Big-Tech’s Performance

Weekly macro storyline: Bessent Reasons Rate-Cuts

Tariff Shock Moves Forward — U.S. consumer sectors are generally facing a downturn in sales, rising costs, and squeezed profits. This includes companies like McDonald’s, Yum! Brands (KFC/Pizza Hut), Starbucks, Domino’s, and Hershey’s. Many of these companies cater to lower- to middle-income groups, and consumption downgrades are leading these consumers to cut back on non-essential spending. Economic uncertainty is spreading.

April ADP employment numbers released on Wednesday showed an increase of only 62,000 jobs, far below expectations and the lowest in nine months. The decline was primarily in education and health services, possibly due to the aftermath of the DOGE healthcare rule, while the impact of tariffs might not yet be fully reflected. At the same time, Q1 GDP shrank at an annualized rate of 0.3%, marking the first quarterly contraction since 2022.

Compared to Trump’s direct calls for rate cuts, Treasury Secretary Bessent, with a Wall Street background, gave a more market-aligned explanation: the yield on the two-year U.S. Treasury note (3.57%) is about 75 basis points lower than the federal funds rate (4.33%), indicating that markets believe the Fed should consider a rate cut. This yield gap has been widening over the past two months, reflecting growing expectations in the bond market for future Fed easing.

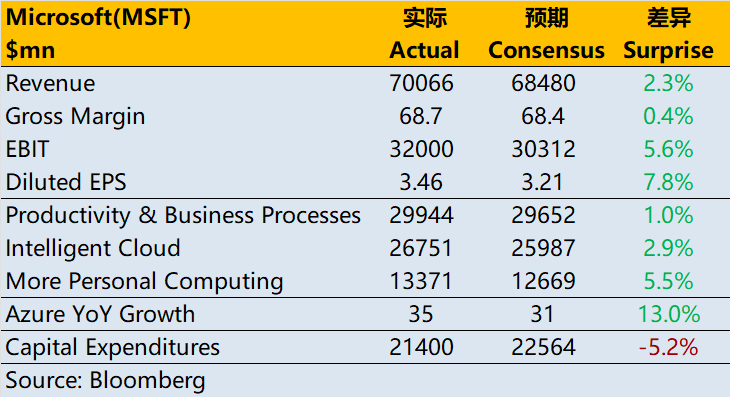

Earnings from major tech companies this week, led by Microsoft, showed stability with surprises, once again disproving overly pessimistic market expectations. The solid business ecosystems and asset quality of tech firms make them more resilient to tariff shocks.

Big Tech stocks generally rebounded this week, with Microsoft being the main driver (its year-to-date return has turned positive).

As of the May 1st close, weekly performance of major Big Tech companies:

$Apple(AAPL)$ +2.38%, $Microsoft(MSFT)$ +9.84%, $NVIDIA(NVDA)$ +4.87%, $Amazon.com(AMZN)$ +1.96%, $Alphabet(GOOG)$ $Alphabet(GOOGL)$ +1.27%, $Meta Platforms, Inc.(META)$ +7.33%, $Tesla Motors(TSLA)$ +8.1%.

Big-Tech’s Key Strategy

Breaking Up with OpenAI? Microsoft Takes Benefits!

Microsoft's Q3 FY2025 earnings release on Wednesday led to a rare 10% surge in its stock, not only delivering the largest positive surprise in two years, but also becoming the biggest earnings beat in the tech sector this season.

