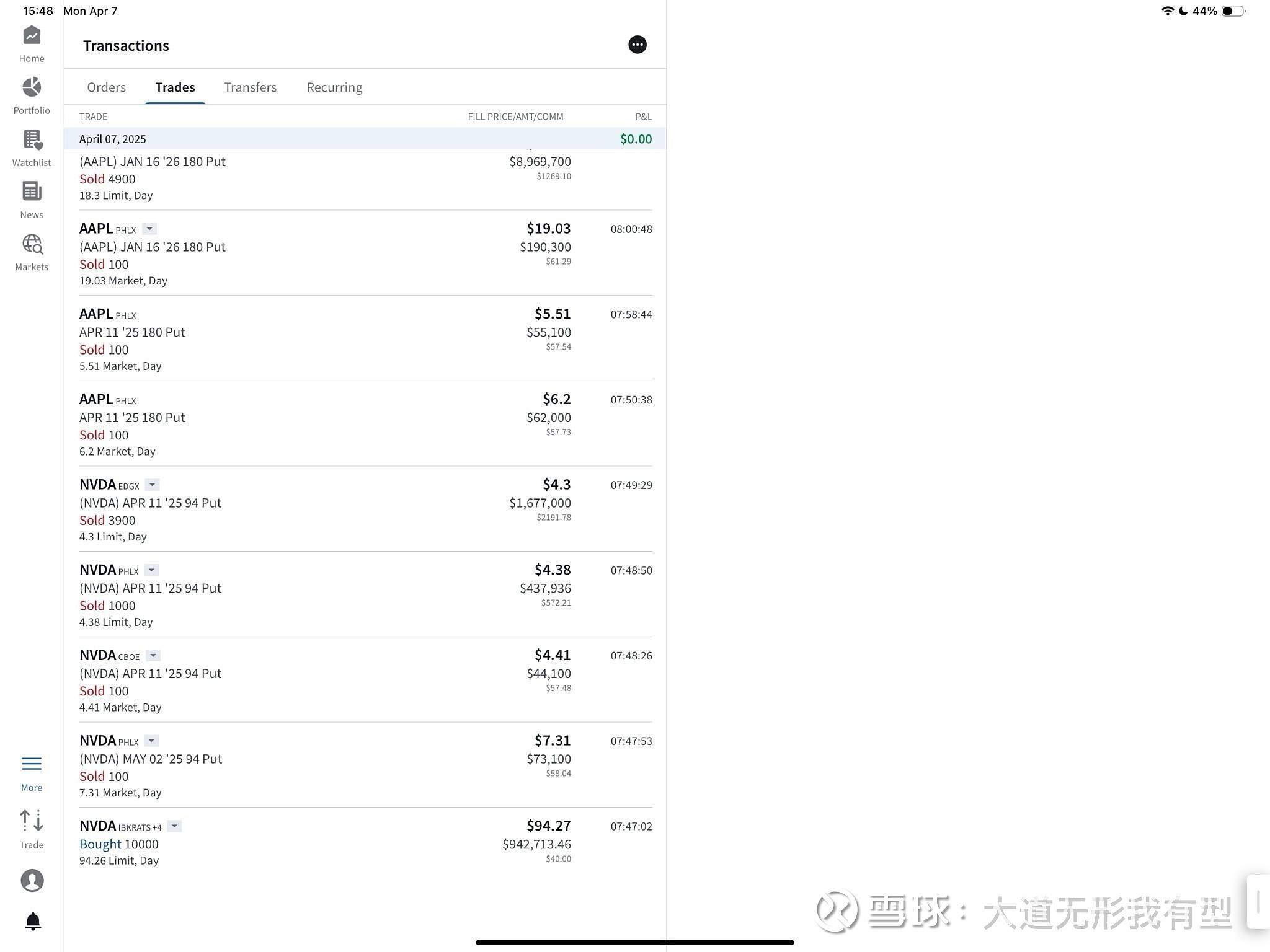

An institutional investor Duan Yongping just showes his “buy the dip” on April 7, most of the transaction are in options (sell naked put).

