$ Tesla (TSLA)$ reported Q1 2025 earnings after the bell on April 22, 2025, kicking off the year with a double miss on revenue and profit.Not only did this earnings report mark the worst earnings slide since Q2 2022, management withdrew its full-year growth guidance.

However, investors were also heartened by Elon Musk's change in attitude, saying he would reduce his hours at the government department DOGE starting in May and return his focus to Tesla.

Markets in the days before the earnings report on the violent shock, the day before the earnings report fell more than 5%, in the case of the market plunge in the week before the earnings report to the options implied volatility also once reached 170%, IV Percentage reached 98%.The actual earnings report was followed by an after-hours gain of over 5%, as investors chose to further game the long-term narrative after the negative news cleared.

Performance and market feedback

Core financials performance

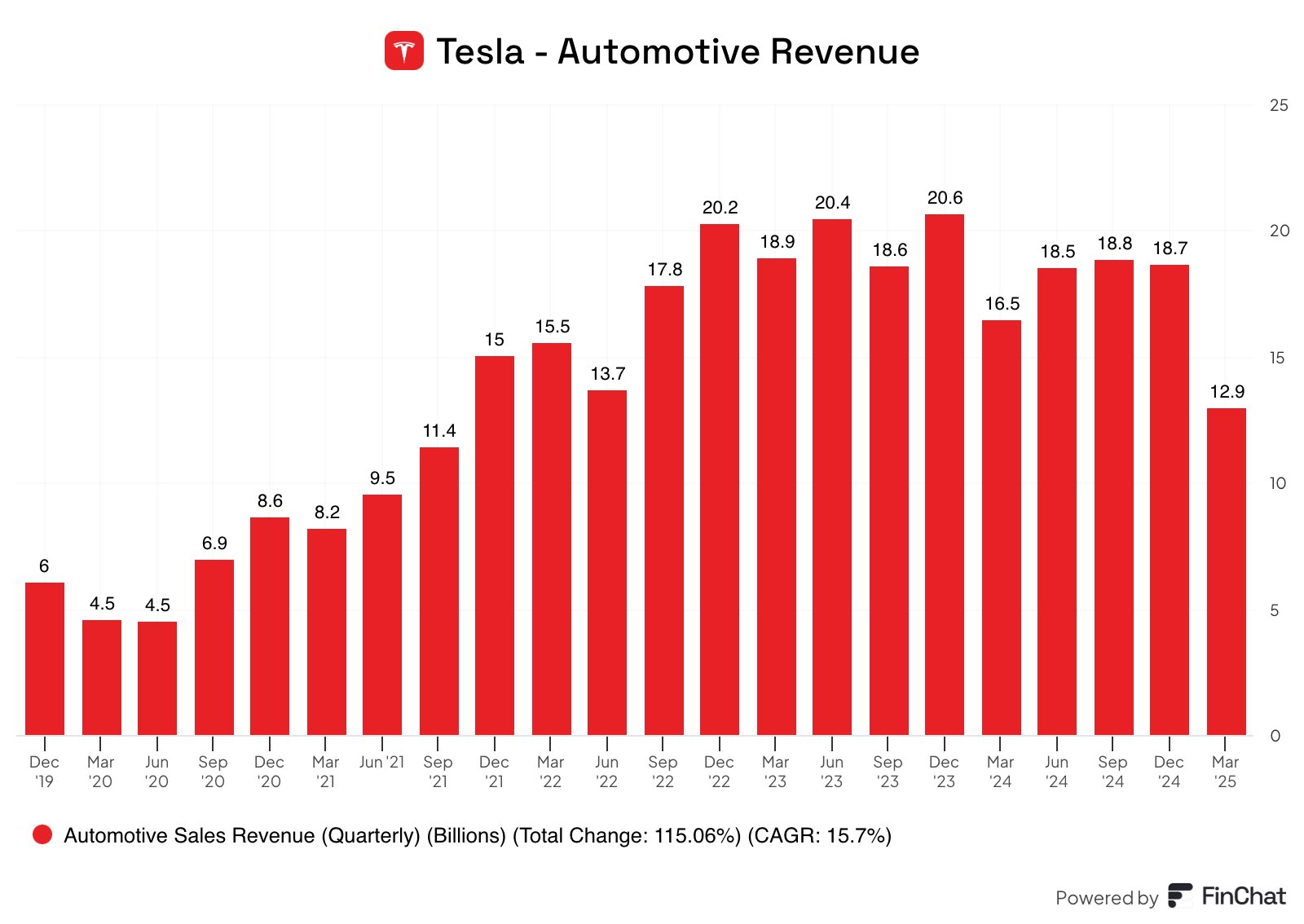

Revenue: 19.34B, lower than expected 19. 34B, lower than expected 21.35B, -9% yoy, -24.8% qoq

EPS: GAAP 0.12 (lower than expected 0.12 (lower than expected 0.32), Non-GAAP 0.27 (lower than expected 0.27 (lower than expected 0.39), -71% YoY and -40% YoY, respectively)

Net Profit: GAAP 0.4B, -710.4B yoy, -710.9B yoy

Gross margin: 16.3%, down 104 bps y/y, automotive gross margin down to 11.83%

Operating cash flow: 2.2B, 2. 2B free cash flow, 0.7B free cash flow (+126% yoy)

Cash Reserves: 37B, +37B yoy, +0.4B yoy

Operating Metrics Highlights and Challenges

Automotive business: deliveries -13% yoy to 337,000 units, Model Y production line upgrades led to capacity bottlenecks; automotive gross margin excluding regulatory credit 12.5% (expected 11.9%).Of these, China retail sales of 134,607 units (40% share), +1.65% yoy but -31.6% qoq; double-digit sales decline in Europe as Musk's political stance triggered consumer boycott.

