Big-Tech’s Performance

Weekly macro storyline: Powell’s “Rate Cut” Mini-Drama

Trump repeatedly pressured Powell with inflammatory comments and even threatened to replace him, triggering a market “panic” at the start of the week. As Treasury Secretary Bessent clarified in his speech on April 23: “America First” doesn’t mean “America Alone.” Trump later softened his tone (backed off?) and stated he had no intent to replace Powell. This easing of tension helped fuel the market’s sharp rebound in subsequent days. The core of Trump’s message was a call for rate cuts, which ironically aligns with current market sentiment.

Why does the market also want rate cuts? Because the clear shift in trade policy is expected to impact the real economy in Q2 and beyond. Both corporate profits and consumer confidence may decline. If the Fed sticks to a tight monetary policy out of caution, market sentiment could take a further hit. Even if trade tensions ease, a major rollback seems unlikely. Thus, while the market may rebound, it’s unlikely to fundamentally restore confidence. Meanwhile, the PE sector is beginning to face liquidity issues due to Trump’s pressure and declining returns, with institutions like Yale and Harvard starting to offload private equity assets.

This week saw a flood of earnings results. Despite low expectations, post-earnings market responses were generally not “too pessimistic”—a key feature of this earnings season.

Big Tech stocks also rebounded from lows. Tesla and Google surged post-earnings, reflecting mean reversion after overblown negativity.

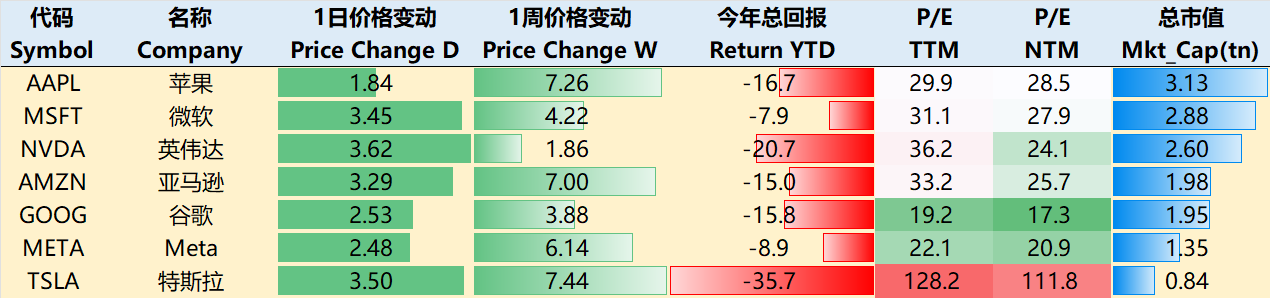

By the close of trading on April 24th, most of the big tech companies rallied over the past week.Among them $Apple(AAPL)$ +7.26%, $NVIDIA(NVDA)$ +1.86%, $Microsoft(MSFT)$ +4.22%, $Amazon.com(AMZN)$ +7%, $Alphabet(GOOG)$ $Alphabet(GOOGL)$ +3.88%, $Meta Platforms, Inc.(META)$ +6.14%, $Tesla Motors(TSLA)$ +7.44%

Big-Tech’s Key Strategy

Google Earnings: The Market Over-Worried

Google reported strong Q1 results after the April 24 close, jumping 5%:

Total revenue: $90.2B, up 12% YoY (14% in constant currency), beating consensus of $89.1B

Operating profit: $30.6B, up 20% YoY, margin improved from 32% to 34%

Net profit: $34.54B, up 46% YoY, with significant gains from non-operating investments

With expectations already lowered in recent weeks, these results were better than anticipated.

Three key takeaways comforted the market:

