$Netflix(NFLX)$ has shown notable strength recently, delivering a YTD return of +9.5%, significantly outperforming the S&P 500 (.SPX), which is down -8.25%.

Last week's rally could be attributed to the market's belief that Netflix is relatively immune to tariff-related headwinds. This week's strength, however, appears more related to heightened earnings expectations. What's surprising is that NFLX rose 6.31% in the week leading up to its earnings, despite its Monday-implied volatility (IV) pricing in a ±10% move post-earnings.

More interestingly—perhaps coincidentally or by design—the anticipated earnings gap (post-earnings gap-up/down) will not impact the weekly options expiring on April 17, as the market is closed on April 18 due to a holiday.

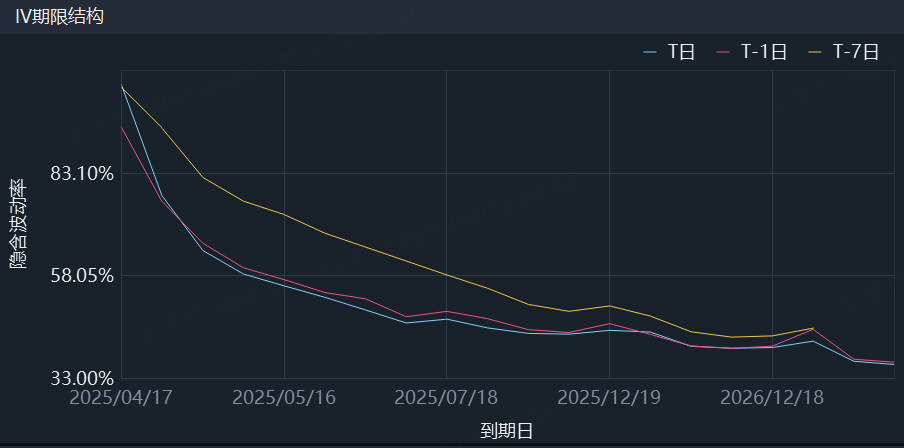

Yet, despite this timing nuance, the IV on the April 17 options remains extremely elevated at 111%, significantly higher than the 77% IV on the following week's expiry. This suggests that the market is still pricing in the earnings move—even though these options technically won’t capture it. This could be considered a classic case of mispricing.

So how can you trade this?

Simple short-volatility strategies may work here—such as Short Straddles or Short Strangles. For example, you could sell simultaneously

1050 Call expiring this week

880 Put expiring this week

Alternatively, focus on exploiting IV differentials across expirations using Calendar Spreads or Diagonal Spreads—in essence, using next week’s options to hedge the delta exposure of this week’s options (keep in mind, this only hedges static delta; gamma exposure remains).

For instance, a Calendar Spread could be structured as:

Sell the 950 Put expiring this week

Buy the 950 Put expiring next week

If you’re confident in pinning the stock price near a specific level, consider a Butterfly Spread, which offers higher reward but narrower profitability range.

For a more conservative setup, try the “1+2” configuration—essentially an Iron Condor built using next week's expirations for the long legs. This approach involves shorting both sides of the implied volatility on this week's expiry, while also delta-hedging both sides using further-dated options. For single-sided spreads, use relatively tighter strikes to balance the payoff.

Key takeaway: Ideally, close all positions by Thursday’s close, before earnings are released after-hours.

Why? Because earnings-related volatility will play out after the close on Thursday, and the market won't reopen until Monday. At that point, next week's options will undergo a classic IV crush.

The core of this arbitrage lies in the implied volatility crush on April 17 options.

Happy Trading!

Comments