Last week, Trump raised the import tariff of the United States to the highest level since 1930s, causing chaos in the financial market. The S&P 500 has fallen by about 10%. On Monday, U.S. stocks were still fluctuating violently following the "tariff news".

For some investors, this is when "selling off the market" may be more attractive than going through these ups and downs. However, new research from JPMorgan Asset Management shows that,Investors who sell their stocks may miss out on the upside.

Jack Manley, global market strategist at JPMorgan, said: "When there is a severe sell-off, there is usually a strong rebound.Given the nature of this sell-off, a rally is much more likely, and whenever it occurs, it will be quite concentrated and quite strong.”

The bank's research shows that the market's best days often follow the worst days.

JPMorgan's data over the past 20 years shows that overall, seven of the 10 best-performing trading days in the market occurred within two weeks after the 10 worst-performing trading days. For example, on March 12, 2020, at the beginning of the COVID-19 pandemic, the market experienced the second-worst day of the year. The next day, the market had another second-best day of the year.

JPMorgan's research shows that investors who follow through earn better returns in the long run.

JPMorgan "takes $10,000 to invest in the S&P 500 Index" as an example. If investors had put the money in on Jan. 3, 2005, and stayed unmoved until Dec. 31, 2024, they would have accumulated $71,750, representing an annualized return of 10.4% over that period, the bank said.

However, if the same investor sold their stock, they would miss 10 of the best days in the market and their portfolio value would drop from $71,750 to $32,871, a return of just 6.1%.

Xiaomo also pointed out,The more investors go in and out of the market, the more potential upside they lose.Had they missed the market's best 60 days between 2005 and 2025, their return would have been-3.7% and the balance would have been just $4,712, well below the initial $10,000 invested.

In this volatile market, using options to build a diagonal spread strategy can reduce net costs while capturing$Nasdaq 100ETF (QQQ) $Potential gains from the rise. The following will take the specific TQQQ options contract as an example to explain how to do long operations through diagonal spreads and conduct a detailed analysis of its profits and losses.

Diagonal spread strategy construction

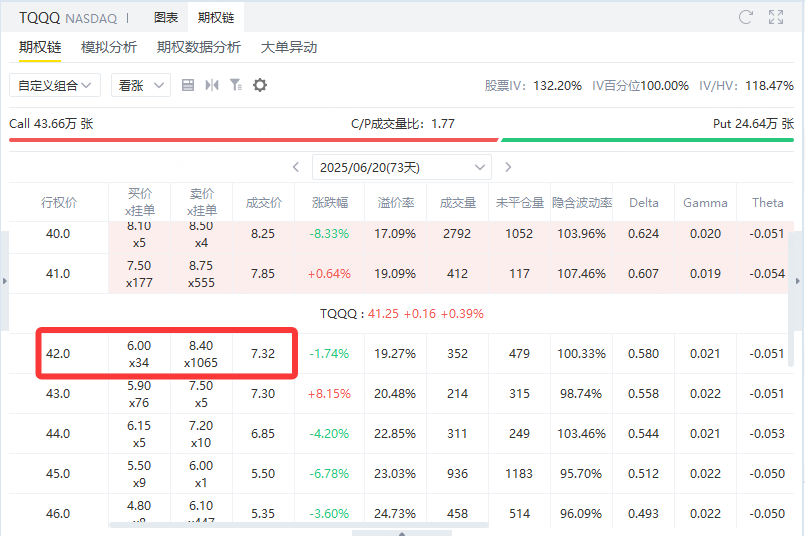

Long-term option contracts:

Contract subject matter:$Nasdaq Triple Long ETF (TQQQ) $

Type:Call Options

Strike price:42

Expiry date:June 20, 2025

Premium:$732

Investors first buy a call option with a longer term and a lower strike price. Since this option has a long expiration time, it can not only capture the possible upside of TQQQ in the future, but also contain high time value.

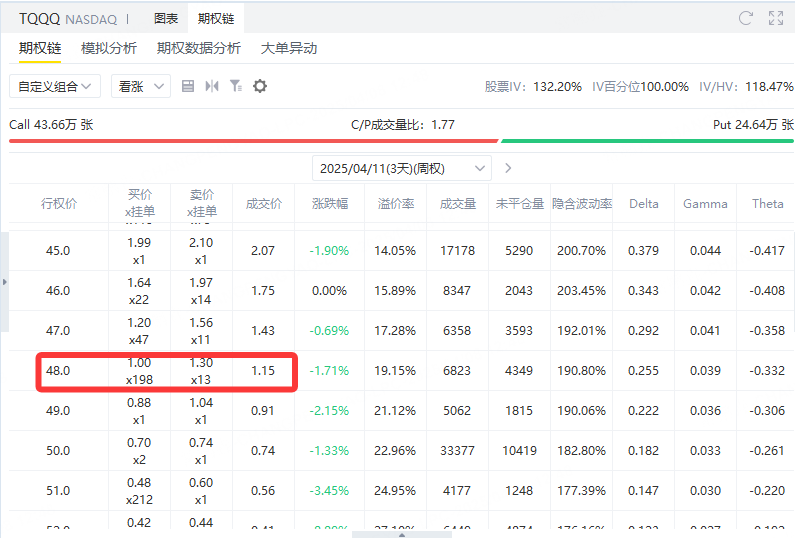

Short-term options contracts (sell weekly):

Take this week as an example:

Contract subject matter:TQQQ

Type:Call Options

Strike price:48

Expiry date:April 11th

Premium:$115

To partially hedge against the high premium payouts of long-term options, investors can sell one near-month call option per week. Taking this week as an example, by selling a call option with an exercise price of 48 and an expiration date of April 11, investors were able to charge a premium of $115, thereby reducing the net cost of the overall position.

PROFIT AND LOSS

The initial net cost after constructing the diagonal spread combination is:

Net cost = $732 (buy) − $115 (sell) = $617

The sold front-month options expire after expiration, and the investor retains the entire $115 premium.

Long-term options still have the potential of time value and future intrinsic value, and the net cost drops to US $617, which is still waiting for the release of subsequent market trends.

At this time, the strategic risk is mainly the net cost of long-term options. When the fluctuation falls, it may face certain losses, but it has been partially compensated through the premium collected.

Upstream scenario:If TQQQ continues to rise, long-term options will gradually turn into deep real value. Investors can use option arbitrage (such as early exercise or liquidation of positions) to achieve greater returns, and the premium obtained by selling options every week will further enhance returns.

Downlink scenario:If TQQQ fluctuates or falls back in the short term, the front-month option premium sold provides a defensive buffer, while although the long-term option faces the risk of depreciation, its limited net cost ($617) and longer expiration time are the subsequent market. The rebound reserves room for operation.

Using the diagonal spread strategy to go long TQQQ options is a way to seek steady returns amid market uncertainty. By buying forward call options with low strike price, investors not only gain full upward participation rights, but also sell front-month options every week to continuously recover premium in market shocks, reducing the cost of holding positions. In this way, regardless of the short-term fluctuations of the market, risk control and potential returns can be taken into account, so as to gain more opportunities when the market rebounds.

Comments