SAP is one of the few software companies base in Europe, by virtue of its European local identity, enterprise software leadership, to become the core beneficiary of the impact of tariffs in Europe.

In the short term, customer budget shifts and alternative demand will directly drive the growth of its cloud business; long-term need to pay attention to its ability to iterate technology and the sustainability of the European policy landing. $SAP SE(SAP)$

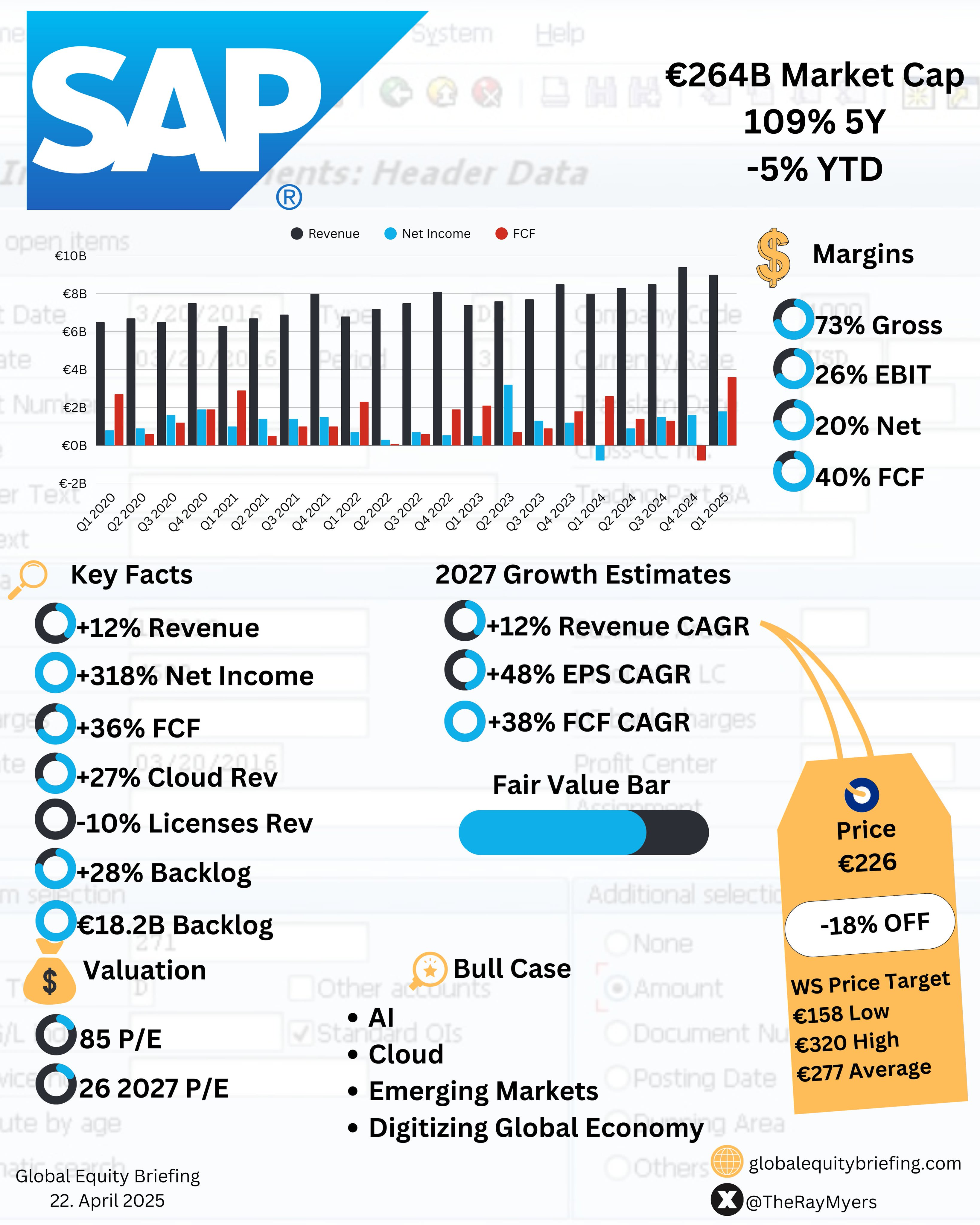

Q1 earnings performance

Q1 of FY25 was a strong performance.Overall revenue and profit beat market expectations.Total revenues of €9.01bn, +12.1% y-o-y (+11% at constant exchange rates), were slightly below analysts' expectations of €9.08bn, but the cloud business shone with €4.99bn, +27% y-o-y (+26% at constant exchange rates), slightly below the market's expectations of €5.04bn.Cloud ERP suite revenue growth was even more impressive at +34% year-on-year (+33% at constant exchange rates)

