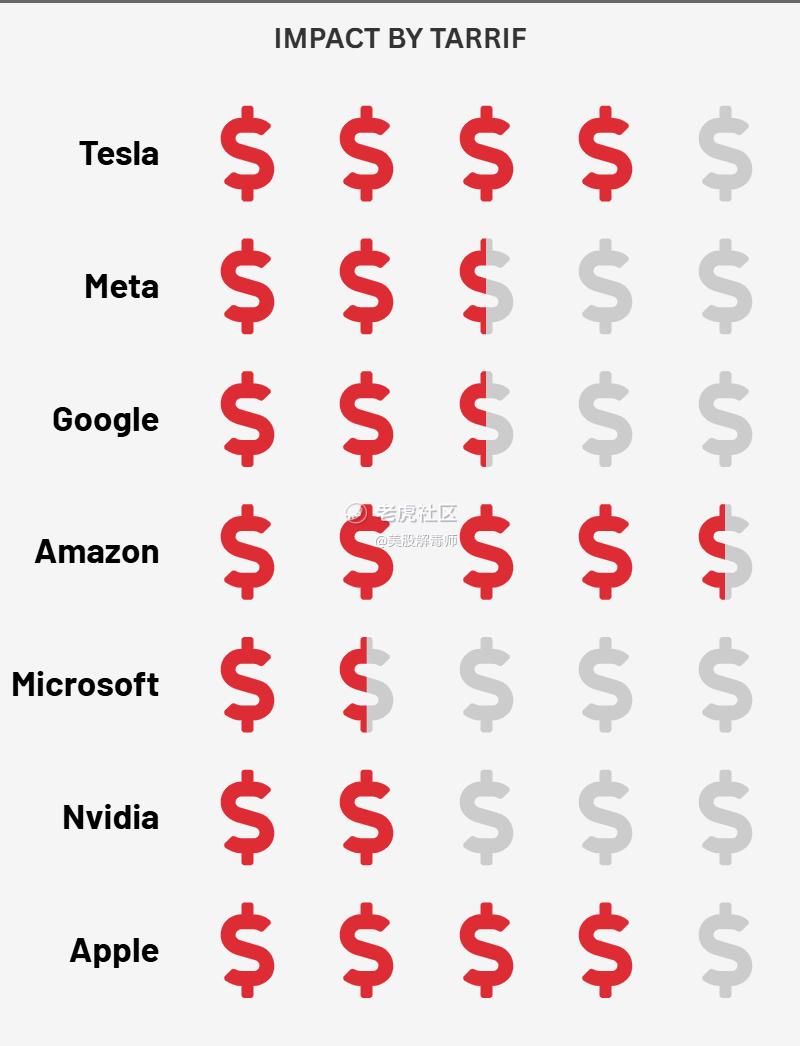

Big tech companies as weight, naturally guides the main fluctuations of the $NASDAQ(.IXIC)$ April 7 opening by the "small essay" impact of the $NASDAQ 100(NDX)$ appearedBurst pull, but the second half of the transaction between the long and short sides are evenly matched, relatively "balanced", mainly because of the two days of tariff impact seems to be undecided.

At present, both the long and short sides of the two main lines of logic in each other's influence:

Downward pressure on performance (favorable).Mainly supply chain cost surge, profit compression (competitiveness decline), of which the supply chain transfer is not only costly, long cycle, but also face future policy changes again.

May become an "exempt object" (negative).Apple has been shifting the industry since Trump's last cycle (could cost $500 billion), and Jensen has become a regular at the Haywood Estate.

For Mag 7, 50% of profits come from overseas, much higher than the 41% for the more S&P 500 as a whole, so investors also see a bigger impact on Mag 7.

Looking specifically at

AAPL.