Ad Resilience > Industry Worries

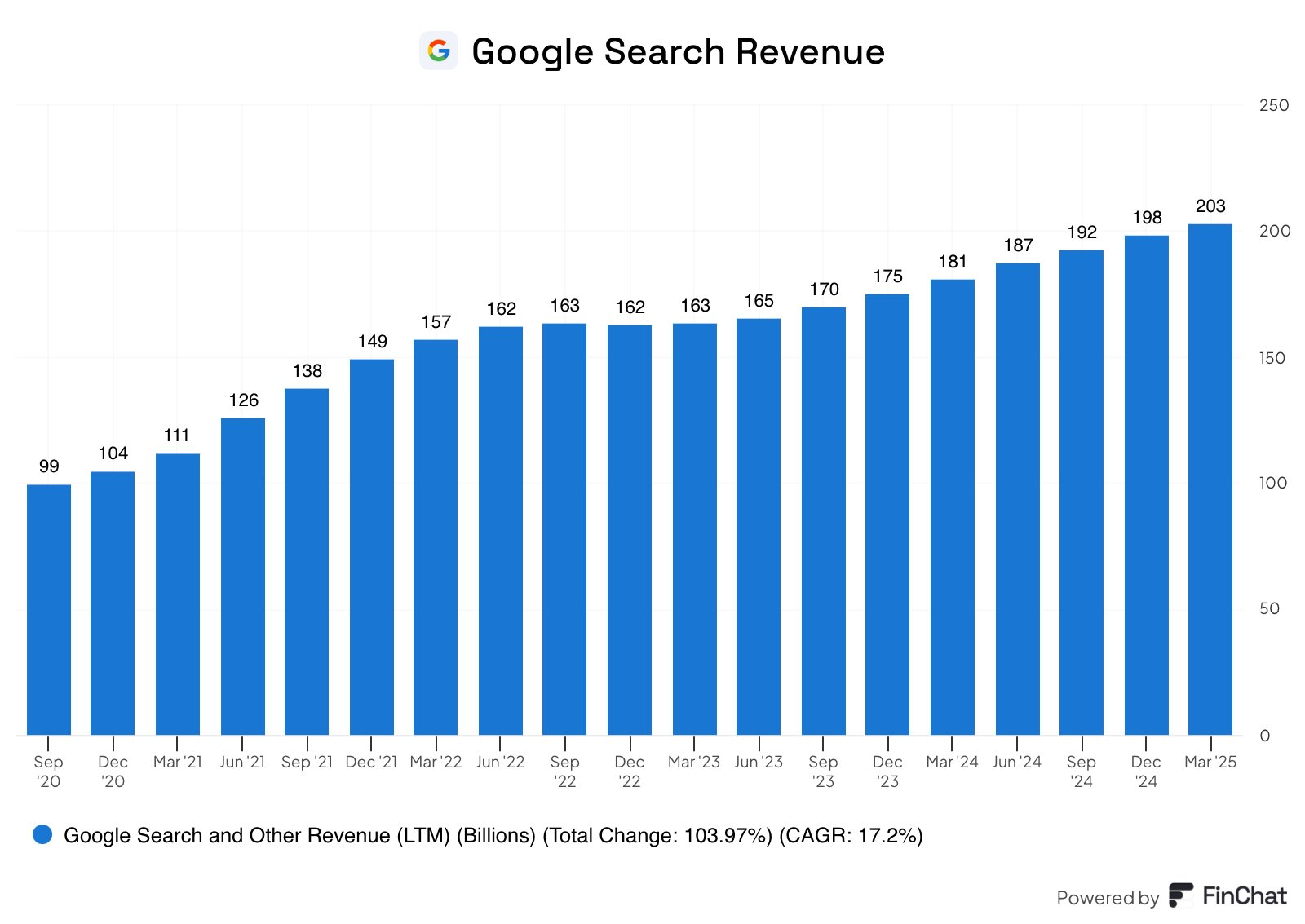

AI’s impact on Search hasn’t shown in earnings yet: Google Search ad revenue rose 10% YoY to $50.7B.

Despite the long-term threat from platforms like ChatGPT, the actual marketing effect is still limited. AI Overview boosts user engagement.

E-commerce ad cuts had minimal impact as Google Search ads are mostly brand-focused, less sensitive to short-term consumer shifts.

YouTube ads slightly missed expectations but still grew 10% YoY. The high bar from last year amplified concerns.