Energy storage business: deployments +154% yoy to 10,400 GWh, Powerwall installations at record highs for fourth consecutive quarter, but hit by tariffs more than auto business.Separate regulatory credits revenue: $0.595B (145% of net profit, without which the company would have lost money)

Market Reaction and Investor Sentiment

The seemingly contradictory market reaction of Tesla's shares, which rose about 5% after hours against the trend despite lower-than-expected results across the board, reflects investors' positive interpretation of the following factors:

Confirmation of strategic shift: Musk announced that he will significantly reduce his time working for the government from May to focus on Tesla's business, easing investor concerns about a "distraction".

Product roadmap clarification: Confirmation that the low-cost model is still on schedule for production in 2025H1, and that the Robotaxi will be launched on August 8, 2025 and mass-produced in 2026

Energy business exceeds expectations: Energy storage business is the biggest highlight of the report, showing the effectiveness of business diversification.

Cash flow resilience: $0.7B free cash flow despite declining deliveries, demonstrating cost control ability

Market sentiment showed a clear divergence: undivided investors expressed disappointment at the deterioration of financial metrics (hence the heavy selling ahead of earnings), while long-term investors were more focused on the company's strategic placement in AI, self-driving and energy businesses, and felt that they have Price-in considerable risk for now.

Looking at the after-hours performance, the market is more inclined to accept the narrative of short-term pain for long-term growth potential.

Investment highlights

Automotive business is facing structural challenges

The core issue faced in Q1 was the decline in deliveries, which in turn impacted the overall gross margin. 323,800 units (-12.4% yoy) of Model 3/Y were delivered, compared to 12,881 units of other models, mainly due to the upgrade of the production line of Model Y. However, in terms of unit price, the ASP increased slightly to $40,000 compared to the previous quarter due to the higher starting price of the new version.However, in terms of unit price, the overall ASP increased slightly to $40,000 compared to the previous quarter due to the higher starting price of the new Model Y, which hedges discounts and incentives to a certain extent.

Gross margin for the car sales business, while down 1.1% year-on-year to 12.5%, was considerably higher than the market consensus estimate of 11.8%, which had been overly pessimistic.And the geopolitical risk of the auto business is mainly ringing supply chain costs, especially threatening the energy business (as Megapack uses Chinese-made lithium iron phosphate batteries)

The company has made some strategic adjustments

Accelerated launch of cheaper models (Model 2.5/cheaper Model Y), confirmed that production will start in 2025H1 as planned, adopting a hybrid solution of "existing platform + next-generation platform technology", and utilizing existing production lines to achieve rapid ramp-up of production capacity.Meanwhile, the supply chain localization, Texas lithium refinery and cathode materials plant is expected to go into production in 2025.Also in terms of production optimization, Model 3/Y/ Cybertruck has achieved fully automated driving transportation from production line to shipping area.

Energy Business Becomes New Growth Pole, AI/Robotics Long-Term Strategy Advancement

The biggest highlight of this quarter is the energy business revenue exceeded expectations ($2.73B (+67% yoy)), energy storage deployment 10.4GWh (+154% yoy), Powerwall deployment exceeded 1GWh for the first time, of which the AI infrastructure investment is also driving the demand for energy storage products, and grid stabilization application scenarios to expand.

Tesla's strategic initiatives in this regard are also clearer:

AI-first strategy: Musk emphasizes AI as a "major pillar of growth" and Dojo supercomputer investment is key.

Robotaxi program: launch August 8, 2025, mass production 2026; pilot launch in Austin June 2025

Optimus Robotics: pilot production and deployment of additional working robots at Fremont facility in 2025

Guidance and market divergence

Withdrew its 2025 growth forecast for the automotive business, saying it would update full-year guidance in Q2 and emphasizing the potential impact of "rapidly changing trade policies" and "shifting political sentiment" on demand.Meanwhile, the company maintained its 2025 capex program, but said it would make "prudent, high-value investments."

Market delivery expectations for 2025 have now been lowered to 1.65 million units from 2 million, but will likely rebound +35% in 2026

A few points of concern for the market:

FSD progress, as China's FSD (Supervised) has been rolled out, but the timeline for full driverlessness remains unclear

Whether growth in the energy business can offset the decline in the automotive business, which is still low (14.1%) but growing at a significant pace

Will high capex on AI investment continue to squeeze margins?The company sees this as a necessary upfront investment

In terms of cash flow

Financial Health Highlights:

Generated $2.2B in operating cash flow and $0.7B in free cash flow despite significant earnings decline

Cash reserves increased to $37B, providing ample strategic flexibility

Improved capex efficiency: Free cash flow improved partly due to reduced capex

Risk factors:

Gross margins in the automotive business have declined to 11.83% and further decline could threaten cash flow sustainability

High-investment projects such as AI and Robotaxi may continue to depress margins in the coming quarters

Comments