Key Surprises Came From:

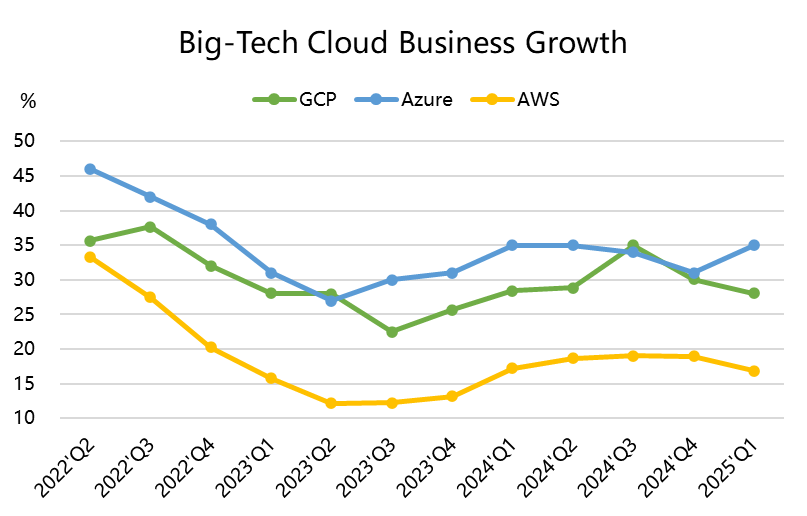

Strong Cloud & AI Business: Revenue grew 13% YoY, with Azure growing 33% YoY — exceeding the upper end of market expectations (29–32%). This was driven by robust execution in non-AI business and accelerated AI infrastructure deployment.

Guidance Remains Strong, AI Demand Outstripping Supply: Next quarter Azure is expected to grow 34–35% YoY, with AI contribution likely increasing. The company confirmed ongoing CapEx expansion and reaffirmed its focus on meeting AI demand while improving long-term efficiency through software.

Minimal Tariff Impact: Only the relatively smaller Windows and Devices segments are expected to be affected by recent tariff announcements. The overall accelerated growth pace seems sustainable.

All business lines performed well this quarter: PBP business bounced back to +10%. LinkedIn performed well, Office commercial purchases increased, M365 saw strong growth post-price hike (with no pushback), ARPU improved. More Personal Computing revenue was boosted by increased advertising from search and news (driven by third-party partnerships and Bing/Edge improvements), Copilot demand remained strong. Gaming revenues beat expectations, with both 3P and 1P strong, and price hikes expected next quarter to counter tariff impact — possibly improving gross margins even further.

Why Was Microsoft the Surprise Winner?

Breaking from OpenAI Led to Better Monetization: AI made an outsized contribution this quarter — Microsoft rented out GPU capacity (and will continue to next quarter). This accelerated monetization of compute resources.

This also explains why Azure growth exceeded even the top-end of market estimates.

By shifting the low-margin, long-cycle training workloads to OpenAI (and other cloud providers), Microsoft concentrated its compute resources on high-margin inference workloads (enterprise-facing, steady demand). As OpenAI’s gross margins decline, it may become more reliant on Microsoft’s Azure infrastructure (where Microsoft retains API exclusivity), thereby increasing Azure’s share of inference revenue.

More compute capacity allows Azure to partner with additional tech players, including Elon Musk’s Grok.

Counter to Major Sell-Side Survey Results: Just a day before earnings, JPM released a survey of Microsoft partners, lowering Azure growth expectations for FY2025 (from 31% to 25.5%), citing lower AI usage and slower-than-expected adoption of M365 Copilot and Azure OpenAI services. The surprising earnings results contradicted these surveys, leading many institutional investors to miss the rally.

Despite Competition, Microsoft Holds Distinct Advantages: European clients may prefer localization, but lack suitable alternatives — Microsoft maintains an edge through M365 penetration. While some clients reduced long-term commitments, actual consumption didn’t drop. Google's earnings gave a false signal — some VMware clients switched to Azure due to Broadcom’s pricing, and Salesforce lost ground on pricing and AI integration. AWS and Google are catching up in inference, but last week Google reported GCP growth at 28%, which misled many investors about Azure’s momentum.