AI Growth Still Core; Capex Commitment Boosts Hardware Confidence

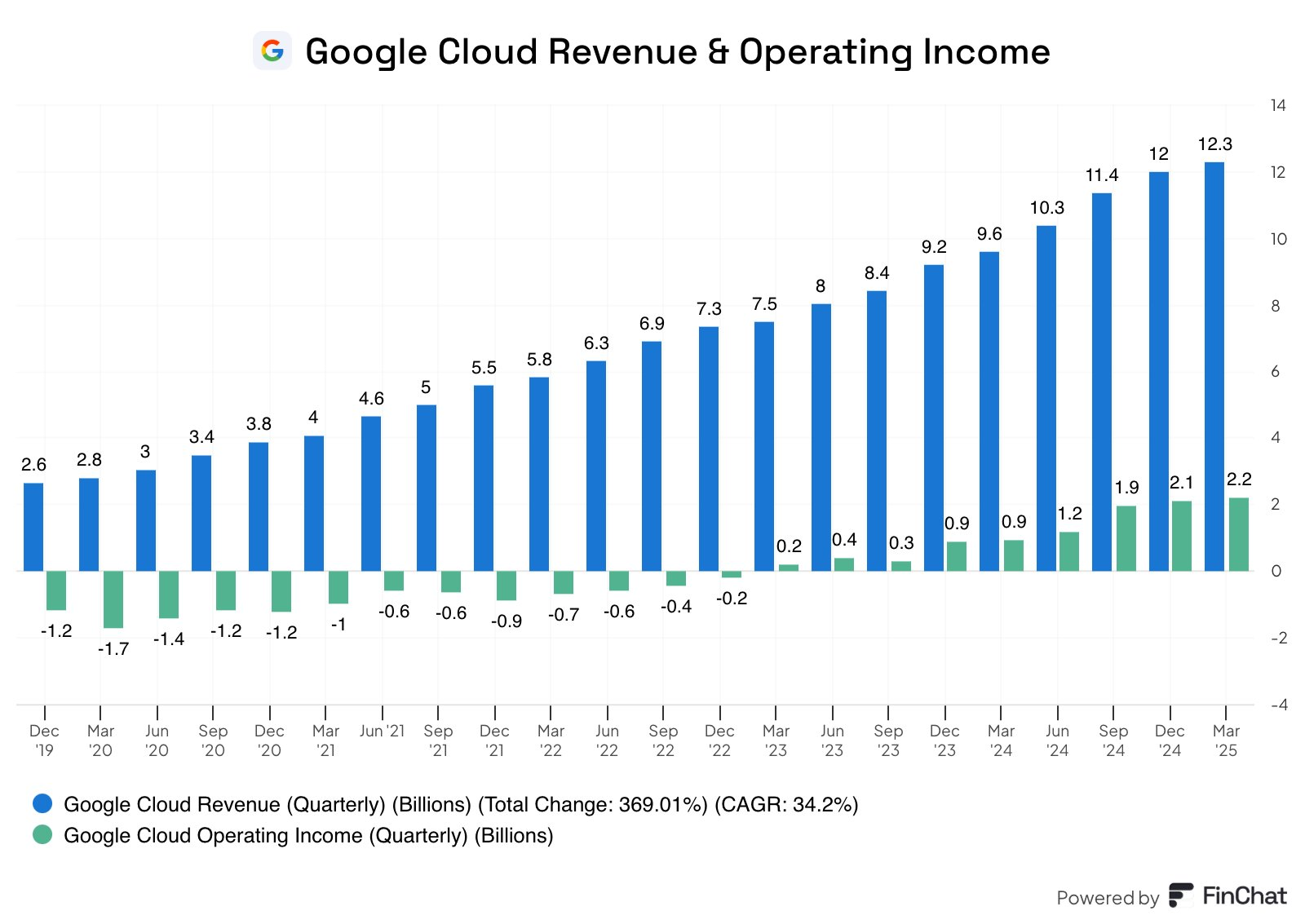

GCP revenue rose 28% YoY to $12.26B—helping offset previous infra shortcomings. Slightly below expectations but close to surpassing AWS.

Profit margin improved to 17.8%. Contract backlog growth slowed (26% YoY vs 30% in Q4).

Margin may rise further (towards AWS’s 30%), though macro uncertainty and server shortages are near-term risks.

Capex guidance for 2024 held at $75B. Though debated, it reinforces Google's AI moat. ROIC is 32%, so the market remains optimistic.

Antitrust Cases Managed; Strong Cash Flow and Shareholder Returns

Potential U.S. divestitures may be eased under Trump’s expected lax regulatory stance.

European DMA law poses risks but Google has begun compliance steps (e.g., letting users choose default search engines).

