$ServiceNow(NOW)$ Strong Q1 FY2025 Earnings Performance Drives Shares Significantly Higher After HoursCore Insights

Growth resilience highlighted: management raised guidance despite cautious IT spending environment, reflecting deep product moat (RPO +24% YoY to $18B).

AI commercialization speeding up: from "technology story" to actual revenue generation, 2025 may be the inflection point of AI contribution.

Strong upgrade guidance: current demand resilience exceeds expectations, customers regard ServiceNow as a "must-have" rather than an optional tool.If the economic downturn leads to a contraction of corporate IT budgets, it may affect the pace of expansion of small and medium-sized customers (current revenue concentration: Top 50 customers account for 35%).

Performance and market feedback

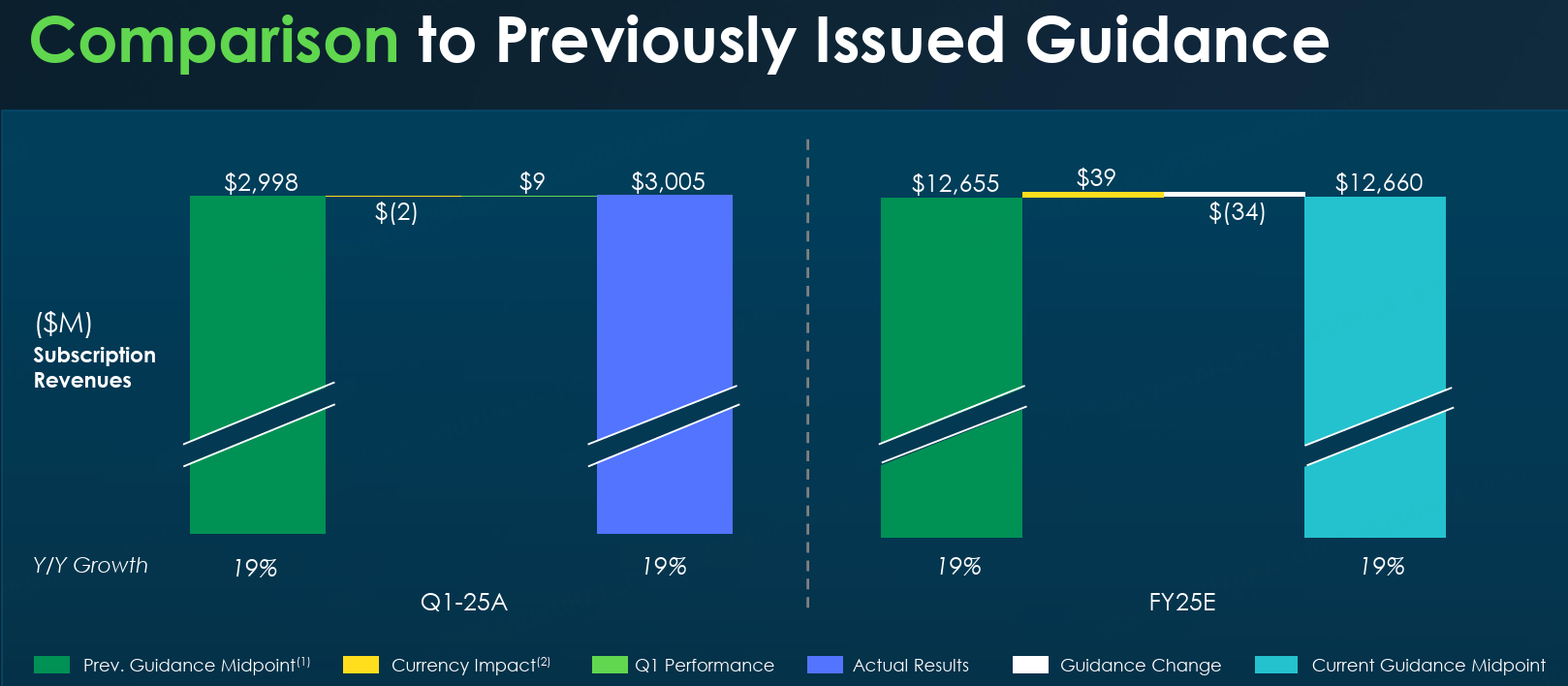

The company achieved subscription revenues of $3,005 million, up 19% year-on-year (up 20% at constant exchange rates), with total revenues reaching $3,088 million, up 18.5% year-on-year (19.5% at constant exchange rates)