Big Tech Options Strategy

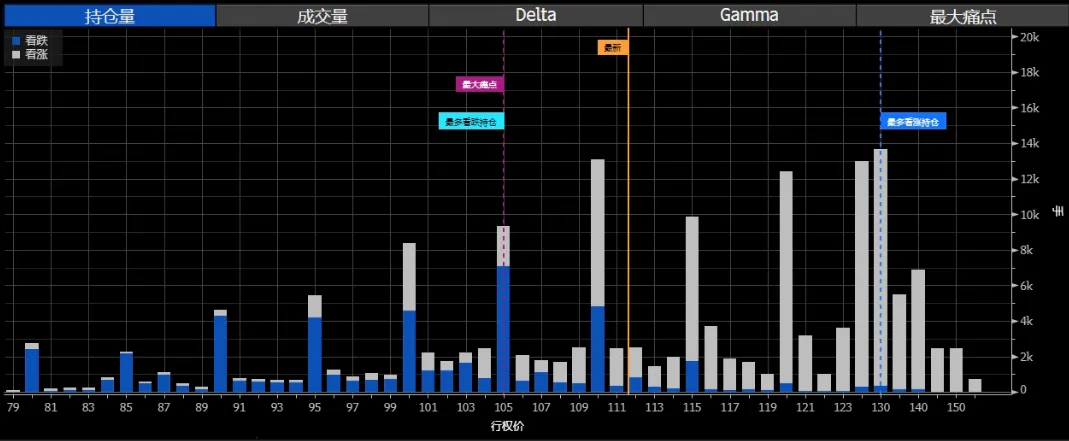

Focus This Week: Waiting on NVIDIA’s Earnings Guidance?

NVIDIA is actively pushing Asian clients to place early orders to circumvent export restrictions and has publicly criticized new regulations for potentially undermining U.S. tech competitiveness. It is concerned that the restrictions may erode U.S. companies’ share in the global AI market, accelerating innovation by rivals.

Additionally, demand for inference chips by large language models has surged — token generation has increased over 5x since the beginning of the year, causing GPU shortages. Unlike training, inference is driven by real application and monetization (API calls, user growth), proving the real-world scalability of AI models. New chips like GB200/300 cannot meet the explosive demand in the short term. This has reignited market optimism toward NVIDIA.

Among open interest options expiring May 30 (earnings week), CALLs between 120–130 dominate, with max pain currently at 130.