Search traffic in Europe dipped ~5%, but CPC (ad pricing) remained stable.

Google set aside $3B for antitrust litigation (under 2% of cash reserves).

Q1 free cash flow: $19B. Raised quarterly dividend by 5%, and approved up to $70B in share buybacks—showing confidence in earnings and cash flow.

Shareholder return exceeds 4%

Big Tech Options Strategy

Focus of the Week: AAPL’s Problems Go Beyond Tariffs?

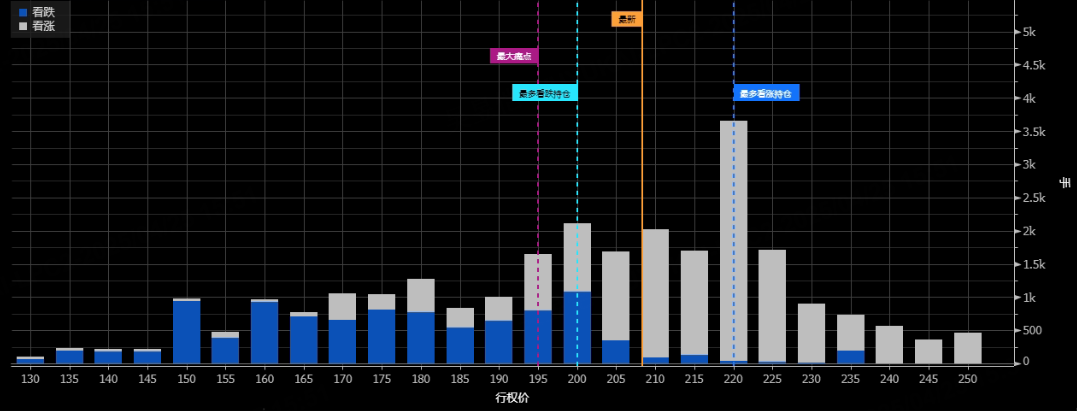

Based on upcoming expiring options, the market is divided on AAPL:

For expiries on May 2 (earnings week) and May 9, there’s heavy PUT open interest around the $180 strike—suggesting caution about earnings.

For May 16 and May 23 expiries, PUTs concentrate around $200, reflecting more optimism.

That said, Apple’s issues run deeper than tariffs:

Slow progress in AI

Poor Vision Pro sales

Delayed Siri updates These reveal internal disarray in tech strategy (frequent LLM strategy changes) and weak execution. The AI team is mocked as "directionless."

Tensions between the dominant software engineering group and the fragmented AI team worsen the situation. Budget constraints drag down R&D. Apple Intelligence may not launch until late 2026, putting its innovation image and tech edge at risk.

In the short term, some investors may bet on tariff easing—especially for AAPL’s supply chain. But long-term performance still hinges on AI execution.