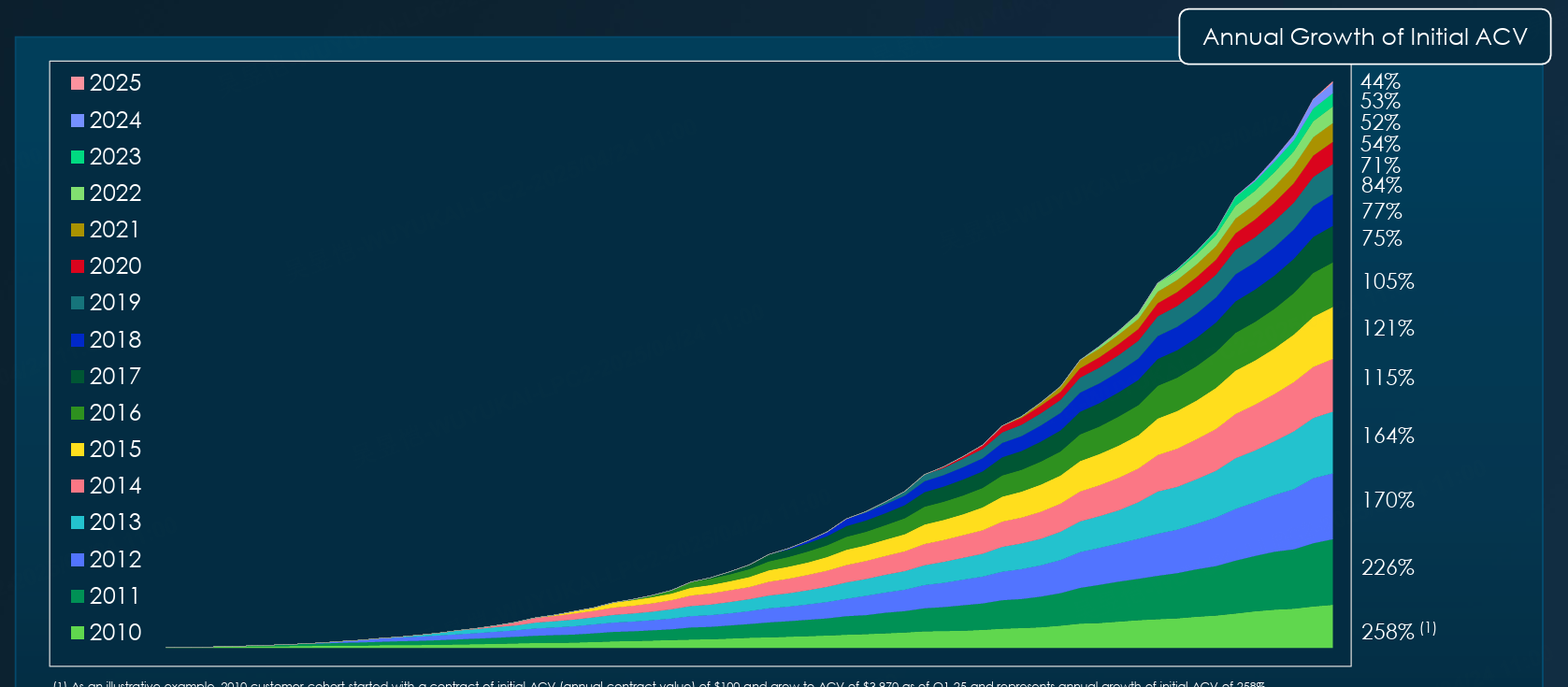

Current Remaining Performance Obligations (cRPO) of $10.31 billion, up 22% year-over-year, and overall Remaining Performance Obligations (RPO) of $22.1 billion, up 25% year-over-year.The company's customer base continues to expand, with the number of customers with more than $5 million in annual contract value (ACV) reaching 508, an increase of approximately 20 percent year-over-year