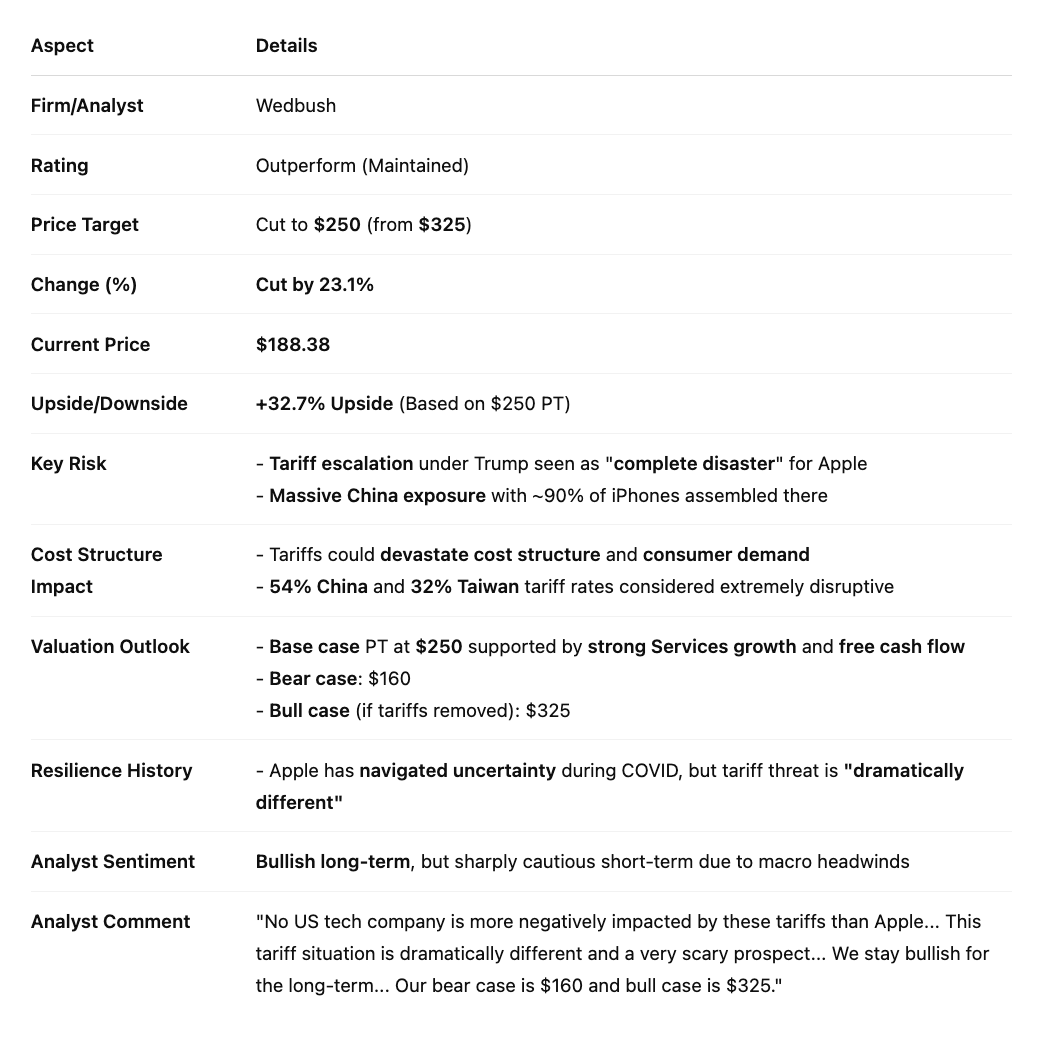

Worst case scenario, Apple profits could fall as much as 30%

The price of iPhones in the U.S. market will increase, with the 16 Pro Max likely to increase by $350, and global prices would need to increase by about 6% to partially hedge against the impact;

China's supply chain accounts for more than 80%, which is difficult to replace in the short term, although we can try to move part of the production capacity to India and Vietnam, but there are also local tariffs and there are yield issues;

Explore new technologies (such as chalcogenide photovoltaic cells) to reduce dependence on the Chinese supply chain;

Apple had successfully lobbied the Trump administration to exempt some products from tariffs in 2019 (e.g., 2019 iPhones), but there is limited room for policy exemptions this time around

Major Wedbush cuts price target (325-250)

MSFT.

Microsoft's business model focuses on enterprise software and cloud services, and a large portion of its revenue comes from long-term contracts with enterprise customers, making it more stable;

The more significant impact will be on data center investment, mainly due to the increased cost of imported equipment, but Microsoft is already wary of expanding its data centers (and over-investing in them), so this is a good opportunity to take advantage of the situation.

Enterprise customers may cut spending on cloud services as revenue slumps due to tariffs, but it may take a few quarters before that manifests itself $Meta Platforms, Inc.(META)$

GOOGL, META

Hardware products (e.g. Google's Pixel phone, Meta's Oculus headset) are affected by the supply chain, but the revenue share is very low and the impact is limited;

The impact of the advertising business is a second-order derivative because of the impact of tariffs affecting other industries (e.g., e-commerce, import/export) leading to lower investment by advertisers;

Potential geopolitical retaliation, such as the EU considering tariffs on U.S. tech services (mainly just the giants), and of course this factor is more or less already priced in $Alphabet(GOOGL)$ $Alphabet(GOOG)$ $Meta Platforms, Inc.(META)$

AMZN

Overall tariff shock, Amazon faces triple pressure on costs, supply chain, market demand

