Most airlines have now released their Q1 2025 earnings, reflecting a pattern of "falling costs overshadowed by weak demand." While declining fuel prices provided some breathing room, rising labor costs and sluggish domestic demand weighed heavily on profits. Airlines with higher international exposure (e.g., United Airlines) performed relatively better, whereas low-cost carriers reliant on domestic leisure travel (e.g., Frontier, $JetBlue Airways(JBLU)$ faced more severe challenges.

Industry Overview: Weak Demand Pressures Earnings, Mixed Cost Dynamics

In Q1 2025, the U.S. airline industry was under dual pressure from weak demand and elevated costs. Industry-wide profit growth stalled, with the following core characteristics:

Demand Weakness Drives Performance Decline

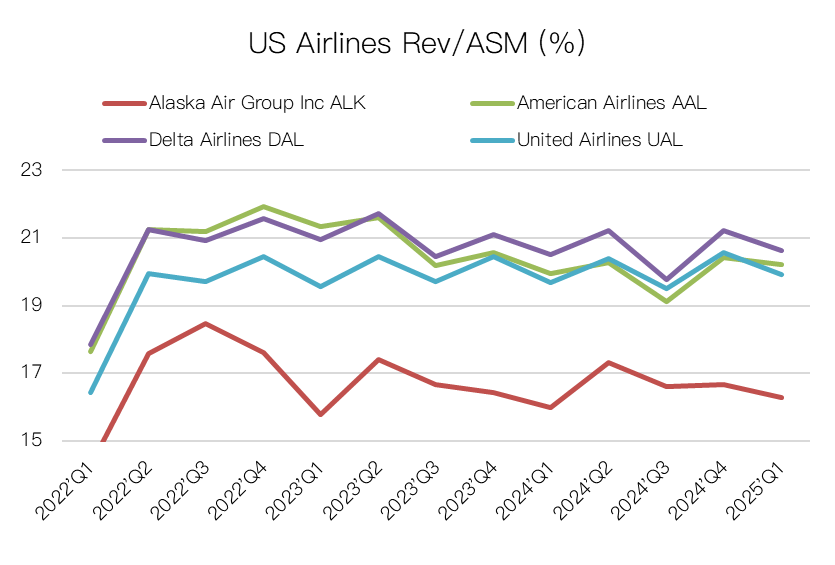

Domestic drag is significant: Weaker consumer confidence reduced leisure travel demand, leading to lower yield on domestic routes for many airlines (e.g., Delta -1%, American -1%, JetBlue -1.5%). Only Southwest saw yield improve (+1.5%) due to capacity cuts.

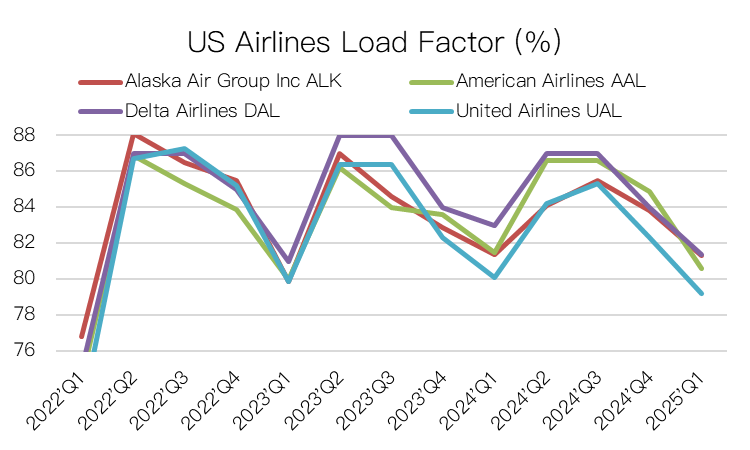

International performance diverged: International routes (especially Asia-Pacific and Latin America) helped offset domestic weakness for American and United, but load factors remained below 2019 levels (e.g., Delta at 81.5% vs. 88% in 2019).