On the earnings front, adjusted EPS came in at €1.44, significantly higher than the €0.81 recorded in the same period last year and ahead of market expectations of €1.30.The company's net profit was 1.78 billion euros, and non-IFRS operating profit reached 2.46 billion euros, an increase of 60% year-on-year (+58% at constant exchange rates), far exceeding market expectations.IFRS operating profit was 2.3 billion euros.

After-hours market reaction was positive, SAP shares rose about 7% after the earnings announcement, despite a 7.5% decline in the previous quarter and a cumulative decline of 4.4% for the year, the stock has been a solid performer over the long term, up more than 35% over the past 12 months.

Key Info

Cloud Business Continues to Grow at a High Rate and Becomes a Key Driver of Results

SAP's cloud revenue and cloud order backlog (Current Cloud Backlog) grew by 27% and 28% year-on-year, respectively, and the cloud business has reached 55% of total revenue (at constant exchange rates), demonstrating the company's successful transition to a cloud subscription-based business model.Cloud ERP suite revenue grew 34%, reflecting strong customer demand for SAP's core business suite in the cloud.SAP's AI-driven product portfolio helps customers improve efficiency and agility in complex environments such as supply chain disruptions, and is an important strategic direction for SAP's future growth.

Significantly improved profitability and cost control

Non-IFRS operating profit jumped 60% year-on-year, demonstrating SAP's effectiveness in controlling costs and improving profitability while growing revenues, and CFO Dominik Asam emphasized that the company will continue to maintain cost discipline, protect profits and cash flow, and remain cautious in the face of macro-environmental uncertainty.

Rising tide of "European autonomy"

While the company remains vigilant to external risks such as trade friction and exchange rate volatility, which could negatively impact conversion rates and the global economy if the trade war escalates, the company's current earnings guidance has not been adjusted, and the company continues to be optimistic about its full-year growth outlook.

Influenced by the U.S.-China trade war, geopolitical tensions (e.g., the risk of U.S. technology sanctions) and local anti-U.S. sentiment in Europe, European companies and governments are accelerating to reduce their reliance on U.S. technology (especially cloud services, software, and semiconductors) and turn to local or non-U.S. suppliers.

Local European software companies (e.g., Proton, Tuta Mail, NextCloud, etc.) have seen a surge in subscribers, with some enterprises tripling their paid subscriber growth.In addition, the governments of France, Germany, Italy and other countries plan to shift their budgets from U.S. software companies to local European programs.French social media launched a "US software blacklist" campaign, calling for the replacement of Mag7 ( $Apple (AAPL) $ $Google (GOOG) $ $Amazon (AMZN) $ </ a8> $Meta Platforms, Inc.a8> $Meta Platforms, Inc.(META)$ $ $Microsoft(MSFT)$ ) and others.

Guidance is optimistic, and SAP's long-term direct benefit logic

Alternative $ Oracle (ORCL)$ and other U.S. giants, SAP as Europe's largest enterprise software provider (German company), in the field of ERP, cloud computing and other areas of technological autonomy, to become the first choice of European customers to replace the United States of America's products such as Oracle, Salesforce.European customers (about 30%) explicitly requested to switch to European vendors, SAP may seize Oracle's market share.

SAP's Cloud Revenue growth guidance for 2025 (26-28% constant currency) exceeded market expectations, and the stock surged after hours, indicating that investors are optimistic about its growth potential under the European autonomy trend.

SAP's B-side customer base will be further strengthened as European government budgets are skewed in favor of local companies, and companies are taking the initiative to replace U.S. software due to "data sovereignty" and "supply chain security".

Risk point:

Technological capabilities: SAP needs to continuously improve the competitiveness of its cloud services (e.g. SAP S/4HANA Cloud) in order to fully replace U.S. cloud infrastructures such as AWS and Azure.

Ecological barriers: Some European companies still rely on the U.S. software ecosystem (e.g., Microsoft Office), and full migration will take time.

Comments