Big-tech Portfolio

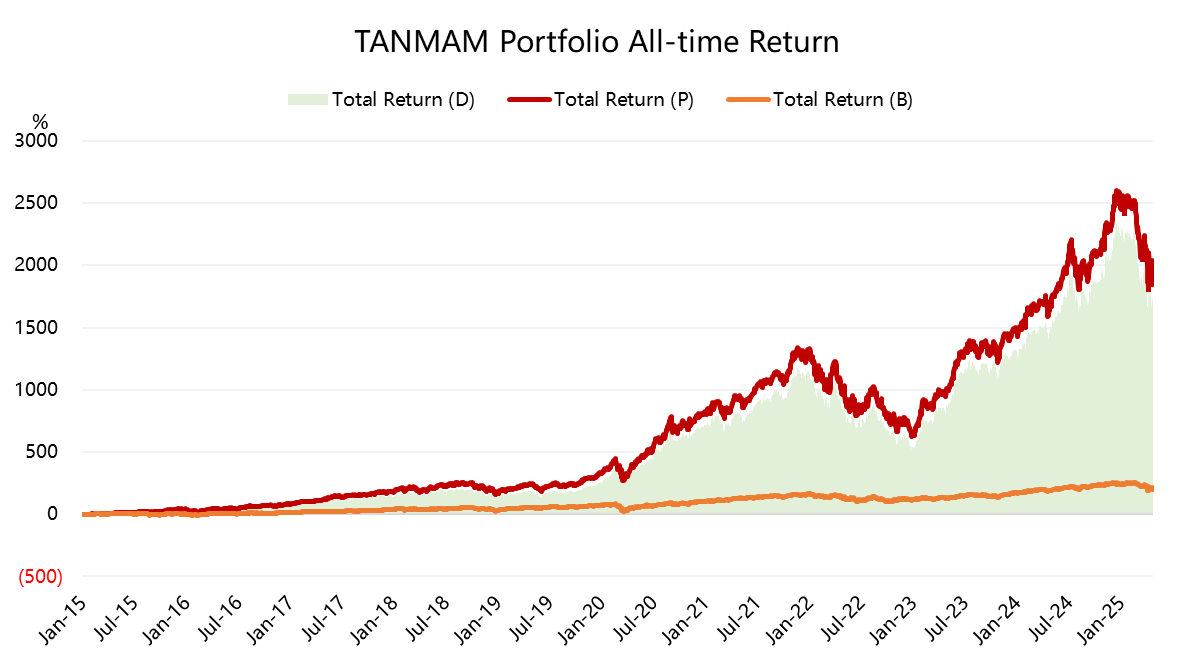

The Magnificent Seven can be restructured into an equal-weight portfolio (“TANMAMG”), rebalanced quarterly. Backtests since 2015 show it has massively outperformed the $S&P 500(.SPX)$ :

Total return: 2040.96%

$SPDR S&P 500 ETF Trust(SPY)$ return: 217.82%

Excess return: 1823.14%

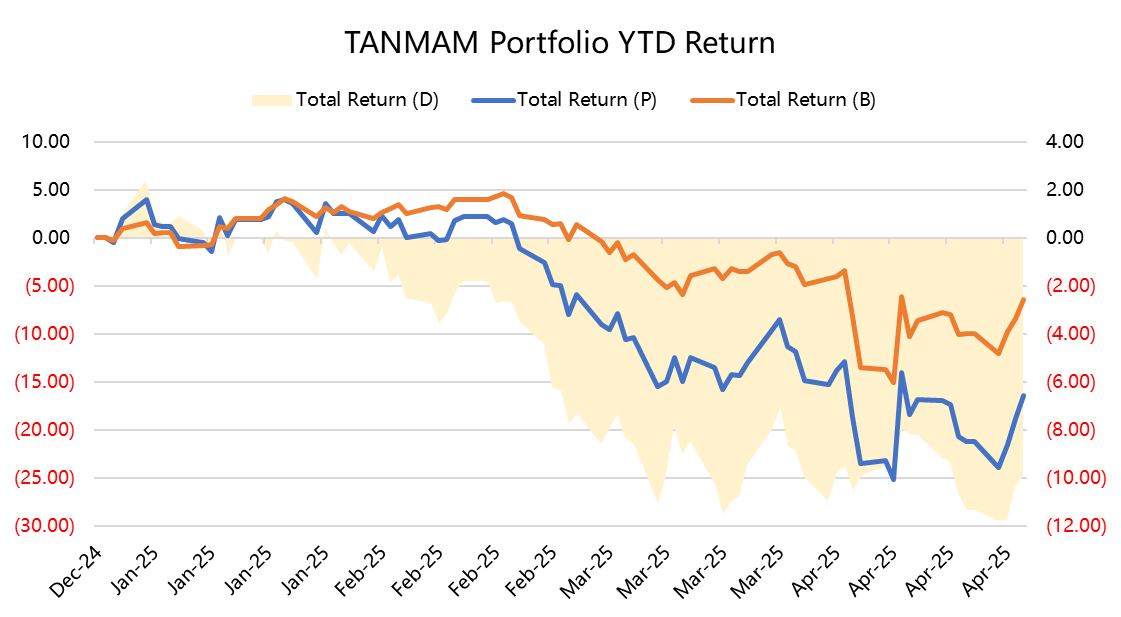

So far in 2025, Big Tech has pulled back:

TANMAMG YTD return: -16.36%

SPY YTD return: -6.44%

But over the past year:

TANMAMG Sharpe Ratio: 0.73

SPY Sharpe Ratio: 0.35

TANMAMG Information Ratio: 0.90

$Invesco QQQ(QQQ)$ $ProShares UltraPro Short QQQ(SQQQ)$ $ProShares UltraPro QQQ(TQQQ)$

Comments