$Alphabet(GOOG)$ earnings jumped 5% after the bell, mainly to address three market anxieties:

The impact of AI on the advertising business is not reflected in the results, the loss of market share is really excessive concern

Capital expenditure expenditure maintenance, AI competition continues, maintain the guidance of hardware manufacturers $Taiwan Semiconductor Manufacturing(TSM)$ $NVIDIA(NVDA)$

E-commerce advertising will have an impact, but too much billing, DMA antitrust case has a program and has been accrued, the extent of which remains to be seen, and not as pessimistic as the market billing

Performance and market feedback

Announced strong FY2025 Q1 results that beat market expectations, driving shares up over 3%-4% after hours.

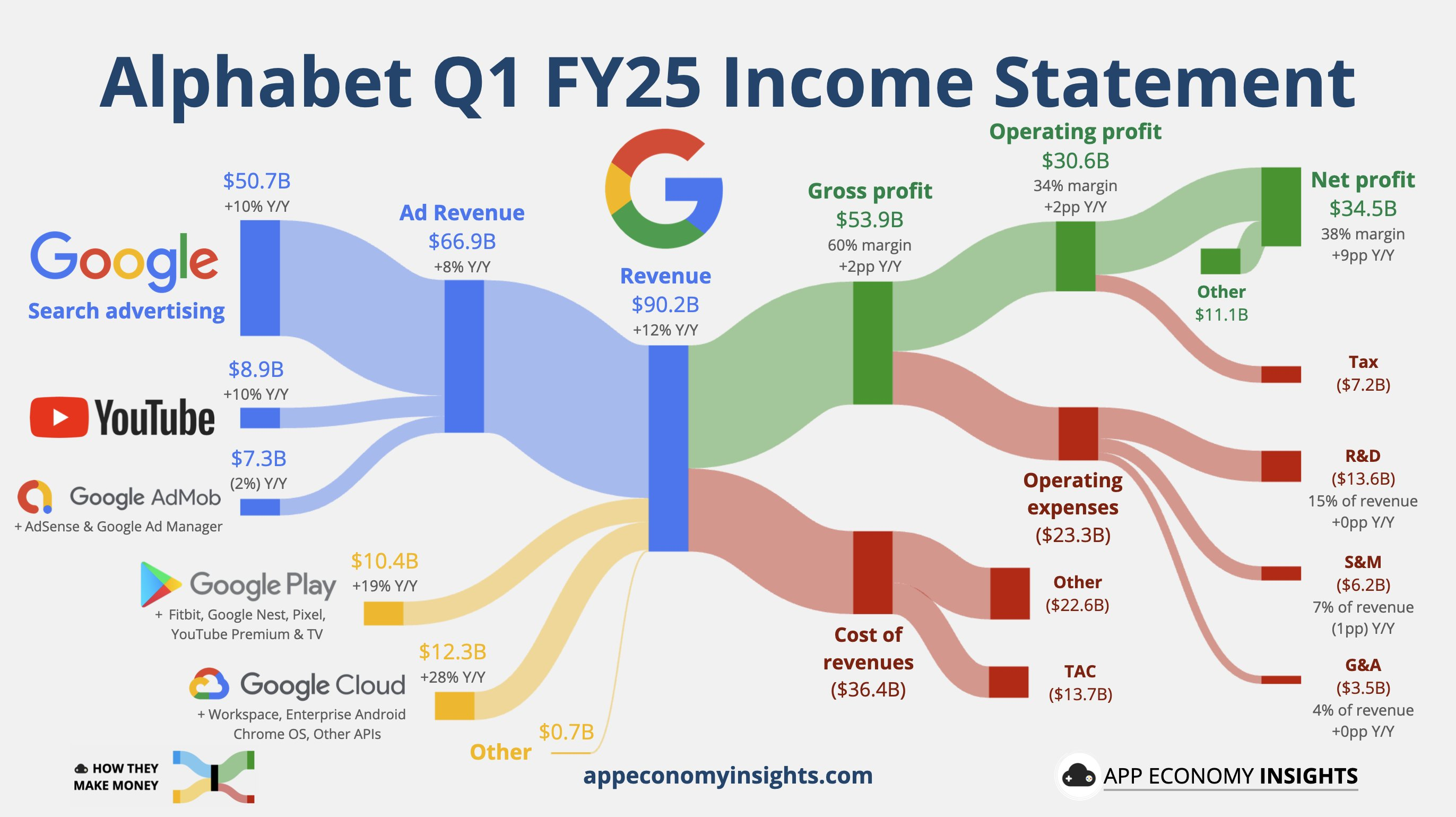

Total revenue reached $90.2B, up +12% YoY (+14% in constant currency), higher than the market consensus estimate of $89.1B; operating profit of $30.6B, up +20% YoY, with operating margin improving from 32% to 34%; net profit of $34.54B, up +46% YoY, with a large contribution from non-operating investment income; and diluted EPS of $2.81.Diluted EPS $2.81, up +49% YoY, far exceeding market expectations of $2.01.

In terms of revenue classification, advertising revenue of $66.8B, slightly higher than the expected $66.4B, of which Google Search advertising revenue of $50.7B, YouTube advertising revenue of about $8.9B, a year-on-year growth of about +10%; Google Cloud revenue of $12.26B, a year-on-year growth of +28%, although slightly lower than the market expectation of $12.3B, the operating profit of $2.18B exceeded the expectation of $1.94B, showing improved profitability.However, operating profit of $2.18B exceeded expectations of $1.94B, indicating improved profitability.

The announcement of a 5% increase in the quarterly cash dividend to $0.21 and the re-approval of a share buyback program of up to $70B demonstrated the company's confidence in its future performance and cash flow, resulting in a return to shareholders of more than 4%.

The market reacted positively to the results, and the actual "expectation gap" has been reduced after the market sharply lowered earnings estimates over the past month, so it has outperformed the market's pessimistic expectations in the after-hours, and has risen significantly.

In addition, investors are optimistic about the company's AI-driven growth prospects and overestimated the impact of Q2 cross-border e-commerce, so "it's too early to comment", suggesting that the market's previous sell-off was "overpriced".

Investment highlights

1. AI-driven growth momentum across the board

CEO Sundar Pichai emphasized that Q1's strong performance was driven by the company's unique "full-stack AI strategy," especially the newly launched Gemini 2.5 AI model, which has achieved a major performance breakthrough and is widely recognized as the most advanced AI model in the industry, laying a solid foundation for future innovation.

Gemini 2.5 is used in 15 Google products, each with more than 500 million users.

AI Overviews reached 1.5 billion monthly active users, driving continued strong growth in the search business.

AI has significantly improved internal development efficiency, with more than 30% of employees using AI-suggested code, demonstrating the depth of AI technology penetration.