Big-tech Portfolio

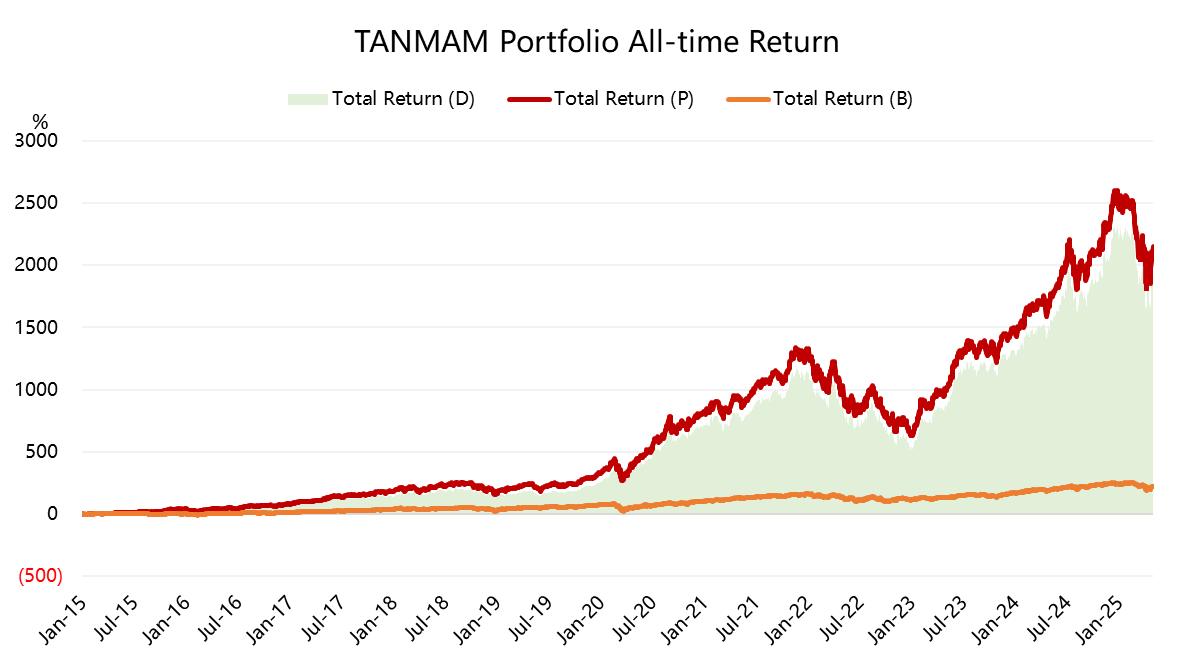

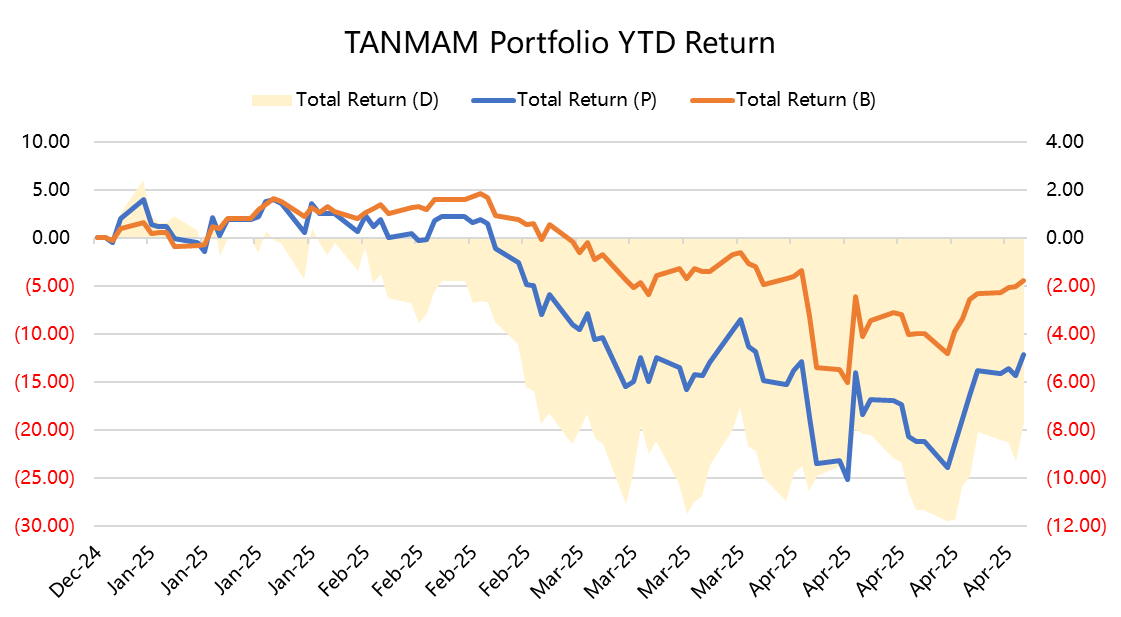

The "Magnificent Seven" stocks form the “TANMAMG” portfolio — equal-weighted and rebalanced quarterly. Backtesting shows it has far outperformed the $S&P 500(.SPX)$ since 2015, with a total return of 2,149.76% versus $SPDR S&P 500 ETF Trust(SPY)$ ’s 224.67%, delivering an excess return of 1,925.10%.

This year, Big Tech has experienced a pullback, with the portfolio down -12.11%, underperforming SPY’s -4.42%.

Over the past year, the portfolio’s Sharpe ratio rose to 0.9 (vs. SPY’s 0.53), and its information ratio hit 0.96.

Comments