$Lam Research(LRCX)$ 2025Q3 Earnings Outperform, Revenue and Earnings Significantly Beat Expectations, Operational Efficiency and Gross Margin Improvement Significantly, Capital Expenditures Accelerate Layout for the Future, and the Company is Optimistic for Subsequent Quarters.

Core view

Dual-engine growth: NAND technology upgrade (+40% QoQ) and logic chip advanced process (foundry revenue +15% YoY) together drive performance beyond expectation.

Gross margin resilience: supply chain management capability is highlighted, but may face $200M-$300M/QoQ inflationary cost pressure in the future.

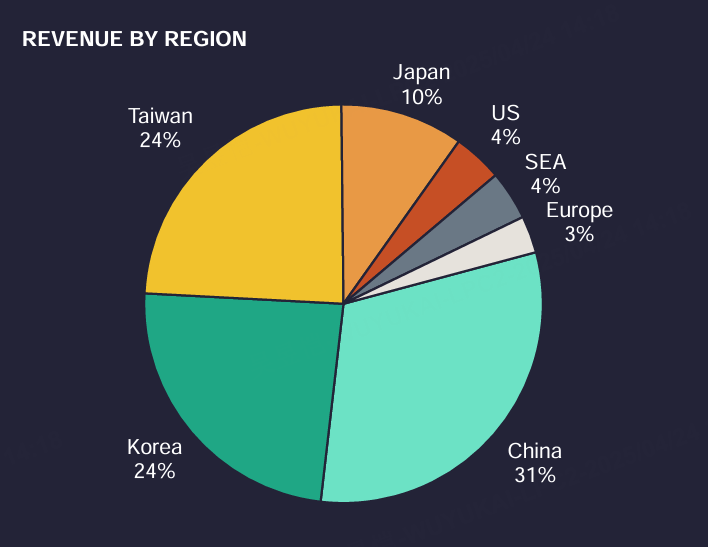

Geo-balancing: China market revenue share is stable, showing the company's ability to flexibly deal with export control.

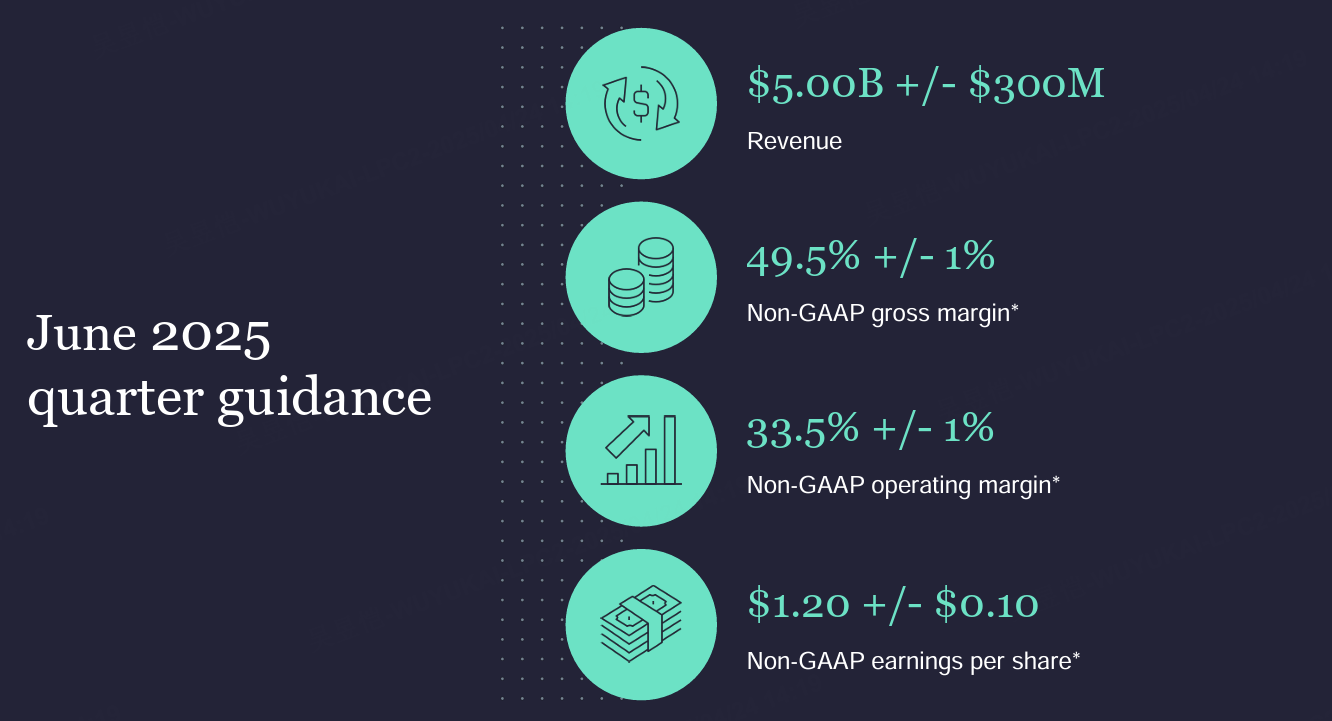

Guidance caution: 25Q4 revenue guidance of $5.2B±0.3B (implied +8% QoQ) is lower than some analysts' expectation of $5.5B, reflecting early warning of memory customers' capex volatility.

