Gold is really too fierce for a while, the past year directly up 50%, sitting on the "most beautiful boy" throne.In the face of this strong performance, has been 3300 U.S. dollars / ounce price, the price of the yuan close to 1100 yuan, many people began to entangle an old problem - is it time to sell gold?

Unlike stocks, bonds can rely on PE, price-earnings ratio, interest rate pivot, CPI and other indicators to assess the "fair value" of gold, gold is a hard currency without income, valuation standards, to put it bluntly, is to look at the market atmosphere and macro expectations.

From the historical point of view, the gold price has been in the high, but not to the limit!

Historically it's not uncommon for gold to rise 2-4 times after a few key breakouts.Like 1972, 1978, 2008, these time points after a few years, the price of gold are taking off in place.

If you are a medium to long term investor, to 2-3 years as a cycle, this kind of big market you can hold "sit and wait for $4000" idea.After all, this wave of the market from the technical and fundamental point of view, indeed not yet come to an end.

Interest rates, the economy, geopolitics: these indicators haven't reversed yet

So when is the signal to sell?We have to keep an eye on a couple of old friends:

Real interest rates.Gold tends to peak when real interest rates "turn negative".Now that U.S. real interest rates are still positive, gold has yet to come under real pressure.

Recession signals.Things like unemployment over 6%, rapid cooling of the economy, and the like are not clearly coming at the moment.Going by history, gold generally tops out when the economy is at its worst.

Relative to the rise in stocks.Gold outperforming stocks by too much is also a sign to be wary.Currently the gold stock ratio is about 62%, although the rise, but from the historical high of 135% ~ 492% there is a lot of space.

In addition, some people like to take gold as a "real asset", take it and real estate comparison.Historically, gold relative to real estate rose more than 100% of the time is often the top. 2024 wave only 72%, said "overheated" is still too early.

Funding: still far from "crowded"

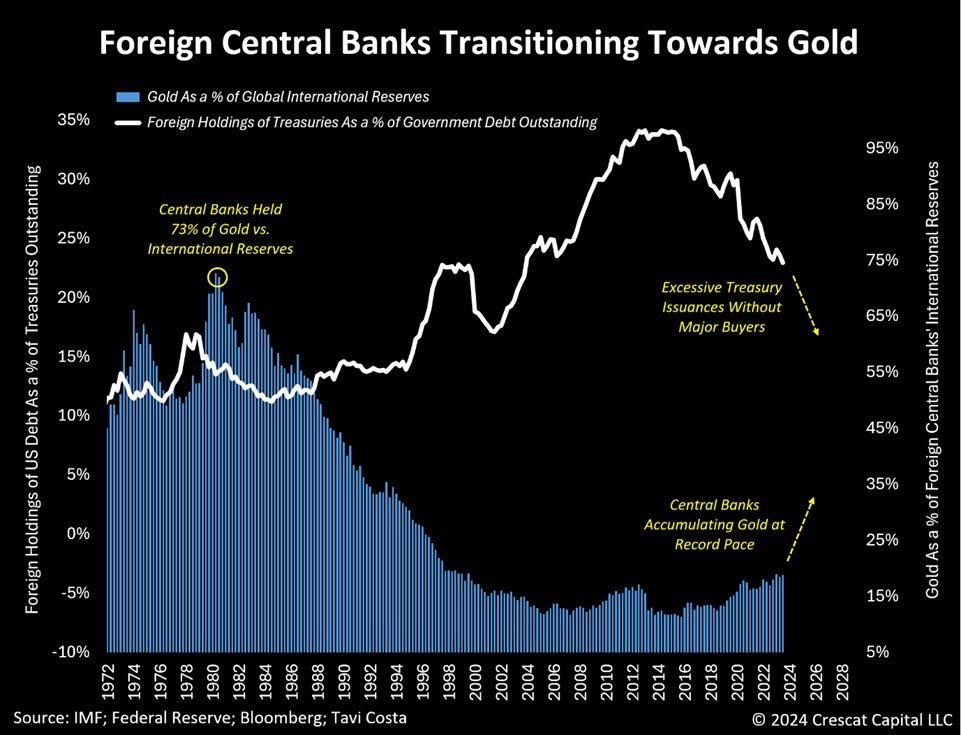

The allocation to gold is now about 0.7% of global funds, which is very low.Even taking into account exposure to ETFs and futures, etc., it's 2-4%, which doesn't compare to the peak in 2012-2013.And central bank holdings have yet to reach historical levels.