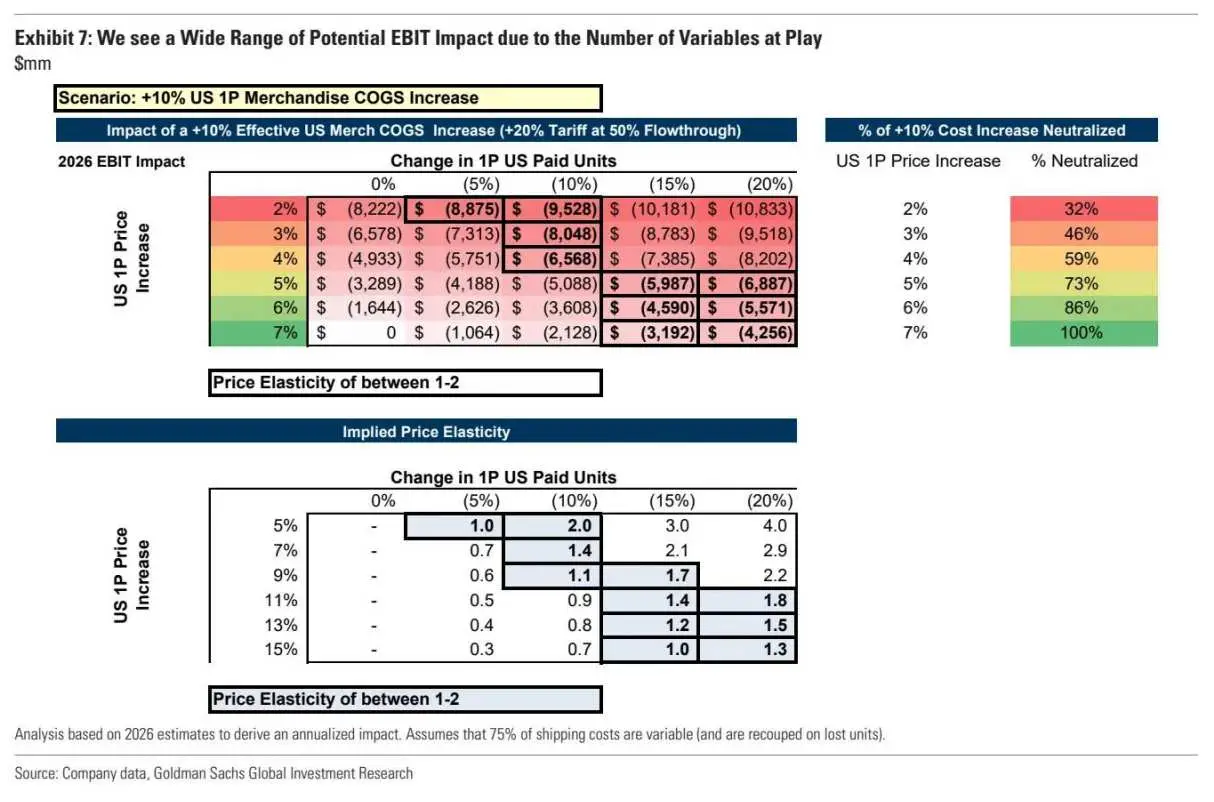

1P Increase in the cost of direct business

Potential 15%-20% increase in the cost of goods in the U.S. market and 9%-12% increase in the cost of goods globally

If borne by Amazon, annual profits could fall by $5 billion to $10 billion, or 8.4%-16.9% of 2024 net profit;

The cost of goods for the 1P business currently accounts for about 74% of its online store revenues, the US market accounts for about 60% of Amazon's global gross merchandise volume (GMV), and about 35% of the cost of goods in the US for 1P is sourced from China

3P costs are also significantly higher, mostly sourced from China.

Removal of duty-free small parcels means that even small shipments are now subject to tariffs (from May 2, tariffs will be payable on parcels under $800, leading to a 15-20% rise in logistics costs and a squeeze on the profit margins of sellers relying on low-priced small parcels)

Possible stricter certification of origin and customs clearance procedures

Failure of strategies to avoid tariffs through Southeast Asian re-exports (Cambodia, Vietnam transshipment)

Potential risk of consumer downgrade as higher commodity prices coincide with depletion of U.S. household savings, with middle-class U.S. households spending $2,600-3,900 more per year or more, potentially triggering a 10%-15% contraction in market demand;

Enterprise customers may cut spending on AWS cloud services due to tariff-induced revenue declines, which may take a couple of quarters to reflect

Amazon's profit performance during the 2018-2019 tariff period is relatively stable, and possible countermeasures at this time include

Supply chain negotiations: asking suppliers to share cost pressures

Commodity restructuring: shift to low tariff goods or U.S.-based suppliers $Amazon.com(AMZN)$

NVDA

Semiconductor supply chain impact, mainly including foundries such as TSMC.Semiconductors themselves are exempt from tariffs, finished products (GPUs) containing these chips may be subject to tariffs

The current supply and demand situation suggests that it may be NVDA that eats this cost;

TSMC's U.S. plant ($100 billion investment) will reduce international supply chain dependence $NVIDIA(NVDA)$

TSLA

Tesla key components (e.g., Mexican-made motors, Chinese-made battery modules) Imported auto parts cost increases

(Model Y long range version relies on Mexican imports for about 25% of its parts, cost per car may increase by $2,000-3,000)

The selling price of main models such as Model 3 may increase by 15-20 percent

Rare earths, graphite and other materials are 80% dependent on China's supply, even if the Nevada plant in the U.S. develops its own 4680 battery, it still needs to import cathode materials from China

Mexico plant still has yield and other problems

Major Wedbush cuts price target sharply on Sunday (550-315) $Tesla Motors(TSLA)$

Comments