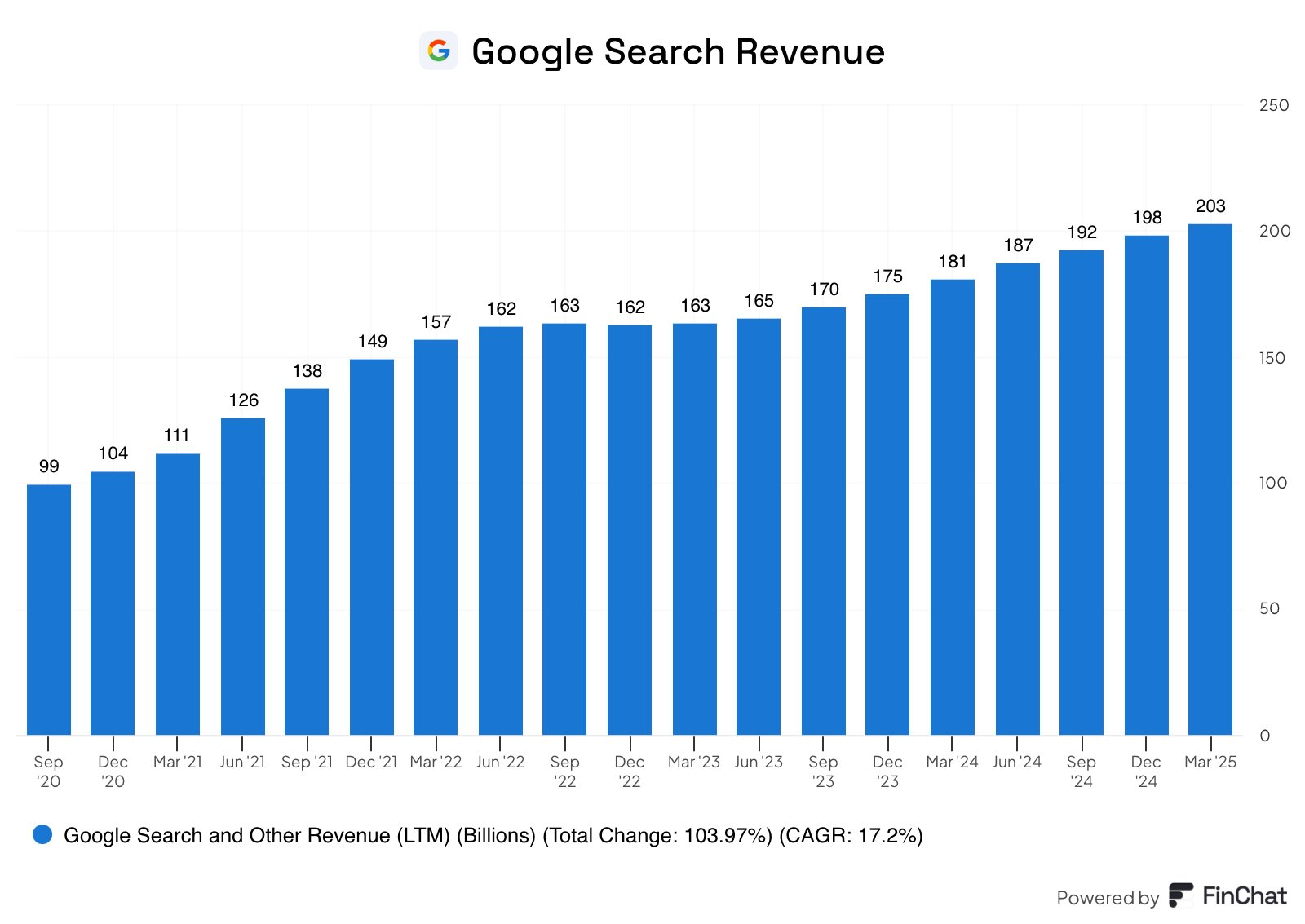

2. Search and advertising business continued to be solid

Google Search ad revenue grew by +10% YoY to $50.7B, which continues to be the main revenue driver of the company, while YouTube ad revenue grew by +10% YoY to $8.9B, which is slightly lower than expected but still a good performance.Previously, the market's expectation for YouTube was higher, also due to last year's high growth and high base, and Nielsen's survey showed that YouTube's hourly market share is still the number one.

Overall advertising revenue of $66.8B exceeded expectations, showing that the demand for digital advertising is still strong, and a more important reason is that the impact of brand advertising tends to be more backward, and the most likely to be affected by the conversion of e-commerce and other very high demand for instant consumer advertising.