In terms of profitability, non-GAAP operating margin reached 31%, an improvement of approximately 50 basis points year-over-year, and free cash flow ratio improved to 48%, demonstrating improved operational efficiency and cash flow position.Non-GAAP net income increased to $846 million from $707 million a year ago, and non-GAAP diluted earnings per share increased to $4.04 from $3.41.The market reacted positively to the earnings report, with shares up nearly 9% in after-hours trading and about 6% during the day

Management emphasized that ServiceNow's leading position as an enterprise-grade AI platform is the key to the outperformance, with the platform helping customers transform their businesses and improve operational efficiency and agility, especially in the current uncertain environment where customers are more focused on ROI and cost control, which ServiceNow's AI capabilities are well suited to address

Investment Highlights

Exceeded Revenue and Earnings Growth: ServiceNow Q1 2025 subscription and total revenues exceeded company guidance and market expectations, with subscription revenues up 19% year-over-year, and non-GAAP net income and EPS up significantly, demonstrating the robustness of the company's business model and improved profitability.

Strong contract signings and customer expansion: 72 new high-value contracts exceeding $1 million were added in the quarter, setting a new record for net new ACV, and 508 customers with annual contract values exceeding $5 million continued to improve in customer quality and scale, enhancing visibility into future revenues, while maintaining a 98% renewal rate for the fifth consecutive quarter, reflecting customer satisfaction with ServiceNow's products and services.Maintained 98% customer renewal rate for the fifth consecutive quarter, reflecting customers' high level of reliance on and satisfaction with ServiceNow's products and services, and reducing the risk of customer churn.

Remaining Performance Obligation (RPO) growth: cRPO and total RPO grew 22% and 25% year-on-year, respectively, exceeding guidance, demonstrating a solid revenue base for the next 12 months and beyond, and continued momentum for business growth.

AI-driven business transformation and operational efficiency: CEO Bill McDermott emphasized ServiceNow's status as the "platinum standard" for enterprise-grade AI platforms to drive customers' digital transformation, and CFO Gina Mastantuono noted thatAI technology not only helps customers, but also improves the company's own operational efficiency, resulting in higher profitability and cash flow.

Diversification of business structure: The share of net new ACV contributed by Technology Workflows slightly decreased to 48%, while the share of CRM, industry and core business workflows increased to 34%, demonstrating the company's success in expanding from IT service management to a broader range of enterprise workflows and broadening the room for growth.

Strong guidance upgrade: FY2025 subscription revenue guidance was raised to $12.64 billion to $12.68 billion, up 18.5%-19% year-over-year, with Q2 subscription revenue expected to be in the range of $3.030 billion to $3.035 billion, up 19%-19.5% year-over-year.Management expressed confidence in the continued momentum of AI-driven solutions, emphasizing its role in achieving the company's goal of 20% CAGR through 2026.

Earnings Call Discussion

Question 1: Drivers for 2025 Subscription Revenue Guidance Increase to $12.68B (+19.5% yoy)

Management Response:

Key drivers include product innovation (e.g. Now Intelligence, an AI-powered process automation tool) and cross-industry penetration (financial, healthcare, government, etc.).

Significant growth in large customers, with the number of customers with annual contract value exceeding $1M +20% YoY, and the rate of incremental purchases from existing customers continues to increase.

Question 2: Is macroeconomic uncertainty affecting customers' budget decisions?

Management Response:

Current demand is more resilient than expected, with customers viewing ServiceNow as a "must-have" rather than an optional tool, as it directly optimizes operational efficiency (e.g., 30%+ reduction in IT work order processing time).

The contract term structure is stable, with long-term contracts accounting for more than 75% and renewal rates >99%.

Question 3: Progress in monetizing AI features

Management Response:

AI add-ons are already contributing low single digit % incremental revenue in Q4, targeting to ramp up to mid to high single digits by 2025.

Case in point: a retail giant saves $15M/year in labor costs with AI work order categorization tool.

Comments

Thanks