Market volatility from tariffs also poses a challenge to the 2025 outlook for U.S. airlines.

Despite a strong start to the year and optimistic forecasts, the U.S. airline industry is now facing significant headwinds due to economic uncertainty, rising inflation and shifting consumer behavior.While the long-term growth trajectory through 2030 remains optimistic, immediate concerns about declining passenger traffic and spending have prompted airlines to implement capacity adjustments for the upcoming quarter.

$United Continental(UAL)$ reported first quarter earnings after the bell on April 15, 2025, and the company delivered its best quarterly financial performance in nearly five years, despite the uncertainty of the macroeconomic environment.

Market Feedback

Core financial metrics diverged beyond expectations

United Airlines achieved revenues of $13.2 billion (+5.4% yoy) in the quarter, slightly below market expectations of $13.26 billion, but adjusted EPS came in at $0.91, significantly beating expectations of $0.76.This divergence in performance stemmed from cost control effectiveness, with cost per available seat mile (CASM-ex) increasing only marginally by 0.3%, while revenue per unit (TRASM) grew by 0.5%, driving a 4.9 percentage point year-on-year improvement in pre-tax margin to 3.6%.

Notably, unit revenue growth of over 5% on international routes offset a 3.9% decline on domestic routes, demonstrating the resilience of business structure optimization.

Dual performance guidance draws attention

Scenario assumptions for recession resilience and risk hedging, respectively:

Stable environment: full year 2025 adjusted EPS guidance of 11.50-13.50 (corresponding to net profit of ~3.8B-4.5B);

Recession: EPS down to 7.0 (net profit ~2.3B), still profitable

Compared to peers (Delta withdrew full year guidance), United's $2.3B net profit in recession scenario still outperforms market expectations (stemming from cost control), boosting market optimism.

Positive Market Feedback, Possibly Lower Expectations

Shares rose more than 6% in after-hours trading following the earnings report, possibly reacting to compensation for very low prior expectations.But year-to-date the stock is down a cumulative 30%, significantly underperforming the S&P's 9% decline over the same period.

Short-term positive reaction and long-term weakness coexist: on the one hand, the recovery of international travel and demand for premium cabins create room for imagination; on the other hand, weak domestic demand and the risk of recession depress the valuation pivot.

Investment Highlights

Liquidity position continues to improve

Q1 generated $3.7 billion of operating cash flow and free cash flow topped $2 billion, with cumulative free cash flow of $5 billion over the past 12 months.Supported by strong cash flow, the balance sheet has been significantly repaired, providing sufficient cushion against potential economic volatility.Management emphasized in the earnings call that it will maintain a prudent capital expenditure plan, prioritizing investment in high-return international routes and fleet renewal.

International Strategy is Effective but Regional Risks Emerge

Revenue from international routes rose to an all-time high of 48% in the quarter, with transatlantic routes up 9% driven by the recovery of business travel in Europe and Asia-Pacific routes up 12% due to the full opening of China's borders.

However, geopolitical risks require vigilance - tensions in the Middle East led to a 4% year-on-year decline in revenue on routes to the region, and the Company has announced a 4% reduction in capacity in the Middle East for the third quarter.This ability to adjust dynamically reflects management's agility in responding to regional risks.

Premiumization Strategy Builds Differentiation Advantage

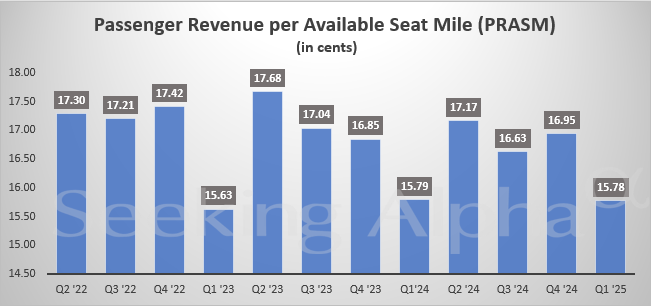

Premium cabin revenue increased by 17% year-on-year, rising to a record high of 35% of total passenger revenue.Polaris' Business Class occupancy rate remained high at 89%, and revenue from the Economy Plus product grew by 21%.This structural upgrade resulted in a 2.1 percentage point improvement in passenger revenue per unit (PRASM), effectively hedging against weaker domestic demand for economy class.Notably, the company is testing the "Premium Economy Plus" product, and plans to increase the share of ultra-warp seats from the current 24% to 30% to further strengthen revenue quality.

Issues in Focus

During the earnings call, analysts mainly questioned around the following issues:

Economic sensitivity: management revealed that every 1 percentage point drop in domestic GDP will result in a $0.8 reduction in full-year EPS, but the international business is more anti-cyclical

Impact of Boeing delivery delays: four 787 model deliveries are confirmed to be delayed until 2026, and capacity will be supplemented by extending the service life of existing aircraft and the leasing market

Loyalty program valuation: MileagePlus program valuation raised to $28 billion, but declined to disclose the possibility of a spin-off, emphasizing its role as a cash flow stabilizer

United Airlines is currently at a critical stage of strategic transformation, with international network expansion and premium product portfolio forming the twin engines of performance, but uncertainty in the macro environment requires investors to pay more attention to the quality of operations rather than pure growth rate.

It is recommended to pay attention to the progress of international peak season bookings in the second quarter (currently +12% year-on-year) and the effect of domestic capacity adjustment, which will determine the probability of full-year performance.

Comments