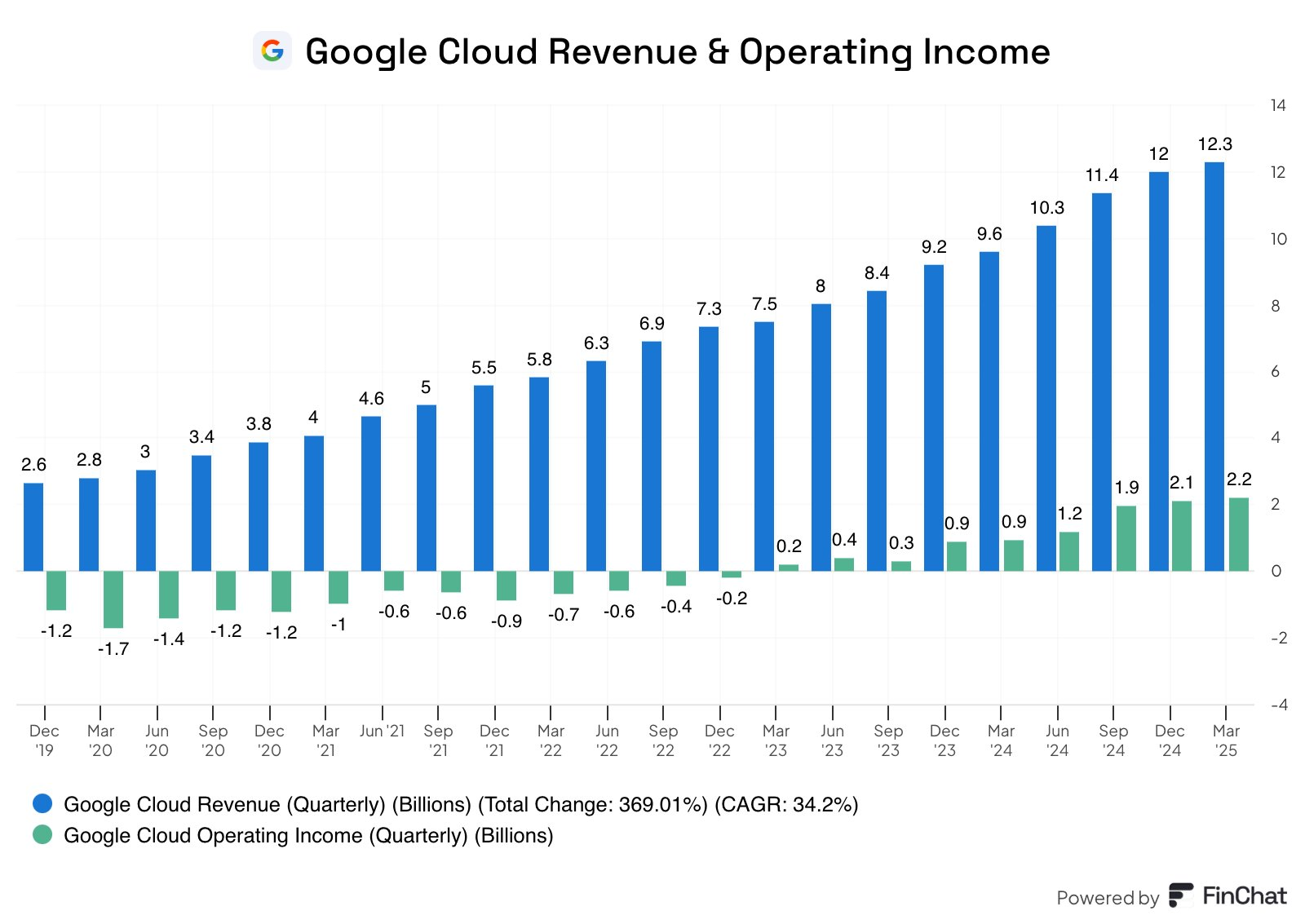

3. Google Cloud High Growth and Profitability Improvement

Cloud revenue +28% YoY to $12.26B, growing rapidly, reflecting strong customer demand for Google Cloud infrastructure, AI infrastructure and generative AI solutions.Outstanding contract value grew 26% YoY, which, while still maintaining a high growth rate, has slowed down from earlier (and also slightly worse than the hot expectations).

In the short term, the slowdown in growth may be mainly due to supply-side constraints, with some customers failing to respond to demand in a timely manner and order advancement being suppressed to a certain extent, and, of course, the impact of the general environment is also a reason for customers to be cautious at present. $Microsoft(MSFT)$ $Amazon.com(AMZN)$

Nonetheless, the market as a whole remains optimistic about the growth prospects of Google's cloud business, benefiting from the continued drive of AI-related applications.

Cloud operating profit of $2.18B, far exceeding market expectations, indicating significant improvement in cloud profitability.

CFO confirmed that capex will reach $75B in 2025, a significant increase from last year, indicating the company's continued heavy investment in cloud and AI infrastructure

4. Other Businesses and Challenges

Losses in Other Bets widened from $1.02B to $1.23B and remained unprofitable.

Several antitrust cases: the company is under pressure from a U.S. federal court ruling that its online advertising business has an illegal monopoly, and may face a business split or restructuring, with short-term regulatory uncertainty;

The impact of the EU's Digital Marketplace Act (DMA) on the search business.Management indicated a short-term decline of ~5% in European search traffic, but no significant fluctuations in advertisement cost-per-click (CPC), and with compliance programs in place (e.g., user selection of default search engine), the impact of the regulation is expected to be decreasing on a marginal basis.Q1 antitrust litigation provision of $3B has been accrued (<2% of cash reserves)

Google's digital advertising market performance amidst macroeconomic uncertainty and trade policy impact, advertising growth is expected to likely slow down next quarter, but the growth potential of AI and cloud business, there is still huge room for growth, the monetization rate of AI Overviews is stable, and is expected to become a new growth point of advertising revenue in the future (and also an important measure to fend off the competition for entrances to platforms such as OpenAI).

Comments