In summery, the nominal value of the underlying surpass 400 million U.S. dollars, option premium is more than 30 million U.S. dollars

Specifically

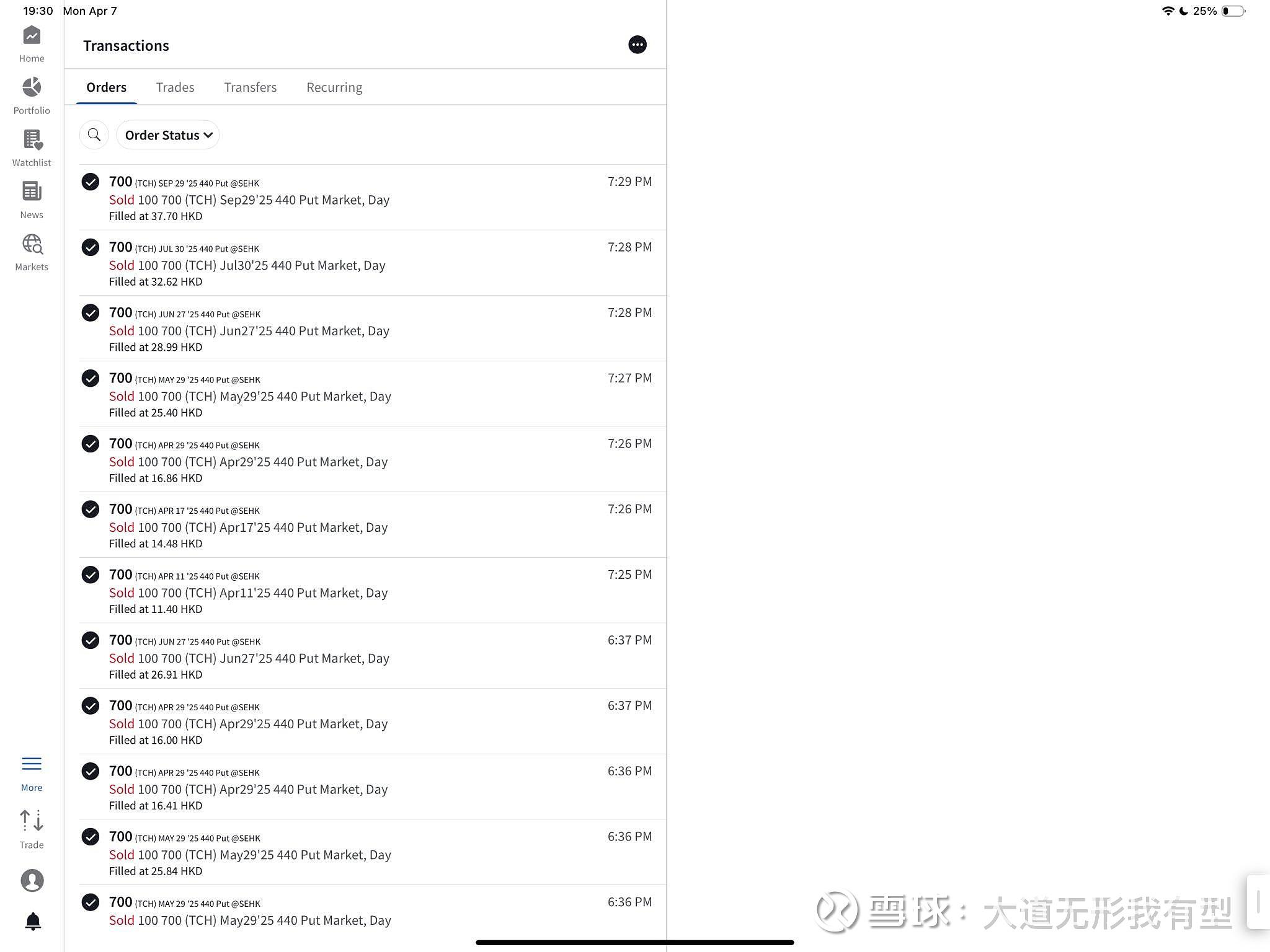

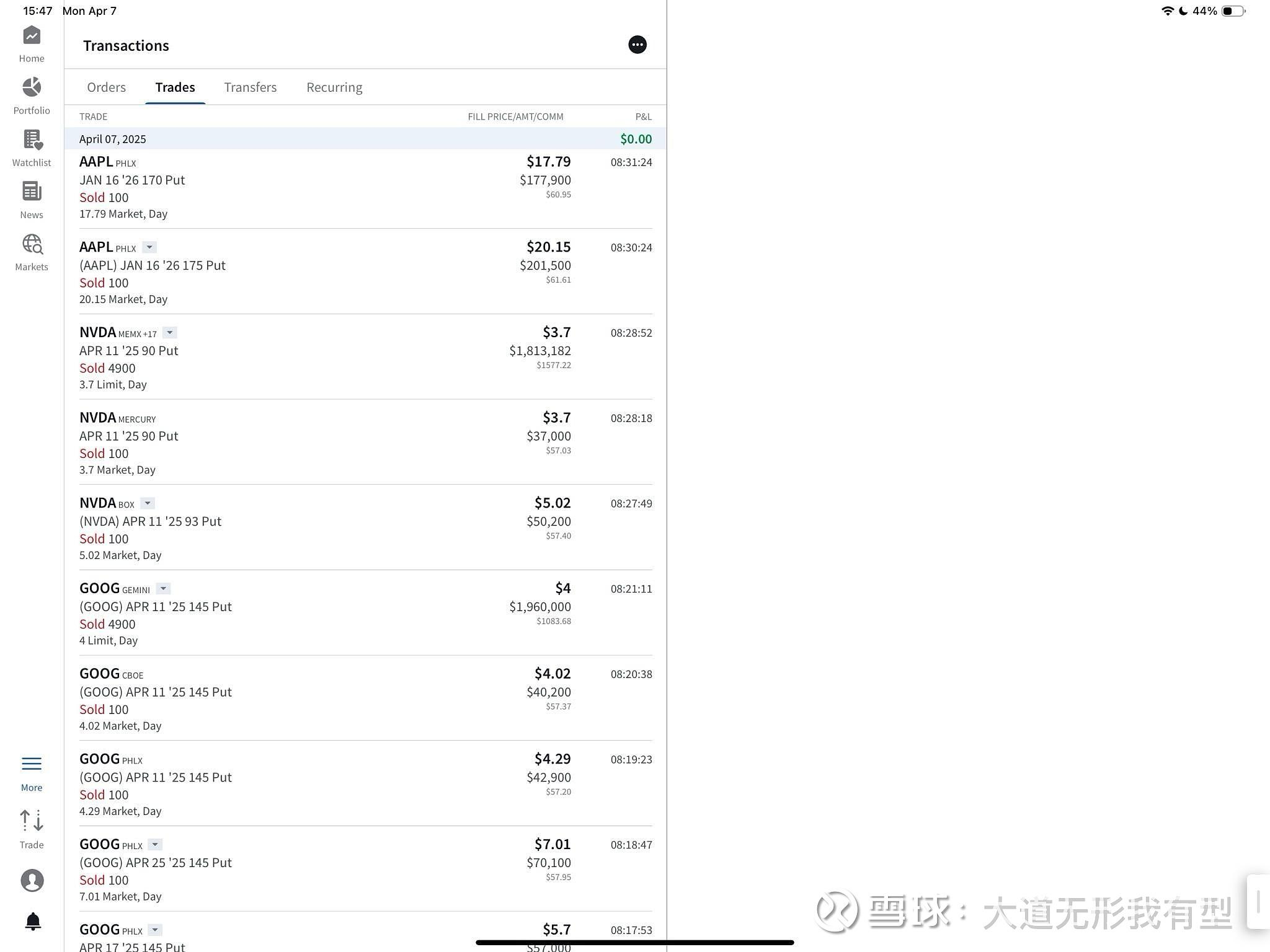

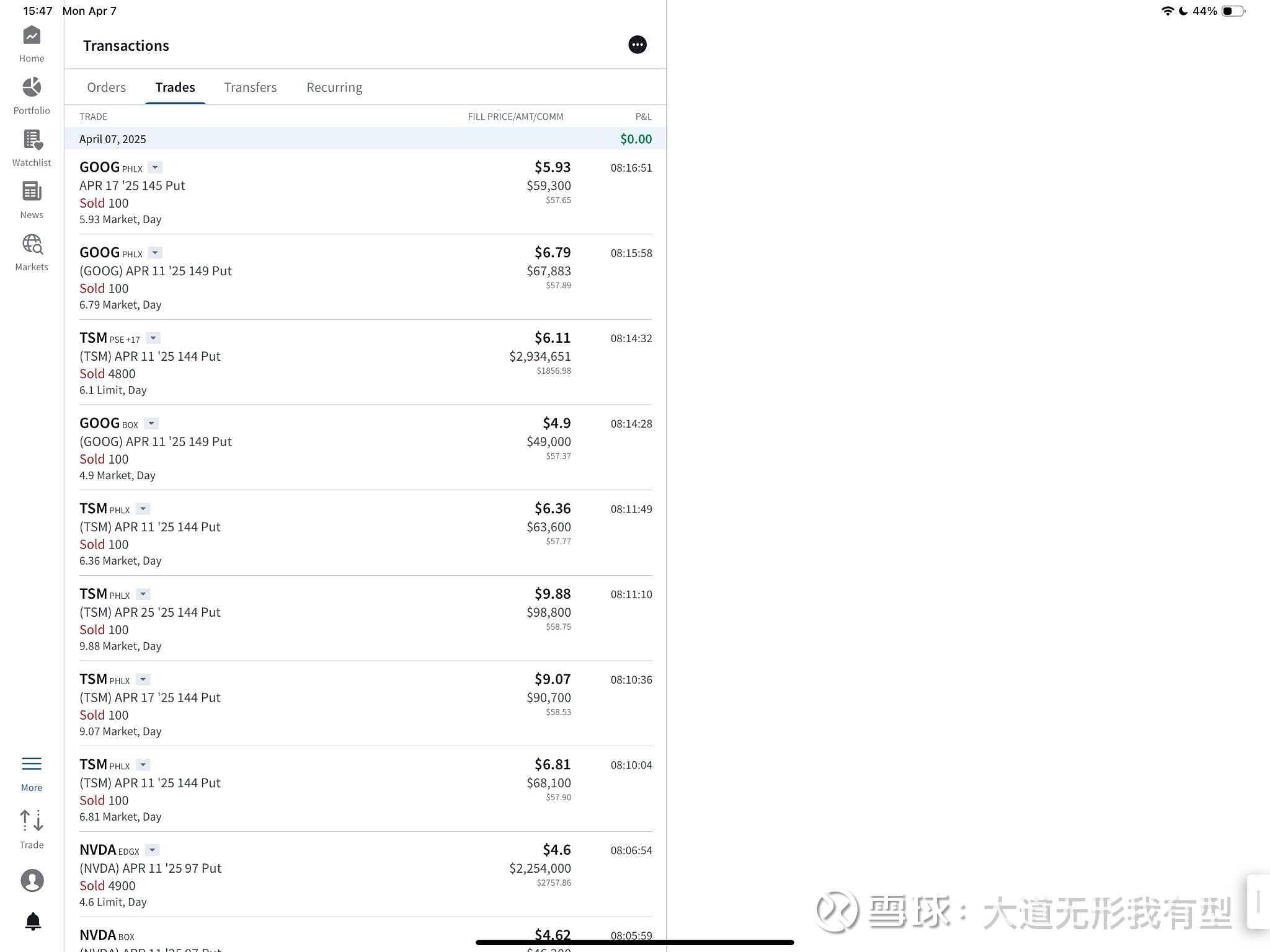

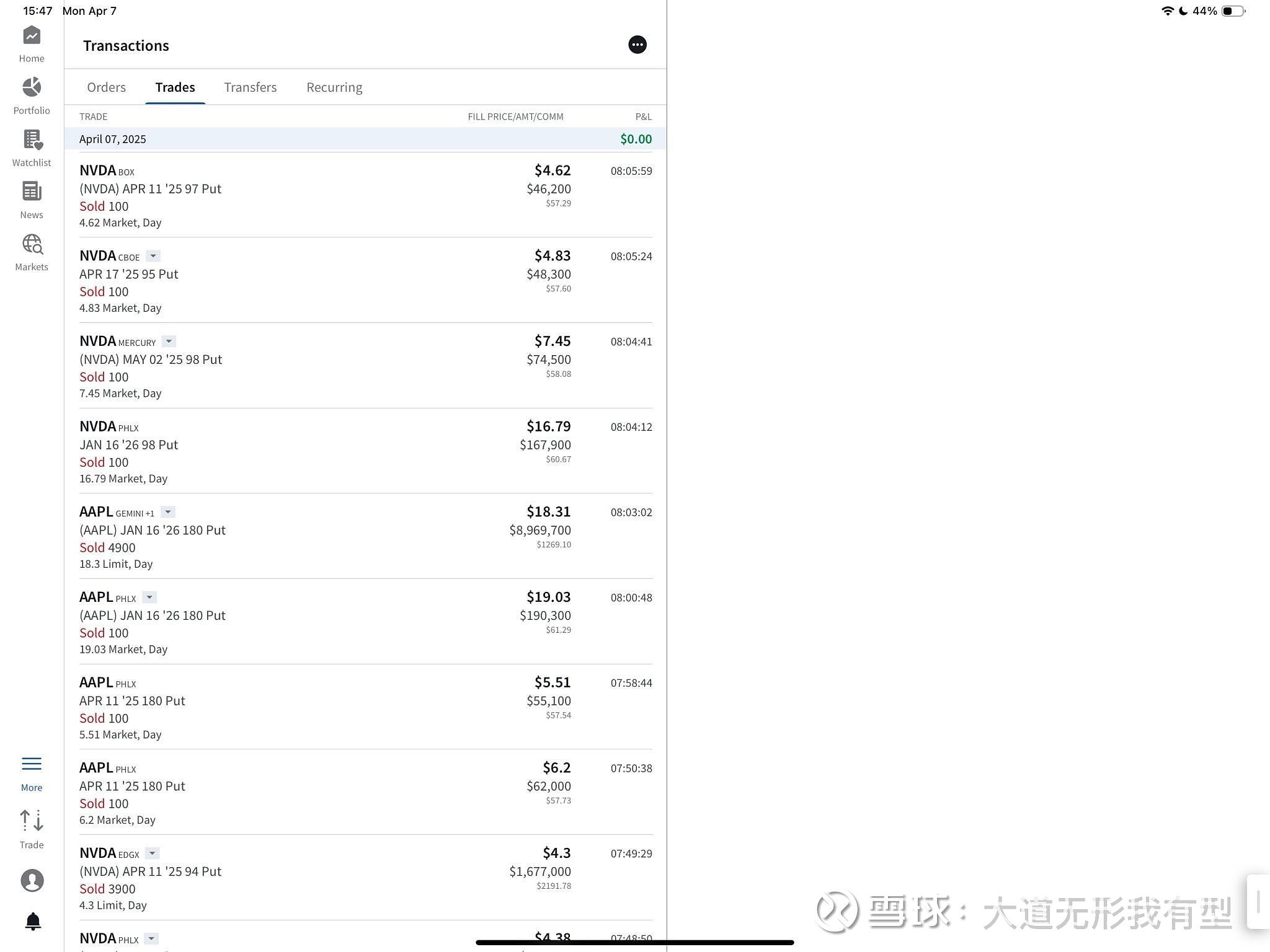

Underlying involved include: $NVIDIA(NVDA)$ $Alphabet(GOOGL)$ $Apple(AAPL)$ $Taiwan Semiconductor Manufacturing(TSM)$ and $TENCENT(00700)$ in Hongkong.

Option dates: from this week's April 11 expiration, to this month's April 25 expiration, May expiration, and all the way to January 2026 expiration, with a higher percentage of this week's expirations (near doomsday options);

Strike prices: most of this week's expirations are at-the-money (ATM) or OTM (out-of-the-money) PUTs within 5% of the spot price, while forward options range from 10-20% OTM predominantly.

AAPL's strike prices are 180, 175; NVDA's strike prices are 90, 93, 94, 95, 97, 98; TSM's strike prices are 144; GOOGL's strike prices are 144, 149

HK Stocks: Tencent's options start this week (4.11 weekly options) and continue through September (monthly options), with a strike price of 440 (ATM), each SELLED for 100.If all were exercised, the total value would amount to HK$52.8 million (about $68 million)

Comments