Key risk point: If NAND prices fall back in 25H2, it may cause customers to delay equipment orders, affecting 26H1 revenue growth.

Performance and market feedback

Revenue reached $4.72 billion, up 24% year-over-year ($3.79 billion in the same period in 2024), beating market expectations of $4.64 billion; gross margin reached 49.0%, up from 48.7% in the same period last year and ahead of the market's expectations of 48% Net income was $1.33 billion, a significant increase of approximately 38% from $966 million in the same period last year;GAAP EPS of $1.03 exceeded the market consensus estimate of $1.00

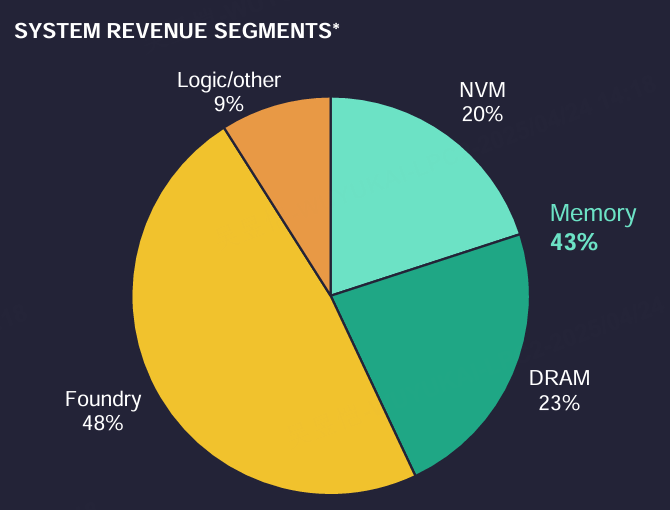

System equipment revenue increased 27% to $3.04 billion, exceeding expectations of $2.89 billion and reflecting strong demand for semiconductor equipment; customer support and other services revenue increased 21% to $1.68 billion, slightly below expectations of $1.72 billion.

In addition, capital expenditures increased significantly to $288 million, far exceeding the $104 million reported in the same period last year and the market's expectation of $145 million, demonstrating the company's aggressive expansion and investment in the future.

Investment highlights

Earnings exceeded expectations with clear drivers

Lam Research's revenue and earnings for the quarter exceeded market expectations, driven by strong demand for semiconductor manufacturing equipment, especially continued investment in key process equipment such as deposition and etch.The 27% year-on-year growth in system equipment revenue and solid expansion of customer support services demonstrated the company's competitive product portfolio and high customer stickiness.

Improved Gross Profit Margin and Operational Efficiency

Gross margin improved to 49.0% and operating margin reached 32.8%, both better than market expectations, reflecting Lam's progress in cost control and operational efficiency.The company cited the highest gross margin since the merger with Novellus, demonstrating significant integration benefits and solid technology leadership.

Capital Expenditures Surge, Positioning for Future Growth

Capital expenditures nearly doubled year-over-year to US$288 million, far exceeding analysts' estimates, indicating that the company is investing more in capacity expansion and technology R&D to cope with the complexity and high-end demand of semiconductor manufacturing processes in the future

Positive guidance signals continued growth

The Company's fourth quarter fiscal 2025 revenue guidance of approximately $5.0 billion (±$0.3 billion) and net income per share estimate of $1.20 (±$0.10) both demonstrate confidence in the future growth of the business.Based on the current diluted share count of 128 million shares, profitability is expected to continue to improve

Conference Call Discussion

Question 1: Sustainability of NAND demand recovery?

Management Response:

Emphasized that the NAND industry is undergoing a "technology upgrade cycle", with customers accelerating their migration to 200+ layer 3D NAND, driving equipment demand.

NAND capex is expected to remain stable over the next 2-3 quarters as customers balance capacity expansion and technology upgrade needs.

Question 2: Are the drivers of the record foundry business dependent on a single customer (e.g. TSMC)?

Management Response:

Growth is driven by the "Global Logic Chip Advanced Process Race" covering 3nm/2nm nodes and GAA (Surrounded Gate Transistor) technology.

Diversified customer base, including leading foundries and IDMs (Integrated Device Manufacturers), with no specific customer share disclosed.

Question 3: Bottleneck in gross margin expansion, 25Q3 gross margin improved 1.5pp YoY to 47.8%, can it be sustained in the future?

Management Response:

Cost control and product mix optimization (higher share of high margin products) are the main reasons.

Warning that "supply chain inflationary pressures" may limit further expansion, targeting long-term gross margins at 45%-48%.

Question 4: China market exposure (~30% of total 25Q3 revenue), impact of US export controls?

Management Response:

Partially licensed to continue supplying mature process equipment to customers in China.

Compliance will be maintained in the long term, but China remains a "key strategic market".

Comments

.