In recent years, the endowment funds of top U.S. colleges and universities have frequently attracted attention due to their huge private equity exposure. 2024, Yale University announced that it would sell $6 billion in private assets (15% of its endowment fund) through the secondary market, and Harvard University is also facing liquidity pressures in the context of a crisis in its tax-exempt status.The sell-off storm not only exposes the inherent contradictions of the "Yale model", but may also become a trigger to burst the bubble of the private equity market, triggering a systemic risk comparable to the subprime mortgage crisis.

Motivation for the sell-off: the flaws of the Yale model in the volatile gaming market

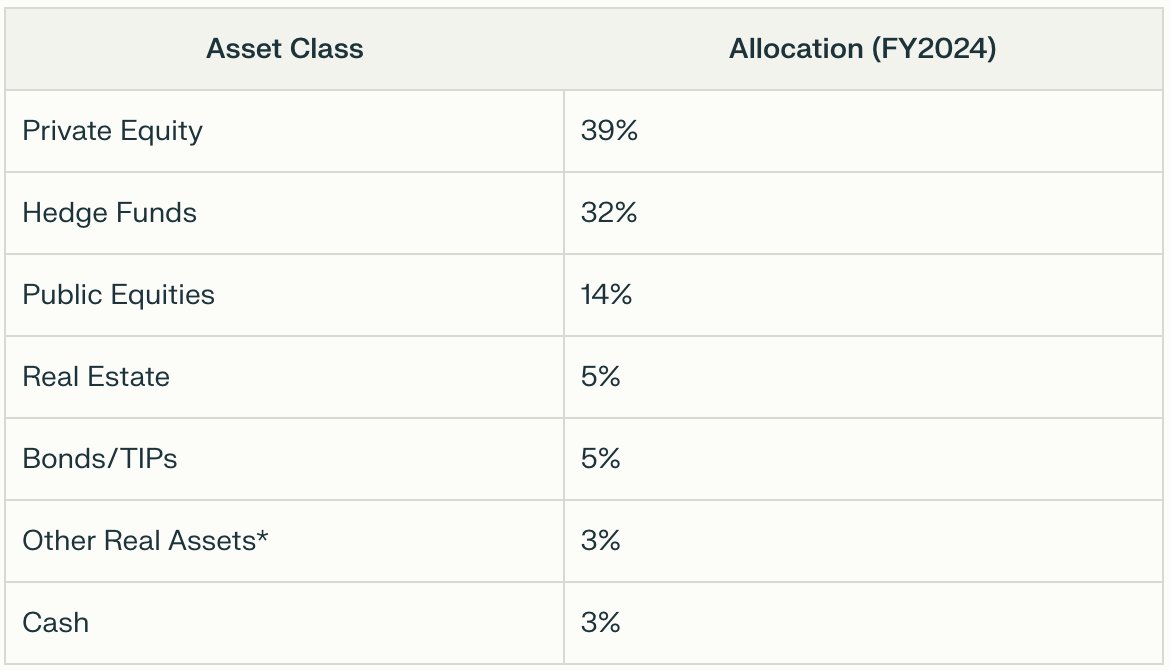

Ivy League endowments have long played the role of "privileged players" in the capital markets.Harvard, Yale and other institutions with tax-exempt status and long-term capital attributes, more than 40% of the assets allocated to private equity (PE) and venture capital (VC), creating what is known as the "Yale model" of investment myths - through the sacrifice of liquidity in exchange for excessiveThe Yale EndowmentThe Yale Endowment Fund, led by Chief Investment Officer David Swenson, has pioneered an allocation strategy centered on alternative assets: 35% PE+VC allocation, 18% real estate and natural resources, and less than 15% reliance on traditional stocks and bonds through 2023.This model has generated 13.9% annualized returns over the past four decades, far outpacing the S&P 500's 10.5%, and has become a benchmark for institutional investors around the world to emulate.

Market Impact: Valuation Collapse & Confidence Crisis

The immediate impact of the sell-off of private equity by universities has been felt on three levels.

First, the private equity industry is facing a liquidity drain.As one of the world's top 30 private equity investors, Yale's sell-off has forced giants such as $Blackstone Group LP(BX)$ and $KKR & Co LP(KKR)$ to face pressure to withdraw on the capital side of the equation, with their shares plummeting by more than 20% in 2024, far below $S&P 500(.SPX)$ .

More seriously, the secondary market for private equity (Secondaries) trading volume plummeted, the valuation system is in disarray - when the head of the organization to sell at a discount, small and medium-sized funds will be forced to accept the more demanding pricing, the formation of "sell-off - discount - panic" of the death spiral.A "sell-off-discount-panic" death spiral.