That is to say, now this wave of capital into the enthusiasm is not "bubble".Look at China's insurance companies began to pilot gold investment quota, the industry's total assets of 20 trillion, even if 1% to invest in gold, the inflow is also huge.Behind this is real new money, not speculate a handful of hot money to run.

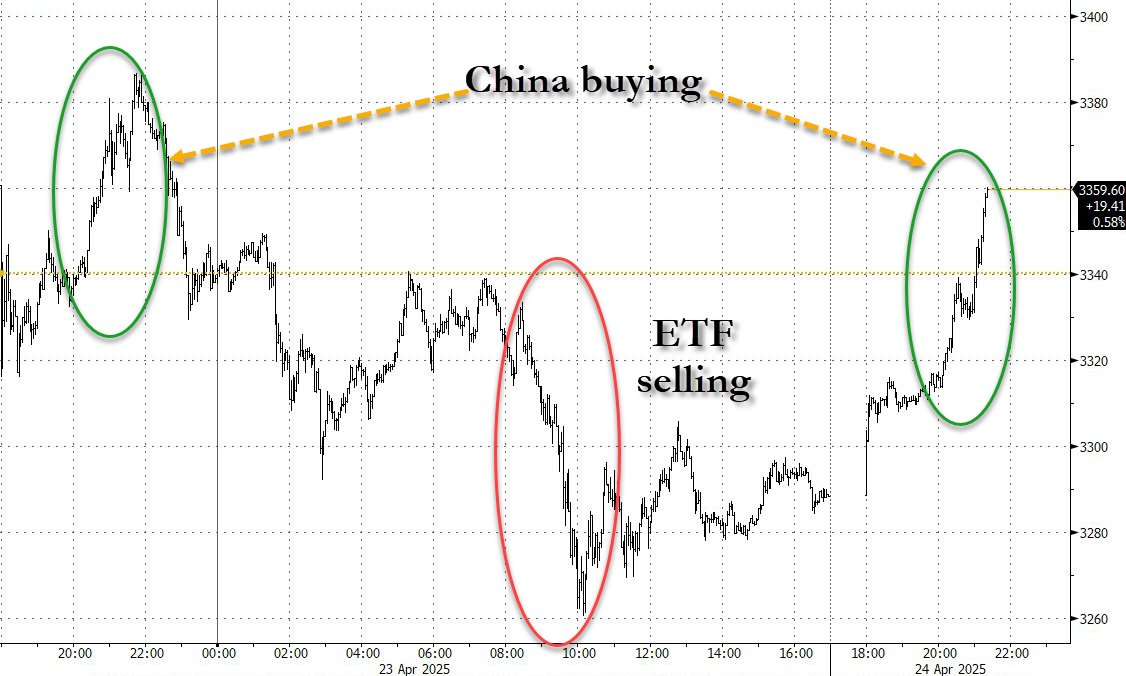

A couple of sharp pulls in the last few days have also seen the entry of Chinese money:

The possibility of a pullback in gold can't be ignored

Although the overall trend is still dominated by the bulls, but the risks are really piling up.Every time the market is too consistent, such as when everyone shouts "gold is going up", but be careful.

What could trigger a pullback?For example, the stock market suddenly diving lead to the return of funds, geopolitics suddenly cooled down, the Fed and Trump's tensions ease ...... these breaking news will cause a short-term impact on the price of gold.

Moreover, too much "fast money" will also pull up volatility.Once sentiment reverses, those short-term funds will withdraw very quickly, resulting in a short-term price decline.

Summarize: should I sell?

If you are a short-term speculator, this time you can start part of the bag for peace, at least the principal back to stay profits continue to rise;

If you are the medium and long term configuration, the market is still in the starting phase, the structural bull market may not be finished, you can continue to hold, the appropriate opportunity to increase the position is not unavoidable.

The key lies in your strategy and risk tolerance.Gold this kind of asset, itself no "reasonable valuation", all rely on the environment to determine the direction.So, in the end, sell or not sell gold, not a "now is not a high point" can decide, but whether you have for the rise can also fall asleep, fall also not panic position preparation.

$S&P 500(.SPX)$ $Cboe Volatility Index(VIX)$ $NASDAQ(.IXIC)$ $SPDR Gold Shares(GLD)$ $Barrick Gold Corp(GOLD)$ $Newmont Mining(NEM)$

Comments