Cost Side: Fuel Tailwinds Offset by Soaring Labor Costs

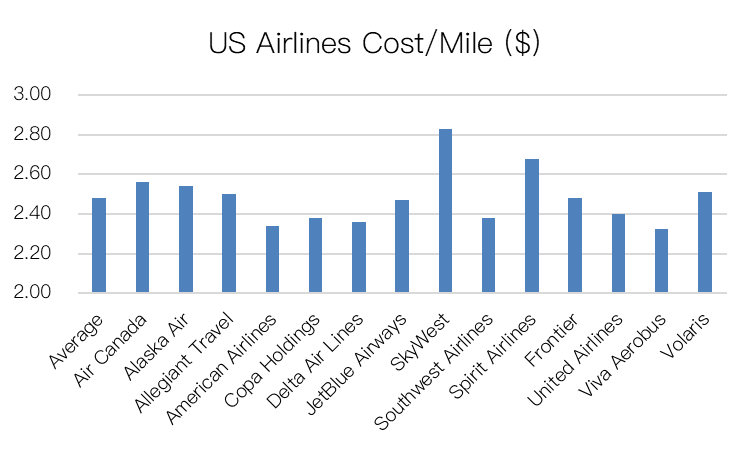

Fuel cost relief is the biggest positive: Fuel prices dropped 12%-14% YoY (average $2.40–2.62/gallon), contributing 270–590bps margin improvement (e.g., Southwest +520bps, United +350bps).

Labor cost surge erodes profits: Pilot wage agreements pushed labor costs up 5%-11% YoY (e.g., American +9%, JetBlue +11%). For some airlines, labor cost hikes offset the fuel benefit (e.g., American -280bps vs. fuel +320bps).

Operational efficiency under pressure: Non-fuel unit costs (CASM-ex) rose 3%-8% due to higher airport fees, aircraft maintenance, and M&A integration (e.g., Alaska’s acquisition of Hawaiian).

The industry has shifted from "post-COVID recovery" into a "structural adjustment" phase. With reduced demand elasticity and rising fixed costs, margins remain under long-term pressure. Falling fuel prices alone can’t reverse the trend.

Macro Headwinds: High Rates and Consumer Cutbacks

Rates suppress demand: The Fed’s high-rate policy shrinks corporate travel budgets and slows disposable income growth, increasing fare sensitivity (e.g., fewer domestic leisure travelers for American).

Tight labor market lifts costs: Ongoing pilot shortage and union contracts locking in wage hikes (e.g., United pilots’ hourly pay +7%) pushed labor costs to over 30% of total costs.

Fuel and FX volatility: Though fuel prices fell, geopolitical risks persist. A strong dollar weakens international route revenue (e.g., Latin American routes priced in local currencies).

Awaiting impact of Trump’s potential tariff policy.

Performance by Major Airlines Varies Slightly

$American Airlines(AAL)$ : Heavily impacted by weak domestic demand

Highlights: International revenue share rose to 35%, fuel cost decline added +320bps.

Key risks: Domestic leisure weakness dragged total revenue down 1%. Labor costs +9% compressed profit margin to 5.1% (820bps below 2019), with EPS at -$0.59.

$United Continental(UAL)$ : Supported by resilient international routes

Highlights: Strong transatlantic and Asia-Pacific demand drove revenue +5% to $11.9B, with adjusted EBITDAR margin at 9.8% (industry high).

Key risks: Capacity increased 3.7%, causing load factor to dip to 81.2%. Pilot contract raised costs +3.5%.

$Delta Air Lines(DAL)$ : Business travel shows resilience

Highlights: Premium cabin revenue mix improved, while non-ticket revenue (e.g., loyalty programs) partially offset yield decline.

Key risks: Domestic overcapacity led to -1% yield, EPS fell to $0.39 (down 40% YoY).

$Southwest Airlines(LUV)$ : Low-cost model under pressure

Highlights: Fuel savings added +520bps margin boost; 2.3% capacity cut drove +1.5% yield increase.

Key risks: Single aircraft model limits flexibility. Labor costs +5% pushed CASM-ex up 5.3%, EPS at -$0.20.

Outlook: Industry Must Rebalance Supply and Demand

In the short term, airlines will need to manage risk via flexible capacity adjustments (e.g., American cutting domestic flights) and optimizing ancillary revenue (e.g., baggage fees, loyalty programs).

Longer term, success depends on modernizing fleets (to cut fuel use) and deepening international network presence. However, near-term visibility remains clouded by Trump’s uncertain policy direction.

Key Takeaways:

The airline sector could be a leading indicator of economic downturns; continued monitoring of data is essential.

Carriers relying on domestic leisure travel are most at risk, while international and business travel remain relatively resilient.

Consumer confidence is key to recovery, but signs of a rebound are still lacking.

Comments