Second, the risk is transmitted to the broader financial system.Endowments are often leveraged to magnify the returns on private placement investments, and Harvard's $750 million bond issue in 2024 was used to fill a liquidity gap.Once private placement assets are impaired, collateral calls could be triggered, recreating the liquidity run scenario of the 2022 UK pension crisis.Preemptive trading by hedge funds (e.g., shorting private equity-related derivatives) will further amplify volatility, rippling through tech venture capital, cryptocurrencies, and other related areas - areas that are highly dependent on endowment fund money transfers, with 30% of the funding for Silicon Valley's famed incubator, Y Combinator, coming from college endowments.

Finally, market confidence has been fundamentally shaken.Private equity valuation models have long relied on "hold-to-maturity" assumptions, but Yale's sell-off has ripped away that veil.According to Preqin, global private equity assets will reach $12 trillion by 2023, with 70% of valuations based on internal models (IRR) that have not been tested in the market.As Harvard, Yale and other "smart money" begins to withdraw, investors will have to re-examine the true risk premium of this market, and CalPERS (California Public Employees' Retirement Fund) has already taken a 15% write-down on private equity assets in 2023, signaling a defensive retreat of institutional capital that could evolve into a deleveraging of the entire industry.

III. Historical Mirrors and the Specter of the Subprime Crisis

The current crisis bears a striking resemblance to past financial catastrophes: at the heart of the 2008 subprime crisis was the packaging of illiquid mortgage-backed securities by banks as highly rated products, while today's private equity market is also rife with the "art of packaging" - fattening up unlisted companies with capital and manipulating EBITDA multiples to create the illusion of high valuations.The private equity market today is also full of the "art of packaging" - fattening unlisted companies with capital and manipulating EBITDA multiples to create the illusion of high valuations.

Apollo and other institutions will be the subject of the acquisition of leverage up to 6-8 times, and the actual cash flow of the enterprise is seriously disconnected.This "paper rich" once encountered liquidity contraction, the collapse speed may be far more than expected.

More alarming is that the college sell-off wave exposed the depth of the private equity market and macro policy binding.Over the past decade, the Federal Reserve's zero-interest-rate policy has spawned an "income-chasing" frenzy, with endowments allocating 44% of their assets to alternatives (Cambridge Associates data for 2023), triple what they did in 2008.But the cost-benefit ratio of private investments has deteriorated dramatically as interest rates have remained high for a long time and the Inflation Reduction Act has eliminated the tax benefits of fringe benefits.Structural cracks have appeared in the twin pillars of "tax exemption + low interest rates" on which the Yale model relies.

Revelations of the Yale Model and Systemic Reconstruction

The crisis was essentially the ultimate showdown between institutional privilege and the laws of the market.The strengths of the Yale model - long-term horizons, alternative asset premiums, diversification strategies - did create alpha returns in a smooth cycle, but its weaknesses were exposed under stress tests: over-reliance on illiquid assets, ignoring tail political risk, valuationmodeling away from market pricing.By the time Harvard was forced to pay its faculty with bond issues ($1 billion in cumulative debt by 2024), the so-called "rich endowment" had already revealed itself to be a travesty - only 3 percent of its $53 billion in assets were in cash reserves.

The way forward lies in a threefold reconfiguration:

Liquidity repricing: private equity must establish a transparent secondary market that is subject to fair value testing, putting an end to the game of "self-talking" valuations;

Innovative risk-hedging tools: Develop a derivatives market for private equity assets, allowing institutions to hedge against political risk and interest rate volatility;

Updating the regulatory framework: including university endowments in systemic risk monitoring and limiting their private equity exposure (e.g., by setting a 25% cap) to avoid the "too big to fail" dilemma.

Dawn of a new order

The sell-offs at Harvard and Yale signaled the end of the "Gilded Age" of institutional dividends.As political risk becomes a central variable in asset pricing, and liquidity goes from being a source of premium to being a fatal shortcoming, institutional investors must revisit the old adage that "if you owe a bank a million dollars, you're in trouble.

"If you owe the bank a million dollars, you're in trouble; if you owe the bank $100 million, the bank is in trouble."

Today, college endowments owe trillions of dollars to the private equity market, dragging the entire financial system into uncharted waters.The crisis may end in tighter regulation and market clearing, but its real legacy will be the declaration of the truth that there is no such thing as a privilege that never dies, only a risk pricing that is eternally volatile.

Comments